Holding cryptocurrencies isn’t like holding cash as crypto is very volatile. But some exchanges will allow you to hold crypto on deposit and earn interest like a savings account.

Many of these platforms will also let you borrow cash by putting your crypto up as collateral. Nexo is yet another crypto platform that pays interest on deposits and allows you to borrow against your crypto.

But is it any different from all of the other platforms that do the same? And is there a compelling reason to choose Nexo over its competitors? Let’s find out.

Note: In February 2022, Nexo paused its Earn Interest product for new U.S. based customers. Existing customers will still be able to earn and withdraw, but cannot add more deposits into it.

Nexo Details | |

|---|---|

Product Name | Nexo |

Interest Rates | Up to 16% |

Interest-Earning Cryptocurrencies | 17 |

Withdrawal Limits | 1-5 free crypto withdrawals per month |

Promotions | $100 in BTC |

Who Is Nexo?

Nexo describes itself as the world’s leading regulated financial Institution for digital assets. Antoni Trenchev is the co-founder and managing partner. It was founded in 2017 and is based in London, England. Nexo has raised $52.5 million in funding and claims to have over $15 billion in assets under management.

What Do They Offer?

Nexo is a cryptocurrency platform that allows customers to earn interest on crypto deposits and also take out loans. Below we break down how each option works.

Earning Interest

Note: In February 2022, Nexo paused its Earn Interest product for new U.S. based customers. Existing customers will still be able to earn and withdraw, but cannot add more deposits into it.

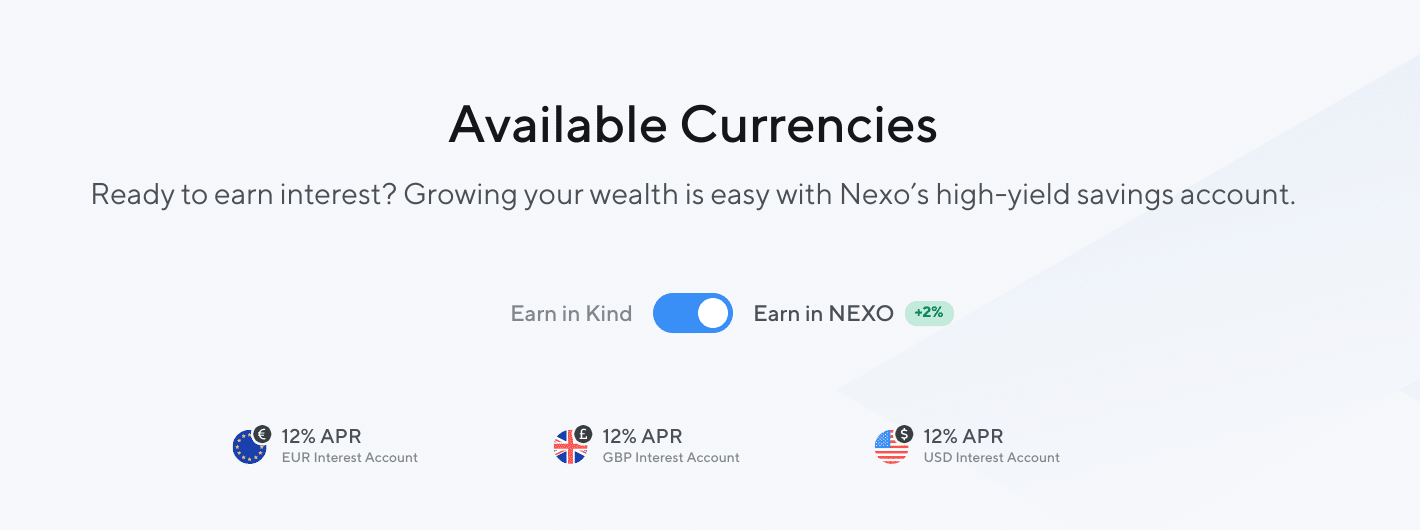

Interest can be earned on crypto and stablecoins. Crypto pays up to 8% while stablecoins pay up to 16%. Interest is compounded daily which means you get an interest payout every day. Money can be added and withdrawn at any time. There isn’t any lockup period on deposits.

While fiat money can be withdrawn at any time, there are limits on the number of times you can withdraw crypto. These limits range from 1 to 5 times per month and are dependent on your loyalty tier. Here are the four tiers, their requirements, and monthly withdrawal limits:

Tier | Nexo Tokens In Portfolio | Withdrawals Per Month |

|---|---|---|

Base | 1% | 1 |

Silver | 1-5% | 2 |

Gold | 5-10% | 3 |

Platinum | At least 10% | 5 |

To earn between 8% and 12%, at least 10% of your portfolio will need to be in Nexo so that you're eligible to be a Platinum-level client.

Earnings differ by crypto coin and fiat and if your deposits are in crypto or Nexo. Some example interest rates are listed below:

Coin | Earn In Kind | Earn In Nexo (Additional 2%) |

|---|---|---|

USDT | 10% | 10% |

USDC | 10% | 10% |

DAI | 10% | 10% |

BTC | 6% | 5% |

ETH | 6% | 5% |

LTC | 6% | 5% |

EOS | 6% | 5% |

XRP | 6% | 5% |

In total, there are 12 cryptocurrencies, 6 stablecoins, and 3 fiats (USD, EUR, GBP) that are accepted for deposit. New tokens are added all the time, including Arbitrum (ARB).

Interest rates are also dependent on the time held. A one-month holding period will earn 1% more and a three-month holding period will earn 4% more. It isn’t clear if these rates are on top of those quoted above and if they apply only to NEXO deposits.

You can deposit funds directly from your bank (i.e., fiat currency) or transfer crypto from a wallet or exchange. Bank transfers will take between 1-3 days.

Borrowing

Nexo allows you to borrow in cash or stablecoins without a credit check. Rates start at 5.9%, and you don’t have to sell your crypto. The borrowed amount is called a credit line. You can borrow from $50 to $2 million. You can keep borrowing until you hit your credit limit.

The amount you can borrow is dependent on the amount of crypto you have on deposit. For example, for Bitcoin, your credit line will be 50% of the BTC on deposit and will fluctuate based on BTC’s market value. For other cryptos, the amount might be more or less than 50%.

If the value of your crypto begins dropping, you’ll receive an email from Nexo to deposit more crypto to maintain your collateral. If you don’t deposit more crypto, funds will move from your savings wallet to your collateral account. If there isn’t anything in your savings wallet, Nexo will begin selling off your collateral to repay the loan.

You can spend the borrowed amount as cash, crypto, or by using the Nexo card. Since you don’t have to sell any crypto in order to borrow, you avoid a potentially taxable event (in the event that the crypto was sold at a profit).

Nexo Card

Nexo combines credit and debit features in a single card, called a Nexo Card. The card allows you to toggle between Credit and Debit Modes, allowing you to choose the way you spend.

In Credit mode, you can spend without selling your crypto. As soon as you deposit crypto, it becomes a backup for your Nexo credit line. The more you deposit, the higher your credit limit.

Debit mode allows you to spend 60+ cryptocurrencies, including BTH, ETH, and USDT. You can easily change your spending priority using Nexo's drag-and-drop feature, or rearrange your cryptocurrencies in order of priority.

And while your crypto is always available to spend, you will continue to earn interest on your deposit balance.

Are There Any Fees?

There are no fees for depositing or withdrawing fiat or moving crypto into your Nexo Wallet. And, as mentioned previously, Nexo customers will receive 1-5 free crypto withdrawals per month based on their loyalty tier.

But what if you want to make more crypto withdrawals in a given month than you're allowed to do for free at your tier level? In these cases, it's unclear what you'd be charged. We couldn't find a crypto withdrawal fee structure listed anywhere on Nexo's site.

If you decide to borrow against your crypto assets, you'll of course be charged interest until your loan is repaid. Borrowed funds start at a 6.9% interest rate. There are no origination or early pay-off fees.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Supported Currencies | 15+ | 200+ | 30+ |

Savings APY | Up to 8% | Up to 25% | Up to 7.4% |

Crypto-Backed Loans | |||

Mobile App | |||

Cell |

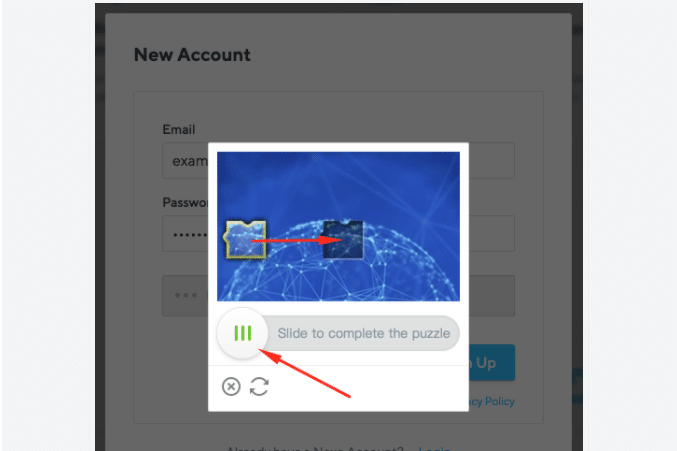

How Do I Open An Account?

You can visit Nexo's website to open an account. After providing your email address and password, you'll need to verify your account by completing a simple slide puzzle.

You'll also need to provide a high-quality photo of a government ID for Nexo's KYC and ALM checks.

Nexo Bonus Offers

Right now, Nexo is offering the following promotion to new users. You can get $100 in BTC when you open a new account, complete advanced verification, and deposit at least $1,000 in any supported asset on the platform.

You must keep the $1,000 minimum for at least 30 days.

Is My Money Safe?

Nexo isn’t a U.S. company and doesn’t follow U.S. regulations or offer FDIC insurance. But its custodial wallet does use cold storage that is held in military-grade Class III vaults. And it also has $375 million insurance on custodial assets and says it aims to increase its insurance coverage to $1 billion in 2021. That means that you're protected against the loss or theft of your private keys.

Is It Worth It?

The interest rates that Nexo offers are competitive and they pay out daily which is a bonus. If it happens to pay interest on one of the coins that you own, it could certainly be worth checking out. But if you want to deal with a U.S.-regulated company or you're looking earn interest on a coin that Nexo doesn't support, you'll need to choose a different platform.

Nexo Features

Product Type | Crypto savings, loans, and exchange |

Interest-Earning Cryptocurrencies |

|

Interest-Earning Fiat Currencies |

|

Interest Rate On Deposits | 5% to 8% |

Payout Frequency | Daily |

Min Balance Requirements To Earn Interest | Varies by coin |

Lockup Period | None |

Loyalty Tiers |

|

Deposit Fees | None |

Fiat Withdrawal Limits | None |

Crypto Transfer Limits | None if transferred to your Nexo Wallet |

Crypto Withdrawal Limits | 1-5 free withdrawals per month (based on loyalty tier) |

Fees For Additional Crypto Withdrawals | Unclear |

Loan Interest Rates | Starting at 6.9% |

Loan Origination Fees | None |

Loan Processing Time |

|

Insurance | $375 million of insurance on assets held inside Nexo Wallet via Lloyd’s of London and Marsh and Arch |

Security | Deposits kept in cold storage held in military-grade Class III vaults |

Mobile App Availability | Yes, iOS and Android |

Desktop Availability | Yes |

Customer Service Options | Email and support tickets |

Customer Service Email | info@nexo.io |

Promotions | $100 in BTC |

Nexo Review

-

Commissions and Fees

-

Interest Rates

-

Ease of Use

-

Customer Service

-

Safety and Security

-

Liquidity

Overall

Summary

Nexo is a cryptocurrency platform that offers bank-like services such as interest-earning accounts and crypto-backed loans.

Pros

- High interest rates

- Daily interest payouts

- No lockup periods

- 1-5 free crypto withdrawals per month

- Nexo Card flips between Credit and Debit modes for spending flexibility

Cons

- Unclear what users pay for additional crypto withdrawals (beyond their monthly limits)

- Limited customer service

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak