Being on top of your finances means that financial mistakes become fewer and farther between. But tax filing happens just once per year, and it’s easy to make mistakes that lead to overpaying the IRS. When that happens, filers have the opportunity to correct their mistakes by filing IRS Form 1040-X. Once the amended return is processed, the IRS cuts overpaying taxpayers an extra refund check.

If you’ve ever made a mistake on your tax return, you may have the opportunity to correct it. We dive into how to file an amended tax return.

What Is Amending A Tax Return?

Amending a tax return is the process of correcting a tax return that you’ve already filed. Most people choose to file an amended tax return when they realize they can get a larger refund based on a mistake they made during the filing process. Some people have to file amended returns based on IRS notifications. These types of amendments typically come with taxes due.

The IRS allows people to correct their mistakes (and get the money they overpaid) by filing IRS Form 1040-X.

To correct issues with your tax return, you generally must file an amended return within three years of the date you originally filed your return or two years from the time you paid the taxes for that year. If you paid your 2019 tax return on March 1st, 2020 then you have until March 1st, 2023 to file an amended tax return.

Why Should You Amend Your Tax Return?

The primary reason to amend a return is to correct a mistake that affects the amount of tax due in a specific year. An amended return may result in owing additional taxes due or getting a larger refund.

A few major issues that will likely affect the amount owed include:

- Incorrect filing status.

- Claiming the incorrect number of dependents.

- Changes to your total income (including deductions in business income if you forgot to deduct legitimate business expenses).

- Claiming tax deductions or credits that you didn’t originally claim.

Rarely, the IRS will also issue tax law changes very late (or even retroactively) which could cause you to want (or need) to amend your tax return. Over the last few years, this has become increasingly common.

When Do You File Your Amended Tax Return?

You have three years from your original filing date to file an amended return. You don’t want to sit on it for months, but you also don’t want to file too early.

The IRS warns that people who are expecting a refund from their original tax return should not file an amended return until after they have received the expected refund. For example, if you're one of the unlucky few people still waiting on a tax refund from 2020, you should wait until you receive it before amending your taxes.

How To Amend A Tax Return

Just as we recommend using tax software to file your normal tax return, we recommend using tax software to file your amended return. The only way to e-file your amended tax return is to use a tax software product.

Each tax software has slightly different steps, but these are the general steps you’ll need to follow to amend your tax return.

Step 1: Gather The Correct Documents

To file your amended tax return, you will need your original tax return and any documents that will support the changes to the tax return. To get your original tax return, you can either access the return via your tax software (you’ll typically have access for a year or more) or you can get your tax transcript from the IRS.

Aside from your original return, you’ll need documents that support the change you’re making to your tax return. For example, a parent claiming an additional child as a result of a child custody settlement needs evidence of the final settlement.

Those who are claiming forgotten credits or deductions may need receipts supporting the claim. If you forgot to claim a portion of your income, you will likely need a 1099-NEC, W2, or another 1099 source to support the change.

Step 2: Choose How To File Your 1040-X

It’s theoretically possible to prepare a 1040-X by hand and mail it in. However, we recommend using a CPA or tax software to do the heavy lifting for you.

Filers who used a CPA for the tax year they are amending should talk to their CPA about the cost structure. You may be able to enlist the CPA to file an amended return at no cost or a limited cost, especially if the CPA should have caught the issue.

If you choose to use tax software, we typically recommend that you use whatever software you used to originally file your tax return. For example, if you used FreeTaxUSA to file your 2019 tax return, then you should use FreeTaxUSA to amend your 2019 tax return.

Step 3: Complete The 1040-X

To complete your amended return, you’ll need to follow instructions from the tax software product you choose. These are instructions from some of the most popular tax companies.

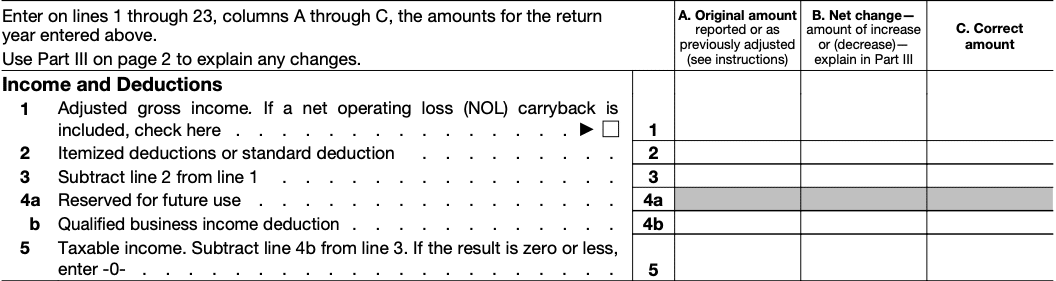

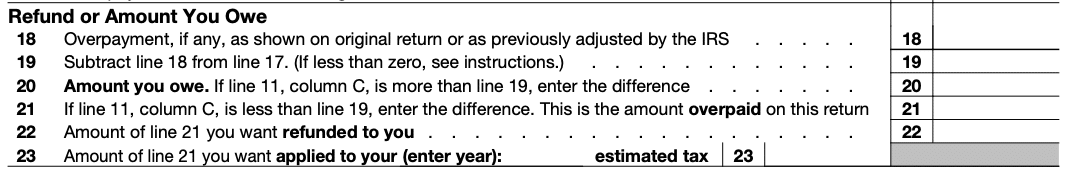

Form 1040-X has only three major columns that need to be filled out. Column A shows the amount you originally reported on you 1040. Column B shows the net changes (both positive and negative) and C shows the correct amount.

Once you fill out the basic information associated with your income and deductions, you can easily calculate the correct refund amount.

Most major tax software offers step-by-step guidance to help filers complete their amended returns accurately. The software asks questions about what changed so users can resubmit their information more accurately.

Step 4: Submit The 1040-X With Supporting Information

The IRS supports e-filing using tax software products such as the software listed above. Filers can currently e-file returns for tax years from 2019 through 2021. The IRS doesn’t allow filers to e-file forms they filled out by hand.

People who want to fill out their 1040-X without tax software have to mail their return and the supporting documentation to the IRS. People choosing to amend their return on their own should mail it to:

Department of the Treasury

Internal Revenue Service

Austin, TX 73301-0215

If you are amending your return based on instructions from the IRS, mail the return to the address specified in the official IRS notification.

Remember, you need to submit IRS Form 1040-X and any changed schedules or forms that support the change.

Step 5: Track The Status

You can track the status of your amended return using the IRS website. During peak tax filing season, amended returns may take 16 weeks or more to process. Unless there is some sort of error with your return, the IRS will eventually get your money back to you.

Final Thoughts

It can be frustrating to learn that you left money on the table by making a mistake on your taxes. But the IRS allows tax filers to reclaim the money that is legitimately theirs. You probably won’t want to spend your Saturday afternoon filing preparing the return, but it can lead to an extra refund of hundreds or even thousands of dollars.

While filing is a hassle, it’s probably worth it to get the money that is due to you.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Robert Farrington Reviewed by: Claire Tak