Ellevest offers investing and financial planning services for women.

To say that women are becoming more involved in the financial world is an understatement. While income inequality is still an issue, females are earning higher salaries and taking more agency with their finances than ever.

But research shows that men are still more likely than women to prioritize investing. The reasons range from a lack of confidence to a distaste for the male-dominated world of financial planning. But one thing is certain - there's a male/female investing gap that needs be bridged.

That’s where Ellevest is looking to make a difference. Ellevest is a money management platform geared towards women. They claim to offer holistic help with money - from banking* to investing and more - and attempting to make the whole experience more comfortable for their clientele.

But is Ellevest filling a service gap or taking advantage of timid or inexperienced investors? Read on to find out what we think.

Ellevest Details | |

|---|---|

Product Name | Ellevest |

Min Investment | $0 |

Monthly Fee | $1 - $9 per month |

Account Types | Banking, Taxable, Traditional, Roth, SEP IRA |

Promotions | First Three Months Free |

Who Is Ellevest?

Ellevest has transformed itself into a money management platform for women. It's designed to help with everything from banking to investing - with personalized guidance along the way. With three membership plans, you can tailor your needs to where you're at in your life.

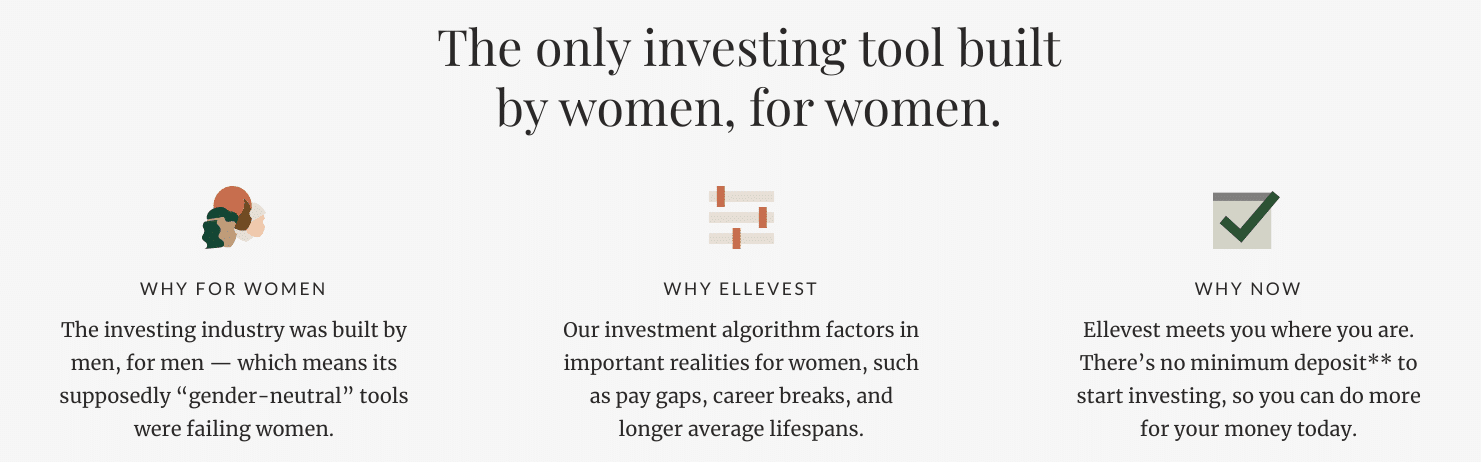

Ellevest is tailored to female financial needs. It recognizes the unique financial difficulties that women experience, including slower salary growth and increased longevity. They also claim to understand and address why women are more hesitant to invest their earnings - a main reason they fall behind in retirement planning.

In seeking to narrow that gender investment gap, Ellevest is dealing with the murky but important emotional aspect of investing. According to some experts, that could mean all the difference.

“The emotional side of investing is more influential than just about anything else,” said CFP Meg Bartelt of Flow Financial Planning. “So, anything that makes women more comfortable with investing and directs them to a tried-and-true investment strategy is a good thing.”

What Does It Offer?

Ellevest offers four core products rolled into its membership. They offer banking, investing, coaching and learning. Here's a closer look at at each service:

Banking

Ellevest calls their banking* suite Spend and Save. You get a debit card that pays an average of 5% cash back on eligible purchases at participating national brands.

You can also round up** your purchases to save in a FDIC-insured*** savings account. Unfortunately, the savings account doesn't currently pay any interest.

There are no overdraft fees, no minimum balance requirements, and you'll get unlimited domestic ATM reimbursement****. However, you may incur foreign transaction fees if you use your debit card overseas. And there's a $5 fee for withdrawing cash from an international ATM.

Investing

When it comes to investing, Ellevest offers both a robo-advisor service (which was their original product when they launched) and personalized financial planning sessions for purchase at a discount with membership.

Like other robo advisors, Ellevest determines which investments to choose by asking the user questions about her goals, retirement timeline and financial history. But unlike other robo-advisors, its algorithms also consider factors that often specifically impact women such as wage gaps, career breaks, and average lifespans (which are longer than men).

Members can have their money invested in a Core or Impact Portfolio. Core Portfolios focus solely on tax minimization and diversification. Impact Portfolios is the term that Ellevest uses for its socially responsible portfolios. Each Impact Portfolio invests at least 53% of funds in ESG and impact funds.

While Ellevest does offer automatic rebalancing, it should be noted that they don't offer tax-loss harvesting. They look at this as a strength instead of a weakness though, so don't expect them to be adding this feature anytime soon.

You can open a taxable brokerage account with Ellevest as well as a Traditional, Roth, or SEP IRA. The only costs associated with investing are the monthly fees you pay - you don't pay any asset under management (AUM) fees.

Learning

Ellevest also has a robust learning offering built into the membership. As a member you’ll be able to access live workshops with CFP’s and executive coaches, on demand email courses, content on their blog, and also get monthly customized progress reports.

Coaching

Finally, Ellevest does offer coaching for both financial and career needs. You can pay for sessions with a financial planner to get questions answered, or a career coach to help you with things like negotiating a raise.

Here are few of their most popular sessions and their non-member prices:

- Budget and Debt Planning Session: $300

- Career Clarity Coaching: $350

- Money Checkup: $190

- Your Money and Your Values: $75

- Resume Review: $400

- Unlimited Access to a CFP® Pro: $995 (for a year of access)

Members can get a discount of up to 50% on each of the prices listed above. Essential member get 20% off, Plus members get 30% off, and Executive members get 50% off the regular price of Ellevest's coaching sessions.

What Are Ellevest's Fees?

With their switch to a money membership model, Ellevest has adjusted their pricing to simply be a monthly fee depending on the level of service you want. They currently offer three membership plans:

Ellevest Essential - $1/mo

Ellevest Essential is their basic plan that gives you access to their banking* and investing products. You also get access to all the learning resources including free workshops. If you want to speak to a financial planner or career coach, you receive a 20% discount.

Ellevest Plus - $5/mo

Ellevest Plus includes everything in essentials, but it also gives you access to personalized retirement planning for your IRA or 401k. They will also help you rollover your IRA or 401(k) to Ellevest for free. If you want access to a financial planner or career coach, you'll receive a 30% discount.

Ellevest Executive - $9/mo

Ellevest Executive is designed to provide a high level of access for people who want even more personalized help. You can plan for more personalized goals with investing and banking, and you get access to a free 1-on-1 review of your investments with a specialist (they clearly don't say financial planner, so we're not sure who this person would be). You also get 50% sessions with a financial planner or career coach.

Note: Ellevest also offers Private Wealth management for clients with balances above $1 million. It's unclear how they charge for this service but it's likely that high net worth clients pay a percentage of assets under management (AUM) rather than a flat fee.

Evaluating Ellevest's Pricing

Before this transition to a membership model, Ellevest charged 0.25% AUM for digital and 0.50% for their Premium offering. In general, we don't like to see companies shift to this monthly-fee based approach. For lower account balances, it's actually more expensive as a percentage of your assets.

Today, if you have less than $4,800 in your account, even Ellevest Essential (at just $1 per month) is more expensive than what was previously charged. If you opt for Ellevest Plus at $5 per month, $60 per year doesn't sound like much, but once again, if you only have $5,000 in your account, you're paying 1.2% per year in fees - which is very high.

The alternatives here are cheaper for lower value accounts. For example, Betterment simply charges a flat 0.25% AUM. To be at the same pricing level on Ellevest Plus, you'd need to have an account with more than $24,000. At that point, Ellevest does become cheaper.

For Ellevest Executive, you'd need to have about $43,000 in your account before Ellevest becomes competitive strictly from a pricing perspective. Now, you may find value in their additional services, but they also still come at a price.

How Does Ellevest Compare?

Now that Ellevest uses a flat-fee pricing model, it's actually more a direct competitor with Acorns or Stash than traditional robo-advisors that charge a percentage of assets under management (AUM).

If you have a large account balance, Ellevest's model could make sense. It could also be a good option for investors with small accounts who feel like the round-ups and cash back rewards debit card could really help with increasing their monthly saving and investing.

However, we still believe that most people looking for a robo-advisor will find more value in an AUM-based platform like Betterment or Wealthfront. Both companies offer banking products with interest-bearing savings accounts. Here's a closer look at how Ellevest compares:

Header |  | ||

|---|---|---|---|

Rating | |||

Annual Fee | $1/mo to $9/mo | 0.25% to 0.40% | 0.25% |

Min Investment | $0 | $0 | $500 |

Advice Options | Auto and Human | Auto and Human | Auto |

Banking | |||

Cell |

How Do I Open An Account?

It only takes a few minutes to open an Ellevest account. You can begin by visiting the Ellevest website or by downloading one of its mobile apps.

During the sign-up process, you'll be asked some questions about your gender and salary. This helps Ellevest estimate how much you'll need to contribute each month to reach your investing goals by your deadlines.

Next, you'll need to link an external bank account which will be used to pay your membership fee and send funds to your Ellevest account(s). Lastly, you'll be asked to provide some personal information (including your Social Security number) to confirm your identity.

Is It Safe And Secure?

Yes, Ellevest's clients are protected by SIPC insurance up to $500,000 ($250,000 for cash). The SIPC protection is provided by Folio for its Essential, Plus, and Executive clients and by Schwab for its Private Wealth clients.

Ellevest has also taken several steps to protect your sensitive data. It uses industry-standard encryption and closely monitors its servers for network threats. And members also have the option of setting up two-factor authentication to improve their account security.

How Do I Contact Ellevest?

Like other robo-advisor platforms, Ellevest wants to solve as many customer questions as possible without requiring actual contact with a support representative. So when you visit its support page, you'll find a bunch of FAQ articles rather than contact information.

Without logging into your account, you won't be able to see any phone numbers. However, you can start a live chat at any time from the website or app. You can also email the Ellevest team at support@ellevest.com.

Ellevest has a B rating with the Better Business Bureau (BBB) but is not currently BBB-accredited. Its apps are very well-reviewed, however. The iOS Ellevest app has a 4.7/5 rating out of over 3,800 customer reviews and its more-recently launched Android app is currently rated 4.6/5.

Why Should You Trust Us?

We've been writing about investing and have reviewed brokerage firms since 2009. When Ellevest launched in 2014, we were one of the first platforms to review the service and quickly called them out for charging a "Pink Tax" to their subscribers. And since then, we've reviewed most robo-advisor platforms in the United States (and also, thankfully, Ellevest changed their pricing model as well).

Also, our compliance team regularly checks and updates the rates in this review as needed.

Is It Is Worth It?

Ellevest remains divisive among financial planners, many of whom think there are better products already on the market. “I think it's an interesting concept, but I'm just not convinced that investing for women is that different than it is for men,” said CFP Sophia Bera of Gen Y Planning.

Other planners say talking to a real human being would be more comforting to women concerned about retirement. “Women do have a different set of needs and concerns, from unequal pay to a much higher need for long-term care in retirement, but how does an asset allocation model solve that?” said CFP Mark Struthers of Sona Financial. “I don't think it can - only a real fiduciary planner can do that.”

Anyone interested in a financial planner can find one through the National Association of Personal Financial Advisors or the Certified Financial Planners organization. Or if you're convinced that a robo-advisor is right for you, you can compare your options here.

Ellevest FAQs

Let's answer a few of the most common questions people ask about Ellevest:

Can men open Ellevest accounts?

Yes, anyone can use Ellevest regardless of gender identity. If you do identify as a man, Ellevest will based its recommendation on men-specific lifespan and salary curve data.

Is Ellevest a bank?

No, all banking services are provided through its partner, Coastal Community Bank, member FDIC.

Who is the CEO of Ellevest?

Sallie Krawcheck, co-founder of Ellevest, has served as the company's CEO since its founding in 2014.

Does Ellevest support self-directed trading?

No, Ellevest is strictly a robo-advisor investing platform and only offers managed portfolios.

Are there any Ellevest promotions for new clients?

Yes, Ellevest is currently offering three months of free membership to new clients.

Ellevest Features

Account Types |

|

Minimum Investment | $0 |

Management Fees |

|

ETF Expense Ratios |

|

Socially Responsible Investments | Yes |

Access to Human Advisor | Yes, but not included in management fee |

Coaching Discount |

|

Automatic Rebalancing | Yes |

Tax-Loss Harvesting | No |

Customer Service Number | Not published |

Customer Service Email | support@ellevest.com |

Other Customer Support Options | Online live chat |

Web/Desktop Access | Yes |

Mobile App Availability | iOS and Android |

Promotions | First three months free |

DISCLOSURES

*Banking products and services are provided by Coastal Community Bank, Member FDIC, pursuant to license by Mastercard International.

**If you opt in to the Roundup Program for debit card purchases, each settled (i.e. fully completed) purchase transaction made with your Ellevest Debit Card will be rounded up to the nearest whole U.S. dollar. The Roundup amount will be transferred from your Spend account to your Save account. Foreign purchases are rounded up to the nearest whole dollar after the purchase is converted to U.S. dollars. ATM withdrawals and transactions in whole US dollars, e.g. $20.00 are excluded from the Roundup program. If, at the time of settlement of a purchase, your Ellevest Spend Account has insufficient available funds to cover the full amount of the Roundup transfer, the Roundup Transfer will not be made.

If a purchase is canceled or reversed for any reason (including disputes), the corresponding Roundup Transfer will not be reversed. You can opt out of the Roundup Program at any time.

***The Ellevest Spend and Save accounts are FDIC-insured up to $250,000 per depositor through Coastal Community Bank, Member FDIC.

****Domestic ATM transaction fees will be reimbursed if a payroll direct deposit has been received within the prior 30 days of the ATM transaction settlement. International ATM withdrawal fee of $5 will apply.Ellevest Review

-

Commissions & Fees

-

Customer Service

-

Ease of Use

-

Tools & Resoureces

-

Investment Options

-

Specialty Services

Overall

Summary

Ellevest is a money membership platform for women that focuses on investing, banking, coaching, and more.

Pros

- Algorithms tailored to women’s needs

- Offers socially responsible funds

- Average of 5% cash back on debit card

- No minimum balance

Cons

- Flat fees can be expensive (especially for accounts with smaller balances)

- No tax-loss harvesting

- Must pay an extra fee for access to CFPs

Zina Kumok is a freelance writer specializing in personal finance. She has been featured in Lifehacker, DailyWorth and Time, and she paid off $28,000 worth of student loans in three years. She also works with people one-on-one as a money coach at ConsciousCoins.com.

Editor: Clint Proctor Reviewed by: Ashley Barnett