If your company offer a 401(k) retirement plan program, it would be good idea to take advantage of it and boost your contributions.

Your company's 401(k) will likely offer a selection of investment options, generally mixes of various mutual funds or index funds.

A plan that consists of a general index fund designed for employees retiring in a certain year range will probably have lower fees than an actively-managed equity fund, for instance.

However, employees who want to have a more active role in their portfolio may be able to choose between stocks and bonds, or even specific sectors or industries (technology stocks or U.S. long-term government bonds, for instance).

Even if you're self-employed, you can potentially take advantage of a solo 401k to both lower your taxable income and save for retirement. If you don't have a solo 401k plan yet, check out the best places to open a solo 401k.

No matter the path, you need to know the limits!

2024 401k Contribution Limits

Here are the 2024 401k contribution limits. These were announced by the IRS on November 1, 2023.

The employee deferral limit increased by $500 and the total combined contribution limit increased by $3,000 compared to 2023.

Contribution Type | Limit |

|---|---|

Maximum employee elective deferral. | $23,000 |

Employee catch-up contribution (if age 50+) | $7,500 |

Combined employee and employer contribution | $69,000 |

This means that for savers under 50, you can defer $23,000 per year, or a total combined $69,000. If you're over 50, you can save $30,500 per year, or a combined limit of $76,500.

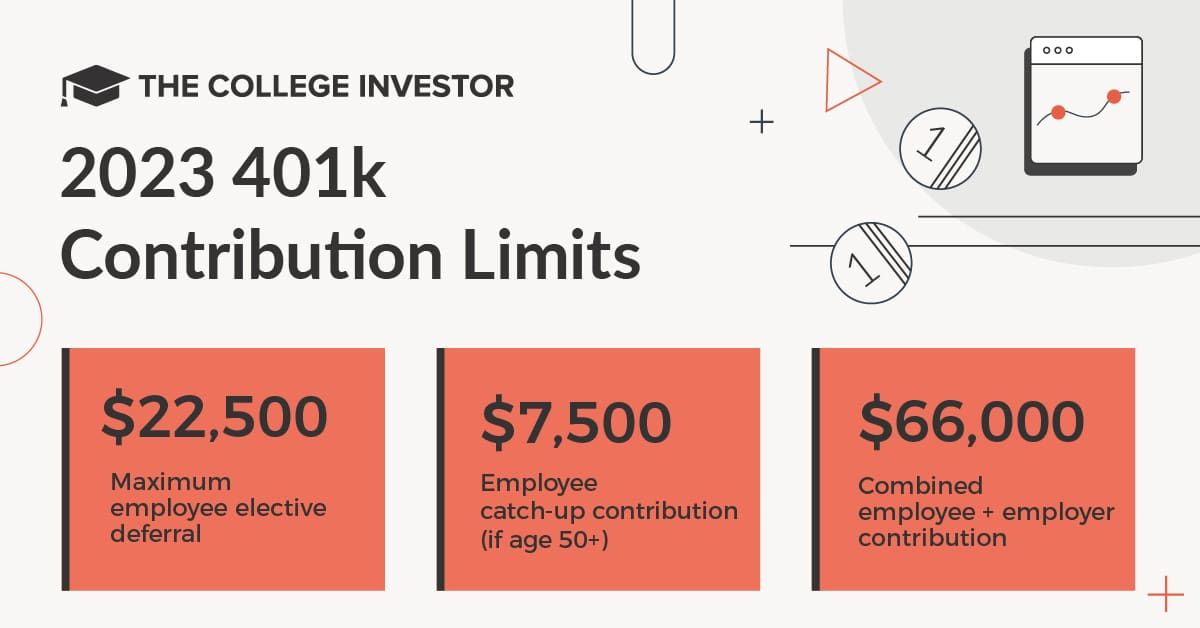

2023 401k Contribution Limits

Here are the 2023 401k contribution limits. These were announced by the IRS on October 21, 2022.

The employee deferral limit increased by $2,000 and the total combined contribution limit increased by $5,000 compared to 2022.

Contribution Type | Limit |

|---|---|

Maximum employee elective deferral. | $22,500 |

Employee catch-up contribution (if age 50+) | $7,500 |

Combined employee and employer contribution | $66,000 |

This means that for savers under 50, you can defer $22,500 per year, or a total combined $66,000. If you're over 50, you can save $30,000 per year, or a combined limit of $73,500.

Past Year's Contribution Limits

If you're looking for reference to past year's limits, here you go:

2022 401k Contribution Limits

Here are the 2022 401k contribution limits. These were announced by the IRS on November 4, 2021.

The employee deferral limit increased by $1,000 and the total combined contribution limit increased by $3,000 compared to 2021.

Contribution Type | Limit |

|---|---|

Maximum employee elective deferral. | $20,500 |

Employee catch-up contribution (if age 50+) | $6,500 |

Combined employee and employer contribution | $61,000 |

2021 401k Contribution Limits

Here are the 2021 401k contribution limits. These were announced by the IRS on October 26, 2020.

The employee deferral limit stayed the same and the total combined contribution limit increased by $1,000 compared to 2020.

Contribution Type | Limit |

|---|---|

Maximum employee elective deferral. | $19,500 |

Employee catch-up contribution (if age 50+) | $6,500 |

Combined employee and employer contribution | $58,000 |

2020 401k Contribution Limits

Here are the 2020 401k contribution limits.

The employee deferral limit increased by $500 and the total combined contribution limit increased by $1,000 compared to 2019.

Contribution Type | Limit |

|---|---|

Maximum employee elective deferral. | $19,500 |

Employee catch-up contribution (if age 50+) | $6,500 |

Combined employee and employer contribution | $57,000 |

2019 401k Contribution Limits

Here are the 2019 401k contribution limits. These were announced by the IRS on November 1, 2018.

The employee deferral limit increased by $500 and the total combined contribution limit increased by $1,000.

Contribution Type | Limit |

|---|---|

Maximum employee elective deferral. | $19,000 |

Employee catch-up contribution (if age 50+) | $6,000 |

Combined employee and employer contribution | $56,000 |

2018 401k Contribution Limits

Here are the 2018 401k contribution limits. Remember, you must have your employee deferral in the account by December 31, 2018. However, if you're self employed, you can fund the employer profit-sharing contribution anytime before you file your tax return.

Contribution Type | Limit |

|---|---|

Maximum employee elective deferral. | $18,500 |

Employee catch-up contribution (if age 50+) | $6,000 |

Combined employee and employer contribution | $55,000 |

Remember, for those with a solo 401k, you can setup your employee elective deferral to be either Roth or Traditional. However, the employer contribution is always traditional.

Solo 401k Contribution Deadlines

If you're looking at this contribution limits for a solo 401k, it's important to note that you also are required to contribute by certain deadlines.

The solo 401k has two sets of deadlines: the deadline for the employee contribution (i.e. your elective contribution), and the deadline for the employer matching contribution (i.e. what your business puts into the 401k).

For your employee elective contribution, you must make your contribution by December 31, usually. If you're an S-Corp and on payroll, you must elect to make this contribution and have it paid by December 31. If you're a sole proprietorship or single-member LLC, you must still elect to make your contribution by December 31, but your contribution can be made up to the personal tax filing deadline (typically April 15). Sound strange? It is a bit strange, but the nuance is due to the type of tax return you file (S-Corp return versus Schedule C on your personal return).

For your employer contribution, you must make your contribution by the tax filing deadline of your corporation (or personal return if you're filing on a Schedule C). This could be March 15 or September 15 for S-Corps, or April 15 or October 15 for those filing on a personal return.

Benefits Of Contributing To A 401k

One major benefit of 401(k) plans that some employers offer is matching employee contributions up to a certain extent of the employee's income (between 3% and 6% of annual income is a common percentage).

In that case, the employee should contribute at least as much as that amount to take advantage of what is essentially free money, even if that means reducing contributions to other accounts such as IRAs or general investment accounts.

Another critical benefit of the majority of 401(k) plans is that they are tax-deferred investment vehicles, meaning that employees do not have to pay income tax on money that they earned during that year and contributed to their 401(k), reducing their total income tax bill for the year. Many employers also offer a Roth 401k option, but not many employees are aware or choose it.

Finally, these plans also offer a useful target for retirement savings. Though employees should generally save more than the limits, they provide a specific target savings amount to meet at the minimum annually.

Withdrawals From A 401k Plan

As tax-deferred 401(k) contributions are not taxed as income in the year that the contribution is made (the amount is deducted on the employee's annual income tax returns), withdrawals are taxed instead. However, if an employee opts for a Roth 401(k), contributions are taxed before they are made, and then can be withdrawn in retirement tax-free.

The tax rate that will apply to these withdrawals is the income tax rate that applies to the account owner during the year of withdrawal. This is generally considered advantageous because most people will have lower taxable income during their retirement years than when they worked, meaning their effective tax rate on the amount withdrawn will be lower.

Owners of 401(k)s must be at least 59½ or be completely and permanently disabled to withdraw the funds in their account without tax penalties.

If they are younger than this age, they will pay a 10% penalty tax on the amount withdrawn in addition to owing normal income tax on the amount.

There are several limited exceptions to this 10% penalty, including the employee's death, qualified domestic court orders, and unreimbursed medical expenses that exceed 7.5% of the employee's Adjusted Gross Income.

Finally, account owners must begin making at least required minimum withdrawals, which are set by the IRS using a life expectancy table, when the account owner turns 70½, unless he or she is still employed.

A 50% penalty is applied on the minimum withdrawal if it is not taken for that tax year.

Final Thoughts

401(k) plans are a valuable tool to save for retirement, and one that many employees do not fully utilize, especially if their employer will match their contributions. This is true even if you have a related 403b retirement plan.

Annual contribution limits are much higher than those for Individual Retirement Accounts (IRAs) while allowing the same tax-deferral benefits, and they provide an excellent first step for employees to save annually for a secure retirement.

Plus, contribution limits tend to increase each year allowing you to stash away more for retirement.

Do you contribute to a 401(k)? Why or why not?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ohan Kayikchyan Ph.D., CFP®