eSmart Tax, is a subsidiary of Liberty Tax, previously operated as a separate tax filing platform. However, for 2024 (the 2023 tax year), eSmart has now been moved over to Liberty Tax.

Thankfully, you're not missing out on a whole lot. The outdated, hard-to-read website never instilled confidence that users would have the best tax filing experience.

eSmart was always one of our lowest rated tax softare platforms here at The College Investor. In hindsight, Liberty Tax had likely planned to consolidate the platforms for some time, which may be why little effort was made to improve the eSmart Tax platform.

If you're interested in filing your taxes with Liberty Tax Online in 2024, you can read our full review here.

eSmart Tax Is Now Liberty Tax In 2024

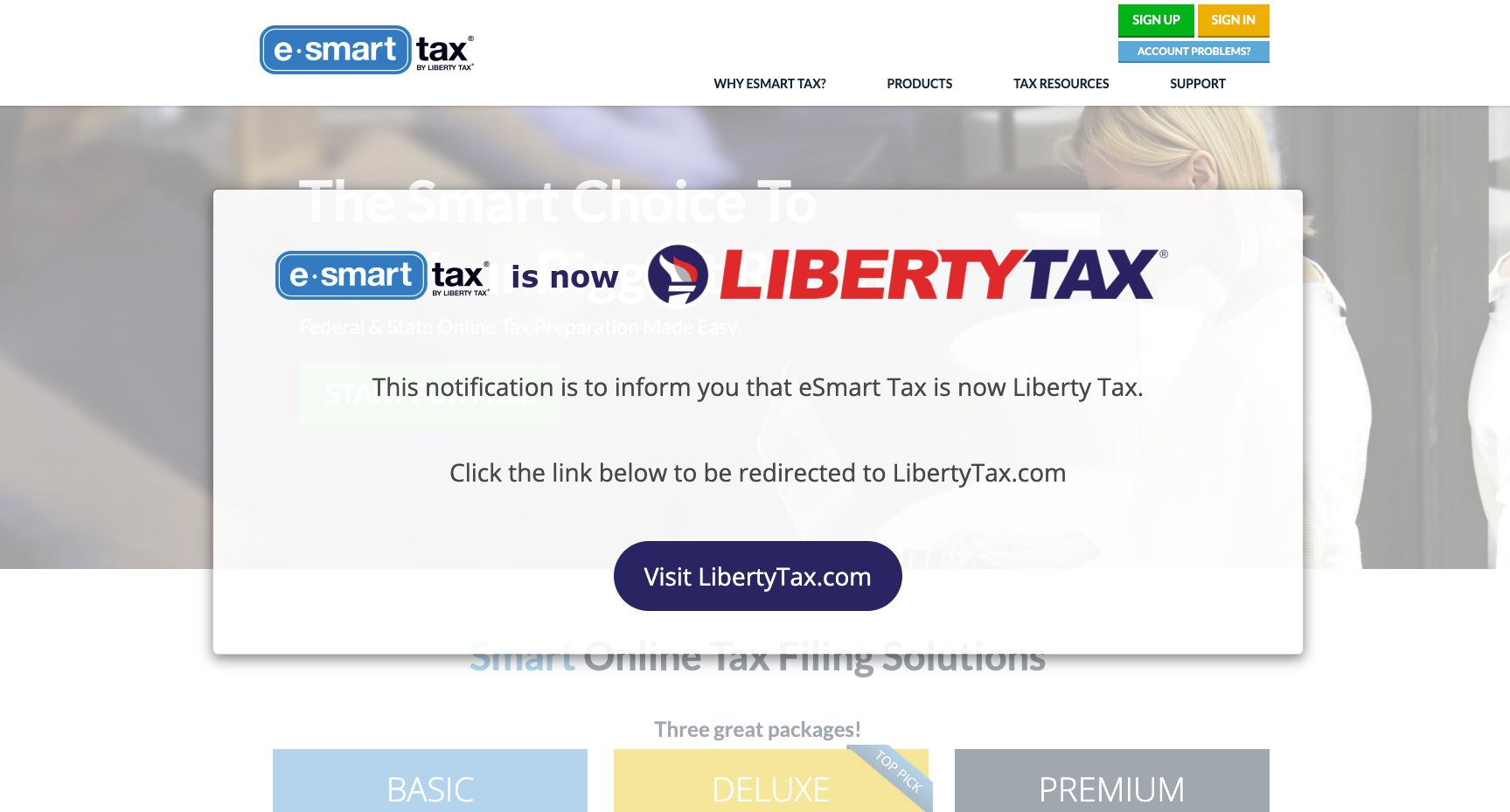

eSmart Tax, one of The College Investor's lowest rated tax software programs, has been moved to Liberty Tax for 2024, and is no longer functioning under the eSmart Tax banner. You may receive the following notice directing you to Liberty Tax when you arrive at the eSmart Tax homepage:

Liberty Tax is a well-known brick-and-mortar tax preparation service with over 2500 retail locations. Much like another traditional tax preparation service, H&R Block, it also has its own online tax filing software. Liberty Tax Online. eSmart tax filers can expect a slightly better experience with Liberty Tax Online, however, before signing up for 2024, we recommend that you take a closer look at our list of the best tax software options, which doesn't include Liberty Tax.

Here's a closer look at what Liberty Tax Online offers:

About Liberty Tax Online

Liberty Tax Online is a mid-tier online tax software at a premium price. Plans start at $45.95 for a federal return, and an additional $36.95 per state return. You can get audit support, and if you get stuck, you have the option of transferring to a full service return in person at a Liberty Tax Office. In fact, Liberty Tax offers three types of customer support: Email, Live Chat, and In-Person.

Unfortunately, it's online filing option falls well short of top platforms, such as TurboTax and H&R Block. If you're a returning Liberty Tax customer, then you may be comfortable with their platform and not mind the price. In that case, head to Liberty Tax Online to get started or read our in-depth Liberty Tax Online review for more details.

Otherwise, you can check out our list of the best tax software options for 2024 here.

eSmart Tax Review

-

Navigation

-

Ease Of Use

-

Features And Options

-

Customer Service

-

Plans And Pricing

Overall

Summary

eSmart Tax was one of our lowest-rated tax software platforms, but for 2024, it’s moved to Liberty Tax and is no longer operating under the eSmart Tax banner.

Pros

- Guided interface works well for simple filing situations

- Basic Audit Assistance included

- Filers can receive advice from tax pros at Liberty Tax offices

Cons

- Difficult to enter rental income, stock trades, and crypto transactions

- No section summaries

- Relatively high prices

- Misleading website advertising

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Colin Graves Reviewed by: Robert Farrington