Temporary Expanded PSLF is a stop-gap program to help borrowers qualify for Public Service Loan Forgiveness who may have been in the wrong repayment plan.

If you’re a public servant — a teacher, a nonprofit worker, a public defender, a government worker, or another — you might have cheered when you heard about the Public Service Loan Forgiveness program. This program, in theory, allows borrowers to make 10 years of income-driven payments on their loans and then have the rest forgiven.

But the program’s rules are complex — so much so that we have a whole training course dedicated to getting it right — and when the first borrowers became eligible for forgiveness 10 years after the program’s start in 2007, hardly anyone who applied for loan discharge was able to get it processed.

In fact, as of September 2021, only 9,038 people out of more than 442,277 applicants had had their loans forgiven (that's 2.0% if you're looking for the math).

Not good. But it's significantly improved since then - so that's good news.

Note: TEPSLF is different than what President Biden recently announced. If you're looking for that information, check out this guide to Biden's PSLF Simplification and FFEL Waiver.

Editor's Note: Dates and loan servicers have been updated to reflect the most recent changes to TEPSLF.

Why Was/Is PSLF So Hard to Qualify For?

Good question. This is a program that was started with good intentions. But many of the people it was supposed to help didn’t read and/or understand the fine print, and loan servicers didn’t help; it seems that many of them gave borrowers deliberate misinformation or failed to inform them of something that could have helped them.

Basically, to meet the original requirements, you needed to have a specific type of loan (or consolidate your existing loans in order to get the specific type of loan), to be on a specific type of repayment plan, to certify that your employer qualified as “public service” every single year, and to make 120 payments under these conditions (not 120 payments overall, or 10 straight years of payments, but 120/10 years of payments while having this kind of loan and working for this kind of employer).

That’s a lot to keep track of, and being in the wrong kind of payment plan in particular seems to have bitten a lot of people.

Plus, FedLoan Servicing, the only servicer that handles PSLF loans, is pretty terrible overall, which doesn’t help.

Note: Starting in 2022, MOHELA will become the loan servicer that handles PSLF and TEPSLF.

What Is Temporary Expanded Public Service Loan Forgiveness (TEPSLF)?

TEPSLF is, well, a temporary opportunity to access a (slightly) expanded eligibility pool for PSLF. It’s controversial right now because congressional Democrats are arguing that the Republican-controlled Department of Education hasn’t expanded the pool enough. Maybe it’ll expand further and maybe it won’t, but for the moment, the “expanded” part refers to the types of repayment programs that are eligible for forgiveness.

Here's a quick infographic to help you understand the differences between PSLF, TEPSLF, and the special Biden PSLF Waiver:

Where Did Temporary Expanded PSLF Come From?

Remember, it took 10 years for the first possible qualifiers to apply to have their loans forgiven, so that was in 2017. When news started to break that 99% of PSLF applicants were being denied due to not meeting requirements, it became a major scandal.

Due to a big push from Senator Elizabeth Warren and other student-debt advocates in Congress like senators Sheldon Whitehouse and Tim Kaine, the 2018 U.S. budget included a pot of $350 million to aid borrowers who hadn’t met the PSLF requirements, but would meet an “expanded” definition.

The money is finite, and will eventually run out — so it’s on a first come, first served basis. Hence, temporary. However, not much of it has been used so far due to another round of eligibility issues, so there’s a good chance that if you qualify, you’ll be able to use it.

Who Is Eligible? Part 1: Type of Repayment Plan

First of all, you should know that TEPSLF hasn’t gone so great so far. Nearly everyone who applied for it in 2018 was rejected — and I do mean nearly everyone. Only a couple hundred out of literally tens of thousands of applicants were accepted.

In other words, there’s still a lot of difficulty in getting your loans forgiven under the new rules. Before I go any further, here’s a link to the Department of Education’s TEPSLF website, which addresses some of these issues too.

The purpose of TEPSLF is to help people who were in the wrong kind of repayment plan.

Original-flavor PSLF required that borrowers be on one of the income-driven repayment plans: PAYE (Pay As You Earn), REPAYE (Revised Pay As You Earn), IBR (Income-Based Repayment), or ICR (Income-Contingent Repayment).

All of these plans tie the amount of your payments to your income, and since public service incomes are generally lower, it made sense that lots of PSLF applicants would be on one. But it turned out this often isn’t the case and lots of people were rejected for being on another payment plan.

TEPSLF expands the kind of eligible repayment plans. If you have been using a Graduated Repayment Plan, an Extended Repayment Plan, a Consolidation Standard Repayment Plan, or a Consolidation Graduated Repayment Plan, you’re now eligible as long as you meet all the other PSLF requirements.

Who Is Eligible? Part II: Procedure

It’s not just the kind of repayment plan you have though. You also have to go through a very specific procedure to have your loans forgiven under TEPSLF.

TEPSLF only kicks in once you've hit the 120 payment mark for PSLF. That's the only time your payments are considered for TEPSLF (even though the same form is used for both PSLF and TEPSLF).

So here’s the skinny. In order to get access to TEPSLF:

- You have to have 10 years of certified qualifying employment.

- Your 12 most-recent payments have to have been at least as much as they’d have been in a qualifying PSLF repayment plan.

- You have to have made 120 payments that qualify (they need to have been made after October 1, 2007; to not have been more than 15 days late; and to have been made while employed by a qualifying employer). If your loans were in a grace period, a deferment, or forbearance when you made a payment, it won’t qualify. Also, the payments need to have been made on the loan(s) you’re seeking forgiveness on. If you consolidated halfway through the 10 years, then the payments you made on the unconsolidated loans won’t count.

Then you can go on to apply for TEPSLF using the PSLF/TEPSLF form.

What Kinds of Loans Are Eligible?

As with PSLF, only Direct Loans qualify for TEPSLF. If you had other loans but were able to consolidate them into a Direct Loan, that’s ok, but only payments you made on the Direct Loan will count.

Parent PLUS loans, FFEL loans, Perkins Loans, and private loans are not eligible.

Direct Loans in default are also not eligible.

Note: The PSLF Waiver allows for borrowers with FFEL loans to consolidate before October 31, 2022 and become eligible for PSLF.

How To Apply For TEPSLF

First, if you haven’t already made 10 years of payments while working for an approved employer, applied for PSLF, and been denied, you’ll need to do all those things.

That means your first stop should be submitting all our PSLF/TEPSLF forms to MOHELA to ensure that your employers have been certified.

Next, you’ll need to apply for TEPSLF/PSLF using the combined form once you've reached 120 qualifying payments.

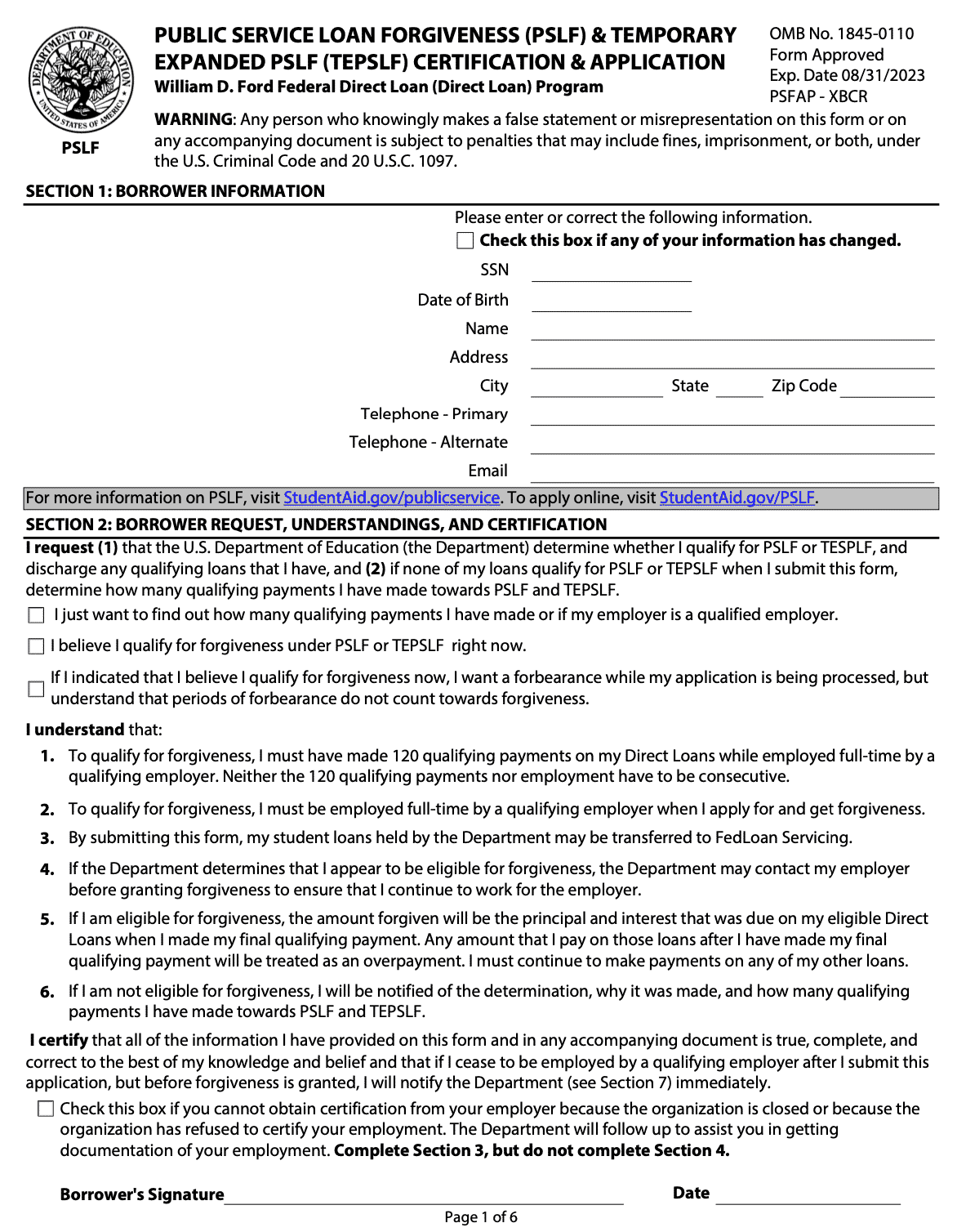

Note: In November 2020, the Department of Education launched a new form, the Public Service Loan Forgiveness (PSLF) & Temporary Expanded PSLF (TEPSLF) Certification & Application, or PSLF Form for short. This form will combine the PSLF and TEPSLF application process. If you previously used the PSLF Form, that form is still valid, but those going for TEPSLF must use this new form.

Step 1. Fill Out The Form

You need to fill out the new combined PSLF and TEPSLF form (linked above). Make sure you fully complete the form. Too many applications are denied because borrowers don't fill it out. And always keep a copy for yourself.

Step 2. Submit The Form To MOHELA

If you're at the point of applying for TEPSLF, you should already have your loans at MOHELA. You need to send this form to them.

Note: If this if your first time applying, you still send the form to the MOHELA address below, and your loans will move to MOHELA. If your loans were previously at FedLoan, they will move to MOHELA (if they haven't already).

We recommend using the secure upload portal in your dashboard located on their website. If that doesn't work for you, we then recommend sending it certified mail with return receipt. This will be your proof they received it. As a last resort, you can fax it, but we don't recommend it.

Here's where to send it if you don't use their secure portal:

Mail:

U.S. Department of Education

MOHELA

633 Spirit Drive

Chesterfield, MO 63005-1243

Fax: 866-222-7060

Then, wait for MOHELA to reply to you. They’re required to confirm that you are eligible and to email you back with a determination (which will post in the secure mailbox). This might take several months (they say 60 to 120 days). You may be asked for additional information, especially about your income in the last 12 months, your family size, or your employer.

(They might want to know about your income or family size because they want to determine whether or not your recent payments were at least as much as they would have been on an income-based repayment program, which is one of the markers of eligibility for TEPSLF.)

If they do ask you for more info, move on it quickly, because you’ll need to provide it in 21 days or your request will be canceled.

If you’re denied, you may need to follow up with more information if you want to appeal. The denial ought to come with a reason and also an explanation of what you should do next. That may include submitting a PSLF application, making further payments (if you don’t have 10 eligible years’ worth), and/or getting your employer certified (which means following up with MOHELA and your employers during the 10-year period).

If you're still denied but believe you should be eligible, you want to follow up with the FSA Ombudsman with the details of your concern.

If you’re approved, that should be it. Your loans will be forgiven, along with any outstanding interest, and you can log into your account and see a $0.

What About Taxes?

This is a big deal! If your loans are forgiven under either PSLF or TEPSLF, the forgiveness amount is not considered taxable income on your Federal taxes.

You may face state taxes on student loans forgiven under these programs.

Does This Actually Work for Anyone?

Like I said, the implementation of this program has been messy and contested. But it has worked for highly organized, persistent people who do meet all of these requirements. Here’s one story of a woman who not only got her loans forgiven, but got nine months of “overpayment” refunded to her. That ought to be inspirational!

One thing I really noted in that story is that while it’s really frustrating to deal with servicers, it can have benefits to keep pushing them. The woman in the story called her servicer maybe 20 times to check on things, insist that they look further into her situation, get documentation, and so on.

That sounds awful and it really sucks that it’s this challenging to access the program. But on the other hand, which would you rather do: call MOHELA 20 times or pay on your student loans for another 5 years when you don’t have to?

Here is another takeaway from that story: If you can afford it, it might help to hire a professional to assess your situation and help you make a plan. The woman in the story used a student loan lawyer. She still had to do a lot of the work of calling the servicer, etc., but it must have been comforting to have an expert on her side.

What Else Is Going on with PSLF?

President Biden recently announced that he was working to streamline PSLF - by creating three major new initiatives by executive order.

First, he's offering a temporary one-year waiver for those with old FFEL loans or Perkins loans to consolidate into a Direct Loan and let past payments qualify for PSLF. This is a big win - but the consolidation and employment certification must be done by October 31, 2022.

Second, he's going to automatically allow payments of government workers to count. We've argued this automatic student loan forgiveness should be done for everyone via data-matching, but it's a start.

Finally, he's going to review all past PSLF applications. So maybe some people will get credit that have been missing it.

It definitely seems like PSLF has become a partisan issue, with Democrats trying to expand the program to more borrowers and Republicans trying to prevent borrowers from accessing it. This didn’t used to be the case — PSLF was signed into law by George Bush and the Obama education department didn’t exactly do a great job of keeping servicers from misbehaving — but unfortunately, it does seem now like the program has become a political football, meaning that its future probably depends a lot on who wins Congress and the presidency.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller