Everyone knows that you should try to take out as little student loans as possible. It's just common sense, right? But how much of a difference does it make to have $20,000 or more less in student loan debt? I mean, if you go to a "good" school, you pay a little more, but you have the potential to earn more money - or so they say...

For most undergraduate students, where you go to college doesn't really matter any more - it's about what you do while you're there. You need to build your network, specialize your skills, and get internships. That's they key to making college worthwhile.

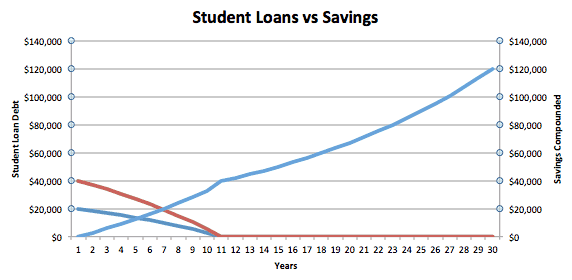

So, what if you went to a state college and only had to borrow $20,000 versus going to a more expensive school and borrowing $40,000? How much of a difference would it make on your life? Honestly, it could make a difference of almost $120,000 or more.

Let's break it down.

Setting Up The Scenario

I don’t think a lot of college students have a grasp of how much say $40,000 in student loans translates into payments once they are out of school. Sometimes it sounds like $40,000 doesn’t sound bad because they say to only take out what you can earn in your first year. But what does that payment look like? And what would it be if you only took out $20,000?

In our scenario, we break down what it looks like to take the difference between owing $20,000 and owing $40,000, and putting that difference towards owning a $250,000 condo. Over the 10 year repayment plan, what does that difference look like? How much of a difference does building equity versus paying down debt only make?

Our key assumption in that you make the same income regardless of how much student loan debt you make. That allows us to compare the situations.

$20,000 In Student Loan Debt

First, let's look at how $20,000 in student loans looks like after graduation:

Loan Balance | $20,000 |

Interest Rate | 6.8% |

Loan Term | 10 Years |

Monthly Loan Payment | $230.16 |

Number of Payments | 120 |

Cumulative Payments | $27,619.31 |

Total Interest Paid | $7,619.31 |

$40,000 In Student Loan Debt

Now here's what $40,000 in student loan debt looks like. You knew it would be more, but did you realize it would be that much more?

Loan Balance | $40,000 |

Interest Rate | 6.8% |

Loan Term | 10 Years |

Monthly Loan Payment | $460.32 |

Number of Payments | 120 |

Cumulative Payments | $55,238.63 |

Total Interest Paid | $15,238.63 |

The Difference $20,000 Makes

However, the difference in payment is only half the situation. The real benefit of having $20,000 less in student loans is what you can do with that money. 🙂

Let's say that you take your monthly savings of $230.16 and invest it every month for 10 years. If you earn just 6% per year, your money would have grown to $37,396.68 - more that you ever had in student loans. And do you know where the other guy would be at financially? $0.

Just take a look at the chart below. The blue line is the $20,000 borrower, and the red line is the $40,000 borrower.

You can see that the borrower that only has $20,000 and saves money each month actually moves from negative to positive net worth at year five. However, the $40,000 student loan borrower is only at $0 net worth at year 10.

Starting at year 10 is where things get interesting. By taking out $20,000 less in student loans, you're actually giving yourself a $37,000 lead on the other person. If we look at just this money - no additions - it will continue to grow at 6% until it reaches almost $119,936.22. So, in 30 years, your "lead" has grow significantly.

The bottom line is that you should be taking out as little student loan debt as possible. If you can take out $20,000 less when you start school, that money could be worth $120,000 when you get closer to retirement.

It's important to note that none of this takes into consideration student loan forgiveness options such as PSLF. That can skew the equation if you qualify.

One More Thing - Getting The Best Student Loan Rate

The amount you borrow obviously has a huge impact on your ability to cross out of debt and into savings but also important is the rate on your student loans. Here's a quick guide to finding the best rate on your student loans.

In my examples above, I assumed a rate of 6.8%, but if you take out private student loans, the rate and term of your loans can have a big impact. So, shop around to make sure you get the best student loan rate. I recommend using Credible where you can receive and compare private student loan offers from many lenders after filling out one form.

What are your thoughts? Should you care about the future value of your costs, or just pay for the education today?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.