Navy Federal Credit Union (NFCU) provides financial products and services solely to members of the military community. As such, you'll need to meet NFCU's eligibility requirements in order to qualify for membership.

Thankfully, Navy Federal Credit Union's field of membership goes beyond just active and retired military service members. Family and household members are eligible to join as well in addition to Department of Defense personnel. Learn more about NFCU membership eligibility.

We've previously reviewed NFCU's student loan products. Read the review. Today we'll evaluate some of its more traditional banking products like savings accounts, checking accounts, and mortgages. Here's what you need to know about Navy Federal Credit Union before you apply for membership.

Navy Federal Credit Union Details | |

|---|---|

Product Name | Navy Federal Credit Union |

Min Deposit | $0 |

Savings APY | Up to 0.25% |

Checking APY | Up to 0.45% |

Account Types | Savings, checking, mortgages, credit cards, personal loans, auto loans, student loans |

Promotions | None |

Who Is Navy Federal Credit Union?

Navy Federal Credit Union is a credit union oriented toward military service members. It has been around since 1933. NFCU is a full-service, traditional, brick-and-mortar financial institution with hundreds of local branches scattered throughout the U.S.

It's currently the largest credit union in the United States. It has over 13.3 million members and $168.4 billion in assets.

What Do They Offer?

Navy Federal Credit Union offers many of the services and products you’d expect from a full-service bank. This includes savings, checking, mortgages, HELOCs, credit cards, and retirement products.

Savings

Like many other large full-service banks with physical branches, NFCU doesn’t currently offer a high-yield savings account. Instead the rate on its saving account is currently 0.25% APY.

There is a $5 minimum deposit required for the Share Savings Account. Dividends are compounded monthly rather than daily. If you are looking for a high-yield savings account, online-only banks are still the best place to find them.

Certificates

NFCU's "certificates" are similar to traditional CDs offered at many other financial institutions. Here are the rates and terms of two of their most popular certificates:

- Standard Certificate: Can earn up to 5.25% APY with terms of 3 months to 7 years. The minimum deposit is $1,000.

- Special EasyStart Certificate: Pays the highest rate, which is up to 5.30%. You’ll need a checking account and must have direct deposit to open one of these accounts. The minimum deposit is $50 and the term is 12 months.

There are other certificates offered by NFCU, which offer more flexibility but at a lower rate. You can see all of NFCU’s certificates here.

Money Markets Accounts

Money market accounts (MMAs) often pay higher rates than savings accounts and offer more liquidity than a CD (or certificate). With Navy Federal Credit Union, there are two MMAs to choose from:

- Money Market Savings Account: Rates range from 0.00% up to 1.50% APY. The highest rate is paid on accounts with a balance of at least $50,000.

- Jumbo Money Market Savings Account: Earns up to 2.25% APY. To earn the highest rate, you’ll need a balance of at least $1,000,000.

Checking

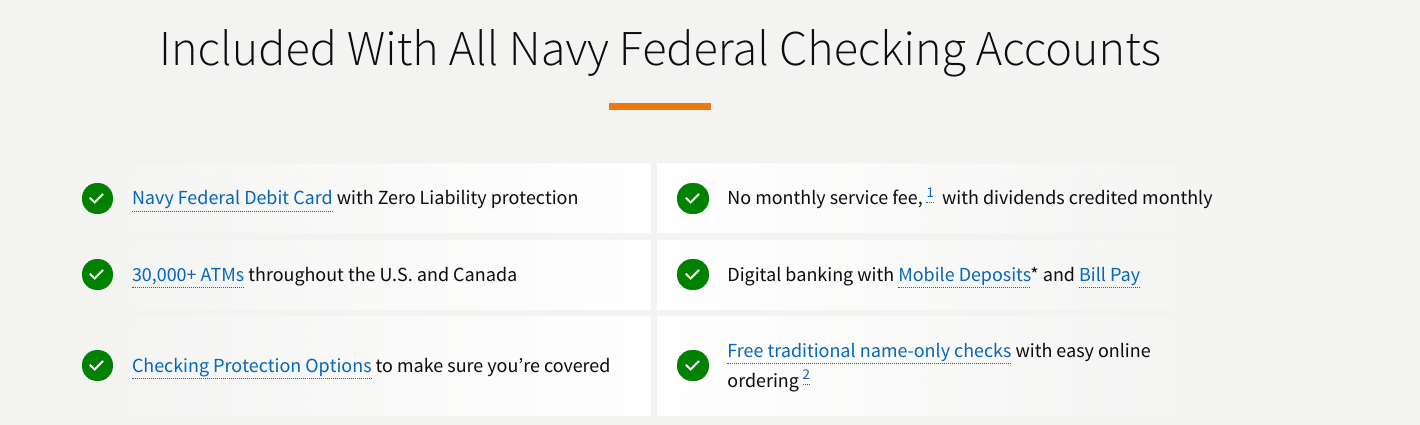

Except for the “Flagship Checking,” which offers rates from 0.35% to 0.45% APY, all other checking accounts offer rates of 0.01% to 0.05% APY. Each checking account also offers a dividend rate that matches the account's APY.

While the Flagship Checking offers higher rates, it's also the only NFCU checking account that requires a minimum balance ($1,500) to avoid a service fee ($10).

Depending on the checking account, a direct deposit may required to avoid a monthly service fee. “Free EveryDay Checking” is a simple checking product that doesn’t require a minimum balance and has no monthly service fee. But it doesn’t offer any ATM reimbursements either.

Related: These Are The Best Checking Accounts For Military Members

Mortgages

As a top VA Lender, NFCU has a lot of expertise handling home loans for military members. Its loans do not require PMI and some don't even require a down payment (although an additional funding fee may be applied).

Navy Federal Credit Union also has a rate-match feature on its mortgages products. If another lender has a better rate, NFCU will match it, or you’ll receive $1,000. Be aware, however, that rate matches often have a number of stipulation. If all of NFCU's condition aren't met, they could choose to withdraw the rate match.

Be aware, though, that they can be very slow when working with your loan. In our experience, every time we're tried to get a loan via Navy Federal, they were talking days and weeks longer than other mortgage lenders. This could be a deal breaker for you.

However, if you're using them for a HELOC or other loan product, that timeline might not matter as much.

Business Banking

You might be surprised to learn that Navy Federal also offers competitive business banking products. Maybe it's because they know many military members go on to entrepreneurship after their service, or maybe it's to support military spouses who side hustle.

Regardless, we're always impressed by their business offerings. NFCU offers business checking and business savings accounts that are top notch. Check out our list of the Best Online Business Checking Accounts and you'll see NFCU on there!

Branch Locations

Unless you live near a military base (where most NFCU branches are located), you may not have a branch near you. At less than 355 branches, your chance of local availability with Navy Federal Credit Union is less than with other national banks and credit unions. For many, this will mean being restricted to online, mobile, and ATM access.

Mobile And Online Banking

NFCU accounts include both a mobile app and online banking. On the Apple Store, the app has a 3.3 out of 5 rating from 6,300 people. On the Google Play Store, it has a 4.1 out 5 rating from 60,611 people.

The Navy Federal Credit Union app is also available for Kindle Fire devices. Their mobile apps include most of the common features that banking customers have come to expect such as transfers, bill pay, and mobile deposit.

Are There Any Fees?

Yes, a $10 monthly service fee will be charged on your Navy Federal Credit Union Flagship Checking account if your average daily balance for the statement period is less than $1,500.

The overdraft fee on NCFU's checking accounts is $20.00. However, transfer from savings are free as are overdrafts that occur on transactions of less than $5 or when the overdrawn balance is less than $15. Returned loan payment and check returned (due to non-sufficient funds) fees are $29 each.

Navy Federal has a network of 30,000+ fee-free ATMs. And with the exception of Free EveryDay Checking, all of its checking accounts offer some reimbursements of out-of-network ATM fees. You'll get up to $120/yr of ATM fee rebates with Free Easy Checking, Free Campus Checking, and Flagship Checking. And Free Active Duty Checking account holders can receive up to $240 of ATM fee reimbursements annually.

How Does NFCU Compare?

Navy Federal Credit Union has competitive rates on many of its products. However, they're still a tad bit lower than you get from some of the best high-yield savings accounts right now.

But most of those banks are online-only and may not have the best ATM networks. But NFCU offers the trifecta of brick-and-mortar branches, a large ATM network, and up to $240 of out-of-network ATM fee rebates.

NFCU's solid rates combined with the cash and branch access that it offer could make it a strong choice for military members and their families. Here's a closer look at how it compares:

Header |  |  | |

|---|---|---|---|

Rating | |||

Top Savings Or Checking APY | 0.45% | 2.00% | 0.61% |

Monthly Fees | $0 | $0 | $0 |

Min Deposit | $0 | $0 | $0 |

ATM Access | 30,000+ ATMs & Up to $240 ATM Rebates | 60,000+ Free ATMs | Unlimited |

FDIC or NCUA Insured | |||

Cell |

Navy Federal Credit Union Promotions

Right now, Navy Federal doesn't have any promotions.

How Do I Open An Account?

You can visit Navy Federal's website to open an account or by visiting a branch near you. NFCU says that most people can apply for membership in just 10 minutes online. Here is the information that you'll need to provide:

- Social Security Number

- Driver’s license or government ID

- Current home address

- Credit card or bank account and routing number to fund your account

If your membership is being sponsored by a relative or household member, you'll need to provide their last name, access number, and affiliation to you as well. If you don't know their access number, you can provide the last four digits of their social instead.

Is My Money Safe?

Yes — while NFCU doesn’t have FDIC insurance that is used by banks, they are insured by the National Credit Union Administration (NCUA). NCUA insurance is the equivalent of FDIC insurance for credit unions and comes with the same $250,000 of insurance coverage.

How Do I Contact Navy Federal Credit Union?

NFCU has phone representatives available 24/7 at 1-888-842-6328 or 1-703-255-8837 (collect) if you're based overseas. You can also live chat, send a secure message, or visit a local branch if you happen to have one near you.

Navy Federal has built a strong reputation over time of offering superior customer service. Its Trustpilot rating is truly impressive at 4.6/5 from over 6,600 reviews. And its rated 4.1/5 on WalletHub from a sampling size of nearly 2,700 reviews.

Is It Worth It?

If you're a service member that lives near a military base with a Navy Federal Credit Union branch, NFCU could be one of your most convenient banking options. And it could particularly be a smart choice if you have an interest in a VA mortgage.

However, with the possible exception of its Special EasyStart Certificate, NFCU's savings and checking products offer few stand-out rates or features that separate it from its competitors. These are the best savings accounts available today and here are the best checking accounts.

One thing NFCU does offer that many credit unions and banks don’t, however, is 24/7 live phone support and online chat support. So if strong customer service and access to local branches is important to you, joining Navy Federal Credit Union could be a smart move.

But if you're comfortable with handling the majority of your banking tasks on your own and rarely require the assistance of a human teller, an online bank may be a better choice. Here are our top picks.

Navy Federal Credit Union FAQs

Here are a few of the questions that people ask most frequently about NFCU:

Is Navy Federal Credit Union better than USAA?

It depends on what kind of banking product you're looking for. Currently, NFCU's rates are slightly better, but only USAA offers a checking account that earn rewards on debit card transactions.

Can you use Zelle with Navy Federal?

Yes, NFCU customers can send and receive money for free using Zelle from right inside the Navy Federal mobile app.

Do you need to maintain a minimum balance to earn dividends with NFCU?

It depends on the account that you've opened. Some accounts will pay dividends on all balances. However, Flagship Checking requires that you keep a daily ending balance of $1,500 to earn dividends and you'll need a balance of at least $2,500 to earn dividends with the NFCU money market account.

Is Navy Federal running any promotions?

NFCU isn't currently running any bonus offers on its deposit accounts. But it does have a Mortgage Rate Match that will pay you $1,000 if it can't match another lender's rate for a home purchase or refinance loan.

Navy Federal Credit Union Features

Account Types | Savings, checking, mortgages, credit cards, personal loans, auto loans, student loans |

Minimum Deposit | $0 |

Minimum Balance Requirements |

|

Monthly Service Fees |

|

Branches | 355 branches (often located near military bases) |

ATM Availability | Over 30,000 fee-free ATMs at local branches, CO-OP Network®, or CashPoints® ATMs |

Out-of-Network ATM Fee Reimbursements |

|

Mobile Check Deposits | Yes |

Cash Deposits | Yes |

Checkbook Support | Yes (and customers can order checks for free) |

Customer Service Number | 1-888-842-6328 |

Customer Service Hours | 24/7 availability |

Mobile App Availability | iOS and Android |

Bill Pay | Yes |

NCUA Charter Number | 5536 |

Promotions | None |

Navy Federal Credit Union Review

-

Interest Rates

-

Customer Service

-

Availability

-

Fees and Charges

-

Products and Services

Overall

Summary

Navy Federal Credit Union (NFCU) exclusively serves military community members. It offers a variety of financial products and is a top VA lender.

Pros

- Top-notch VA loan rates and servicing

- Solid APY on checking, MMA, and multiple certificate products

- No monthly service fees or minimum balance requirements on most checking accounts

- 24/7 live customer service phone support

Cons

- No rewards checking accounts

- Limited branch availability

- Membership restricted to military men and women or their family and household members.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett