If you're looking to buy or sell crypto, there are many cryptocurrency platforms to choose from. Crypto.com, based in Hong Kong, is one such cryptocurrency platform that has been gaining in popularity over the past few years.

In addition to supporting many currencies, Crypto.com offers its own native coin and allows users to earn interest on their crypto holdings.

Continue reading our full Crypto.com review to see what makes them attractive as a cryptocurrency platform.

Quick Summary

- Earn interest by staking coins

- Get a Visa card that allows you to spend your crypto

- Store your coins in a secure cryptocurrency wallet

Crypto.com Details | |

|---|---|

Product Name | Crypto.com |

Supported Currencies | United States: 50+ Worldwide: 90+ |

Interest Rate On Crypto | Up to 6.5% per year |

Maker Fees | 0.036% to 0.40% |

Taker Fees | 0.090% to 0.40% |

Promotions | $10 sign-up bonus |

Who Is Crypto.com?

Crypto.com (legal name: MCO Malta DAX Limited) is a cryptocurrency investing and staking platform. It was founded in June 2016. Crypto.com’s founders are Bobby Bao, Gary Or, Kris Marszalek, and Rafael Melo. It is based in Sai Wan, Hong Kong Island, Hong Kong. It has raised $26.7 million.

What Do They Offer?

Crypto.com allows people to buy, sell, trade, and earn interest on their cryptocurrencies. United States users can sign up for the Crypto.com App, Crypto.com Visa Card, and DeFi Wallet. But you must live outside the U.S. to use the web-based Crypto.com Exchange.

Below are some of the notable features of the Cypto.com App:

- Buy and sell crypto

- Send funds to other crypto.com users

- Included crypto wallet

- Staking platform — earn interest

- Visa card

Crypto.com supports over 150 cryptocurrency pairs in total. However, a few dozen of those currencies aren't available in the United Stats..

CRO Coin

Crypto.com offers its own native cryptocurrency called Cronos (CRO). It enables customers to pay for goods and services using the Crypto.com DeFi Wallet App. It can also be traded.

Crypto.com users can choose to receive payments in CRO as well as stable coins or fiat. They can also swap CRO or stake it (detailed below) to boost their interest yield by 20x.

Use Your Crypto In The Real World

One of the most unique features of Crypto.com is that it allows you to use your crypto in the real world. Often crypto owners are restricted to exchanging coins with other investors.

But with Crypto.com, you can use your crypto to buy physical goods and services.This is possible because Crypto.com allows users to load their crypto onto one of the platform's various Visa cards.

At least that's what it looks like on the surface. Since most merchants still don't accept crypto as payment, Crypto.com will still need to convert it to USD before it hits your card. Basically, they're just automating the process for you.

Card Rewards

Crypto.com offers several different card tiers. Each tier has a different CRO reward amount and is based on the amount of CRO staked on the card. CRO rewards are issued when you spend using the card.

You can also receive credit on popular subscriptions such as Spotify, Netflix, and Amazon Prime. The highest reward rate occurs when you stake 5 million CRO, which provides an 8% reward.

Staking Coins To Earn Interest

Staking means that you lock your coins up for a period of time and, in exchange, earn interest on them. The rates that you’ll earn varies with the length of time your coins are staked. Interest is paid in the coin that you stake rather than in USD or other fiat money.

The app feature that allows you to earn interest is called Crypto Earn. You’ll receive a weekly payout on your simple interest earnings. The app will show how much your staked coin was worth at the time of payout.

Because your staked coin is locked up based on the term you’ve selected, it doesn’t really matter what the coin’s price does (i.e., whether it goes up or down) because you can’t sell it. This can be good and bad. But it does help you avoid panic-selling at the bottom.

Terms are one and three months. There is also a flexible term option. Longer terms pay more and the flexible option pays the least. You’ll get higher rates if you stake 50,000 or more CRO. Staking 500,000 or more CRO will earn an additional 2%.

Are There Any Fees?

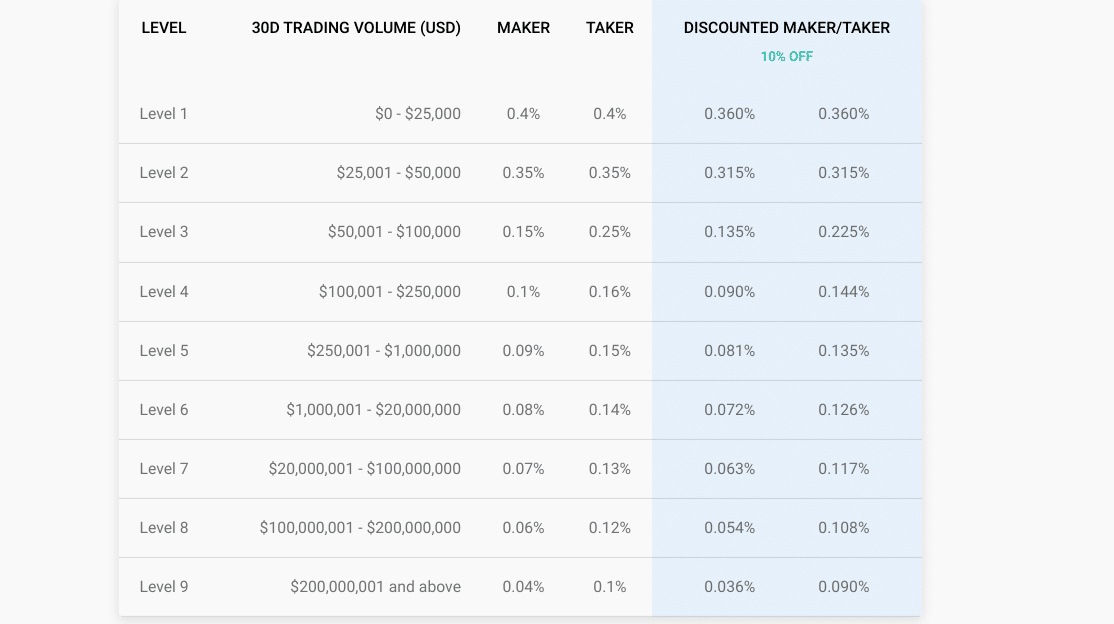

Yes, Crypto.com has a complex maker/taker fee structure for trading crypto. Depending on your 30-day trading volume, the maker fee can range from 0.036% to 0.40% and the taker fee can range from 0.090% to 0.40%.

Also, it should be noted that the minimum and maximum withdrawal fee is different for each type of cryptocurrency. It’s best to read about the fee structure in detail on their website.

Editor's Note: Starting August 12, 2022, Crypto.com will apply top-up fees for Visa card users in the U.S.

New fees are as follows:

- Add funds via debit card: 1%

- Add funds via credit card: 2.99%

You can continue adding funds to your Crypto.com Visa Card at not cost with your Fiat or Crypto Wallets.

How Does Crypto.com Compare?

When it comes to crypto exchanges and earning interest on cryptocurrency, we compare Crypto.com to Gemini and Nexo.

Gemini is one of the largest and most well-known cryptocurrency exchanges, and Nexo is one of the largest crypto savings platforms.

Here's a closer look at how these three platforms compare:

Header |  | ||

|---|---|---|---|

Rating | |||

Interest Rate | Up to 5.25% | Up to 10% | Up to 4.86% |

Desktop Access | Yes, but not for users in the U.S. | Yes | Yes |

Rewards Card | |||

FDIC Insured | |||

Cell |

How Do I Open An Account?

You can visit Crypto.com where you’ll find links to download the mobile app for iOS and Android. You'll need to be at least 18 years of age to sign up.

Is My Money Safe?

Crypto.com does take measures to protect your funds and crypto. However, it's not FDIC or SIPC insured. Additionally, Crypto.com is not a U.S.-based company. It's based in Hong Kong, where regulations are very different. Also, you won’t find a phone number or mailing address to contact anyone.

Furthermore, Crypto.com announced in November 2022 (in the wake of the FTX collapse) that it would be providing proof of reserves. When it did so, it was revealed that 20% of its reserves were in SHIB - a meme coin. That is concerning for users of the platform as there is little liquidity in that token for that amount.

How Do I Contact Crypto.com?

Like other cryptocurrency platforms, Crypto.com offers little in the way of personal customer service. You won't be able to find a customer service phone number on its site or even a contact form.

The good news is that the site's Help Center is fairly extensive. It also has a chat box that you can use to search for Help Center articles. Underneath the search field, it says "The team can help if needed." But it's unclear how one would go about escalating their issue to get in contact with them.

Crypto.com's rating on Trustpilot is "Poor" at 2.2/5 out of over 4,500 reviews. That's honestly not too unusual for a crypto exchange. Still it bears mentioning that if you run into a problem that requires human intervention, it's likely to be awhile before you get it resolved or even receive a response.

Is It Worth It?

If you're comfortable with using a non-U.S. cryptocurrency platform and find Crypto.com’s rates attractive, it can be worth it. But those who would rather stick with a U.S. company will want to look elsewhere.

U.S. users may also be disappointed that they won't have access to the Crypto.com Exchange which is more tailored to the needs of advanced traders. Finally, some crypto traders may want to look for a company that offers a more straightforward fee schedule.

If you're primarily looking to buy and sell cryptocurrency, here are all of our favorite platforms. But if you're hoping to lend out your crypto to earn interest, you'll want to check out our list of the top cryptocurrency savings accounts.

Crypto.com FAQs

Let's answer a few of the most common questions that people ask about Crypto.com:

Can you margin trade on Crypto.com?

Crypto.com does technically support margin trading. But since this is an Exchange feature, it's not yet available in the U.S.

What is Crypto.com Pay?

Crypto.com Pay is a mobile payment solution that uses QR codes and allows users to pay any merchant with crypto. The platform currently supports 30+ tokens.

Is the Crypto.com Wallet non-custodial?

Yes, Wallet users retain full control of their private keys.

Do Crypto.com Visa cards have annual fees?

No, and ATM withdrawals are free up to a certain amount each month that varies by the specific card that you own.

Crypto.com Features

Services | Cryptocurrency exchange, lending and saving, digital wallet, debit cards, and more |

Supported Currencies | 150+ (fewer are available in the United States) |

Fees |

|

Fees to Add Funds Via Debit Card | 1% |

Fees to Add Funds Via Credit Card | 2.99% |

Fees to Add Funds Via Fiat or Crypto Wallet | None |

Supported Countries | 90+ |

Interest Rate On Crypto | Up to 5.25% |

Card Rewards | Midnight Blue: 1% |

Payment Methods |

|

Deposit Fees | None |

Withdrawal Fees | Varies by cryptocurrency type |

Security | 100% cold storage $750 million of cryptocurrency insurance |

Customer Service Options | Help center only |

Mobile App Availability | iOS and Android |

Web/Desktop Access | Yes, but not in the U.S. |

Promotions | $10 sign-up bonus |

Crypto.com Review

-

Fees

-

Savings APY

-

Ease of Use

-

Customer Service

-

Safety and Security

Overall

Summary

Crypto.com is a cryptocurrency exchange that supports 90+ currencies, pays interest on crypto, and even offers a rewards card. Learn more!

Pros

- Pays weekly interest on crypto savings

- 90+ supported coins

- Visa cards for buying physical goods with crypto

Cons

- Complicated fee structure

- No desktop account access

- No customer service number or email

- 35+ coins unavailable to U.S. residents

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak