When you start thinking about your money, the key place to start is organization. It's essential that you organize your finances so that you can make informed decisions about the "next money steps".

Over the years, I've tried everything possible to organize my money. I'm talking about keeping track of all my accounts, paper statement, insurance documents, bills, wills, old tax returns, business documents, and more. It seems like every year, the amount of "stuff" I need to keep grows and grows. As such, I've become a financial organization pro.

Today, I'm going to show you how I organize my financial life, and you can as well. I break it down into three sections:

- Keeping Your Financial Accounts Organized

- Tracking Your Live Documents (like bills)

- Organizing The Stuff You Have To Keep

Let's get started.

Keeping Your Financial Accounts Organized

The first step in getting your financial life organized is simply listing out your financial accounts. There are three ways to go about this - the simple spreadsheet or list method, the software method, and the online method.

When you start, you need to think about budgeting for your personality. And this means using the tools (like technology or not) that best suite your personality.

But before you start, you just need to list out what you have. You should account for all of the following for accounts that hold monetary value. That is the key - these are the accounts that are worth money, not insurance or other financial "things".

Banking

- Checking

- Savings

- Certificates of Deposit

- Money Market

Debt

- Credit Cards

- Auto Loan

- Mortgage

- Personal Loans

- Student Loans

Investments

- Brokerage

- Peer-to-Peer Lending

Retirement

- 401k

- 403b

- TSP

- IRAs

Once you have all of these accounts listed, it's time to get them organized so that you always know your balance and any transactions that take place. The three ways to go about it are pretty straightforward:

The Spreadsheet or List Method

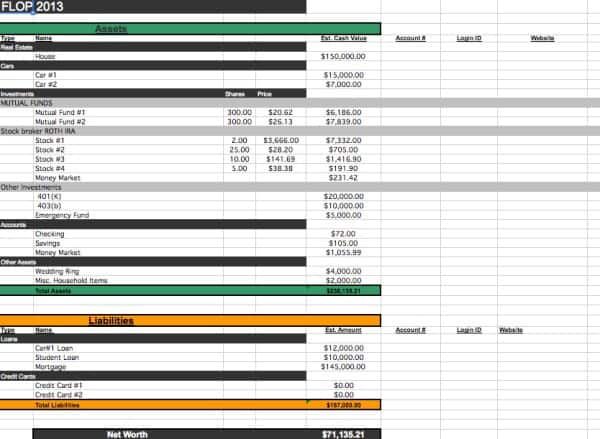

This is the traditional way to keep track of everything. You basically maintain a spreadsheet or list of all your accounts, and you update it manually every month as you pay your bills.

This method takes more work than any of the other methods, and it's hard to get real time data unless you're going online and checking your accounts. Most people that use this method rely on paper statements and reconcile them when they arrive.

One of the best spreadsheets I've found is called My Financial Life on One Page (FLOP). It's a free download, so check it out.

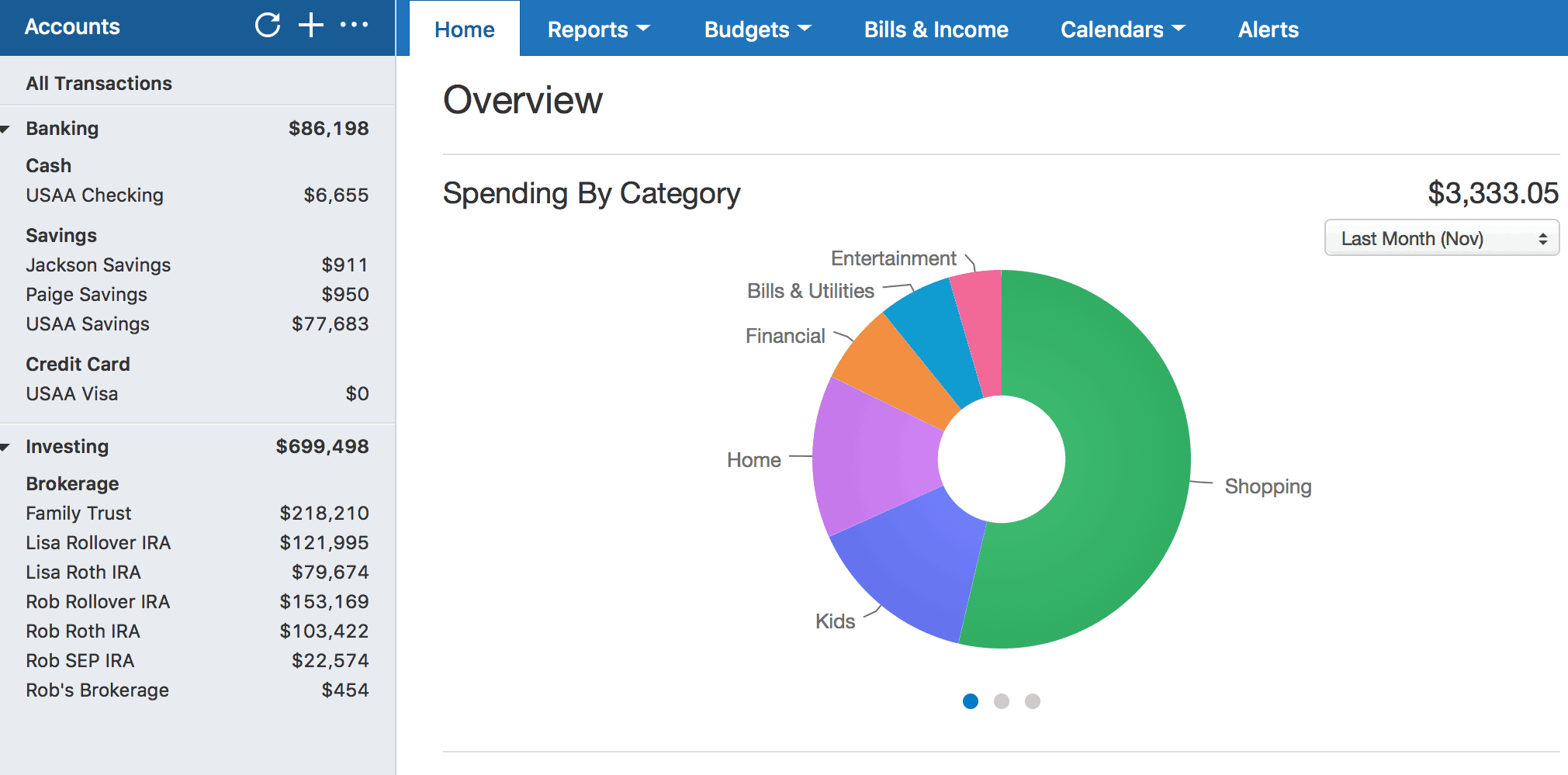

The Software Method

This has been the cornerstone of financial organization for the last 10 years - using software to keep track of all of your accounts. The most popular software for this is Quicken, which I use myself (just don't get Quicken for Mac).

However, there are alternatives, like iBank (which works for Mac).

The great thing about the software method is that you can automatically update all of your accounts, so it alleviates a lot of the manual work involved. First, you take your list of accounts (that you created earlier), and you input them into the software. Next, you connect it to the online service using your online name and password. Going forward, you can use the software (like Quicken) to automatically download recent transactions and update your account balances. Finally, these software tools have more reports and tools that can help you monitor your money easier than with a basic spreadsheet.

The Online Method

Over the last five years, online services to help you keep track of your accounts are really becoming popular. Check out our list of the best Quicken Alternatives.

These services work just like Quicken, except they are online, and they are FREE! Once you add in your accounts, these services will update your balances and make recommendations on how you can save - which is how they make money (through services and advertising).

Tracking Your Bills And Other Documents

Alright, now that you have all of your account balances in one place, what the heck do you do with all that financial mail you get? You know, the bills, medical statements, and more? You have to deal with some now, and some you just need to file for later.

This is all about having a system. For our family, the system is very simple: we have an inbox on our desk that we clear on Friday nights once the baby goes to sleep.

Here's what ours looks like:

The goal is to make sure that you clear out his inbox every week. You have to take action on these documents.

Sometimes the action is very easy, you just pay the bill. I prefer to use online BillPay to send all of my payments, so we typically have Quicken and our bank's website open on the computer while we're paying our bills.

Once we clear out the inbox, we file away the statements and throw away the trash. We also now scan in all of our files digitally to avoid saving what we don't need.

But how to we file the statements?

Managing Your Financial Files

This is the last part of the financial organizing equation - managing your financial files. Over the course of a year, you create so many documents it's important to stay organized. You will typically have: a monthly account statement for every account listed above, a monthly bill for every utility you have, copies of your tax return, insurance statements, and more.

Some of these items you can toss after just a short period of time. Most bills you can toss after a year. However, some items you need to keep for a long time. For example, the IRS recommends you keep your tax returns for at least three years, but it really makes sense to keep them forever.

To make things easy on myself, I use the Home File System:

As you can see, the system provides tabs for all of the major categories that you will ever need to keep, along with guidance about what should go where, and a Quick-Find index up front.

Inside each tab, you make a manilla folder for each individual account. For example, one of the first tabs in "Auto", and you can see a manilla folder for one of our cars- Honda Civic. Inside each tab you can keep a copy of your registration, insurance, and any service records. That way, everything you need for resale or trade-in is filed in one spot.

The same applies to banking, investing files, even pay stubs from your "Employment" (which you can see almost dead-center in the picture).

I then make it a habit, once a year in January, to go through and purge out any old items that I don't need anymore. This is the best way I've found to stay financially organized.

What systems and tools do you use to stay financially organized?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller