The tax deadline is almost here! Here are some last minute tax reminders if you're still working on filing your taxes.

Although it might not be the most enjoyable financial task, it's a necessary obligation that we each undertake every year. And if you use great tax software, filing taxes doesn’t take as much time as you may dread.

But tax filing time isn’t only about filing returns. There are things you can do today to help you save money on your tax bill, and help you save time on filing.

Here are the best last-minute tax tips to consider this season.

Don't Miss The Tax Filing Deadline

First, the tax filing deadline is going to be later than “normal”. This year, most filers face a Federal tax deadline of Monday, April 15th, 2024.

There are a few exceptions to this if you live in a disaster area this year. Check out the IRS list of tax deadline extensions, and a quick summary of them here:

- Rhode Island impacted taxpayers can file until June 17th

- Maine impacted taxpayers can file until June 17th

- Michigan impacted taxpayers can file until June 17th

- San Diego, CA impacted taxpayers can file until June 17th

Most states that charge an income tax also require that the tax be paid by April 15th. However, a few states have later filing deadlines.

Double-Check Your Return Before You File

As you scramble to the tax finish line, don’t rush through the important details. A mistake on your tax form can lead to major headaches down the line.

Every year, we read stories about people who accidentally mistyped their name, address, or number. While tax software can help spot obvious errors, it can’t catch some mistakes like entering the wrong bank account information.

So don’t rush! Make sure to file with the correct Social Security number and include all of the necessary signatures.

We also recommend reviewing different sections of your return to ensure you haven’t made a major typo. For example, one zero separates $8,000 and $80,000. If you mistype one value, you could under or overstate your income, and this type of error could delay your tax return from being processed.

As you file your return, take advantage of opportunities to review your numbers. Double-check that they make sense with your actual income. This is easy to do using software like H&R Block Online which offers section summaries for income, deductions, and credits.

Make Sure You Have All Your Tax Forms

While most people settled into a new normal in the last year, it’s still been remarkably tumultuous. You may have claimed unemployment, received state stimulus checks, had side hustle income, or other “atypical” forms of income. These are a few tax forms you shouldn’t overlook this year:

- 1099-G: Unemployment Income. 1099-G forms provide information on unemployment income (and whether taxes were withheld from the income). While employment numbers are currently strong, many people started 2021 unemployed, and they need to claim that income. If you didn’t receive this form, you may need to go to your state’s website to find out how to request an online copy of the letter.

- 1099-NEC: Forms reporting Non-Employee Income. The 1099-NEC reports non-employment income. Filers with this type of income are considered self-employed, and they may be eligible for all sorts of self-employed deductions. If you earned more than $600 from a single business entity, they are supposed to provide a 1099-NEC to you.

If you're waiting on late tax forms, see this guide.

File Your Taxes Even If You Owe

Even if you owe money on your taxes, you want to file your tax return on time. Interest on late taxes is a reasonable interest rate, but non-filing penalties are steep, and it increases the rate you’ll pay on overdue taxes.

Getting your taxes filed will also help you nail down how much money you owe, so you can make a specific plan to get your back taxes paid off.

Seek Out Legitimate Deductions And Credits

Great tax software makes it easy to claim legitimate tax deductions and credits. Great tax software makes it easy to itemize deductions or claim deductions for student loan interest or charitable gifts.

It also helps you find credits such as:

- Lifetime Learning Credit (LLC). This credit is worth up to $2,000 per tax return. It can be used to cover qualified expenses for eligible students.

- Saver’s Credit. Depending on your income and savings rate in qualified accounts, you could qualify for the saver’s credit.

- American Opportunity Tax Credit (AOTC). Still an undergrad? You might be able to use this tax credit to lower your tax burden.

- Earned Income Tax Credit (EITC). If you have a low to moderate-income, then you might qualify for this tax credit to lower your tax burden.

Don't Forget Your Self-Employment Expenses

Whether you’re a full-time freelancer or a side hustler, you likely have some form of self-employment income. And most forms of self-employed income are accompanied by tax-deductible expenses.

Before you file, comb through your electronic receipts to find expenses that count as tax-deductible. Some common deductible expenses include a portion of your internet costs, website maintenance costs, educational materials, and any direct costs of goods sold. You might be surprised at the sheer number of tax-deductible expenses to be found in your side hustle.

Recording these costs allows you to claim them on your tax return. H&R Block Self-Employed Online explains some of the legitimate deductions, so you can look for these expenses in your past credit card statements and other records.

If your side hustle is becoming a full-time hustle, you might consider looking at getting professional help as well. H&R Block has tax experts that can help you with any situation, from filing your taxes this year, to getting the help you need to set yourself up for success next year.

Claim Your Flexible Spending Account (FSA) Expenses

Many employers offer Dependent Care Flexible Spending Accounts, Healthcare Flexible Spending Accounts, and other tax-deductible spending accounts. Money in your Flexible Spending Accounts is yours, but it's up to you to claim the money in it. If you don’t claim the money by tax time, you will probably lose the money in those accounts, even if you set aside the money yourself.

If you’re lucky, you may have a few weeks remaining to spend the money in the account. So stock up on contacts, get your teeth cleaned, or do whatever you need to do to use up that money. Then submit your receipts, so you can get reimbursed.

Even if you can’t keep spending, you may still be eligible to submit receipts for reimbursement.

Every employer has different rules regarding the Flexible Spending Accounts, so check with your HR representative to figure out what you need to do to take advantage of these funds.

Contribute To An IRA Or Roth IRA

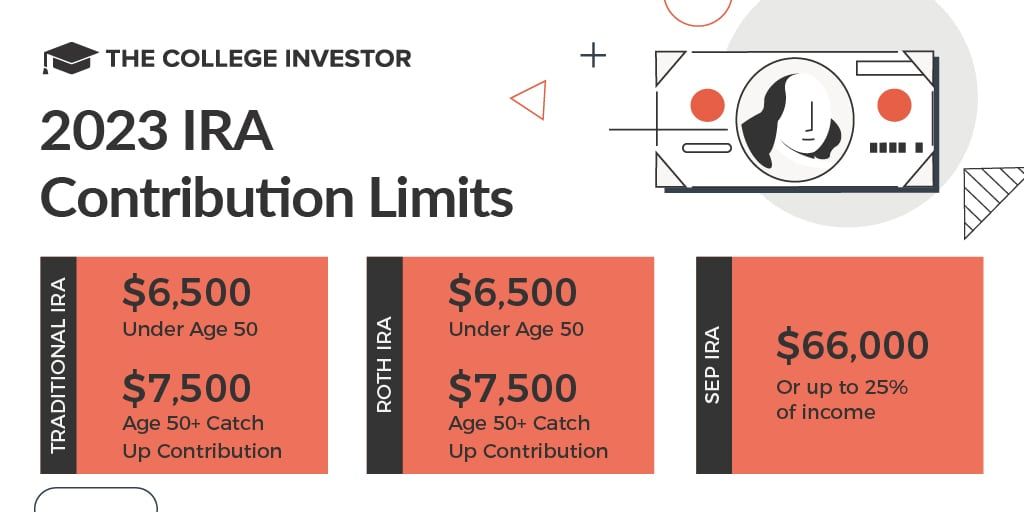

An Individual Retirement Account (IRA) is a tax-advantaged investment account designed for retirement. People who contribute to an IRA can claim a tax deduction this year for funds contributed. The funds can grow tax-free until you withdraw them during retirement. There are income limits associated with IRA contributions, and the maximum you can contribute is $6,500 ($7,500 for people age 50 and up). Contributions aren’t due until tax day, so this is a great way to save on your taxes this year.

Roth IRAs are similar to traditional IRAs, but they don’t allow you to claim a tax deduction this year. Instead, you pay taxes on your contribution this year. Then the gains and distributions are free from taxation. Even though you don’t get a tax deduction, you must complete your 2023 Roth IRA contributions by April 15th, 2024.

Note: You can also contribute to your HSA for 2023 all the way through April 15, 2024.

The Bottom Line

As you move toward the end of the tax filing season, consider taking advantage of these last-minute tax tips that can save you money. The tips above can help you if you’re considering a DIY approach to filing your taxes. However, generic tips are not a substitute for help from a tax professional or tax filing service. Professionals can help you with tax prep and questions specific to your situation.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Ashley Barnett Reviewed by: Colin Graves