There are over 43.2 million student loan borrowers that have a total of $1.73 trillion in student loan debt. Here is the average student loan debt balance by state.

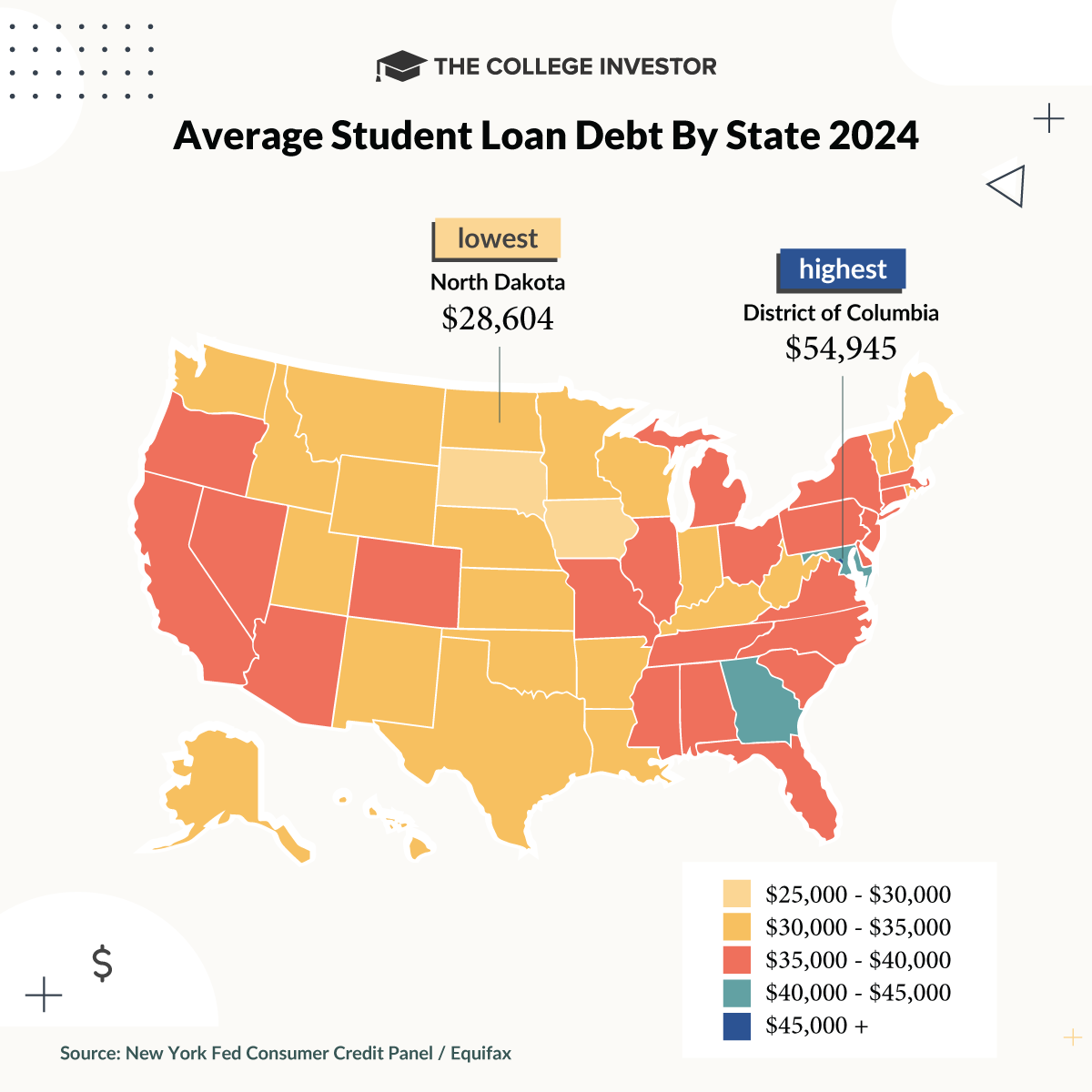

While the average balances across the United States hover in a range, Washington DC has the highest average student loan debt, while North Dakota has the lowest average student loan debt.

Here's a breakdown of the average student loan debt by state in 2024.

Nationwide Student Loan Fast Facts

The descriptive statistics below reflect the state of student loan borrowers across the United States through the third quarter of 2023. However, the delinquency facts in the table below are likely skewed because of the repayment restart.

- Number of Borrowers: 43.2 million

- Median Debt Balance: $19,281

- Average Student Debt Balance: $37,088

- Number of Borrowers with delinquent or defaulted loans: 3.3 million (7.5% of all borrowers)

- Number of borrowers that saw their debt decrease in 2023: 11.5 million (26.6% of all borrowers)

- Percentage of student loan borrowers who have paid off their debt: 49%

- Estimated number of borrowers eligible for loan forgiveness: 38.6 million

Note, given the pandemic and all federal student loan payments being paused, the average student loan payment data is skewed. You can see the past average student loan payment and average student loan debt by graduating class here.

Although debt levels continue to rise, some student loan borrowers are seeing their debt loads fall. Nearly half (49%) of all borrowers who took out loans to pay for their education have paid the loans off in full.

Among current borrowers, 31.4% saw their debt loads shrink in 2023.

Student Loans By State Fast Facts

While the nationwide debt statistics paint a concerning picture, the actual debt loads vary significantly from state to state within a range of about $30,000.

While it's expected to see that California has the most borrowers, it's interesting to see some of the other data.

- Most borrowers: California (3.8 million)

- Fewest borrowers: Wyoming (54,400)

- Lowest Average Balance: North Dakota ($28,604)

- Highest Average Balance: Maryland ($42,861)*

*Washington D.C. is a district rather than a state, but its average student loan balance is a whopping $54,945.

Student Loan Debt By State Breakdown

You can see a state by state breakdown of the student loan debt situation below.

State | Total Borrowers | Average Debt | Percent Delinquent |

|---|---|---|---|

Alabama | 632,800 | $37,137 | 9.5% |

Alaska | 67,600 | $34,024 | 6.9% |

Arizona | 887,100 | $35,396 | 8.7% |

Arkansas | 390,000 | $33,333 | 9.0% |

California | 3,823,700 | $37,084 | 7.1% |

Colorado | 774,000 | $36,822 | 7.0% |

Connecticut | 497,700 | $35,162 | 6.3% |

Deleware | 127,800 | $37,559 | 6.8% |

District of Columbia | 118,300 | $55,945 | 7.8% |

Florida | 2,623,600 | $38,459 | 8.2% |

Georgia | 1,647,500 | $41,639 | 9.4% |

Hawaii | 122,400 | $36,765 | 7.7% |

Idaho | 218,100 | $33,012 | 6.5% |

Illinois | 1,631,500 | $37,757 | 6.7% |

Indiana | 906,500 | $32,874 | 9.4% |

Iowa | 433,300 | $30,848 | 7.6% |

Kansas | 383,700 | $32,578 | 7.7% |

Kentucky | 601,000 | $32,779 | 10.0% |

Louisiana | 651,700 | $34,525 | 9.3% |

Maine | 187,100 | $33,137 | 5.9% |

Maryland | 837,600 | $42,861 | 6.8% |

Massachusetts | 902,000 | $34,146 | 4.9% |

Michigan | 1,412,100 | $36,116 | 7.9% |

Minnesota | 788,600 | $33,604 | 5.8% |

Mississippi | 439,000 | $36,902 | 10.7% |

Missouri | 833,400 | $35,397 | 8.1% |

Montana | 126,700 | $33,149 | 5.6% |

Nebraska | 247,500 | $31,919 | 4.8% |

Nevada | 349,700 | $33,743 | 9.8% |

New Hampshire | 190,700 | $34,085 | 4.8% |

New Jersey | 1,199,400 | $35,434 | 5.8% |

New Mexico | 228,000 | $34,211 | 8.7% |

New York | 2,460,300 | $37,678 | 4.9% |

North Carolina | 1,304,300 | $37,721 | 8.0% |

North Dakota | 87,400 | $28,604 | 5.0% |

Ohio | 1,794,300 | $34,721 | 8.2% |

Oklahoma | 488,500 | $31,525 | 9.6% |

Oregon | 543,000 | $37,017 | 8.3% |

Pennsylvania | 1,822,800 | $35,385 | 7.2% |

Rhode Island | 143,500 | $32,056 | 6.1% |

South Carolina | 731,500 | $38,414 | 9.1% |

South Dakota | 116,300 | $30,954 | 5.3% |

Tennessee | 862,200 | $36,418 | 9.0% |

Texas | 3,645,200 | $32,920 | 8.5% |

Utah | 307,600 | $32,865 | 5.8% |

Vermont | 77,300 | $37,516 | 5.0% |

Virginia | 1,082,600 | $39,165 | 6.4% |

Washington | 788,500 | $35,510 | 6.3% |

West Virginia | 227,200 | $31,690 | 11.0% |

Wisconsin | 727,400 | $31,894 | 6.0% |

Wyoming | 54,400 | $31,250 | 6.6% |

“Economic Well-Being of U.S. Households in 2020 - May 2021”, Board of Governors of The Federal Reserve System, October 7, 2022, https://www.federalreserve.gov/publications/2021-economic-well-being-of-us-households-in-2020-student-loans.htm

The United States Government. “President Joe Biden Announces $7.4 Billion in Student Debt Cancellation for 277,000 More Americans, Pursuing Every Path Available to Cancel Student Debt" April 12, 2024, https://www.whitehouse.gov/briefing-room/statements-releases/2024/04/12/president-joe-biden-announces-7-4-billion-in-student-debt-cancellation-for-277000-more-americans-pursuing-every-path-available-to-cancel-student-debt/

Education Data Initiative, "Student Loan Debt By State", May 13, 2024. https://educationdata.org/student-loan-debt-by-state

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Ashley Barnett Reviewed by: Robert Farrington