Qube Money is a digital cash envelope budgeting and banking system.

The envelope system is a budgeting method where you cash out all (or most) of your income and separate the money into different budget categories. Some money goes towards long-term envelopes (like vacations), and other money goes into fast-spending envelopes (like childcare, groceries and restaurants).

The envelope system is super-effective for helping people to understand trade-offs when it comes to spending. If you don’t have money set aside for something, you either have to do without or borrow from another category. Is that new video game worth a pantry challenge to you? Or do you want to delay a trip because you’re choosing Chipotle for lunch again? That’s the kind of decisions you face when using cash envelopes.

But the problem with cash envelopes is that they are cumbersome to use. Sure they’re effective, but who wants to get a few thousand dollars from the bank every month. Not to mention a lot of bills can only be paid online.

That’s where Qube Money comes into the equation. It’s a banking and budgeting system rolled into one platform. The platform has the power to be one of the most transformative tools for spenders and it's about to move to a nationwide release. Here’s what you need to know about Qube Money.

Qube Money Details | |

|---|---|

Product Name | Qube Money |

Price | $0 to $19/month |

Platform | Web, iOS, Android |

Features | Online banking and digital cash envelopes |

Promotions | None |

What Is Qube Money?

Qube Money isn’t just a bank account. And it’s not just a budgeting app. It’s both, rolled into one. Users can deposit money into an FDIC-insured Qube Account. Then, you can design a plan to allocate funds among different digital envelopes or "Qubes." You can use some of the pre-generated categories or you can make your own.

The Amazing Debit Card Integration

Once you’ve allocated the money, you have your financial system set up. But you can’t run up transactions with your new Qube debit card. As a default, the Qube card has a $0 balance. If you try to swipe your card without allocating a transaction to an envelope/Qube, the transaction will be denied.

Whenever you want to spend money, you open the Qube Money app on your phone. Select the Qube where you’ll spend the money and you’ll immediately have the funds from the Qube available to spend. As soon as the transaction goes through, the transaction is recorded in Qube and any remaining funds are transferred back into the Qube. The balance on the debit card is reverted to $0.

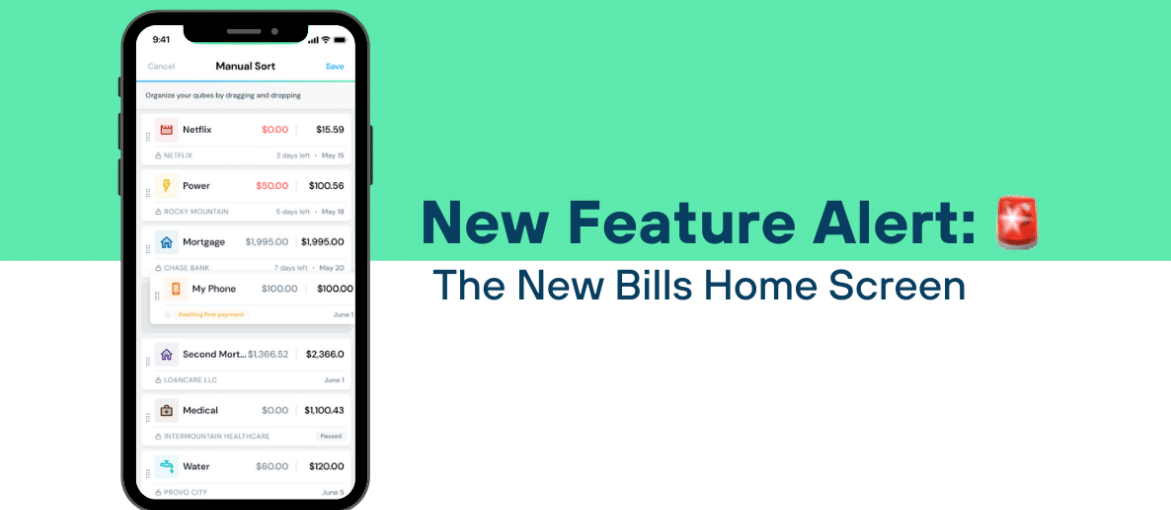

Qube works for both online and in-person transactions. Support for bill pay was released in July 2021. And a new Bills Home Screen launched a month later in August 2021.

Now that bill pay is enabled, Qube is truly an all-in-one platform that could replace your existing checking account. Plus, it makes it really easy to turn off payments on subscriptions!

As a final note - this system is also great for fraud prevention. We normally don't like people to use their debit cards due to the risk of fraud. If someone gets your card, they can drain your account. With this setup, unless you open a Qube on your app, nothing will get charged!

How Much Does It Cost?

Qube Money has a free tier which limits users to 10 cash envelopes and a single debit card. The free tier doesn’t offer budget automation so you’ll need to reset your Qubes each pay period. This may be adequate for a typical person who doesn’t share finances with a partner.

However, people who share finances may want to upgrade to the Premium plan which offers:

- Unlimited Qubes

- Recurring transfers

- Joint accounts

- Partner notifications

- Partner permissions.

Partner permissions mean that both partners need to “approve” a purchase before it can be made. Provided you don’t have an ultra-controlling partner, this can be a great way to get on the same page financially.

Plus, each partner gets their own login and own control. Partners can also have their own "private" envelopes for couples who budget this way.

Individuals and couples with children may want to upgrade to the Family plan (coming soon) which will have:

- Up to 10 kid debit cards

- Parent View

- Parent Permissions

- Chore Trackers

- In-app money requests

The Premium plan costs $12 per month ($108 paid annually) and the Family plan is $19 per month ($180 paid annually). While the prices may sound steep, Qube Money boasts that the average user saves $488 per month without feeling any extra squeeze in the budget.

Does Qube Money Really Work?

I used an early iteration of Qube Money back in 2017 (the app was called ProActive back then). While it was a bit clunky at the time, it did deliver on the promise that it would force me to face my spending decisions.

Whether Qube will save you money will depend a lot on your personality. Personally, it took me about four years of regularly using some form of the cash envelope system to get my spending under control. Now that I have adjusted my spending, I rarely feel the need to go back on an “all-cash diet.” However, I often recommend them for others because the savings can be tremendous.

Header |  | ||

|---|---|---|---|

Rating | |||

Pricing | $0 to $19/month | $11.99/mo or $84/yr | $0 to $129.99/yr |

Budgeting | |||

Banking | |||

Goal-Setting | |||

Net Worth Tracking | |||

Cell |

Is It Worth It?

If you’re not worried about your spending, don’t bother signing up for Qube Money. It will end up being another account and another app that you’ll have to close.

However, anyone struggling with their spending should absolutely consider jumping into the world of Qube Money. It's an amazing tool for helping you transform your money habits. Even the Free tier offers up to 10 Qubes and includes bill pay options.

However, if the idea of having to open up an app on your phone every time you need to spend money sounds burdensome, you may want to consider less restrictive budgeting tools. If you're wanting to compare options, check out our short list of the best budgeting apps.

Qube Money Features

Price |

|

Budgeting | Yes |

Income Tracking | Yes |

Expense Tracking | Yes |

Bill Pay | Yes |

Check-Writing | No |

Investment Tracking | No |

Debit Cards | Up to 10 |

ATM Access | Yes |

ATM Limit | Up to $250 |

ATM Fee Reimbursement | Up to $10 per month |

Tax Preparation | No |

Customer Support Options | Email only |

Mobile App Availability | |

Promotions | None |

Qube Money Review

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Tools and Services

Overall

Summary

Qube money offers an all-in-one online budgeting and banking solution by pairing digital cash envelopes with physical debit cards.

Pros

- Free plan includes 10 qubes (envelopes)

- Amazing debit card integration

- Up to 10 kid/teen cards

- Now supports bill pay

Cons

- Can’t track expenses from other banks

- No net worth tracking

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller