A CP05 notice from the IRS arrives in your mail. That's scary - nobody wants to receive a letter from the IRS. A CP05 notice means the IRS is reviewing your tax return.

Is it time to panic? Not really. Go ahead and open the letter and read it. In many instances, no action is required on your part (just read the letter and follow any instructions) - they are just writing you to let you know, and make sure you understand your tax return may be delayed at least 60 days or more.

If you’re still confused, use this guide to help you understand what the IRS is trying to tell you.

What Is a CP05 Notice?

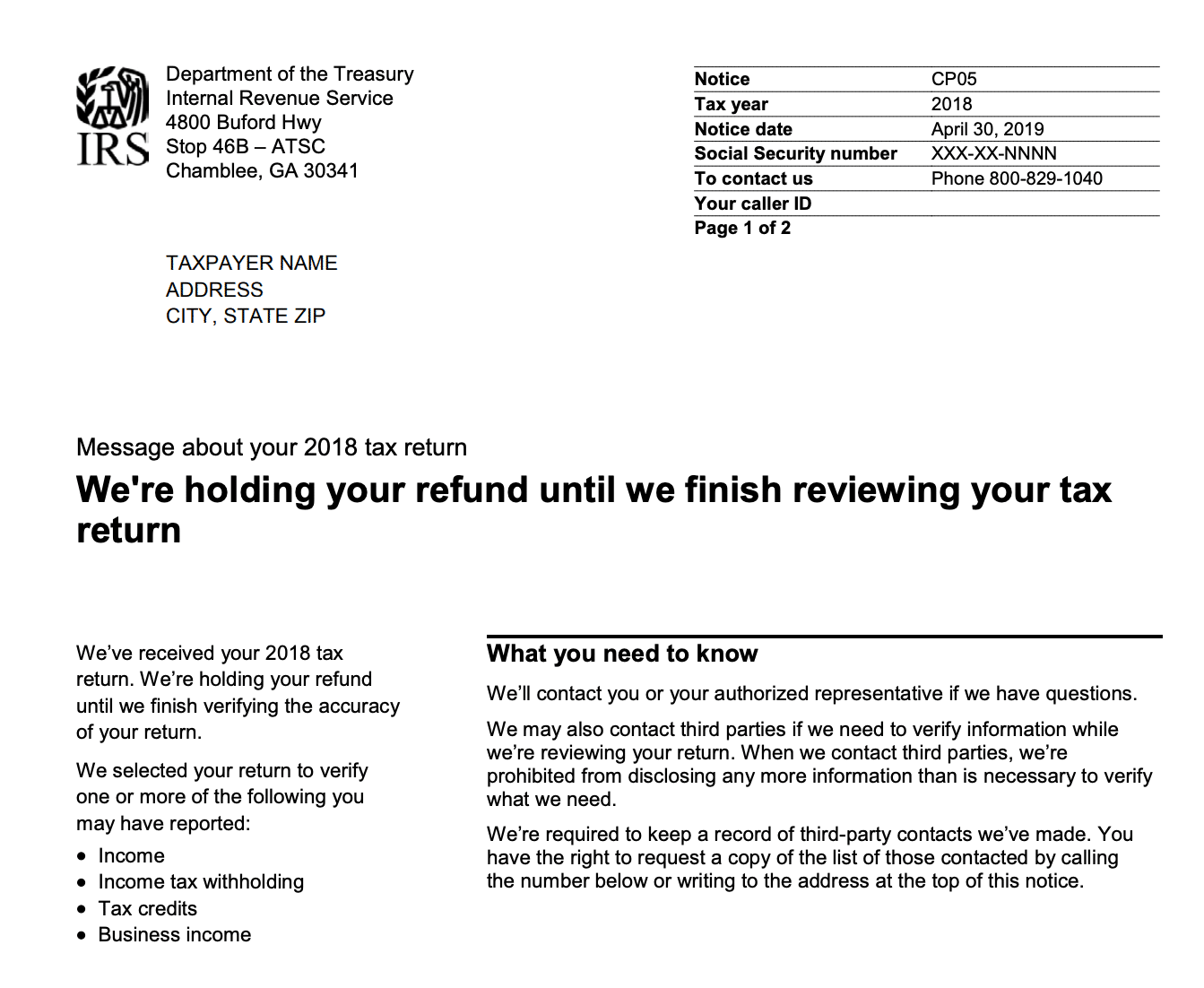

A CP05 notice is a letter from the IRS telling you that your tax return is being reviewed. The goal of the letter is to let you know that your refund may be delayed and that the IRS may request more information from you.

A CP05 notice doesn’t mean that you’ve done something wrong or that you’ve made an error. It’s an alert, and nothing else.

The IRS may be reviewing your income, your tax withholding, tax credits you may have claimed on your return (such as Earned Income Tax Credit or Additional Child Tax Credit), or even Schedule C business income.

Here's what a CP05 notice looks like:

Do I Need to Do Anything with My CP05 Notice?

If you receive a letter from the IRS, you should open it and read it. If you do not understand the letter, get help right away. You may get help at a low-income taxpayer clinic, through the tax toolkit on the IRS website, or through a paid private provider.

A CP05 notice is simply a notice that the IRS is auditing you. You don’t need to do anything unless you receive a follow-up letter from the IRS. This should happen within 60 days of your initial notice.

If you paid a tax preparer or your tax prep software includes “audit protection,” you should notify the appropriate party. They will let you know what to expect next.

Is the IRS Auditing Me?

No, this isn't an audit - this is a notice. A notice (or letter) is considered much less serious than an audit - and in many cases is designed to protect the taxpayer. The goal of the notice is to simply inform you that the IRS is making sure your tax return is correct.

The best is answer is that you’re unlucky. In most cases, the IRS accepts tax returns as filed, and anyone who is due a refund receives it within 60 days.

Those who are audited are the unlucky few.

The IRS does not release much information about the types of activities that trigger an audit. Certain studies show claiming tax credits (especially the Earned Income Tax Credit and the additional child tax credit) can make you more likely to be audited. (Please note, these are valuable credits and you should still claim them. Don’t let the chance of being audited scare you off from claiming money that is yours.)

It is possible that other things like dramatically raising or lowering your income from the previous year, filing a Schedule C, or having a variety of income sources may increase your chances of being audited. However, we can’t confirm that this is the case.

What Happens Next?

Within 60 days of your CP05 notice, the IRS should send a follow-up. The follow-up letter will be either a CP05A or a CP05B.

These will include specific instructions on what you need to send to the IRS. When you get the follow-up letters, you should follow the instructions and send the information within 30 days.

These letters can be vague and confusing which means that getting help should be a top order for you. You may get help at a low-income taxpayer clinic, through the tax toolkit on the IRS website, or through a paid private provider.

When you get a CP05 follow-up, you need to act quickly. You only have 30 days to respond to the IRS.

If you get a CP05A notice or a CP05B notice, the IRS is telling you it needs information from you.

In the case of either notice, you’ll have to send copies of the items listed on the notice so the IRS can verify your income and tax withholding.

The notice will include a contact stub which you should include when you send the letter. The contact stub will also include a specific address where you can send the letter. You can send these via the mail. Be sure to keep copies of anything you send to the IRS.

If you’ve paid for audit protection, or you’re working with a tax preparer, your tax prep service should work with you to send the appropriate items.

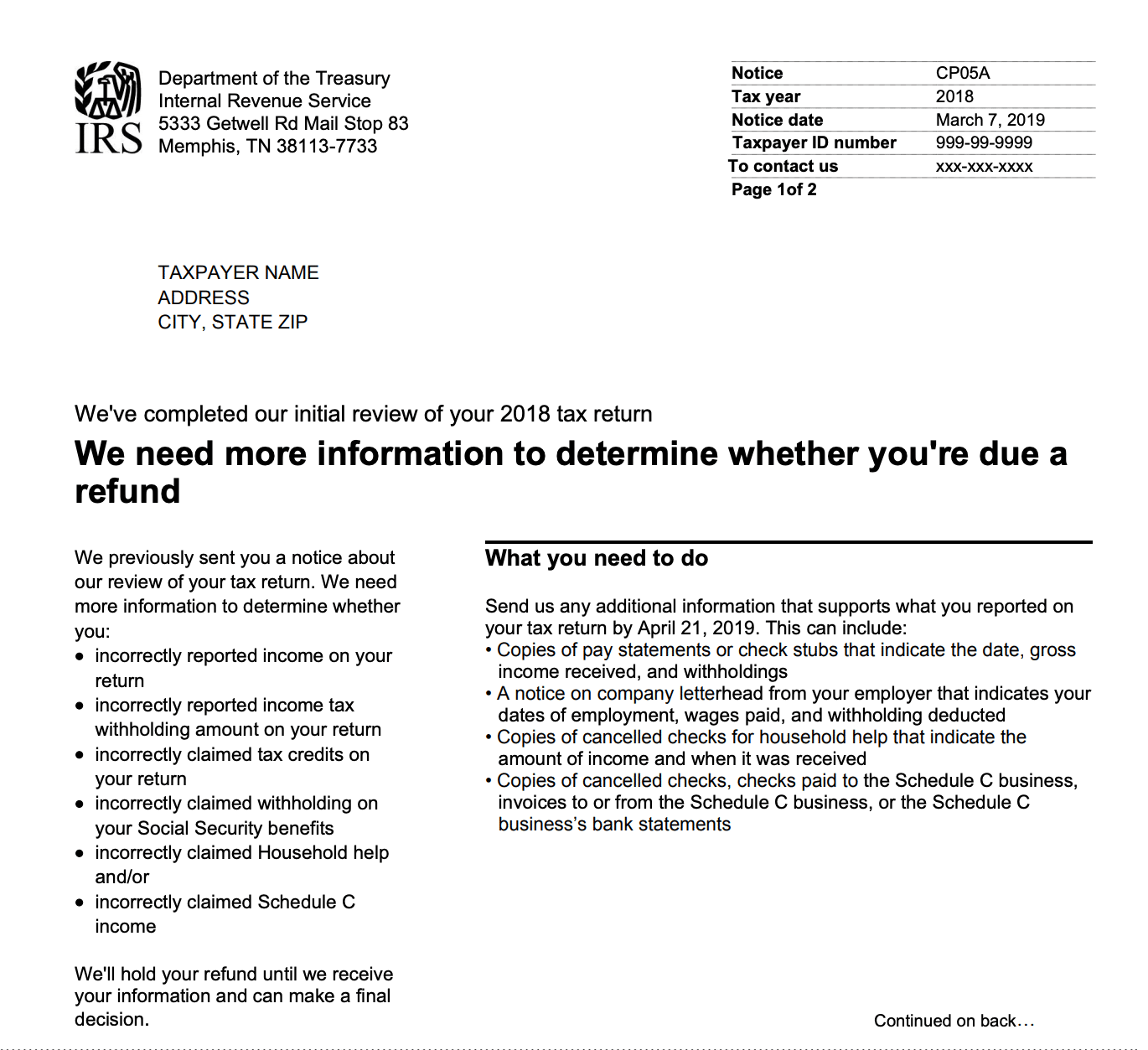

CP05A Notice

The CP05A Letter is a slightly different version of the CP05 notice and it asks for specific information. This letter means the IRS has basically paused processing your return (whether you owe or are due a refund) until it receives the additional information requested.

The most commonly requested information is wage or income information - such as copies of paystubs, copies of checks, or even a letter on a copy letterhead showing dates of employment.

Here's what a CP05A Letter looks like:

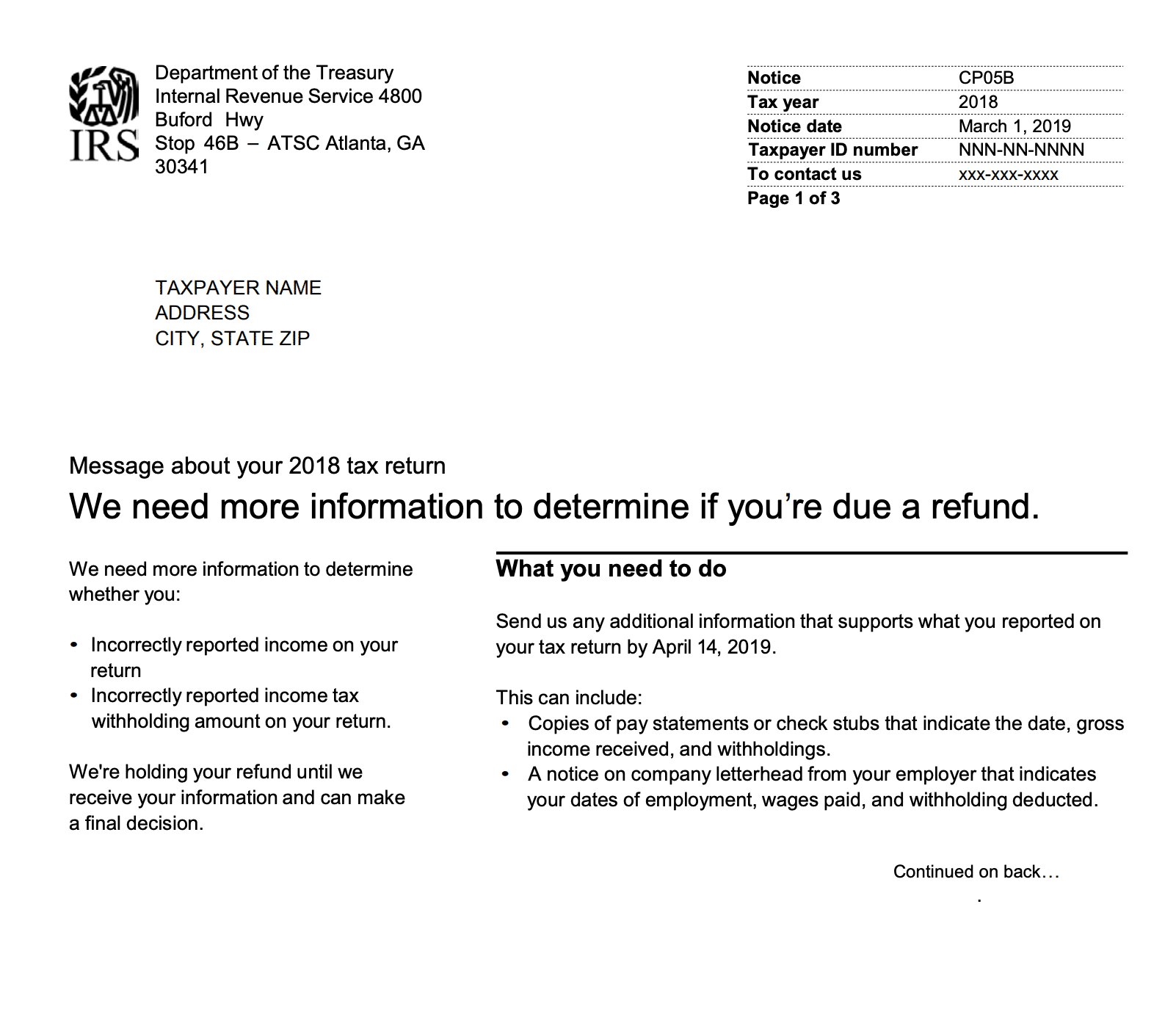

CP05B Notice

The CP05B letter is the next step after a CP05 or CP05A letter. This letter specifically states that your refund is being held by the IRS until it can finish their review.

The only way they can finish their review is if you provide the information requested in the letter.

Here is what a CP05B letter looks like:

The IRS May Suggest Changes to Your Return

After reviewing all the documentation you sent, the IRS may propose an adjustment to your return. The IRS will request that you sign the adjustment (which may change the amount you owe the IRS).

Before agreeing to any changes, it is best to consult with a tax advisor. If you don’t agree with an adjustment, you can request a conference with an IRS examiner or you can request that your case be sent to appeals.

As long as you and the IRS reach resolution within 90 days, there will be no further action. If you cannot reach resolution within 90 days, you may receive a Notice of Deficiency.

If you agree with the adjustment, you can sign it, and the IRS will send your adjusted refund. You should receive a refund within six to eight weeks.

If you owe money (after the adjustment), you can either pay it, or enter into a payment plan with the IRS. The payment plans with the IRS are reasonable, but almost inescapable. If possible, try to use a low-interest form of debt (such as a personal loan or a 0% credit card) to pay the debt.

Final Thoughts

Getting any letter from the IRS can be scary - especially a CP05 notice. Another scary thing is waiting for your tax refund, and not hearing anything. If you've exceeded the 21 days on the tax refund calendar for this year, you might contact the IRS to see if they've sent you a notice or letter of any kind.

Sometimes there may be an issue with your return and you will only know when you contact the IRS or receive a letter.

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Clint Proctor