Many companies provide solutions for trading cryptocurrencies in an IRA. But the process of moving funds from an existing IRA to a crypto IRA can be cumbersome and lengthy.

And if not done right, it can even generate a taxable event. That means the money you thought was going to remain tax-sheltered ends up being taxed during the conversion process.

Bitcoin IRA has come up with a simpler solution to fix these problems. Customers only have to open an account with Bitcoin IRA and initiate an IRA transfer. From there, Bitcoin IRA will take care of the rest. Once the process completes, customers can begin trading cryptocurrencies in their IRA. Let’s see how it works.

Bitcoin IRA Details | |

|---|---|

Product Name | Bitcoin IRA |

Min Deposit | Transferred IRA: $3,000 New Saver IRA: $100 (requires recurring contribution) |

Supported Currencies | 60+ |

Fees | Set-Up Fee: 0.99% - 2.99% of Initial Deposit Transaction Fee: 2% Account Security Fee: 0.08% (Billed Monthly) |

Promotions | None |

Who Is Bitcoin IRA?

Alternative IRA Services (“AIS”) operates under the BitcoinIRA brand name. Bitcoin IRA describes itself as the world’s first, largest, and most secure cryptocurrency IRA platform. It has over 100,000 account holders. Bitcoin IRA was founded in March 2015 and is based in Sherman Oaks, CA. Its founder and CEO is Camilo Concha.

What Do They Offer?

Bitcoin IRA is an all-in-one platform for trading cryptocurrencies from your IRA. The company is a full-service, self-directed IRA provider, which is different from the many companies offering similar services that require cobbling together several pieces.

Bitcoin IRA provides its customers with the following:

- Transfer of an existing IRA to Bitcoin IRA

- 24/7 cryptocurrency trading

- Custody

- Reporting — performance and financial statements

Eligible IRA accounts include Roth, SEP, and Traditional. A 401(k) can be used if it is current. However, to use a 401(k), you must be over 59.5 years of age or have left the employer sponsoring the 401(k) so that it can be rolled over into an IRA. Annuities and pensions can also be used.

The minimum to open a standard account is $3,000. When we first reviewed Bitcoin IRA, less than 10 coins could be traded on Bitcoin IRA's platform. But we've been pleased to see that the company has consistently added to its asset list over time and now supports over 60 coins including popular altcoins like Cardano (ADA), Dogecoin (DOGE), Solana (SOL), and Polkadot (DOT).

Open A New Saver IRA

You can also set up a new IRA with Bitcoin IRA. They recently released a new product called the Saver IRA that can be started with a minimum deposit as low as $100.

To open one of these accounts, you'll need to connect a savings or checking account and set up recurring contributions of at least $100. Your monthly deposits will be automatically invested in the cryptocurrencies that you selected.

Buy And Sell Crypto On Mobile

Bitcoin IRA recently launched its mobile app on Apple and Android devices. Bitcoin IRA says that it's world's first app that allows users to trade cryptocurrencies inside a self-directed retirement account. You can also use the app to view advanced charts, set up custom price alerts, and more.

Do You Need To Form An LLC?

Unlike other companies that offer cryptocurrency IRAs, you do not need to create an LLC to contain a self-directed IRA with Bitcoin IRA. It's is a turnkey solution that does everything for you.

When you go the self-directed IRA route, it takes more time and costs more. By comparison, it takes about three minutes to open a Bitcoin IRA account and the fees are less than that of a self-directed IRA.

Why Trade Bitcoin In An IRA?

Bitcoin profits are taxed just like profits from trading stocks. If the stock is held for a year or less, the gain is short-term and taxed at your ordinary-income tax rate. If held for more than a year, the gain is long-term and taxed at the much lower rate of 0%, 15%, or 20%, depending on your income.

When you trade in an IRA, you don’t have to worry about taxes since gains are tax-free or tax-deferred. With a Traditional IRA, contributions are tax-free, and taxes are deferred on gains. With a Roth IRA, contributions from earned income have already been taxed. Gains are tax-free on a Roth.

Given the volatility of most cryptocurrencies, they are often held for less than a year, generating higher short-term gains in the process — trading in an IRA shelters those capital gains from taxes.

Are There Any Fees?

Bitcoin IRA primarily charges three different fees. These are:

- One-time set-up fee: 0.99% to 2.99% of deposited funds

- Transaction fee: 2% on all buy and sell orders

- Account Security fee: 0.08% of assets under management (billed monthly)

The are also a variety of miscellaneous service fees that can all be avoided such as fees for domestic or international wires. You can see the full fee schedule here.

How Does Bitcoin IRA Compare?

Alto and Rocket Dollar are two of Bitcoin IRA's biggest competitors. Both of those companies will allow you to invest in just about anything inside your self-directed retirement account, while Bitcoin IRA currently only supports crypto and gold.

For smaller accounts, Bitcoin IRA's AUM-based fee (0.08%) should cost about the same as Alto's and Rocket Dollar's flat monthly fees (which range from $10 to $30). However, as your account grows, your monthly fee with Bitcoin IRA will rise as well.

If investing in crypto is your main goal, Alto is a strong alternative to Bitcoin IRA as it has a direct integration with Coinbase. However, it should be noted that Rocket Dollar is currently the only one of these three companies that will allow you invest inside a self-directed Solo 401(k).

Header | |||

|---|---|---|---|

Rating | |||

Account Types | IRAs | IRAs | IRAs or Solo 401ks |

Set-up Fee | 0.99% - 2.99% of deposit | $0 | $360 to $600 |

Account Fee | 0.08% (billed monthly) | $10 to $25/mo | $15 to $30/mo |

Investment Options | Crypto and Gold | Robust | Robust |

Cell |

How Do I Open An Account?

You can visit the Bitcoin IRA website to open an account. Bitcoin IRA says the process takes less than three minutes and consist of the following steps:

- Open a Bitcoin IRA account

- Transfer IRA funds

- Start trading cryptocurrency

Related: See how Bitcoin IRA compares to our picks for the best Bitcoin trading sites.

Is My Money Safe?

Bitcoin IRA uses BitGo Trust for its custodian. BitGo Trust is the largest processor of chain Bitcoin transactions. Additionally, all assets under BitGo Trust custody are insured for up to $700 million. Assets are also stored offline in 100% cold storage technology, in bank-grade class 3 vaults. BitGo Trust storage has a SOC 2, Type 2 rating.

How Do I Contact Bitcoin IRA?

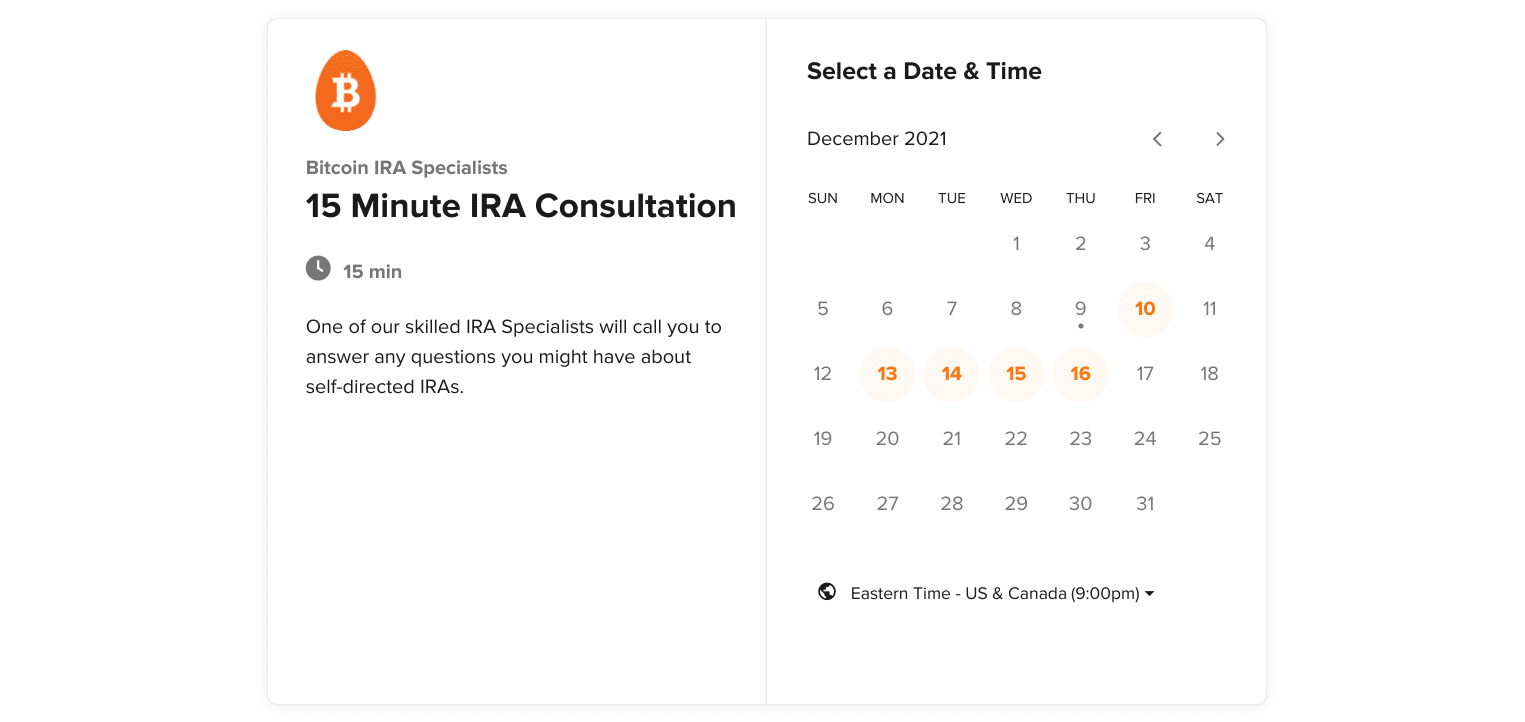

You can call 877-936-7175 to talk to someone from Bitcoin IRA's general customer service team. Or if you'd like to speak with a specialist, you can schedule an appointment here.

As of writing, Bitcoin IRA doesn't have a Trustpilot profile. However, it is accredited with the Better Business Bureau (BBB) and currently has an A+ rating.

Is It Worth It?

Yes, if you're looking to trade cryptocurrencies in your IRA, want someone to fully set up the account, and are comfortable with the fees, Bitcoin IRA could be what you’re looking for. They are very secure, have phone support, and make the entire process easy.

But if you're looking to use your IRA to invest in more alternative assets than just cryptocurrency, a self-directed IRA provider like Alto or Rocket Dollar will be a better choice. Check out our list of the best self-directed IRA providers available today.

Bitcoin IRA FAQs

Here are a few of the most common questions that people ask about Bitcoin IRA:

Can I buy Ethereum inside my Bitcoin IRA account?

Yes, Ethereum is one of the 60+ assets that the platform currently supports.

Does Bitcoin IRA offer Solo 401ks?

No, while transferring money from an existing 401k account is allowed, you can only move the funds into an IRA.

Do Bitcoin IRA's interest accounts have lock-up periods?

No, you can withdraw your assets at any time.

Can I transfer cryptocurrencies into my Bitcoin IRA account?

No, current IRS rules prohibits Bitcoin IRA from allowing account holders to transfer in cryptocurrency assets from an exchange or external wallet.

Can I buy real gold inside my Bitcoin IRA?

Yes, Bitcoin IRA allows you to buy ownership rights to investment-grade physical gold bars that are stored in some of Brink's top bullion vault facilities.

Bitcoin IRA Features

Services |

|

Supported Currencies | 60+ |

Fees |

|

Supported Countries | 50+ |

Minimum Deposit | Transferred IRA: $3,000 New Saver IRA: $100 |

Rates On Interest-Earning Program | N/A |

Investment Caps | None |

Custody Insurance | Yes, up to $700 million |

Security Features | 100% offline investment storage SOC 2 Type 2 security certification for digital wallet |

Custody Insurance | Yes, up to $100 million |

Customer Service Phone Number | 1-877-936-7175 |

Mobile App Availability | None |

Promotions | None |

Bitcoin IRA Review

-

Liquidity

-

Fees

-

Products and Services

-

Supported Currencies

-

Customer Service

-

Security

Overall

Summary

Bitcoin IRA is a platform that offers 24/7 cryptocurrency trading inside an IRA with low investing minimums and robust custody insurance.

Pros

- 24/7 trading

- $100 million custody insurance

- 100% offline storage

- Automatic investing tools

Cons

- Solo 401(k)s aren’t supported

- Fewer investment options than other self-directed IRA providers

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak