Upgrade is a full service financial company that got its start focusing on personal loans. Today, it offers a full suite of banking products, including checking, savings, credit cards, and more.

They're known for offering competitive rates and fees, and as a result, we consider Upgrade to be one of the best personal loan lenders overall. Their reaches into banking has also won the accolades from us.

Is Upgrade right for you? Check out our review below and see if Upgrade's products make sense for you.

Upgrade Rewards Checking Plus Details | |

|---|---|

Product Name | Upgrade Rewards Checking |

Min Deposit | $0 |

Checking Cashback | Up to 2% |

Savings APY | Up to 5.21% |

Monthly Fees | $0 |

Account Types | Checking, Savings, Credit Card, Personal Loan |

Promotions | $200 w/Personal Loan |

Who Is Upgrade?

The team that created Upgrade also created LendingClub. Their goal was to create a lending product that would reduce the cost of credit while providing a great, educational experience about finance. Over the years, it launched several innovative products, including a rewards checking account.

The company was founded in 2016 and its headquarters is located in San Francisco.

⚠︎ This Is A Banking Service Provider, Not A Bank.

Upgrade is a financial technology company, not a bank. While it uses partner banks to provide banking services, your FDIC-insurance protection may be limited. Read this article from the FDIC to understand the risks of using a non-bank company.

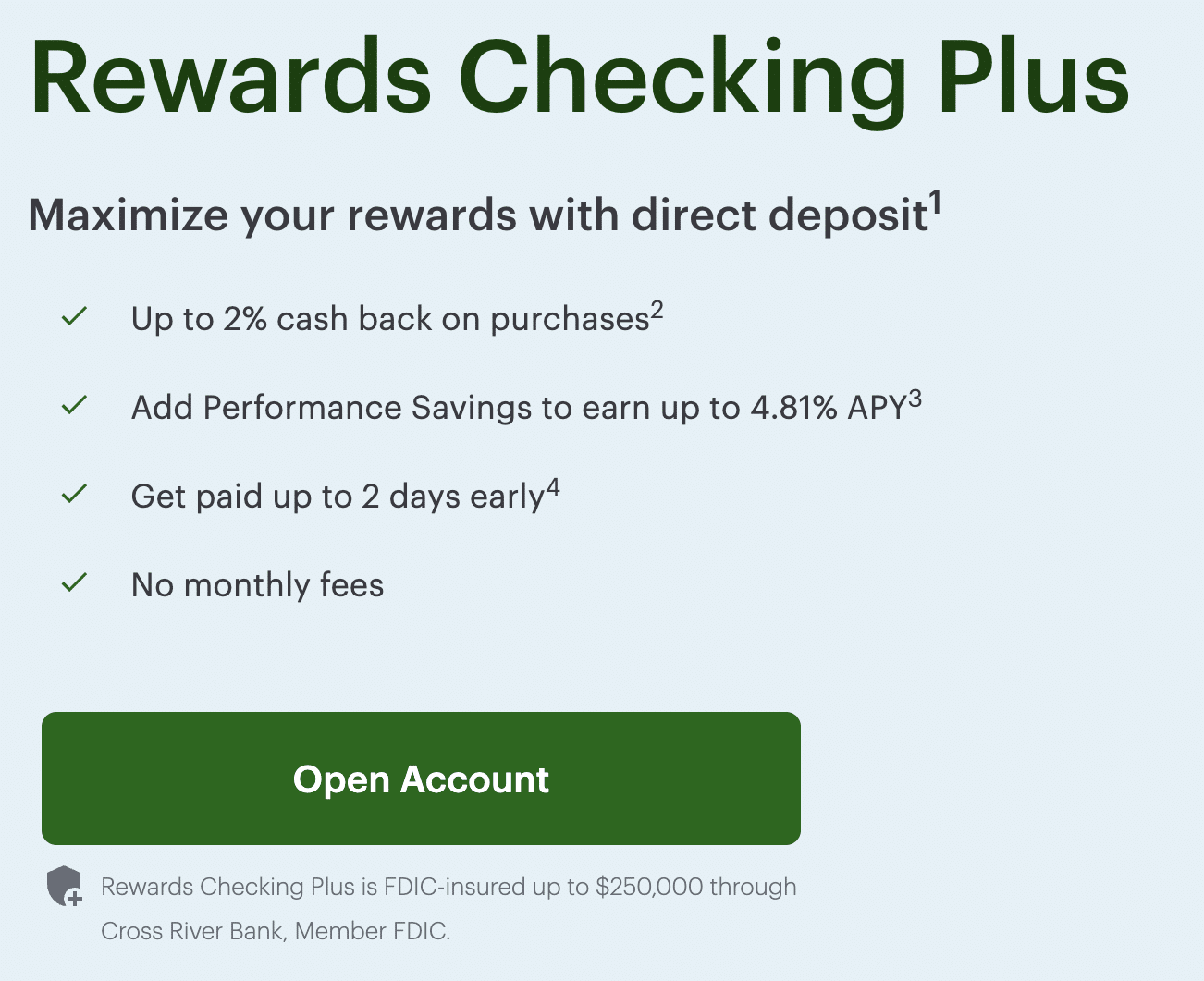

Upgrade Rewards Checking Plus

Upgrade Rewards Checking Plus is their flagship banking product. It's a solid online checking account with no monthly maintenance fees and no in-network ATM fees. Customers have access to over 55,000 free ATMs in the Allpoint network nationwide. Allpoint ATMs are located in retail locations such as Walgreens, CVS Pharmacy's, etc. There is a $2.50 fee if you use an out-of-network ATM.

What really sets it apart is that it offers up to 2% cashback on common everyday expenses, which include:

- Convenience and drug stores

- Gas stations

- Monthly subscriptions (like Netflix or DisneyPlus)

- Restaurants

- Utilities and Phone

The 2% is limited to $500 in cashback per year. Outside of those categories and beyond the $500 limit, you can earn 1% cashback on everything else you spend.

How Does Rewards Checking Compare?

Upgrade Rewards Checking is on our list of the best free checking accounts because it offers a lot of great features with no monthly account fees.

However, there are some other great options as well, including Current and Varo. Both of these accounts don't charge monthly fees. However, instead of cashback, you can earn interest on your money. It's a tradeoff which you think would be more valuable to your own personal situation.

Here's a quick comparison:

Header |  |  | |

|---|---|---|---|

Rating | |||

APY | None | Up To 4.00% | Up To 5.00% |

Monthly Fees | $0 | $0 | $0 |

Min Deposit | $0 | $0 | $0 |

ATM Access | 55,000+ Free ATMs | 40,000+ Free ATMs | 55,000+ Free ATMs |

FDIC Insured | |||

Cell |

Upgrade Premier Savings

Upgrade recently launched their competitive Premier Savings account. This account is one of our top picks for an online savings account, because it has no monthly account fees and a high interest rate.

This account currently offers 5.21% APY.

The account has no monthly maintenance fees and allows up to $100,000 in same-day transfers to and from other banks.

There is no minimum balance to open your account, but you will only earn the APY on days when the closing balance of your Premier Savings account is or exceeds $1,000. On days when the account closing balance drops below $1,000, the APY will be 0%.

It's important to remember that Upgrade is a financial technology company, not a bank. Premier Savings accounts are provided by Cross River Bank, Member FDIC and offer up to $250K in FDIC or NCUA insurance through Cross River Bank or Participating Institutions.

You can also see how it compares in this quick savings comparison:

Header |  |  | |

|---|---|---|---|

Rating | |||

Savings APY | 5.21% | 4.65% | 4.25% |

FDIC Insured | |||

Cell |

Upgrade Personal Loans

Upgrade offers a variety of personal loan options, and doesn’t seem to have any restrictions on whom it allows through its application process. Its minimum loan requirements are standard (borrowers must be U.S. citizens, at least 18 years old, and have a bank account). They do ask about your gross income on the loan application but the application questions appear to be fairly standard as well.

There are some variations in loan amount and availability between states. Minimum loan amounts are $3,005 in GA and $6,005 in MA.

Upgrade is consistently on our list of the best personal loans.

What Types of Loans Are Offered?

You can choose between a personal loan or personal line of credit. Both are fixed-rate loan products. Upgrade loans are unsecured. This means collateral is not required for Upgrade loans or lines of credit.

Personal loans can be used for many things except the following:

- Post-secondary education (school loans including tuition, room and board, supplies, etc.)

- Investments

- Illegal activities

- Gambling of any kind

Loan amounts range from $1,000 to $50,000 with APRs from 8.49%-35.99%*.

Remember, rates and fees are subject to change and based on credit qualification. These rates are accurate as of March 15, 2024. Please see their website for the latest rates and terms.

Upgrade is one of the only online lenders that offer a personal line of credit, which is currently in beta. Lines of credit can go up to $50,000. There aren’t any origination fees on a line of credit and the interest rate is fixed.

The way an Upgrade line of credit works is that you choose the amount to draw on the line. If the line is $10,000 and you draw $1,000, $9,000 remains available on the line of credit. For the $1,000 draw, you choose the terms to pay back the draw and the interest rate. Funds are moved from the line of credit directly into your checking account.

One of the main benefits of using a line of credit is that you don’t have to apply for a loan every time you take a draw. It also means no hits to your credit report for each draw.

How Does The Loan Application Process Work?

You can apply online at Upgrade.com. Once you fill out an application, you’ll be able to choose an offer. This part of the application process does a soft pull on your credit report. A soft pull does not affect your credit score.

Once you accept an offer, a hard pull is done on your credit report. This can affect your credit score. If approved, funds are deposited into your bank account within four days. If you are not immediately approved, additional documentation about your identity and income may be required.

Are There Any Hidden Fees?

All personal loans have a 1.85% to 9.99% origination fee, which is deducted from the loan proceeds.

Any failed check (or e-check) will be charged a $10 fee. A $10 late fee is applied if payment isn’t received within 15 calendar days of your payment due date.

Upgrade Promotional Offer

Right now, Upgrade is offering a solid promotion if you open a personal loan and a Rewards Checking account.

You can get a $200 bonus when you open both a personal loan and checking account, and make at least 3 debit card transactions within 60 days of account opening.

What Else Does Upgrade Offer?

Upgrade also has a variety of rewards cards:

- Cash Rewards: Unlimited 1.5% cash back

- Triple Cash Rewards: Unlimited 3% cash back on home, auto, and health purchases

Upgrade also has a feature called Credit Health, which is similar to CreditKarma.com. It’s an educational finance website mostly focused on building good credit. Some of the main features include:

- Access to your VantageScore® 3.0 anytime

- Credit score summary

- Credit Health insights

- Credit score simulator

- Customized recommendations

- Weekly updates

- Trending charts

- Email alerts

There are also many articles available on Credit Health. It’s a great, free resource for anyone who wants to learn how to improve their credit.

Who Is This For And Final Thoughts

If you need a personal loan or want to open up a personal line of credit, Upgrade offers compelling loan products. Their rates are competitive with other online lenders and terms are similar.

Unlike other online lenders, Upgrade’s personal line of credit is unique. With a line of credit, you don’t incur origination fees or have to go through a loan application every time you want to use the line of the credit.

Upgrade wants to provide people with insight into their financial lives, especially their creditworthiness. It’s worth working on your credit before applying for an Upgrade loan. The better your credit score, the better your interest rate will be.

A credit score isn’t the only factor when considering your rate. You’ll also want to have a good job — preferably one you’ve been at for a little while. All of these factors paint a picture of your creditworthiness and determine if you’re approved or not for an Upgrade loan.

If you believe your finances are in order and you have a good credit score, Upgrade is certainly worth applying to.

Rewards Checking Plus customers who set-up monthly direct deposits of $1,000 or more earn 2% cash back on common everyday expenses at convenience stores, drugstores, restaurants and bars - including deliveries - and gas stations, as well as recurring payments on utilities and monthly subscriptions including phone, cable, TV and other streaming services, and 1% cash back on all other debit card purchases. 2% cash back is limited to $500 in rewards per calendar year; after $500, customers earn 1% cash back on all eligible debit card purchases for the remainder of the year. Rewards Checking Plus accounts with less than $1,000 in monthly direct deposits 60 days after account opening will earn 1% cash back on common everyday expenses and 0.50% cash back on all other eligible debit card purchases. Some limitations apply. Please refer to the applicable Upgrade VISA® Debit Card Agreement and Disclosures for more information.

There are no overdraft fees or annual fees associated with Rewards Checking Plus accounts. Rewards Checking Plus charges no ATM fees, but third-party institutions may charge you a fee if you use their ATM/network or if you use your Upgrade VISA® Debit Card internationally. For Active Accounts, Upgrade will rebate ATM fees charged by another institution for debit card withdrawals in the United States, up to five times per calendar month. To be eligible to receive third-party ATM fee rebates in any calendar month for eligible ATM withdrawals made during that month on a Rewards Checking Plus account, the account must be an Active Account in the prior calendar month. See the Active Account page for more information. As a courtesy to new customers, Upgrade will provide third-party ATM fee rebates for 60 days after account opening regardless of account user status. Some limitations apply. Please refer to the applicable Cross River Bank Checking Deposit Account Agreement and Upgrade VISA® Debit Card Agreement and Disclosures for more information.

The Annual Percentage Yield (“APY”) for the Premier Savings account is variable and may change at any time. There is no minimum balance to open your account, but you will only earn the APY on days when the closing balance of your Premiere Savings account is or exceeds $1000. On days where the account

closing balance drops below $1000, the APY will be 0%.

There are no monthly account fees associated with Premier Savings accounts.

Upgrade is a financial technology company, not a bank. Premier Savings accounts are provided by Cross River Bank, Member FDIC.

Personal loans made through Upgrade feature Annual Percentage Rates (APRs) of 8.49%-35.99%. All personal loans have a 1.85% to 9.99% origination fee, which is deducted from the loan proceeds. Lowest rates require Autopay and paying off a portion of existing debt directly. Loans feature repayment terms of 24 to 84 months. For example, if you receive a $10,000 loan with a 36-month term and a 17.59% APR (which includes a 13.94% yearly interest rate and a 5% one-time origination fee), you would receive $9,500 in your account and would have a required monthly payment of $341.48. Over the life of the loan, your payments would total $12,293.46. The APR on your loan may be higher or lower and your loan offers may not have multiple term lengths available. Actual rate depends on credit score, credit usage history, loan term, and other factors. Late payments or subsequent charges and fees may increase the cost of your fixed rate loan. There is no fee or penalty for repaying a loan early. Personal loans issued by Upgrade's bank partners. Information on Upgrade's bank partners can be found at https://www.upgrade.com/bank-partners/.

Accept your loan offer and your funds will be sent to your bank or designated account within one (1) business day of clearing necessary verifications. Availability of the funds is dependent on how quickly your bank processes the transaction. From the time of approval, funds should be available within four (4) business days. Funds sent directly to pay off your creditors may take up to 2 weeks to clear, depending on the creditor.

Upgrade Review

-

Rates and Fees

-

Application Process

-

Customer Service

-

Products and Services

Overall

Summary

Upgrade offers rewards checking, high-yield savings, credit cards, and personal loans. Learn more in our Upgrade review.

Pros

- No monthly-fee rewards checking

- Competitive high-yield savings account

- Solid personal loan options

- Access to 55,000+ fee-free ATMs

Cons

- APRs can be very high

- Unclear on the credit requirements

- Origination fees on personal loans

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett