Raisin is a unique banking product that brokers savings accounts and CDs to help you earn the highest interest rates possible.

Saving money is an important part of building a bright financial future. While the act of setting money aside is critical, the right savings account can make all the difference. Raisin (previously known as SaveBetter) has become one of the leaders in offering high interest earning savings accounts and CD options.

According to the FDIC, the national average of rates tied to savings accounts is 0.46%. If you stick your funds in a regular savings account with average rates, it will take a while to accumulate interest earnings.

But you can choose to funnel your savings into a high-yield savings account. If you want help finding accounts with top APYs, that’s where Raisin can help.

Raisin Details | |

|---|---|

Product Name | Raisin |

Min Deposit | $1 |

Monthly Fee | $0 |

APY | 4.75% to 5.25% |

Promotions | None |

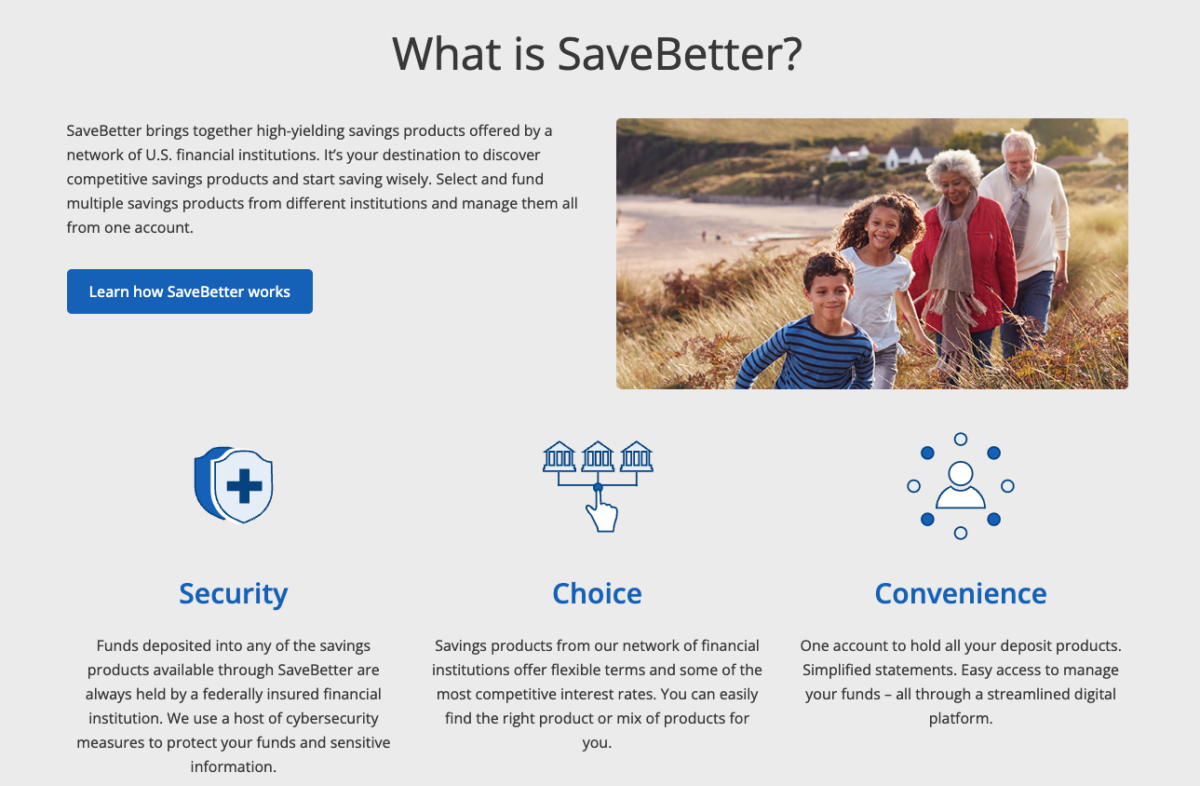

What Is Raisin?

Raisin is an online platform that connects savers to top-notch interest rate opportunities on savings products. While Raisin isn’t a bank itself, it partners with banks and credit unions to offer the products you’ll see through the platform.

Raisin negotiates higher interest rates for savings products directly through partner financial institutions. With that in mind, the rates you see on Raisin are typically higher than you'll find if you head directly to the partner bank’s website. Typically, Raisin works with regional banks and other mid-sized financial institutions.

The whole concept of Raisin is similar to brokered CDs, which have been offered through investment firms like Fidelity and Schwab for decades.

Raisin was founded in 1973. Raisin has been using a similar business model in Europe for decades. In 2023, SaveBetter (the US-version of Raising) fully rebranded to their parent company's name.

What Does It Offer?

Raisin represents a useful opportunity for savers. The company negotiates higher interest rates with partner banks, which means you’ll often find above-average rates.

Raisin is able to make these negotiations work because banks tend to spend a lot of money on advertising. Instead of paying for traditional advertising, partner banks get their offer in front of a built-in audience through Raisin. It’s a win-win for everyone.

When you sign up for the account, you can view your funds through Raisin's online dashboard. But the funds themselves will be stored in a custodial account at the financial institution, which means your funds are pooled with other Raisin customers. This is very similar to the custodial model of brokered CDs.

Here’s a closer look at what the platform offers:

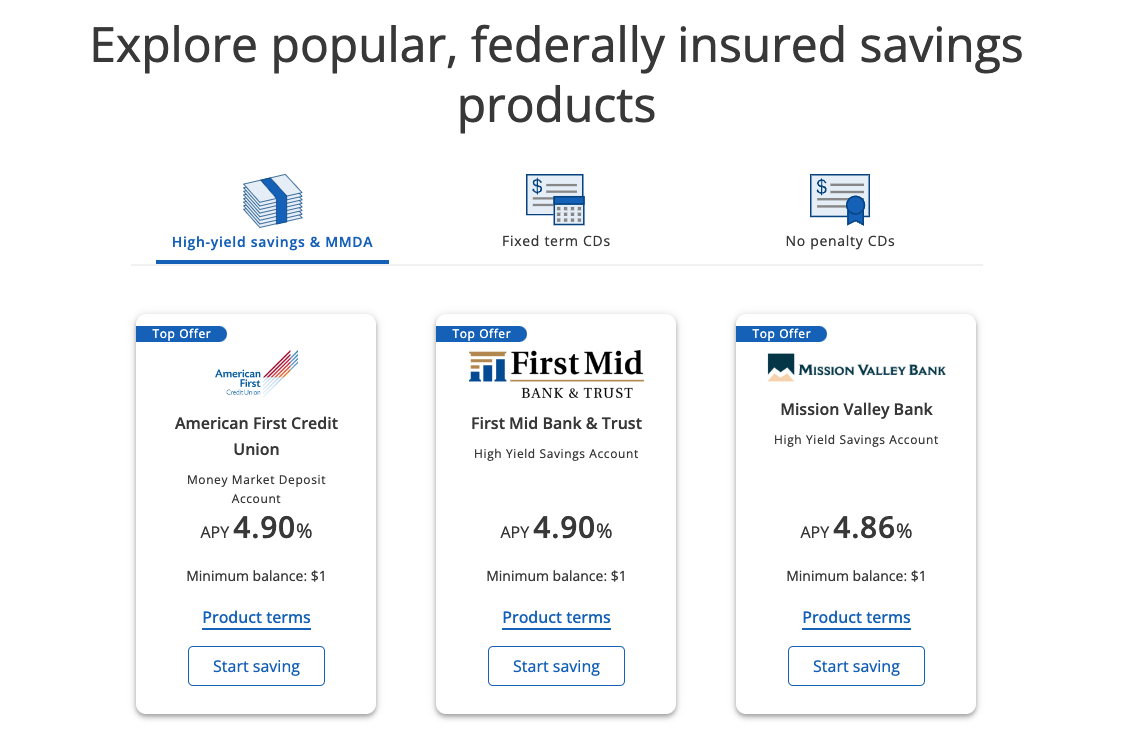

High-Yield Savings Accounts

High-yield savings accounts can come with very attractive interest rates. If you are looking to make the most of your savings, Raisin can help you find the top offers from their partners.

A search for top high-yield savings accounts on Raisin showed several accounts with APYs of 5.25% or higher. When compared to the national average of 0.46%, it’s clear that you’ll earn more money on your savings through one of the accounts on offer.

Money Market Accounts

A money market account might be the right place to store your savings. If you want to move forward with a money market account, Raisin can help you find relatively high rates.

Raisin was advertising several money market accounts with an APY of 5.05% or higher. In contrast to the national average of 0.66% APY, savers can earn more through Raisin’s advertised rates than most other money market platforms.

CD Accounts

A certificate of deposit (CD) works by locking up your funds for a set period of time. In exchange, you’ll lock in an interest rate for the duration of the CD. Most regular CDs charge an early withdrawal penalty if you need to take the funds out before the maturity date. However, no-penalty CDs allow you to pull your funds at any time without a fee.

Through Raisin, you can find traditional and no-penalty CDs with relatively high interest rates. For example, you can find a 6-month CD with a 5.15% APY, which is significantly higher than 1.57% APY, the national average rate for 6-month CDs.

Notably, checking accounts are missing from Raisin’s platform.

What Are The Downsides?

The biggest downside to Raisin is that, since it leverages a "brokered" model, you are limited in how you can deposit and withdrawal your funds.

Unlike a traditional savings account where you get a bank account number and routing number, with Raisin, you must do everything through their platform. Your funds are safe and FDIC or NCUA insured at the partner bank, but since it's in a custodian account, you can't do things like direct deposit or wire transfers.

You must login to the Raisin portal and setup all your transfers to your linked bank account. That's it. Depending on how you want to use your savings account, this could be a dealbreaker.

Are There Any Fees?

Raisin pulls together opportunities from several different partner banks. In general, the platform promises that you won’t encounter any fees. Plus, the minimum deposit is set at a low $1 per month.

However, you should always double-check the product terms before signing up to uncover any specific fees. For example, traditional CD products indicate the size of the early withdrawal penalty within the product term sheet.

How Do I Contact Raisin?

If you need to get in touch with Raisin, you can email service@raisin.com or call 844-994-3276. Customer support is available from Monday to Friday from 9 a.m. to 4 p.m. EST.

Raisin has a lot of positive reviews on Trustpilot with a score of 4.4 our of 328 reviews. Negative feedback seems to center on customer service problems, while good feedback tends to appreciate access to high APYs.

How Does Raisin Compare?

Raisin isn’t the only opportunity for savers looking to find top-notch products. If you don’t want to work on the Raisin platform, consider Current, CITBank, or Upgrade. All offer relatively high APYs.

Current offers 4.00% on up to $6,000 in savings, fee-free overdraft, and no monthly, minimums, or hidden fees. It offers a place for you to manage your money in one place, including debit, card, paycheck, savings, and even crypto.

CITBank has CIT Platinum Savings that has a minimum opening deposit of $100 and an APY of up to 5.00%. Keep in mind that in order to secure that rate, you must maintain a minimum $5,000 balance.

Upgrade has no minimum deposit and you can earn up to 5.21% on their savings. There are also no monthly fees to worry about either. If you’re concerned that Raisin doesn’t offer checking, Upgrade has Rewards Checking, which is a solid online checking account with no monthly maintenance fees, no ATM fees, and no transfer fees.

Header |  |  |  |

|---|---|---|---|

Rating | |||

APY | Up To 5.31% | 5.21% | Up To 4.00% |

Monthly Fees | $0 | $0 | $0 |

Min Deposit | $1 | $0 | $0 |

ATM Access | N/A | Unlimited via Reimbursement | 40,000+ Free ATMs |

FDIC Insured | |||

Cell |

Promotional Offers

Raising doesn't have any promotional offers for opening a new account. They already have the best rates, so they don't need to incentivize you with cash bonuses.

However, they do have a refer-a-friend program. You can earn up to $2,000 in referral bonuses when you refer a friend who makes a qualifying deposit. See site for details.

How Do I Open An Account?

The process starts by reviewing the savings products available. If you spot a savings product that suits your needs, click the ‘Save Now’ button. From there, you’ll be asked to create an account.

Be prepared to provide your email, a password, name, Social Security Number, and funding account information. Keep in mind that you’ll need to be 18 years old to get started.

Is It Safe And Secure?

Most importantly, Raisin partners with FDIC and NCUA-insured financial institutions. As a saver, you can breathe easy knowing that your funds are protected for up to $250,000.

Additionally, the Raisin platform is SOC 2-certified. In other words, the platform has extensive security measures in place to protect your information.

Is It Worth It?

If you are looking for a high APY on a savings product, Raisin presents a worthwhile opportunity. Not only does Raisin make it easy to find relatively high APYs, the platform makes it easy to lock in the opportunity.

However, you might not want to work through this platform. If you aren’t comfortable working with Raisin, consider checking out your other high yield savings account options today.

Raisin Features

Account Types |

|

Minimum Initial Deposit | $1 |

Monthly Fees | $0 |

Checking Account? | No |

ATM Availability | No access to ATMs |

Branches | None (online-only bank) |

Customer Service Number | 844-994-3276 |

Customer Service Hours | Monday to Friday from 9 a.m. to 4 p.m. EST |

Mobile App Availability | N/A |

Web/Desktop Account Access | Yes |

FDIC Insured? | Yes |

Promotions | None |

Raisin Review

-

Interest Rates

-

Fees

-

Customer Service

-

Ease of Use

Overall

Summary

Raisin partners with banks and credit unions to offer unique savings and CD accounts with high interest rates.

Pros

- Relatively high interest rates available

- Low minimum deposit requirement of $1

- Multiple partners leads to many accounts options

Cons

- No checking accounts featured

- No business banking options

- Limited options to transfer into and out of accounts

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Colin Graves Reviewed by: Robert Farrington