Congratulations on the new job! Or you maybe you didn't get the tax refund that you were expecting this year because of the changes to the tax laws, and you want to fix that.

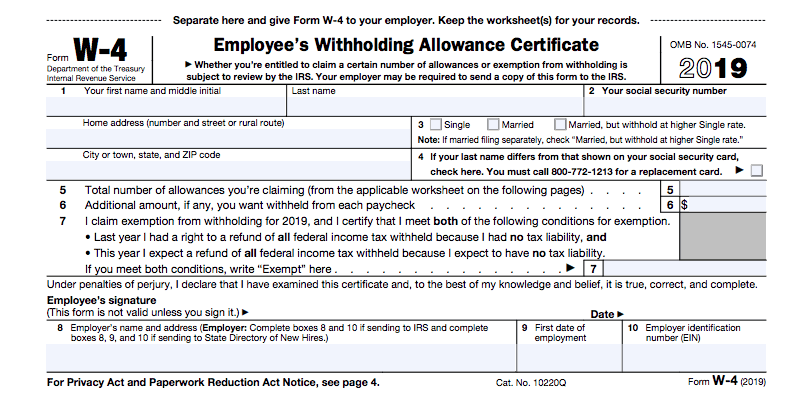

Your first order of business? Filling out the Form W-4. This is the form that determines how much money is take out of your paycheck. Here’s what you need to know about the form, so you can fill it out correctly.

What Is the Form W-4?

Whenever you start a new job, you’ll be expected to fill out a Form W-4. This form tells your employer how much money to withhold from your paycheck. The withheld money is sent straight to the IRS and your state or local revenue department to pay your income taxes.

The IRS has figured out that it collects more tax revenue when it collects money throughout the year instead of relying on people to pay a huge tax bill at the end of the year.

It’s important to note that the Form W-4 only applies to people who have a standard employer. If you’re a contractor, freelancer, small business owner, etc., you’ll need to file and pay quarterly tax estimates on your own.

After you fill out the W-4, your employer withholds a set amount of taxes based on a few different variables. The variables you can’t control include the amount you earn from that employer and whether you file as single, married filing separately, or jointly. The variables you can control include the number of allowances you select (we’ll explain this later, but more allowances means fewer taxes are withheld) and whether you ask to have more taxes withheld.

How Do I Fill Out the Form W-4?

Filling out the first bit of the Form W-4 is easy. Simply enter your name, Social Security status, and your marital status. Also, check box 4 if your name differs from the name on your Social Security card.

Unfortunately, the easy bit is up, and the complicated bit starts when you get to box 5.

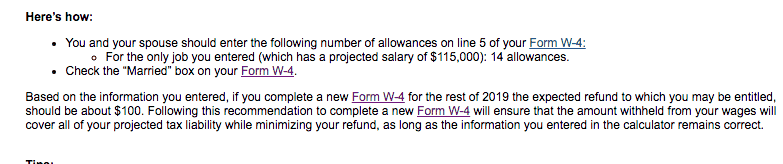

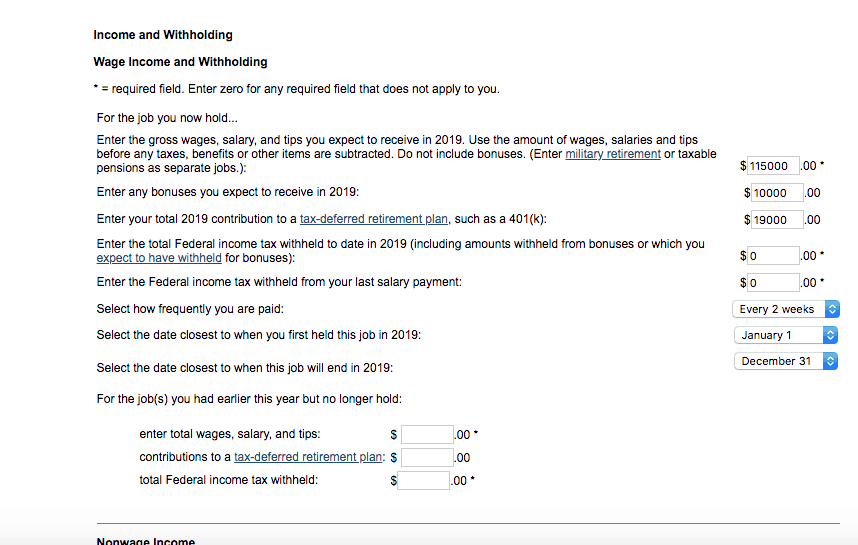

Before you can fill out box 5, you have to go to the next few pages which are “calculators.” I’ll explain the calculations in detail, but I recommend using the IRS Withholding Calculator to do the math for you.

The calculator makes it easy to determine how many allowances (box 5) and how many additional withholdings you should elect.

Just be sure to check your numbers carefully. I accidentally added an extra zero to the Federal taxes withheld ($15,000 instead of $1,500) and the calculator told me to select 14 allowances. When I reran, I was directed to select 2 instead.

How Should I Fill Out Lines 5 and 6?

If you prefer to do things the hard way, you can fill out the Form W-4 calculator by hand. The calculator has three sections.

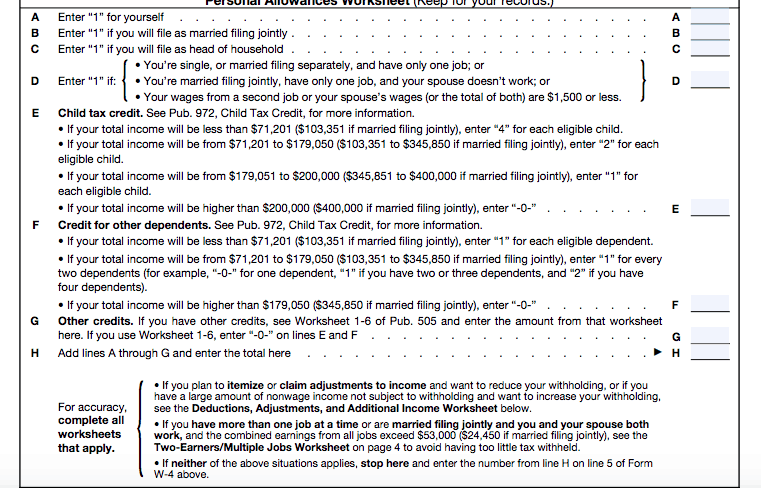

Personal Allowances Worksheet

Starting with the first section, you’ll add up the number of allowances you want to select based on your personal income. Line A is always 1. If you’re married filing jointly, you’ll enter 1 on line B.

Section D, E, and F cover common family scenarios. In my case, both my husband and I work, so we selected 0 for line D. We have 3 children, and we expect to earn between $103,351 and $345,580, so we selected 6 for line E.

If you expect to earn other tax credits, such as the child and dependent care tax credit (especially if you don’t have a daycare FSA and/or the Saver’s credit — a lot of college students who aren’t claimed as dependents could be eligible for this). Honestly, unless you’re a tax geek, you probably don’t know what credits you’re eligible to receive. You could choose to do your research on this by using looking at individual credits on the IRS website.

Not interested in doing tax homework? I’ll refer you again to the Withholding Calculator on the IRS website.

Next, you’ll have to adjust your withholdings. If you’re single, and you only expect to have one job this year, and you won’t itemize your taxes, you’re done. Enter the number from line H into box 5 on the first sheet. Sign the W-4 and call it a day.

However, if you plan to itemize, you need to move to the next part of the worksheet.

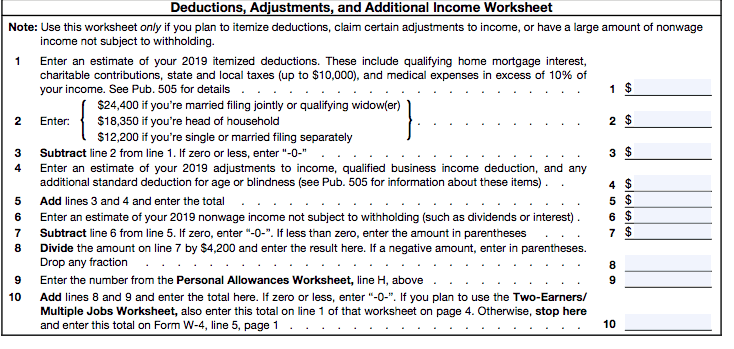

Deductions, Adjustments, and Additional Income

This worksheet is mainly for people who itemize their taxes, but it’s worth calling out line 6. This is where you enter any income that isn’t subject to withholdings. For example, if you earn dividends, interest, capital gains (from the sale of stock or house flipping), or rental income, enter that income here.

In my case, rental property income yields a −2 on line 6 for us. Of course, the exact information you fill in depends on your personal circumstances.

The IRS tells you to add line H from the first worksheet to line 8 from this worksheet. In my case that was 8 + (−2) = 6.

If I were the only earner in my family, I would enter 6 in box 5 on the first sheet, sign my W-4, and be done.

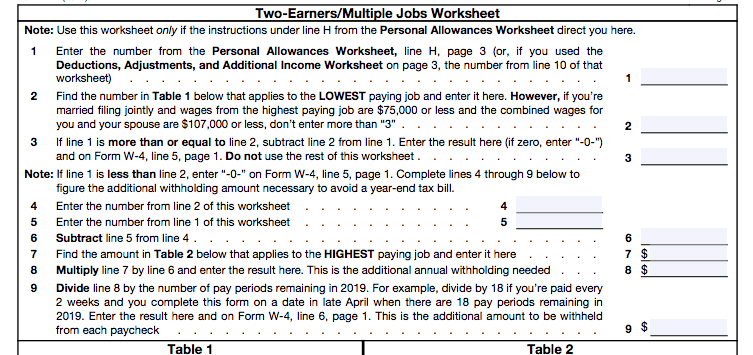

Two-Earners/Multiple Jobs Worksheet

However, I am in a dual-earning couple, so I had to move on to the final sheet. If you’re in a dual-earning marriage, or you have multiple jobs, fill out the final sheet.

This one is worth going through line by line since it applies to many people.

On line 1, you’ll enter your total allowances so far. For most people, that’s line H from the Personal Allowances Worksheet. If you’re someone who itemizes deductions or you have extra income (such as rental income), you’ll need to use line 10 from the second worksheet.

Next, you have to determine where you earn the lesser amount of money. Let’s say your spouse earns $50,000 per year and is the lower earner. You would enter 6 on line number 2. If you’re treating this as a second job, and you earn $20,000 per year at your second job, you would enter 2 on line 2.

Read the directions carefully, and be sure that you’re doing this for the lower number.

Line 3 is a potential stopping point. Subtract line 2 from line 1. In my case I had 6 personal allowances (line 1) and 6 for line 2. This meant my total allowance calculation was 0. The IRS instructed me to enter 0 withholdings and be done.

If your number is positive or 0 you get to stop. But if you have a negative number, the IRS wants you to account for additional withholdings.

The exact amount of additional withholdings is calculated using the formulas in steps 4 through 9. The most important thing to note is that in line 7, you need to think about your highest paying job. You also need to use the table on the right to determine your additional withholdings.

What About State Tax Withholdings?

If you have a state income tax, and you have taxes withheld from your paycheck, you can also adjust your withholding. Each form is slightly different based on the state you're in, but the principles are the same.

Most states also allow you to add extra "flat" dollar amount withholdings if that's easier.

Bottom Line

Filling out the W-4 correctly will help you avoid over- or under-withholding. Personally, I think using the IRS calculator is the way to go. It streamlines the process. That said, filling out the W-4 by hand may give you a few good ideas on how you can reduce your tax burden, so you have more money to save and invest.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller