Side hustling, freelancing, and entrepreneurship are great ways to grow your income. Unfortunately, the bookkeeping that goes along with these activities is sometimes onerous.

If you’re struggling with estimating your taxes, keeping track of your business income and expenses, or tracking your mileage for your Uber or Lyft hustle, Hurdlr is a great app for you.

Here’s what you need to know about it.

What Is Hurdlr?

Hurdlr is an app designed for side hustlers, freelancers, and solopreneurs who need help tracking their income and expenses and estimating their tax burden. The app tracks mileage; allows users to track income and expenses; creates monthly, quarterly, and annual reports; and estimates your tax burden.

The best features of Hurdlr are the automatic mileage tracker (an Uber or Lyft driver can simply keep the app running in the background), the income tracker (it connects to accounts from companies like PayPal and Stripe as well as your bank accounts), and the tax estimator.

The app also generates reports using this information. You can email the reports to anyone (including your bookkeeper or CPA). The reports are designed to make filing your taxes super easy.

How Does Hurdlr Work (and Does It Work Well)?

Mileage Tracking

Hurdlr’s mileage tracking feature runs on your cell phone. You simply have it in your vehicle, and the tracker runs in the background. When you use your car for work, you categorize that trip as a work-related trip. Then Hurdlr will calculate your deductible expenses.

Income Tracking

To track your income through Hurdlr, you simply connect your accounts (including PayPal, Uber, Stripe, etc.) to the app. When income comes through for your business, you categorize it as business income. If you upgrade to Premium, the app will automatically categorize your income based on rules you set.

Expense Tracking

Ideally, side hustlers and solopreneurs will use a separate credit card or bank account for all their expenses. Then you can simply connect that card or account as your expenses account, and the app will categorize those expenses for you.

If you’re not quite that organized, you can connect all your credit cards and bank accounts and categorize expenses as they come in.

Tax Estimator

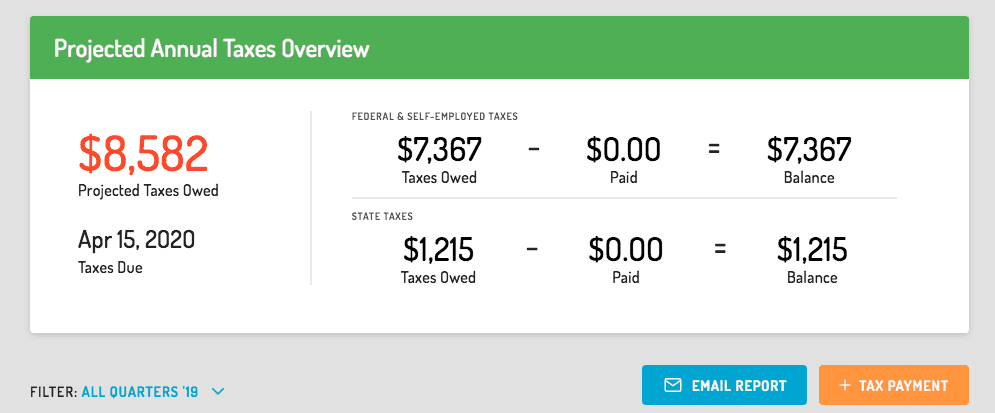

As you earn income (and have expenses), Hurdlr will estimate your Federal, state, and self-employment tax burden.

Overall, Hurdlr is an excellent app for self-employed people. The mileage, income, and expense trackers are all mostly excellent. My only complaint is that the expense tracker sometimes has a jumbled screen which makes categorization tough. And the reports that the app generates are amazing. They can save you a lot of trouble.

The tax estimator also projects your annual tax burden. Just be sure to click on the “Quarterly” section of the app to get your projected taxes. If you only use the “Annual” section, you’ll underpay your taxes at the beginning of the year.

Source: Hurdlr

Hurdlr Pricing

Hurdlr has a free service that includes automatic mileage tracking. It also allows you to connect your accounts to the service, but you have to categorize income and expenses yourself.

Hurdlr also has a premium subscription which costs $8.64 per month (billed annually) or pro for $16.67 per year (billed annually). This is essentially a more automated version of the app. You can set work hours (so all mileage during those hours is deducted), speed up your income and expense tagging, and create rules for income and expense tagging.

Personally, I don’t see a ton of use in upgrading to the premium edition. Most entrepreneurs would be well served to spend 20 minutes per week categorizing expenses and reviewing their own finances before sending the reports to their bookkeepers.

Summary:

- Only Premium users can link bank/credit cards

- Free users need to manually input data

- Only Premium users have access to fully automatic mileage tracker

- Free users have semi-automatic mileage tracker, which means user needs to manually start/stop when tracker runs

- Only Premium users have access to comprehensive tax estimates, the Free users' access is very limited and not what is shown in our screenshot

Should You Use Hurdlr in Your Business?

I created a free Hurdlr account because I love the reports it generates. However, I don’t think upgrading to the Premium account serves any purpose for me. I recommend that most side hustlers and freelancers should do the same.

It’s an excellent app — certainly one of the easiest account apps that I’ve seen. If you struggle with bookkeeping or estimating your taxes, Hurdlr is the app for you.

Hurdlr Review

-

Pricing

-

Ease of Use

-

Customer Service

-

Features and Tools

Overall

Summary

Hurdlr is an expense tracking app that allows for mileage tracking, income tracking, expense tracking, and more for businesses and freelancers or side hustlers.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Colin Graves