TokenTax is a crypto-first tax filing company specializing in crypto tax optimization. It has a stand-alone product that is able to calculate taxes due on crypto transactions.

In addition to the stand-alone product, TokenTax offers full-service filing, including back-tax filing for crypto traders who have inaccurate data, going back to 2014.

If you have a complicated crypto tax situation, TokenTax may be worth considering. Here’s what you need to know about it.

TokenTax Details | |

|---|---|

Product Name | TokenTax |

Service | Cryptocurrency Tax Reports |

Price | $65 to $3,499 per year |

Exchange Integrations | Unlimited Through CVS File Import |

Tax Filing Included | On The VIP Plan Only |

Promotions | None |

What Is TokenTax?

TokenTax is a tax-filing company that offers tax-filing services in many countries including the United States. Founded in 2017, TokenTax provides a self-service tax application that calculates taxes for crypto transactions as well as full-service tax filing.

As a tax-first company, TokenTax specializes in tax minimization strategies, including tax-loss harvesting. It also utilizes IRS-compliant logic related to margin trading and other aspects of crypto trading.

TokenTax users can generate Form 8949 for cryptocurrency or have TokenTax file their complete return for them.

For 2023 taxes filed during the 2024 tax season, we picked TokenTax as our Best Full Service crypto tax software on our annual list of the best crypto and NFT tax software. While some TokenTax plans are pricey, it's a solid offering overall.

Some Crypto Tax Basics

It's important to understand how the IRS treats crypto and taxes. For the most part, cryptocurrency and NFT are treated like stocks. When you buy or earn a token, that token has a cost basis which is the value of the token (in $USD) at the time of purchase. Like stocks, crypto assets lead to capital gains and losses when they sell or trade the tokens.

The profit or loss depends on the value of the token at the time you sell it.

Example scenario

Let’s say a trader purchased 10 BTC (Bitcoin) on Jan. 1, 2021. At this time, BTC was worth $7,175.50.

- The trader’s cost basis in this transaction is $71,755. (10 x $7,175.50 = $71,755)

- $71,755 would be the cost basis, even if the trader paid using another token.

Then, this trader sells all 10 BTC on July 20, 2023, for $29,789.94 per token.

- The amount realized is $297,899.40. (10 x $29,789.94 = $297,899.40)

- The IRS considers $297,899.40 the amount to be taxed even if the trader receives payment in the form of another crypto token.

In this transaction, the trader incurs a long-term capital gain of $226,144.40. The IRS will tax the trader on this basis.

Cryptocurrency is also eligible for tax-loss harvesting. That means you can use realized capital losses (from selling tokens that have depreciated) to offset some or all of your realized capital gains.

Most traders' crypto transactions will be taxed as investments in the ways described above. However, there are also times when cryptocurrency can be taxed as ordinary income. Examples include if you received crypto for mining or staking or as interest on a loan.

TokenTax - Is It Free?

Unfortunately, TokenTax does not offer a free version of its software. Users must pay for a specific tax year before they can start using the service. If you have more than 5,000 trades per year, you may get sticker shock from the pricing.

The lowest cost plan will set you back $65 per tax year. Higher-end plans cost $199 to $3,499 per year.

What’s New In 2024?

It’s been a relatively slow year in the cryptocurrency markets, and not surprisingly, TokenTax hasn’t made many big changes or updates to its software or pricing. But it still works well for the needs of most cryptocurrency tax filers – if you can stomach the cost for higher-end plans if needed.

Does TokenTax Make Tax Filing Easy In 2024?

TokenTax software eases tax filing complications for active crypto traders. The software automatically calculates capital gains and losses and recommends tax-loss harvesting options. This allows traders to benefit from tax minimization strategies without all the effort.

DIY tax filers who use TurboTax will be happy to learn that TokenTax integrates directly with the tax filing software. Unlike nearly all of its competitors, TokenTax also has a CPA and a whole tax filing team available for hire, though the cost is high for this add-on.

TokenTax's tax experts can file your taxes on your behalf and provide white glove service if you need help piecing past gains and losses together based on defunct exchanges. While expensive, this is a service that most accountants simply don’t offer.

You’ll pay a pretty penny for the highest level of service, but that’s worthwhile for some wealthy traders with complex portfolios or trading strategies.

TokenTax Features

TokenTax will file your whole return or create reports for you to file on your own. These are some of the essential features.

Imports From Every Exchange

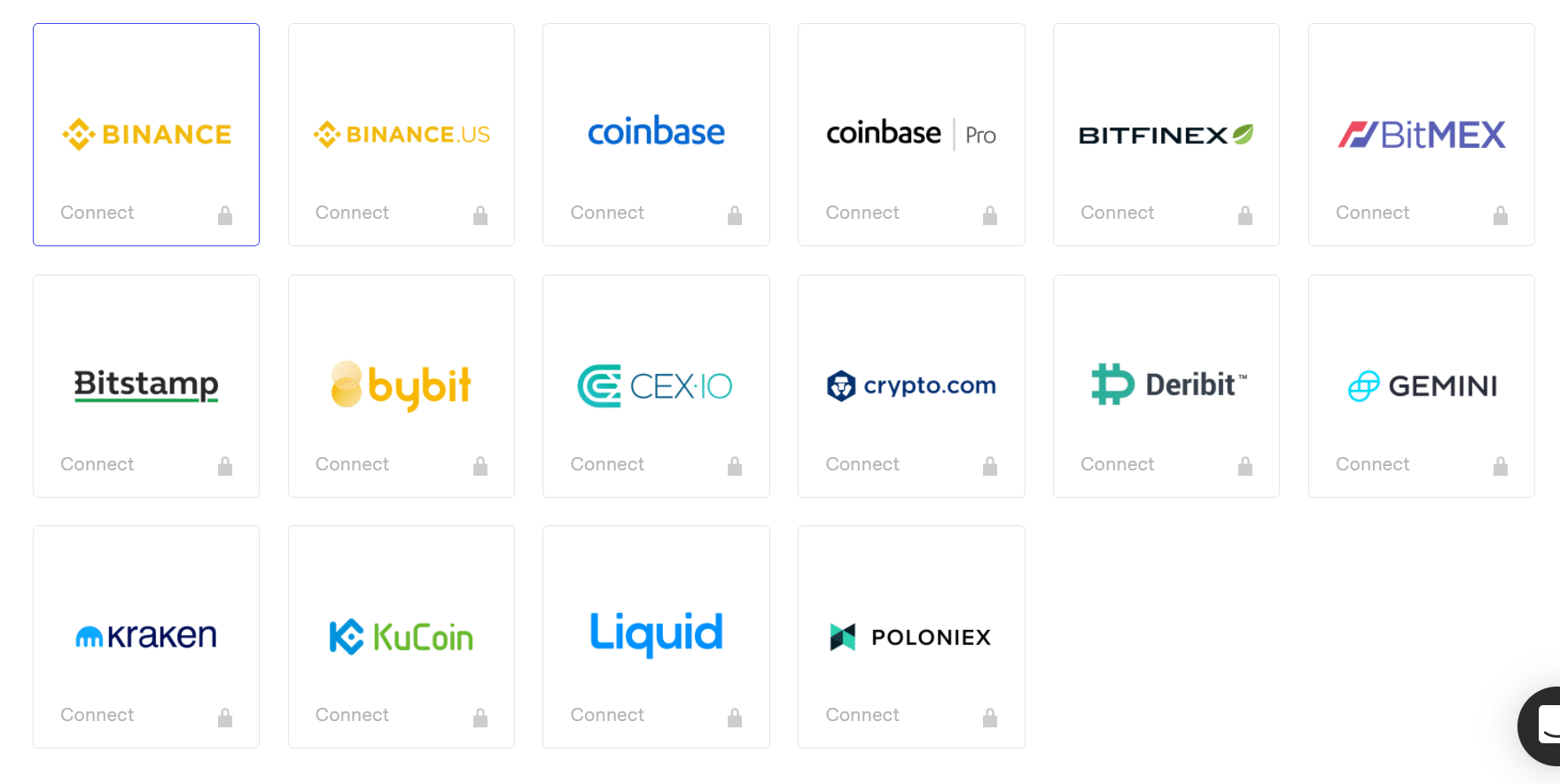

TokenTax says it's the "only cryptocurrency tax calculator that connects to every crypto exchange." Dozens of exchanges, including the ones shown below, can be connected directly via API.

Even if an API integration isn't available, TokenTax can still import your trade data. All you have to do is upload a CSV file from your exchange. If TokenTax's software can't automatically process the report, its team members will personally take care of adding the trades to your account.

Tax-Loss Harvesting

TokenTax works to minimize users’ tax burden by creating opportunities for tax-loss harvesting (where legal). This focus allows traders to take advantage of some times when trading didn’t work out.

Supports Margin Trading

TokenTax supports margin trading and offers API integrations to most exchanges that support margin trading. Users unlock some margin trading support at the Premium level but may need to upgrade to Pro, depending on the exchanges they use.

TokenTax Drawbacks

TokenTax offers an excellent user experience and solutions for crypto traders using sophisticated techniques (like margin trading). However, the software isn’t perfect. These are a few drawbacks.

No Free Trial

TokenTax doesn’t offer a free trial. To start using the software, you need to pay. With super-high prices, this can be a waste of money if the software doesn’t do what a user needs it to do.

API Integration Locked At Certain Levels

TokenTax does not universally unlock API integrations. The most common exchanges are unlocked at the Premium level, but others are not unlocked until the VIP tier.

Steep Increases In Price

TokenTax has a competitive $65 pricing tier (though it only supports Coinbase), but prices increase steeply after that. Users who want to access all margin exchanges via API will have to pay for the Premium tier, which is $199 per tax year.

You could quickly find yourself in the $199 tier, depending on how many transactions you've done. The highest tier offering for more complicated taxes starts at $3,499 per year.

TokenTax Online Pricing Plans

TokenTax charges fees based on several factors. Each tier unlocks more trades, more API connections to exchanges, and different tax minimization strategies. The VIP level includes consultations with crypto tax experts who can help figure out tricky issues related to defunct exchanges.

Number Of Trades | Exchange Support | Price | |

|---|---|---|---|

Basic | Up to 500 | Coinbase and Coinbase Pro only | $65 |

Premium | Up to 5,000 | All traditional exchanges, but only supports margin exchanges that provide API access,which includes: BitMEX, Deribit, Bybit | $199 |

Pro | Up to 20,000 | All centralized exchanges | 1,599 |

VIP | Up to 30,000 | All exchanges (traditional and margin) Help with reconciliation on defunct exchanges | $2,999 |

How Does TokenTax Compare?

TokenTax is one of the only crypto tax prep companies that can offer full service if needed. That said, the VIP pricing tier (which includes hands-on support) is very expensive ($3,999+). Tax filing itself requires a custom quote. Because of the high prices, almost all tax filers will opt for TokenTax’s less expensive options.

Overall, TokenTax’s Basic tier is of poor value relative to the competition. In this tier, Coinbase users who have fewer than 100 transactions can use TokenTax’s Basic package. However, users can just as easily pay TurboTax one time and connect to Coinbase.

At higher levels, other companies support more trades for lower costs. TokenTax offers specific support for margin trading, but other companies, including CoinLedger, also support margin trades.

From a value perspective, TokenTax largely doesn’t make sense unless you qualify for a lower tier.

However, anyone with back taxes who needs help reconciling old transactions should consider TokenTax’s VIP service. Paying more than $1,000 for hands-on help sounds too high, but few other companies provide this service.

Header |  |  |  |

|---|---|---|---|

Rating | |||

Software Pricing | $65 to $2,999 per year | $49 to $299 per year | $0 to $999 per year |

Exchange Support | Upload Any Exchange History CSV File | 280+ | 400+ |

Tax Software Integrations | TurboTax | TurboTax, TaxAct | TurboTax |

Free Plan Available | No | No | Yes |

Cell |

Is It Safe And Secure?

TokenTax uses encryption and read-only access to keep information safe and secure. Users should not worry that TokenTax will steal their tokens or their personal information. The company also protects user information with multiple forms of security.

When users connect to APIs, they will be prompted for multiple forms of authentication. However, TokenTax itself does not require multi-factor authentication for user accounts. A simple email and password combination is used initially. This oversight could be the company’s largest security risk.

How Do I Contact TokenTax?

Unless you're a VIP plan subscriber, your best option to receive support from TokenTax is probably to use its Live Chat service. However, you can also try reaching out by phone at 845-663-1173 or email at support@tokentax.co.

If you do choose the VIP plan, you'll get access to an entirely different level of support. You'll get two 30-minute sessions with a tax expert and will have access to personalized accountant support to help you solve even the most complex tax issues.

Customer reviews of TokenTax on Trustpilot have been generally positive, which is an encouraging sign. The company currently has a 4.7/5 (Excellent) Trustpilot rating with over 160 reviews.

Is It Worth It?

Overall, TokenTax offers a great product but is not competitively priced. Although TokenTax heavily advertises that it supports margin trading, it's not the only company that supports this. In 2024, most crypto traders should pass on TokenTax due to the cost. Traders can find similar crypto tax filing software at lower price points.

TokenTax FAQs

Here are some answers to a few of the most common questions that people ask about TokenTax:

Can TokenTax help me file my crypto investments?

Yes, TokenTax can help tax filers complete their taxes. The company can file your entire return on your behalf.

Can TokenTax steal my crypto?

No, TokenTax uses read-only APIs to get information from your wallet or the exchanges you use. It cannot steal your information.

Do I need to report my crypto wallet transfer data to the IRS?

It depends. While moving cryptocurrencies between wallets is not a taxable event, certain events that tax place inside your wallet could be taxable, such as earning interest, receiving staking rewards, or receiving crypto as payment for services rendered.

Can international traders use TokenTax?

Yes, TokenTax says that its reports can work for any country and can provide results in whatever currency you choose.

TokenTax Features

Price |

|

Exchange Integrations | Unlimited through CVS file import |

Exchange API Integrations |

|

Tax Filing Included | On the VIP Plan |

FBAR Included | On the Pro and VIP Plans |

Tax Software Integrations | TurboTax |

Cost Basis Methods | Minimization (TokenTax's custom HIFO algorithm) |

Audit Trail Report | Yes |

Report Revisions | Unlimited |

Tax-Loss Harvesting Dashboard | On the Premium, Pro, and VIP Plans |

Margin Support | On the Premium, Pro, and VIP Plans |

Refund Period | N/A |

IRS Audit Assistance | On the VIP Plan |

Customer Service Phone Number | 845-663-1173 |

Customer Service Email Address | support@tokentax.co |

Mobile App Availability | None |

Web/Desktop Account Access | Yes |

Promotions | None |

TokenTax Review

-

Price

-

Products & Services

-

Customer Service

-

Ease of Use

-

Third-Party Integrations

Overall

Summary

TokenTax is one of the only crypto tax prep companies that can offer everything from DIY software to full-service tax filing. It’s a great service, but the pricing leaves something to be desired.

Pros

- Support for advanced activities such as tax-loss harvesting and margin trading

- White-glove support available

- Unlimited exchange integrations

Cons

- API integrations limited to Coinbase and Coinbase Pro on the Basic tier

- Higher pricing than many competitors

- No free trial or refund period

Eric Rosenberg is a financial writer, speaker, and consultant based in Ventura, California. He holds an undergraduate finance degree from the University of Colorado and an MBA in finance from the University of Denver. After working as a bank manager and then nearly a decade in corporate finance and accounting, Eric left the corporate world for full-time online self-employment.

His work has been featured in online publications including Business Insider, Nerdwallet, Investopedia, The Balance, Huffington Post, and other financial publications. When away from the computer, he enjoys spending time with his wife and three children, traveling the world, and tinkering with technology. Connect with him and learn more at EricRosenberg.com.

Editor: Colin Graves Reviewed by: Robert Farrington