There are a lot of misconceptions about student loans. A lot of people hate them, a lot of people need them. The majority of people don't understand every facet about them - and that can lead to trouble.

Given that student loans can be a huge part of your financial future, you need to understand how to best pay for college, and how to pay off student loans fast.

Given that there is over $1.7 trillion in student loan debt, and that the average graduate has almost $36,000 in student loans, borrowers need to understand these facts to make sure they are making the best decisions possible.

Share your thoughts in the comments -> did you know these facts about student loans?

If you're not quite sure where to start or what to do, consider using a service like Chipper to help you figure out your student loan debt. Chipper analyzes your loans, and helps you find the lowest repayment plan and loan forgiveness options you qualify for. Check out Chipper here >>

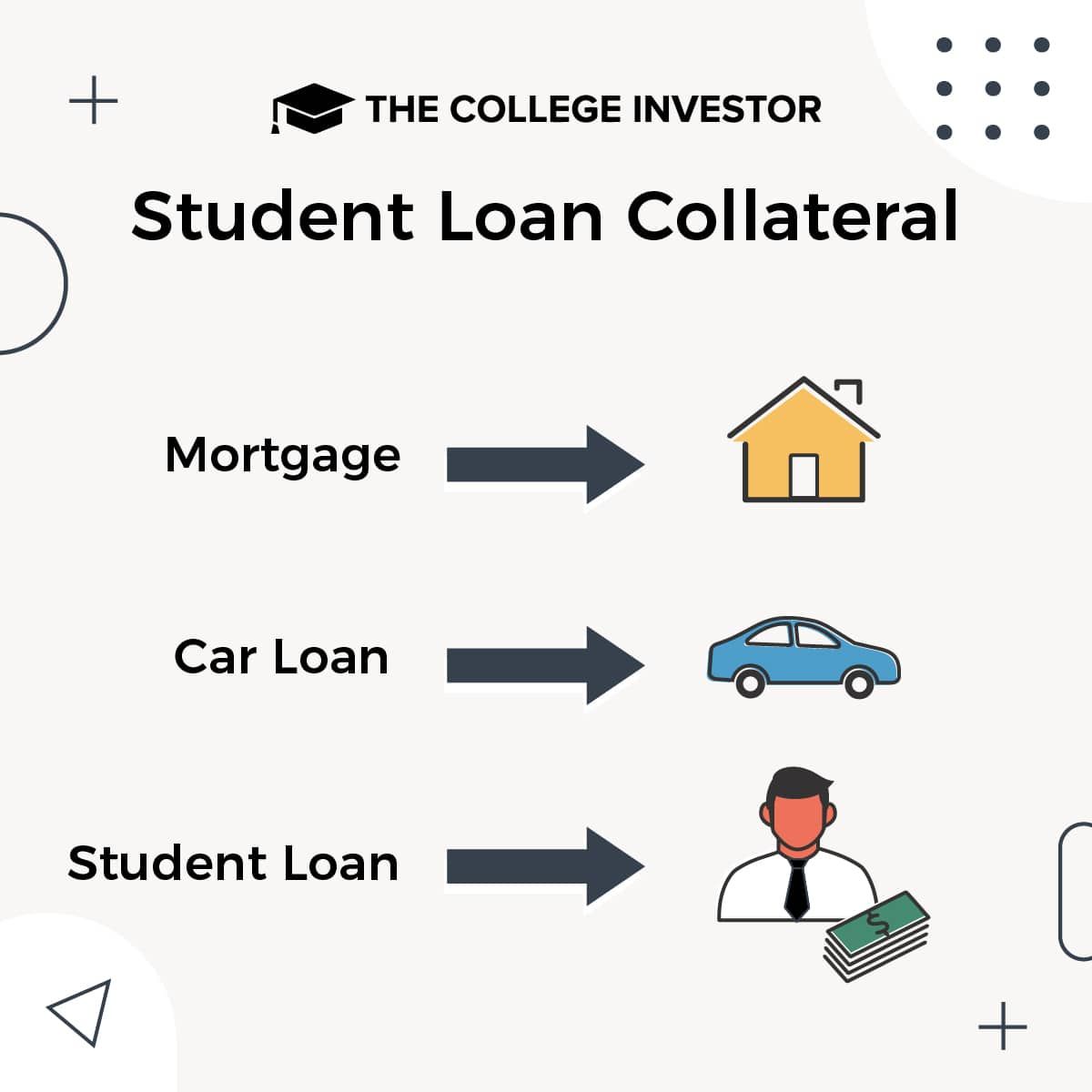

1. The Collateral For Your Student Loan Debt Is Your Future Earnings

When you buy a car and get a car loan, the collateral for the car loan is the value of the car. If you don't make your monthly payments, the bank simply repossesses your car. The same is true for a house and a mortgage. You don't pay your mortgage, the bank forecloses on your house.

So when you take on student loans, what do you think the collateral is? Just goodwill? No, the collateral on your student loans in your ability to earn money in the future. If you fail to pay back your loans, the lender (either the government or bank) can garnish your wages, garnish your Social Security, and even offset and take your tax refund.

This is the key reason why, for the most part, student loans aren't easily dischargeable in bankruptcy. Bankruptcy helps liquidate your assets to repay your debt and cancels the rest if you really can't repay it. But with student loans, as long as you have the ability to earn, you have the ability to pay something. It's also the key reason why there is student loan forgiveness for being disabled - you simply can't earn any more money to repay the loans.

So, when you take out student loans, you need to calculate your ROI (return on investment) and ensure that you can repay the debt.

2. You Can Refinance Federal Student Loans

There is a big misconception about student loan refinancing. Many borrowers don't think they can refinance their student loans to lower their payments, specifically with private student loans. However, since 2009, the government has allowed borrowers to refinance their Federal student loans... into private student loans.

Now, this doesn't make sense for a lot of borrowers. If you rely on your Federal student loans for income-based repayment programs, or some type of forgiveness program, then you shouldn't refinance your loans this way. The reason is that you will lose access to student loan forgiveness programs and special features like deferment and forbearance (including the Covid-19 payment pause).

However, if you are on the Standard Repayment Plan and are looking for options to lower your payment and interest, the refinancing into a lower interest rate private student loan could make a lot of sense. I recommend using Credible, a marketplace for student loans. Like Kayak or Expedia except for student loan refinancing, Credible helps your receive offers from multiple lenders after filling out a single form.

A special offer for College Investor readers - get up to a $1,000 gift card bonus when you refinance your loans with Credible!

3. Parents Who Take On Loans For Their Kids Owe The Debt

One of the most commonly asked questions I receive about student loan debt goes like this: "I took out $30,000 in student loans to pay for my daughter's college. Now I'm 55 and nearing retirement, and my daughter can't make payments because she doesn't have a job yet. What are my options?"

When getting ready to finance college, a lot of parents are under the misconception that if they take out student loans, their children have to make the payments on them. This is incorrect and one of the most misleading facts about student loans.

If a parent takes out a loan, the parent is responsible for the loan - not the student. If the student can't pay, the parents are on the hook for the debt. Want to switch repayment plans? It might not be possible.

Parents should never take out student loans for their children. Going back to Fact #1 - the student loan's collateral is earnings. If the parent takes out the loan, the collateral is the parent's earnings now, not the student.

If you already did, and are struggling, here are your options for dealing with Parent PLUS Loans.

4. If You Don't Graduate College, You Still Have To Pay Back Your Loans

Too many students go to college to "find themselves". This is not a good idea. College is expensive. Life changes. In a lot of these stories, the student ends up leaving college to pursue a dream, with no degree and a bunch of student loan debt.

The fact is, whether you graduate or not, you're still on the line for your student loan debt. Just because you don't finish doesn't get you out of repaying what you've already spend on school. I was recently talking to a woman named Sara, who went to college for a year and a half before deciding the college wasn't for her. She accrued $45,000 in debt from that year and a half. She really wanted to become a dental hygienist, which required another couple years of vocational school, at a cost of $20,000 per year. She was looking for a way out of the original debt - but it wasn't happening.

Whatever your post-college plans are, you need to repay your debt. Vocational school can be a great option, but remember the total cost of school post-graduation. You still have to repay your student loans even if you dropped out of school.

5. Cosigners On Student Loans Are Just As Responsible As The Student

Finally, when you cosign a loan, including a student loan, you are just as responsible as the borrower. Parent, grandparent, family member, friends - don't cosign a student loan. If you really must, you need to cosign a student loan the right way.

When you cosign a student loan and the student can't repay the debt - you must repay the debt. In a worst-case scenario, if you cosign a loan and the student dies, you might still have to repay the debt.

Even after graduation, and the student is making payments every month, it can be difficult to get a cosigner release. That means, you can still be on the hook for the entire duration of the loan. This can have an impact on your own credit score, and even prevent you from purchasing a car or house in some circumstances.

If you're not in a position to personally take out a student loan, then you shouldn't cosign one. It's the same thing.

If you're considering refinancing your student loans, look for student loans that have "cosigner release". This option allows for the cosigner to be removed from the loan after a set number of on-time payments. You can compare options like this at Credible for free.

Sadly, in cases where a borrower dies, the cosigner could also be responsible for the debt. That's why it's so important for cosigners to ensure there is a term life insurance policy for the borrower just in case. We recommend getting a quick quote at Haven Life.

Bonus Fact: Where To Get Help

Even though I’ve said countless times you can do it for free at StudentLoans.gov, there are still people who’ve asked me “that’s great Robert, but I still want to pay someone to help me – who can I trust?” That’s a fair question, so who can you trust?

The basic starting point is to call your student loan servicer and get help directly. They are literally paid by the U.S. Government to help you with your student loans.

Next, you can do a lot of it yourself on StudentAid.gov.

Finally, you can consider paying an expert for help. If you're not quite sure where to start or what to do, consider hiring a CFA to help you with your student loans. We recommend The Student Loan Planner to help you put together a solid financial plan for your student loan debt. Check out The Student Loan Planner here.

If you need help, it can make sense to pay for it. Just don't pay too much and really know what you're getting.

Did you know these student loan facts? Have you ever had to get help with your student loans?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller