If you can’t figure out where your money is going, you need a budget! YNAB, an acronym for You Need A Budget, is an app that “gives every dollar a job” so that you can make each dollar work for you.

Just fill out the categories, and you’re ready to go!

Think you DON’T need a budget? Think again. According The Associated Press-NORC Center for Public Affairs Research, 66% of Americans would have trouble coming up with $1,000 for an unexpected expense because they don’t have an emergency fund.

The study further reveals that families with income above $100,000 would still have trouble coming up with $1,000 for an emergency.

See why we rank YNAB as one of the best budgeting apps and software tools available today!

You Need A Budget (YNAB) Details | |

|---|---|

Product Name | You Need A Budget (YNAB) |

Price | $14.99/month or $99/year |

Platform | Web, iOS, Android, iPad, Apple Watch, Alexa |

Promotions | Free year of YNAB for college students |

What Is You Need A Budget (YNAB)?

YNAB allows you to automate your budget. This is the perfect choice if you are looking for a system that solely focuses on budgeting rather than investing and other bells and whistles.

With YNAB, you can deal with debt and set priorities for upcoming expenses and other financial goals.

If you follow the “YNAB Rules”, you will see improvement in your spending, spend less than you earn, and be ready to save for the future. The goal is to cover this month’s expenses with last month’s income.

This process is called “aging your money”, where your money has to be at least 30 days old before you can spend it.

Plus, we named YNAB one of our Editor's Picks for the Best Budgeting Software for 2024.

How Does It Work?

YNAB's Four Rules are the building blocks to help you live within your means. If you follow these steps, you will be able to save efficiently, get out of debt, and most importantly, stop living paycheck to paycheck.

- Rule #1 is "Give Every Dollar a Job." Each dollar should be used for a certain expense. Rather than spending on whatever comes your way, you will have more organization and order with your spending.

- Rule #2 is "Embrace Your True Expenses." Most people say they had expenses that just “came up”, but the truth is that many of these expenses should be anticipated, such as vacations, birthdays and holidays. YNAB advocates budgeting money for these expenses and allocating funds to pay for them on a monthly basis.

- Rule #3 is "Roll With The Punches." Certain expenses will catch you off guard. You'll also have certain months where you overspend in certain categories. When these things happen, YNAB encourages you to just move money from one category to another and keep going. Don’t let small setbacks get you off track - keep the momentum going!

- Rule #4 is "Age Your Money." When you spend money that you earned last month, you will have this month’s income to roll forward to the next 30 days. You will not stress when there are delays with your cash flow. To successfully “age your money”, you should be spending money that is at least 30 days old.

The YNAB website also offers live online courses for members, including guides and blog posts that cover transitions, long term planning, and dealing with debt. Here's a closer look at how YNAB works and its top features.

Comprehensive And User-Friendly Budgeting Tools

YNAB takes a simple approach to setting up your budget - just connect all of your accounts and start budgeting. All you need to know is how much you have right now, and how you plan to spend your money until you get paid again.

When you apply the concept of “aging your money,” you can begin to break the viscous cycle of living paycheck to paycheck.

Category Customization

YNAB automates your spending while letting you customize your categories, budgeted amounts, the names and order of all categories. You can make manual entries and easily create category groups.

With YNAB’s secure account linking, it's much easier to import your transactions. If you connect your accounts, YNAB will analyze your spending habits, and even guess categories for you. If transactions are bold, that means they are new, and haven’t been categorized yet.

Rather than just assigning categories like Mint, YNAB gives you suggested categories, and you review and approve. This forces you to know what's going on with your money. And it will also help you to quickly identify and report any fraudulent activity on your accounts.

If you overspend in one category, that may be a sign that you need to budget more money for that category. If you have extra money in one category, you can move it to another category. Move it to a category for entertainment, use it to pay down debt, or roll it over to the next month.

Split Transactions For Laser-Focused Budgeting

On that note, if you go to Target and buy a bunch of items that fall under different categories, you can even split transactions. If you went to Target and bought groceries, power tools and beauty products, you can easily split the transactions by category.

Accurate Starting Balance

Whether you’re going to use the software manually or connect it to your accounts, you just start with whatever amount of money you have right now, and go from there. Say you have $225.00 in your bank account, then $225.00 is the number you will start out with to allocate your expenses.

If you budget more money than you have, it’ll turn red.

Link All Your Financial Accounts

YNAB offers the option to securely connect all of your bank and credit card accounts, or enter everything manually. Then, all you have to do is import your transactions into budget categories.

Note that YNAB is really only designed to work out-of-the-box with bank accounts. There are technically two ways to track investments with YNAB, but both options take a fair bit of work. If you want a more seamless solution, you may want to check out one of these portfolio trackers instead.

Set Up Sinking Funds

With YNAB, you can set up a sinking fund and never be stressed about larger expenses again. What is a sinking fund? It's similar to a “rainy day” fund, except you are setting aside money for a large future expense, whether you know the exact amount or not.

You could have a sinking fund for things as small as renewing your annual $258 vehicle registration. Just add a category for vehicle registration, budget $21.50 for each month, and you’re set!

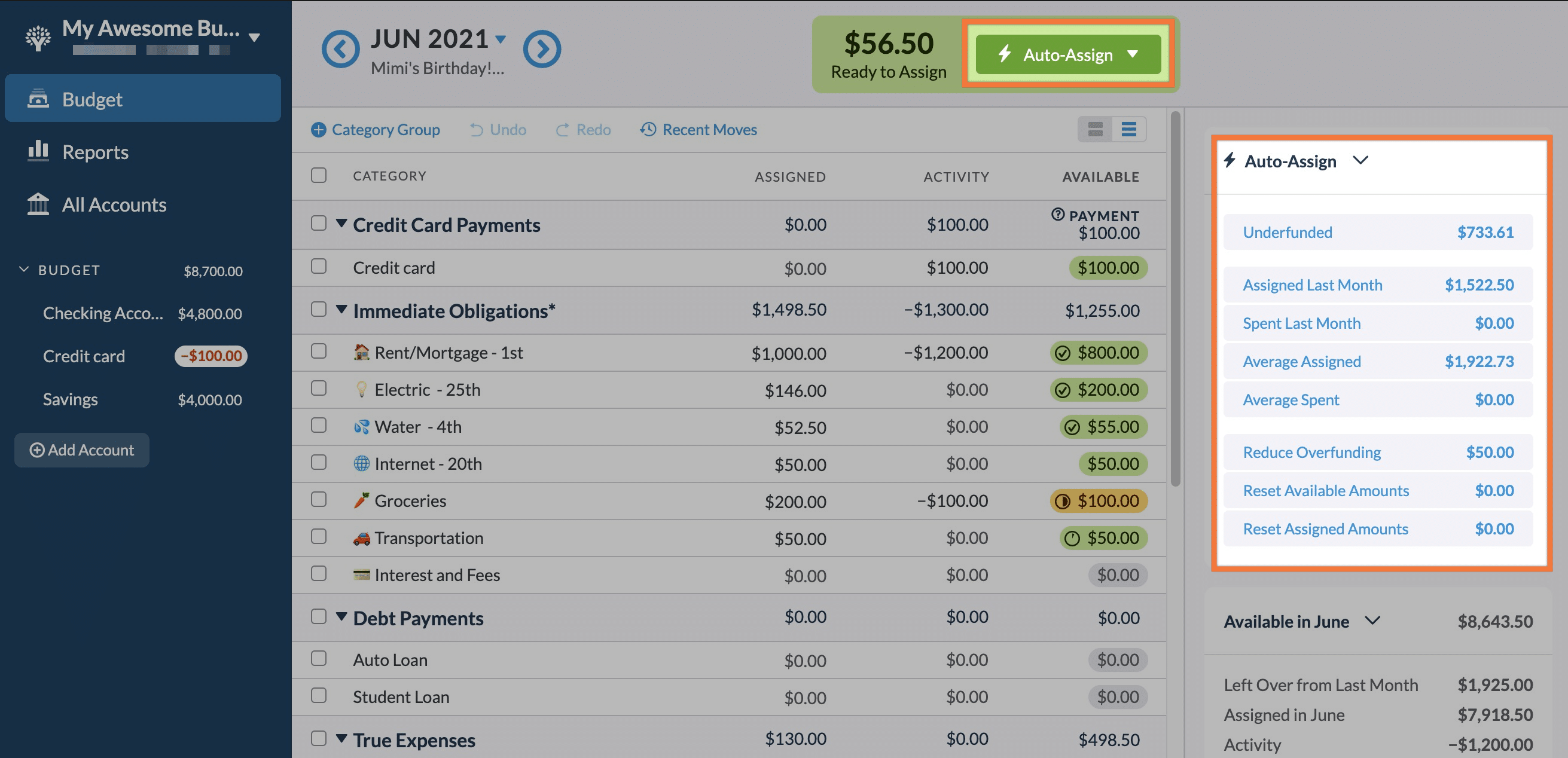

Auto Assign

The "Auto Assign" tool helps you fill in your new monthly budget quickly. There are five options to choose if you're wanting to automatically assign funds to categories: Underfunded, Assigned Last Month, Spent Last Month, Average Assigned, and Average Spent.

Wide Platform Availability

In addition to being available on the web, YNAB has a mobile app on the App Store and Google Play store. You can use the same login credentials that you do for the desktop version. And everything that you can do on the web platform, can also be done on the mobile apps.

In addition to accessing your budget on your phone, you can also get YNAB on iPad, Apple Watch, and even on Alexa devices.

Blog And Forum

YNAB has several detailed blog posts and topics that are updated regularly. They discuss habits, behavior, and other mindset shifts needed to stick to your budget.

If you want to see how other people are using YNAB, you will also have access to other YNAB users who share their budgeting strategies, questions, and helpful tips. Get support and encouragement from other YNAB users, and share your stories in the forum.

How Much Does It Cost?

Priced at $14.99 per month or $99 per year, YNAB will give you a high return on investment when you see how much you save with this budgeting program. YNAB offers a 34-day free trial so that you can see for yourself if it’s a good choice. The best part? They don’t even ask for your credit card information!

YNAB is currently giving college students a free year of use. All you have to do to claim your free year is to provide "proof of student-hood" such as a college ID, tuition statement, or transcript. This student deal is only good for one year of free membership. But if you decide to continue using YNAB after you free year is up, you'll get a one-time 10% discount on the annual plan.

How Does YNAB Compare?

YNAB might be the most powerful budgeting tool on the market today. But that doesn't necessarily mean that it will be the best fit for everyone.

For example, if you're a big fan of Dave Ramsey and his Baby Steps financial process, EveryDollar may be a better budgeting option for you. And if you're looking for an app that combines basic budgeting tools with in-depth tracking and analysis of your investments, you might want to give Empower (Personal Capital) a try.

You can also check out our full comparison of YNAB vs. Empower here.

Check out this quick chart to see how YNAB compares:

Header | |||

|---|---|---|---|

Rating | |||

Pricing | $14.99/mo or $99/yr | $0 to $129.99/yr | Free |

Net Worth Tracking | |||

Retirement Planning | |||

Cell |

How Do I Open An Account?

You can get started with YNAB by visiting its website and clicking the big yellow "Start Your Free Trial" button. You'll only need to provide an email address and password to open an account. Or you can use your Apple or Google credentials to create a YNAB account and log in.

Is It Safe And Secure?

Yes, YNAB doesn’t mess around when it comes to security. Since your financial data is in the software and app, you can rest assured that data is encrypted and they use multiple iterations of a key derivative function for passwords. Also, when you terminate your account, your data is wiped from their system.

How Do I Contact YNAB?

For simple how-to questions, you can search YNAB's detailed help center for easy-to-understand explanations, quick video tutorials, or podcast tutorials. You can also browse the YNAB forum or post a questions to the community.

If you need extra help, you can send a message to YNAB customer support by clicking on the question mark in the corner. However, there is no published customer service phone number to call.

Why Should You Trust Us?

I have deep experience with using "Personal Financial Managers" or PFMs like YNAB. I started using Quicken in the early 2000s to track my personal finances, and since then, I've used or tested almost every budgeting app and investment tracking app in the marketplace.

I've spent hours using YNAB for both testing and tracking my own finances. Zero-based budgeting isn't my style, but for those is it is for, this is the best tool on the market.

Combine my personal experience with that of our amazing team of editors and testers, and we have over 100 years of combined experience using, reviewing, and testing budgeting apps and tools!

Who Is This For And Is It Worth It?

If you are having trouble sticking to a budget, and you find yourself in debt with little savings, YNAB will help you get smart about your money and get back on track.

Most people don’t have the discipline to budget without some extra help. Take advantage of the 34-day free trial and give it an honest try. We don't think you'll be disappointed.

This tool is great for those interested in zero-based budgeting. If you're not sure that this style of budgeting will work for you, it might not be the best tool for you. If this is the case, check out our recommendations for the best budgeting apps.

YNAB FAQs

Here are a few of the questions that people ask most frequently about YNAB:

Does YNAB offer Direct Import in Europe?

Not yet. But the YNAB team announced in February 2021 that Direct Import support would be coming to the UK very soon and that it hoped the rest of the EU wouldn't be far behind.

Can you scan receipts into YNAB?

No, however its developers have acknowledged that this is a highly-requested and it appears that they hope to add this functionality in the future.

Does YNAB use Plaid to sync transactions from financial institutions?

Yes, but not exclusively. It also works with two more financial data aggregation specialists: MX and TrueLayer.

Is YNAB free for college students?

Yes, for one full year. You can claim your free year by uploading a "proof of college student-hood," such as a student ID.

YNAB Features

Price | $14.99/mo or $99/yr |

Budgeting | Yes |

Income Tracking | Yes |

Expense Tracking | Yes |

Split Transactions | Yes |

Goal Tracking | Yes |

Budget Rollover Option | Yes |

Bank Integration | Yes |

Investment Tracking | Yes, but limited |

Credit Score Monitoring | No |

Bill Pay | No |

Tax Preparation | No |

Import Bank Data Files | Yes, QFX and OFX (recommended), QIF, or CSV |

Customer Support Options | Support tickets, Help Center, Community Forum |

Platform Availability | Web, iOS, Android, iPad, Apple Watch, Alexa |

Free Trial | Yes, 34 days |

Promotions | Free year of YNAB for college students |

YNAB

-

User Friendliness

-

Mobile App Functions

-

Customer Service

-

Security

Overall

Summary

You Need A Budget (YNAB) is a top of the line budgeting and personal finance software product that focuses on zero-based budgeting.

Pros

- Zero-based budgeting software

- Set rules for your spending

- Supportive user community

- College students get a free year of use

Cons

- It’s paid and isn’t the cheapest option

- There are reports of some issues with connectivity with banks

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett