Do you have a “free” checking or savings account at one of the big banks? If you’ve ever overdrafted on your account, the $35 per day overdraft charge proves just how “free” your account really is.

Big banks collect big money from overdraft fees, account minimum fees, and bounced check fees. All these fees make it even more difficult to break out from the paycheck to paycheck trap that ensnares so many young people.

But not every bank abides by this philosophy. Chime® is not a bank. It's a financial technology company (fintech) that's making money management and savings easier. This is how they’re doing it. Plus, see why we think Chime is one of the best free checking accounts.

Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank N.A. or Stride Bank, N.A.; Members FDIC. The secured Credit Builder card issued by Stride Bank, N.A.

Chime® Details | |

|---|---|

Product Name | Chime® |

Min Opening Deposit | $0 |

Min Balance Requirement | $0 |

Monthly Fees | $0 |

APY | 2.00%¹ APY |

ATM Access | 60,000+ Free ATMs~ |

Account Type | Checking And Savings |

Promotions | None |

What Is Chime®?

Chime is a financial technology company that was founded in 2013. While Chime itself isn't a bank, it partners with The Bancorp Bank or Stride Bank N.A to provide banking services to its customers.

Like many internet companies, Chime keeps their costs low by investing heavily in technology and eliminating brick and mortar outlets. As such, Chime has grown to be extremely popular today.

It was recently announced that Chime has over 12,000,000 users. In August 2021, the company announced that it had raised $750 million in a Series G round at an eye-popping valuation of $25 billion.

⚠︎ This Is A Banking Service Provider, Not A Bank.

Chime is a financial technology company, not a bank. While it uses partner banks to provide banking services, your FDIC-insurance protection may be limited. Read this article from the FDIC to understand the risks of using a non-bank company.

What Does It Offer?

So why are so many people who decide to go with online-only banking choosing Chime? Let's take a look at a few of the features that help to set it apart from the crowd.

Intuitive Mobile App

Early on, Chime had the foresight to focus on their mobile platform. Their app makes it incredibly easy to receive direct deposits (and up to two days early), transfer money among your accounts, find an ATM and review your recent transactions.

The Chime app is responsive, easy to navigate, and it has all the information you need. You can see recent transactions, account balances, how to find an ATM, and your linked account balances. Plus, the app supports mobile check deposits.

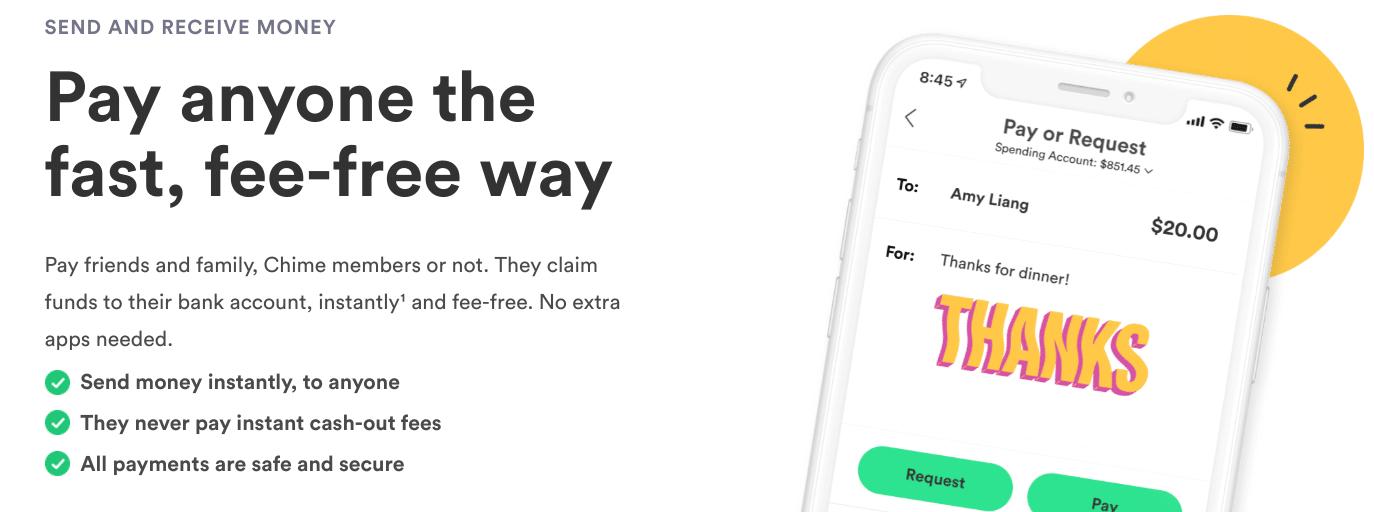

One of the newest features that Chime has added to the app is instant and fee-free peer-to-peer payments. You can transfer money instantly to anyone who has a debit card, even non-members.

The funds will arrive instantly for members or as soon as non-members claims a payment to their bank accounts. And unlike other payment apps, Chime never charges fees for instant cashouts.

SpotMe®

Chime also offers fee-free overdraft up to $200* with their SpotMe on Debit service. There is no fee to use the service, but once your negative balance is repaid, there is the option to leave Chime a tip.

Chime members who have received at least $200 in qualifying direct deposits in the past 34 days are eligible to enroll. Overdraft limits of $20 to $200 will apply based on factors such as account activity and history.

SpotMe on Credit Builder is an optional line of overdraft line of credit that doesn't charge interest or fees. You can qualify for this product if you have an active Chime Credit Builder Account. However, you must have $200 or more in eligible direct deposits going into your Chime Checking account monthly. You also must have activated your Chime Credit Builder Visa Credit or Debit card.

Chime Deals

With Chime Deals™, you can earn cash back at more than 30,000 merchants. This includes purchases for gas, groceries, dining out, and more. To earn cash back, you must swipe a physical Chime card, but this can be either the Chime Debit or Credit card, both work. Virtual card purchases are not included in the cash back program. Eligibility requirements and limits apply. See Chime Deals™ Terms and Conditions.

Make Saving Simple (And Rewarding)

In addition to keeping the fees out of banking, Chime allows you to set up an automatic savings program. They launched a high-yield savings account that currently pays 2.00% annual percentage yield, or APY¹.

With Save When You Spend, Chime rounds up each transaction to the nearest dollar, and sets the money into a savings account. In addition to the Round-Up program, Chime Members also have the opportunity to enroll in Save When I Get Paid, which automatically directs 10% of every paycheck⁴ of $500 or more into your savings account.

If you’re struggling to save for a rainy day, a behavioral tool like Automatic Savings can be a perfect solution. You can always access the money or transfer it back to your checking account, but mentally separating it is an easy solution to a savings problem.

Secured Chime Credit Builder Visa® Credit Card

Chime recently launched their Chime Credit Builder Visa® Secured Credit Card. Just like it sounds, the goal of this card is to help you build credit. It's a secured card, so always make sure you check to see how it compares to the best secured credit cards.

Money added to Credit Builder will be held in a secured account as collateral for your Credit Builder card, which means you can spend up to this amount on your card. But unlike other secured cards, you can use some or all of your deposit to pay off your charges at the end of every month.⁵

The Credit Builder Card is also unusual in that it doesn't have a minimum security deposit. You can deposit as much or as little as you want.

This card has no annual fee and doesn't have a credit check to apply. Best of all, it doesn't charge interest.⁶ To be eligible to apply for Credit Builder, you need to have received a qualifying direct deposit of $200 or more to your Chime® Checking Account.

Extensive ATM Network

It's common for digital banks to partners with an ATM network to provide cash services to their customers. What's uncommon is for one bank to partner with three different networks.

But that's exactly what Chime does. It offers fee-free cash withdrawals at Moneypass, Allpoint, and Visa Plus Alliance ATMs. In total, members have access to over 60,000+ in-network ATMs. And many of these ATMs are located in convenient locations that members may already frequent like Walmart, Walgreens, 7-Eleven, and more.

Unfortunately, none of Chime's ATMs can accept cash deposits. If you want to put cash into your account, you'll have to visit a register at one of its retail locations (like Walmart) and ask a cashier to add the funds to your account. This is not only inconvenient but is also likely to involve third-party fees.

Are There Any Fees?

Chime’s fee schedule is super-short compared to some banks. There are no maintenance fees, overdraft fees, foreign transaction fees, or bounced check fees.

You'll pay $2.50 for out-of-network ATM cash withdrawals. And you're likely to incur a third-party fee when you add cash to your Chime account at a retail location. That's it!

Chime is about as close to a fee-free account as you can get. They take pride in aligning their business profits with their members needs. If you join, you can expect transparency and a bank account with no fine print.

How Does Chime® Compare?

Chime is consistently on our lists of the best free checking accounts and best checking accounts for college students. Why? It's free, mobile friendly, and has a lot great features.

With that being said, here's a quick comparison to other popular checking accounts:

Header |  |  |  |

|---|---|---|---|

Rating | |||

APY | 2.00%¹ | Up to 3.00% | Up to 4.20% |

Monthly Fees | $0 | $0 | $0 |

Min Deposit | $0 | $0 | $0 |

ATM Access | 60,000+ Free ATMs | 55,000+ Free ATMs | 43,000+ Free ATMs |

FDIC Insured | |||

Cell |

Is My Money Safe?

Yes, Chime customers receive up to $250,000 of FDIC insurance protection per depositor through its partner banks, The Bancorp Bank, N.A. and Stride Bank, N.A.

Chime also works hard to make sure that you're only one who gets access to your account and debit card. It's website is encrypted, its debit cards come with Visa Zero Liability protection, and it supports both two-factor and fingerprint authentication.

How Do I Contact Chime®?

Digital banks aren't typically known for their customer service. But Chime is one of the few that seems to mostly get it right.

The company offers 24/7 live chat and email support at support@chime.com. You can also get in touch with them by phone at 844-244-6363. Their phone specialists are available Monday-Sunday, 3 AM to 11 PM (CST). If you're going to choose an online bank, phone support is a pretty big deal as you won't have the option to get in-person assistance at a local branch.

But it's important to point out that "availability" doesn't necessarily mean "competence." Chime's Trustpilot rating is currently 3.8/5 which Trustpilot considers "Great" but not "Excellent."

Why Should You Trust Us?

I have been writing and researching banking and personal finance products since 2009. At The College Investor, we've been comparing and reviewing banks since 2018, and track the best banks for savings and money market accounts daily from a list of over 50 major banks and credit unions.

Furthermore, our compliance team reviews our rates every weekday to ensure that we are accurately showing the correct rates and terms so you can make an informed decision about where to open a savings account.

Who Is This For And Is It Worth It?

If you have straightforward banking needs, Chime is an excellent option. It has no monthly fees. It’s got a built-in savings tool. And you can spend money with a Visa® Debit Card or pay bills via the mobile Chime Checkbook.

The beauty of Chime is in its simplicity. However, that simplicity has some drawbacks. The Chime Checkbook only allows $5,000 in a single transaction, for example. Also, Chime doesn't support joint account. So if you and your spouse want to share an account, Chime isn’t a good option right now.

If you think that Chime is right for you, you can open an account here. Or if you want to explore other options, you can compare the top online banks here.

Chime® FAQ

Here are some common questions about Chime:

What is Chime?

Chime is a financial technology company that has a free checking account and more features - all on your phone.

Is Chime Free?

Chime is about as fee-free as you can get in a checking account. There are no monthly maintenance fees, overdraft fees, or foreign transaction fees˜.

Does Chime offer free ATMs?

Yes, Chime has a network of over 60,000 fee-free ATMs.

Does Chime have a debit card?

Yes, you get a debit card with your Chime account.

Chime Features

Account Types | Checking and savings |

Minimum Deposit | $0 |

APY | 2.00% |

Monthly Fees | $0 |

Foreign Transaction Fee | $0 |

Branches | None (online-only) |

ATM Availability | 60,000+ fee-free ATMs that are part of the Moneypass, Allpoint, and Visa Plus Alliance networks |

Out-Of-Network ATM Fee | $2.50 |

Allows Cash Deposits | Yes, but only at registers inside retailer locations and third-party fees may apply |

Cash Deposit Limits |

|

Checkbook Limits |

|

Credit Builder Card Annual Fee | $0 |

Credit Builder Card APY | N/A |

Customer Service Number | 844-244-6363 |

Customer Service Hours |

|

Web/Desktop Account Access | Yes |

Mobile App Availability | iOS and Android |

Bill Pay | Yes |

FDIC Certificate | 35444 through The Bancorp Bank OR 4091 through Stride Bank |

Promotions | None |

DISCLAIMER

Chime is a financial technology company, not a bank. Banking services and debit card provided by The Bancorp Bank N.A. or Stride Bank, N.A.; The secured Credit Builder card issued by The Bancorp Bank, N.A. Stride Bank, N.A.

Banking services and debit card provided by The Bancorp Bank N.A. or Stride Bank, N.A., Members FDIC, pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa debit cards are accepted.

The secured Chime Credit Builder Visa® Credit Card is issued by The Bancorp Bank, N.A. or Stride Bank, N.A., pursuant to a license from Visa U.S.A. Inc. and may be used everywhere Visa credit cards are accepted. Please see the back of your card for its issuing bank.

Chime Deals. Eligibility requirements and limits apply. See Chime Deals™ Terms and Conditions.

^ Early access to direct deposit funds depends on the timing of the employer's submission of their payroll file. We generally make payroll funds available on the day that the payroll file is received, which may be up to 2 days earlier than the employer's scheduled payment date.

˜ Out-of-Network cash withdrawal fees apply. Third-party and cash deposit fees may apply.

* SpotMe® on Debit is an optional, no fee overdraft service attached to your Chime Checking Account. To qualify for the SpotMe on Debit service, you must receive $200 or more in qualifying direct deposits to your Chime Checking Account each month and have activated your physical Chime Visa® Debit Card or secured Chime Credit Builder Visa® Credit Card.

Qualifying members will be allowed to overdraw their Chime Checking Account for up to $20 on debit card purchases and cash withdrawals initially but may later be eligible for a higher limit of up to $200 or more based on Chime Account history, direct deposit frequency and amount, spending activity and other risk-based factors. The SpotMe on Debit limit will be displayed within the Chime mobile app and is subject to change at any time, at Chime's sole discretion. Although Chime does not charge any overdraft fees for SpotMe on Debit, there may be out-of-network or third-party fees associated with ATM transactions. SpotMe on Debit will not cover any non-debit card transactions,

including ACH transfers, Pay Anyone transfers, or Chime Checkbook transactions. SpotMe on Debit Terms and Conditions.

See terms and conditions: SpotMe on Debit Terms and Conditions

¹ The Annual Percentage Yield ("APY") for the Chime Savings Account is variable and may change at any time. The disclosed APY is effective as of May 23, 2024. No minimum balance required. Must have $0.01 in savings to earn interest.

⁴ Round Ups automatically round up debit card purchases to the nearest dollar and transfers the round up from your Chime Checking Account to into your savings account. Save When I Get Paid automatically transfers 10% of your direct deposits of $500 or more into your savings account.

⁵ To apply for Credit Builder, you must have received a single qualifying direct deposit of $200 or more to your Chime® Checking Account. The qualifying direct deposit must be from your employer, payroll provider, gig economy payer, or benefits payer by Automated Clearing House (ACH) deposit OR Original Credit Transaction (OCT). Bank ACH transfers, Pay Anyone transfers,

verification or trial deposits from financial institutions, peer to peer transfers from services such as PayPal, Cash App, or Venmo, mobile check deposits, cash deposits, one-time direct deposits, such as tax refunds and other similar

transactions, and any deposit to which Chime deems to not be a qualifying direct deposit are not qualifying direct deposits.

⁶ Out-of-network ATM withdrawal fees apply except at MoneyPass ATMs in a 7-Eleven location or any Allpoint or Visa Plus Alliance ATM.

Chime Review

-

Commissions & Fees

-

Customer Service

-

Ease Of Use

-

Products & Services

-

Specialty Services

Overall

Summary

Chime is a mobile-friendly financial technology company that offers almost-fee-free checking as well as some great products and services for banking customers.

Pros

- No monthly fees

- High APY on savings

- Mobile-Friendly

Cons

- Depositing cash can be a challenge

- Lower transaction limits than traditional banks

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett