When it comes to managing your finances, not all financial products are designed to help you meet your financial goals. In fact, many financial products seem to actively put roadblocks in your way. The CapWay debit card is looking to change that.

The features embedded in this debit card might just be the helping hand you need to digitally manage your funds effectively.

CapWay Debit Card Details | |

|---|---|

Product Name | CapWay Debit Card |

Min Balance | None |

Monthly Fee | None |

APY | N/A |

Promotions | None |

What Is CapWay Debit Card?

Based in Atlanta, CapWay is a fintech startup with the goal of providing inclusive products and services through its neobank.

According to CEO and cofounder, Sheena Allen, “Starting a bank account is just the starting point of the financial race. Achieving financial health and generational wealth is a marathon, not a sprint. At CapWay, our purpose is to make sure you have everything you need to complete the race.”

The platform wants to remove banking barriers and provide the tools you need to close gaps in the financial system. The CapWay debit card was launched in 2021 to an extensive waitlist of customers.

What Does It Offer?

The CapWay debit card might be a good fit for your finances. Here’s a closer look at its features.

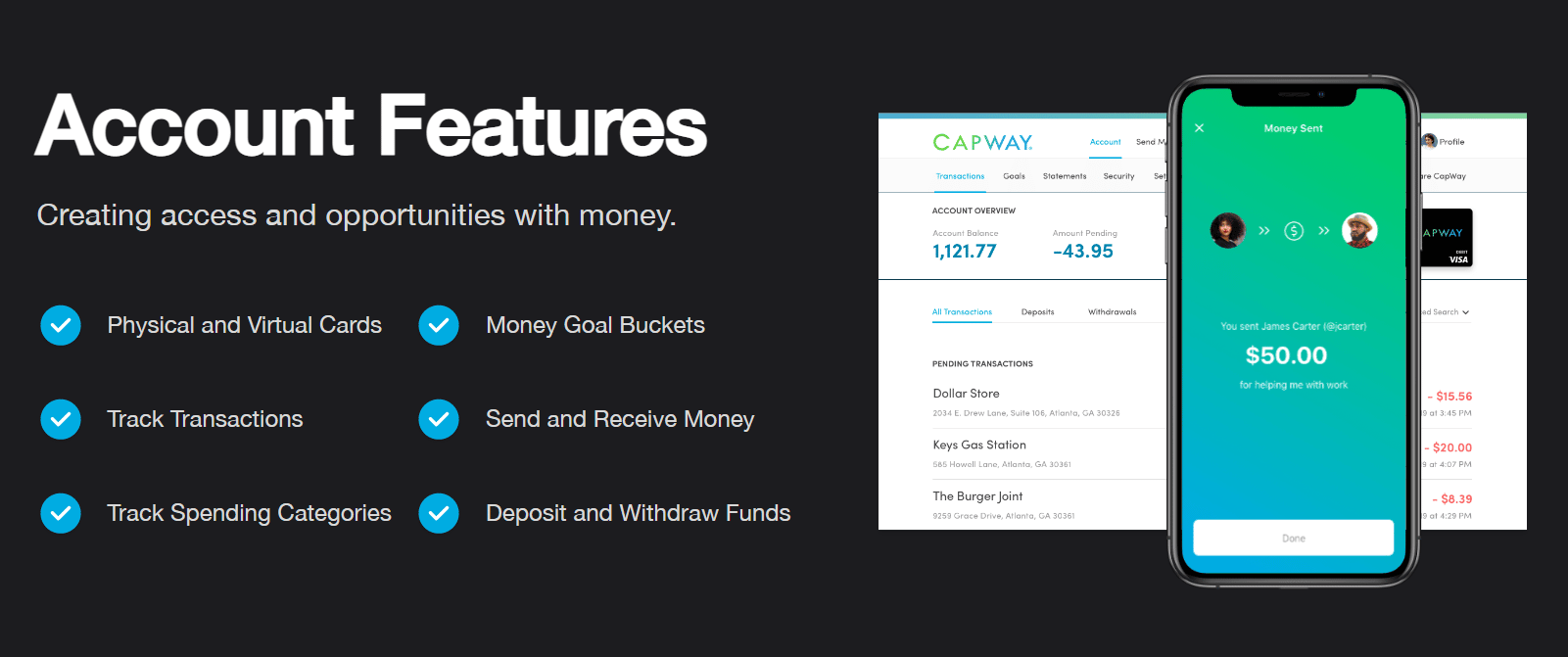

Virtual Card

In addition to a physical debit card, you’ll have access to a virtual debit card. You can use your virtual debit card as soon as you open the account to start making online purchases.

If you want an accessible debit card that you can start using immediately, CapWay presents a good opportunity.

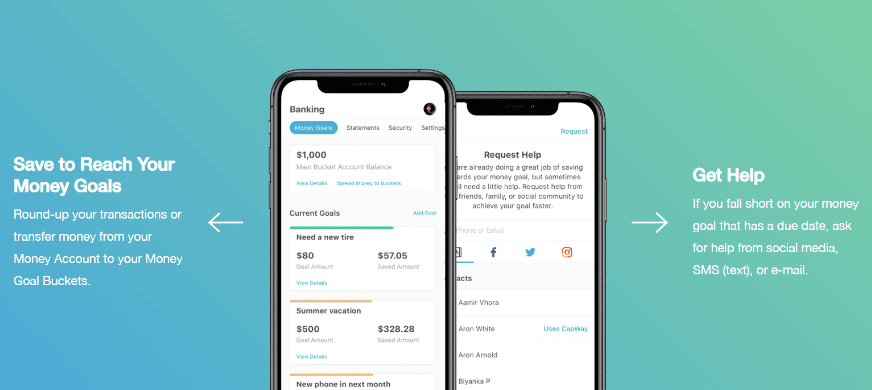

Money Goals

Setting financial goals is a big part of making progress towards your financial dreams. Without a concrete goal, it’s easier to spend on an immediate purchase over an undefined financial future.

CapWay makes it easy to set up Money Goals on its platform.

Not only are the goals easy to set up, but the platform makes it easy to set aside funds on a regular basis. You can round up your transactions and send the difference to your money goals. Or you could set up regular transfers to the Money Goal Buckets.

Ask For Help When You Need It

Sometimes, everyone needs a helping hand. This is especially true when it comes to money.

If you don’t have the funds you need for a money goal deadline, CapWay makes it easy to ask for help. Within the platform, you’ll find a way to request help from friends, family, and social media to make it to the finish line.

Send And Receive Funds Easily

CapWay makes sending and receiving money a breeze. You can transfer funds or make a deposit to anyone’s account, whether or not they use the same bank. It’s free to send or receive money between CapWay accounts.

Are There Any Fees?

CapWay wants to help its users make the most of a positive banking experience. With that, it’s not surprising that this debit card is relatively light on fees.

There are no fees for any of the following:

How Do I Contact CapWay Debit Card?

If you need to get in contact with CapWay, the platform offers a contact form on its website. Although the product has recently launched, it’s enjoyed positive feedback so far.

The platform earned 4.2 out of 5 stars in the Google Play Store and 4.1 out of 5 stars in the Apple App Store.

How Does CapWay Debit Card Compare?

The CapWay debit card isn’t the only option for those looking for a relatively fee-free experience with a banking platform designed to propel their finances forward.

One other option is the Fizz debit card. It’s a fee-free debit card opportunity that works to help you build credit. Fizz even offers the chance to tap into cash back on purchases through select brands.

Or if you are looking for a prepaid debit card option, the American Express Serve card offers a suite of features.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Monthly fees | None | $9.95 | None |

Minimum balance | None | None | None |

Purpose | Offers easy ways to save for your goals | Option to unlock a 6% savings APY | Helping college students build credit |

Mobile App | |||

Cell | Cell |

How Do I Open An Account?

If you decide that CapWay is a worthwhile option for your financial situation, it’s easy to sign up for an account.

Be ready to provide some personal information and create a username. In a more unique twist, the application will request some information about your interests. You don’t need a minimum amount of money to open the CapWay debit card account.

Is It Safe And Secure?

The CapWay debit card is issued by the Metropolitan Commercial Bank, which is FDIC insured. With that, the funds you deposit in this account are federally insured for up to $250,000.

The platform protects your personal information with industry-standard procedures. And you’ll have the opportunity to limit their data collection about your app usage.

Is It Worth It?

The CapWay debit card offers a relatively user-friendly banking experience. Although there are a handful of fees, you’ll largely be able to work through your banking needs without being nickeled and dimed along the way.

Personally, I think the Money Goals feature is one of the most worthwhile offerings. If you are looking for a way to improve your financial situation, setting money goals is one of the best ways to do just that. It’s helpful that CapWay has built this technology right into the platform.

But CapWay isn’t the only neobank out there with a user-friendly experience. If you aren’t sure that CapWay is the right fit, there are many other options to explore.

Read more about the best online banks that make it easy for you to grow your money and reach your financial goals.

CapWay Debit Card Features

Account Types | CapWay Debit Card |

Standout Feature | Offers easy ways to save for your goals |

Minimum Deposit | $0 |

Savings Rewards | N/A |

Monthly Fees | $0 |

Branches | None (online-only) |

ATM Availability | 30,000+ MoneyPass ATMs |

Customer Service Email | |

Customer Service on Social Media | Instagram, Twitter, Facebook |

Mobile App Availability | |

Web/Desktop Account Access | Yes |

Promotions | None |

CapWay Debit Card Review: A Way to Reach Your Goals

-

Min Opening Deposit

-

Min Balance Requirement

-

Fees

-

Savings Goals

-

Availability

Overall

Summary

CapWay is a debit card with features that make it easy for you to save to reach your money goals without a lot of fees.

Pros

- Get access to a virtual debit card immediately

- Avoid overdraft fees

- Set money goals

- Free financial education content

Cons

- Fees for some account actions

- No physical branch locations

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak