You know you want to invest. You know you need to invest. But honestly, how do you start investing in your 20s after college?

Who do you trust? Do you pay someone to help? How do you know you're not going to be ripped off? Or even worse - how do you know you're not going to lose all your money? If you're wanting to invest after college, here's our thoughts.

For 20-somethings, investing is important and you know it. In your 20s, time is on your side, and the more you save and invest now, the better off you'll be later.

But, frankly, getting starting investing after college is confusing. There are so many options, tools, thoughts, blogs to read about, and more. What the heck do you do?

I'm going to share my thoughts on what you should do to start investing after college in your twenties when you're 22-29 years old. Let's dive in.

Be sure to check out the other articles in this series:

Why Start Investing Early?

According to a Gallup Poll, the average age investors started saving is 29 years old. And only 26% of people start investing before the age of 25.

But the math is simple: it's cheaper and easier to save for retirement in your 20s versus your 30s or later. Let me show you.

If you start investing with just $3,600 per year at age 22, assuming an 8% average annual return, you'll have $1 million at age 62. But if you wait until age 32 (just 10 years later), you'll have to save $8,200 per year to reach that same goal of $1 million at age 62.

Here's how much you would have to save each year, based on your age, to reach $1 million at 62.

Age | Amount To Invest Per Year To Reach $1 Million |

|---|---|

22 | $3,600 |

23 | $3,900 |

24 | $4,200 |

25 | $4,600 |

26 | $5,000 |

27 | $5,400 |

28 | $5,900 |

29 | $6,400 |

Just look at the cost of waiting! Just waiting from when you're 22 to 29, it costs you $2,800 more per year, assuming the same rate of return, to achieve the same goal.

That's why it's essential to start investing early, and there is no better time than after graduation.

Do You Need A Financial Advisor?

So, if you're thinking of getting started investing, do you need a financial advisor? Honestly, for most people, they don't. But a lot of people get hung up on this need for "professional" advice.

Here are some thoughts on this subject from a few financial experts (and the overwhelming answer is NO):

I don't believe that young investors need a financial advisor. Rather, what this age group really needs is financial education. Relatively speaking, their financial situations aren't "complex" enough yet to warrant the cost of an advisor or planner.

Being proactive and increasing their financial literacy now will make those future conversations more productive; by "speaking the same language" as an advisor, they'll be better equipped to state their specific goals and discuss potential courses of action. Relying on an advisor today instead of properly educating themselves, however, could lead to costly dependency issues in the future.

Learn more about Tara at Reis Up.

The straight financial science answer is you should only pay for advice that puts more money in your pocket than it costs you.

The challenge in your 20’s is the compound cost of good advice versus bad is enormous over your lifetime so this decision is critically important. If the advisor is a true expert and can add value with superior insights beyond just conventional, mainstream wisdom and the cost is reasonable then s/he should be able to add value in excess of costs. The problem is research shows this situation is rare, which explains the growth of robo-advisors and low-cost passive index investing where no advisor is needed. Controlling costs has been proven in multiple research studies as one of the leading indicators of investment outperformance, and advisors add a lot of expense.

I realized in my 20’s that if I wanted to be financially secure and not dependent on others that I would have to develop some level of financial expertise. Quality books are the best value in financial education and a small investment in that knowledge will pay you dividends for a lifetime. The truth is you can never pay an advisor enough to care more about your money than his own so you must develop enough knowledge to delegate effectively. The compounded value of the knowledge I built in my 20’s over the next 30 years has been worth literally millions of dollars and will likely be the same for you. It’s time well spent.

Learn more about Todd at Financial Mentor.

The fact is simple: most people getting started investing after college simply do not need a financial advisor. I think this quote sums it up best for young investors:

Young investors [typically] have a relatively small portfolio size, so they should put their money into a target-date retirement fund and focus on increasing their savings rate, rather than choosing the best advisor or mutual fund. At that age, increasing savings rate and minimizing fees will go a lot farther than a possible extra percent or two in return.

Learn more about Nick at Mapped Out Money.

But are there circumstances when talking to a financial advisor can make sense? Yes, in some cases. I believe that speaking with a financial planner (not a financial advisor) can make sense if you need help creating a financial plan for your life.

Simply put, if you are struggling to come up with your own financial plan (how to save, budget, invest, insure yourself and your family, create an estate plan, etc.), it could make sense to sit down and pay someone to help you.

But realize that there is a difference between creating a financial plan you execute and pay a fee for, versus a financial advisor that takes a percentage of your money you manage. For most investors after college, you can use the same plan for years to come.

In fact, we believe that it really only makes sense to meet with a financial planner a few times in your life, based on your life events. Because the same plan you create should last you until the next life event. Here are some events to consider:

- After graduation/first job

- Getting married and merging money

- Having children

- If you come into significant wealth (i.e. inheritance)

- Approaching retirement

- In retirement

You see, the same plan you create after graduation should last you until you're getting married. The same is true at the next life event. Why pay a continual fee every year when nothing changes for years at a time?

Aside from the very few who earn very high salaries (attorneys, doctors, investment bankers, etc.) the answer is probably no for most, at least not one with whom they work full time on an AUM basis or similar recurring fee.

That said, they might consider an hourly fee-only advisor to work with on a one-off basis, such as one in the Garrett Planning Network or some NAPFA advisors. Also, many of the financial planners in the XY Planning Network might be a good fit.

Learn more about Roger at The Chicago Financial Planner.

Robo-Advisor Or Self Directed?

So, if you don't go with a financial advisor, should you go with a Robo-Advisor? This could be a great option if you "don't want to really think about investing, but know you should."

Honestly, you still need to think about it, but using a robo-advisor is a great way to have an automated system take care of everything for you. Plus, these companies are all online, so you never have to worry about making appointments, going to an office, and dealing with an advisor that you may or may not like.

Robo-advisors are pretty straightforward tools: they use automation to setup your portfolio based on your risk tolerance and goals. The system then continually updates your accounts automatically for you - you don't have to do anything.

All you do is deposit money into your account, and the robo-advisor takes it from there.

If you want to go the Robo-Advisor route, we recommend checking out our list of the Best Robo-Advisors here >>

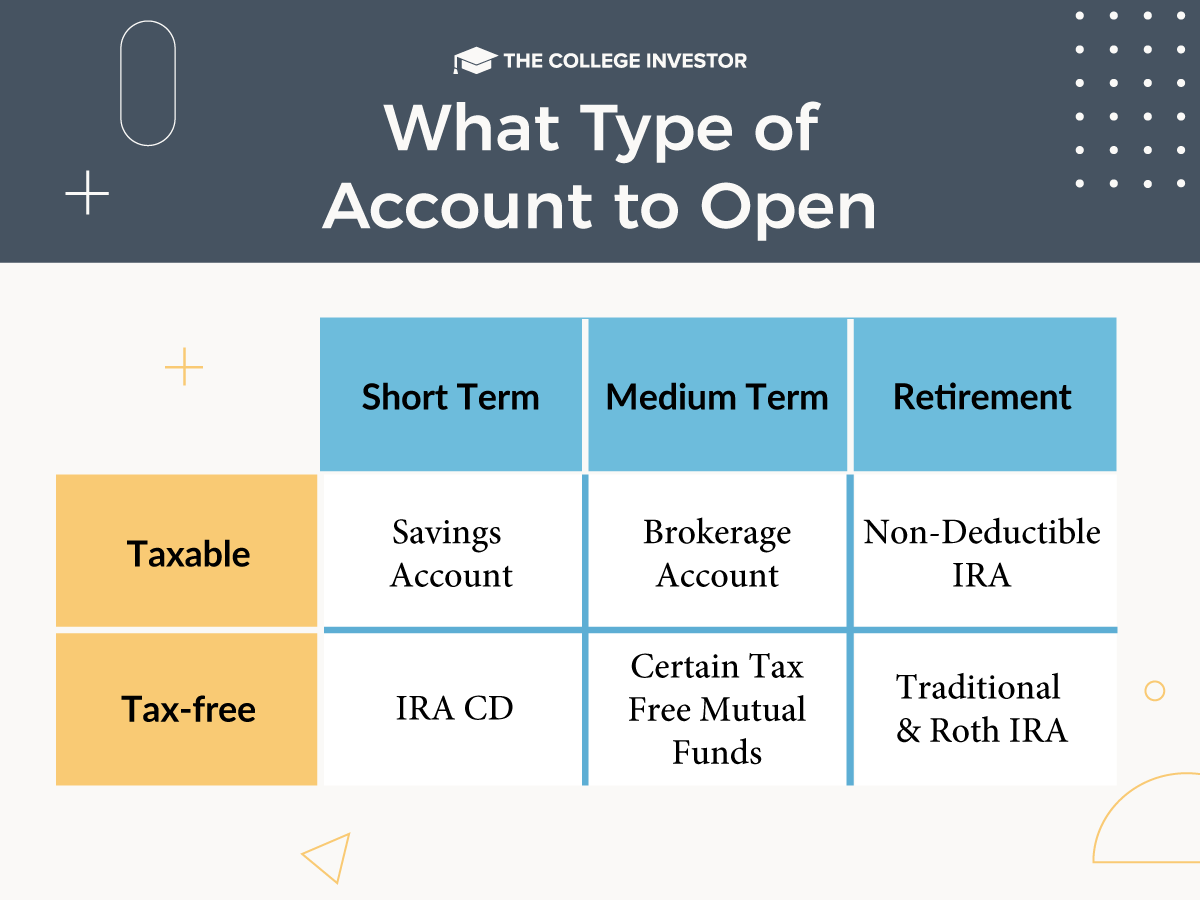

What Type Of Account Should I Open?

This is what makes investing complex - there are just so many different factors to consider. We've touched on a couple, and now let's dive into what account you should consider opening.

Employer Plans - 401k or 403b

First, for most recent graduates, focus on your employer. Most employers offer a 401k or 403b retirement plan. These are company sponsored plans, which means you contribute, and your company typically contributes a matching contribution.

I highly recommend that you always contribute up to the matching contribution. If you don't, you're essentially leaving free money on the table and giving yourself a pay cut.

If you're comfortable with contributing up to your employer's match, my next challenge would be to contribute the maximum allowed each year. As of 2022, that amount is $20,500 for people under 50. Just realize how much money you will have if you always max your 401k contributions.

Make sure you keep up with the 401k Contribution Limits.

Individual Retirement Accounts - Roth or Traditional IRAs

Next, look at opening an individual retirement account or IRA. There are two main types: a traditional IRA and Roth IRA. The benefit of these accounts is that the money inside the account grows tax free until retirement. The downside is that there are limitations on withdrawing the money before retirement. If you're saving for the long-run, these accounts make sense. But don't leverage them if you want to take the money in just a couple of years.

The traditional IRA uses pre-tax money to save for retirement (meaning you get a tax deduction today), while a Roth IRA uses after-tax money. In retirement, you'll pay taxes on your traditional IRA withdrawals, but you can withdraw from the Roth IRA tax free. That's why many financial planners love a Roth IRA.

In 2022, the contribution limits for IRAs is $6,000. You should focus on contributing the maximum every year. Keep an eye every year on the IRA Contribution Limits.

Health Savings Accounts (HSAs)

If you have access to a health savings account, many plans allow you to invest within your HSA. We love using an HSA to invest because it's like using an IRA. It has a ton of great tax perks if you keep the money invested and don't touch it for health expenses today. Just invest and let it grow.

If you have an old HSA and you don't know what to do with it, check out this guide of the best places to invest your HSA. You can move your HSA over at any time, just like you would do with an old 401k.

Finally, make sure you try to max out your HSA contributions. Here's the HSA contributions limits.

How To Balance Contributions To Multiple Accounts Beyond A 401k And IRA

There is a "best" order of operations of what accounts to contribute and how much to do at a time. We've put the best order of operations to save for retirement into a nice article and infographic that you can find here.

Where To Invest If You Want To Do It Yourself

Okay, so you how have a better sense of where to get help, what account to open, but now you need to really think about where to open your account and have your investments.

When it comes to where to invest, you should look at the following:

- Low Costs (Costs include account fees, commissions, etc.)

- Selection of Investments (especially look for commission free ETFs)

- Website Ease of Use

- Great Mobile App

- Availability of Branches (it's still nice to go in and talk to someone if you need to)

- Technology (is the company on the forefront, or always lagging the industry)

We recommend using M1 Finance to get started investing. They allow you to build a low cost portfolio for free! You can invest in stocks and ETFs, setup automatic transfers, and more - all at no cost. Check out M1 Finance here.

We've reviewed most of the major investment companies, and compare them here at our Best Online Stock Brokers And Invest Apps. Don't take our word for it, explore the options for yourself.

How Much Should You Invest?

If you're looking to start investing after college, a common question is "how much should I invest". The answer for this question is both easy and hard.

The easy answer is simple: you should save until it hurts. This has been one of my key strategies and I like to call it front loading your life. The basics of it are you should do as much as possible early on, so that you can coast later in life. But if you save until it hurts, that "later" might be your 30s.

So what does "save until it hurts" mean? It means a few things:

- First, you should make saving and investing mandatory. The money you want to invest goes into the account before anything else. Your employer already does this with your 401k, so do it with an IRA too.

- Second, challenge yourself to save at least $100 more beyond what you're currently doing - make it hurt.

- Third, work towards either budgeting to achieve that extra $100, or start side hustling and earning extra income to achieve that extra $100.

Here are some goals for you:

- Max Out Your IRA Contribution: $6,500 per year in 2023 or $7,000 per year in 2024

- Max Out Your 401k Contribution: $22,500 per year in 2023 or $23,000 in 2024

- Max Out Your HSA (if you qualify for one): $3,850 for single per year, or $7,750 per family per year in 2023 (and that goes up to $4,150 for singles and $8,300 for families in 2024)

- If you side hustle to earn extra income, max our your SEP IRA or Solo 401k

Investment Allocations In Your 20s

This is one of the toughest parts of getting started investing - actually choosing what to invest in. It's not actually tough, but it's what scares people the most. Nobody wants to "mess up" and choose bad investments.

That's why we believe in building a diversified portfolio of ETFs that match your risk tolerance and goals. Asset allocation simply means this: allocating your investment money is a defined approach to match your risk and goals.

At the same time, your asset allocation should be easy to understand, low cost, and easy to maintain.

We really like the Boglehead's Lazy Portfolios, and here are our three favorites depending on what you're looking for. And while we give some examples of ETFs that may work in the fund, look at what commission free ETFs you might have access to that offer similar investments at low cost.

You can quickly and easily create these portfolios at M1 Finance for free.

Conservative Long Term Investor

If you're a conservative long-term investor, who doesn't want to deal with much in your investment life, check out this simple 2 ETF portfolio.

% Allocation | Fund | ETF |

|---|---|---|

40% | Vanguard Total Bond Market Fund | BND |

60% | Vanguard Total Stock Market Fund | VT |

Moderate Long Term Investor

If you are okay with more fluctuations in exchange for potentially more growth, here is a portfolio that incorporates more risk with international exposure and real estate.

% Allocation | Fund | ETF |

|---|---|---|

40% | Vanguard Total Bond Market Fund | BND |

30% | Vanguard Total Stock Market Fund | VT |

24% | Vanguard International Stock Index Fund | VXUS |

6% | Vanguard REIT Index Fund | VNQ |

Aggressive Long Term Investor

If you're okay with more risk (i.e. potentially losing more money), but want higher returns, here's an easy to maintain portfolio that could work for you.

% Allocation | Fund | ETF |

|---|---|---|

30% | Vanguard Total Stock Market Fund | VT |

10% | Vanguard Emerging Markets Fund | VWO |

15% | Vanguard International Stock Index Fund | VXUS |

15% | Vanguard REIT Index Fund | VNQ |

15% | Vanguard Total Bond Market Fund | BND |

15% | Vanguard TIPS | VTIP |

Things To Remember About Asset Allocation

As you invest your portfolio, remember that prices will always be changing. You don't have to be perfect on these percentages - aim for within 5% of each one. However, you do need to make sure that you're monitoring these investments and rebalancing them at least once a year.

Rebalancing is when you get your allocations back on track. Let's say international stocks skyrocket. That's great, but you could be well above the percentage you'd want to hold. In that case, you sell a little, and buy other ETFs to balance it out and get your percentages back on track.

And your allocation can be fluid. What you create now in your 20s might not be the same portfolio you'd want in your 30s or later. However, once you create a plan, you should stick with it for a few years.

Here's a good article to help you plan out how to rebalance your asset allocation every year.

Final Thoughts

Hopefully the biggest takeaway you see if you're looking to start investing after college is to get started. Yes, investing can be complicated and confusing. But it doesn't have to be.

This guide laid out some key principals to follow so that you can get started investing in your 20s, and not wait until later in your life.

Remember, the earlier you start, the easier it is to build wealth.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Danny Cieniewicz, CFP®, CCFC