Anyone sticking to a budget and wanting to know where their money is going most likely uses financial software. In fact, I've rarely seen someone be successful with their money without using some type of tool to help.

Now, this tool doesn't have to be software (it can be pen and paper or an Excel spreadsheet), but you need to keep track of your money somehow.

When I started managing my money in the early 2000s, Quicken was the only game in town. It had a robust set of features and tools - especially if you were an investor. In fact, even today, there are few tools that rival Quicken's investment tracking.

However, over the last several years we've seen some struggles with Quicken (especially Quicken for Mac), and other awesome tools come onto the market. Some people have been dissatisfied with Quicken's pricing, or their features. And other tools have really been upping their game.

In this article, we look at several Quicken alternatives that offer interesting features and can cost less.

Editor's Picks

Over the years, we've used and reviewed every option on this list. I've personally used several as my main net worth and budgeting software. Here's my pick for the top options:

1. Empower - Empower (previously known as Personal Capital) was the tool I used for years until I switched to Monarch. Empower does a good job tracking your investments, and it also has basic spending categorization built in. It links to most banks and brokerages, but doesn't do anything with alternative investments.

2. Monarch Money - Monarch Money is an amazing tool that I've fallen in love with over the last year. It does a great job at spending tracking and categorization, and pretty good job on investment tracking, but best of all - it has great connectivity with your banks and brokers. It is a paid app, but as a result, they're not selling your personal information.

3. YNAB (You Need A Budget) - YNAB is hands-down the best budgeting software on the market. If you're looking to improve your financial situation via budgeting, YNAB is the tool that you should be using.

1. Empower

Empower (the tool formerly known as Personal Capital) is a focused on investment management rather than budgeting. It does include budgeting, net worth and a great looking dashboard of your financial life.

But its budgeting feature isn’t as strong as the above three apps.

If you are wanting to view your investments and understand how well they are performing, this is where Empower shines. You can sign up for free and sync your investment accounts. Or sync all accounts if you want to see your net worth.

Empower has strong analysis tools and helps you discover hidden fees in your investments. You’ll be able to look at various retirement scenarios and understand if you are on track or not.

Empower can manage your money and provide access to financial advisors for a 0.89% fee up to the first $1 million. There after, the fee continues dropping to 0.49% once you are over $10 million. This is why they offer their budgeting and investment tracking for free - they want to upsell you into their investment management product.

Empower's app is available via web and mobile.

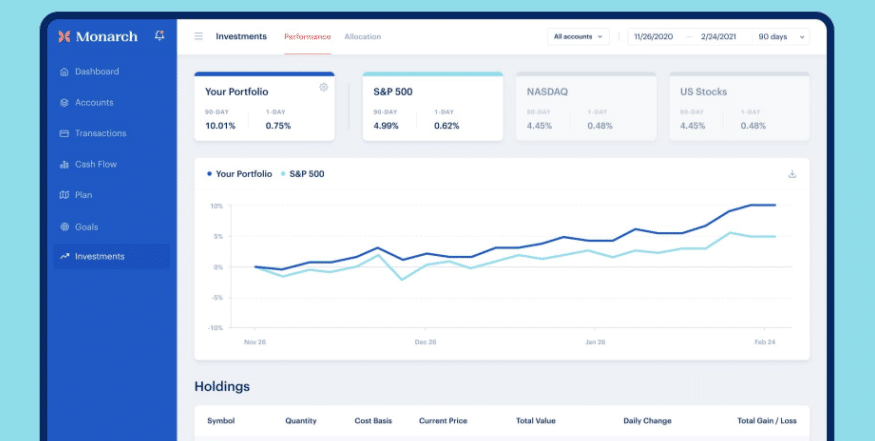

2. Monarch Money

Monarch has been building an amazing budgeting and net worth tracking app that combines all the features we love - transaction categorization, net worth tracking, and investment monitoring. In fact, the founder was one of the original team members at Mint.

And unlike some of the other apps that connect and update your accounts automatically, Monarch actually works! We rarely see connectivity issues or problems.

It's a paid app though, and you're going to be paying $9.99 per month or $89.99 annually.

Read our full Monarch review here.

3. You Need A Budget (YNAB)

YNAB stands for You Need A Budget. Budgeting is it all YNAB does. It’s also very good at it. YNAB makes you give every dollar a job. This means you assign each dollar of income to a category, virtually cutting out any chance that you’ll spend money spontaneously.

Categories are setup to group expenses. If you happen to go over in one category, you can take from another category to cover the difference.

Eventually, the goal with YNAB is that you are living off of the previous month’s income. The way you get there is through consistent use of YNAB and making sure you follow its rules, which is difficult not to do.

YNAB can be installed as a desktop app on Windows or Mac, mobile app on Android or iPhone or simply run it from the web. It offers a 34-day trial and thereafter will cost $98.99/yr. YNAB is able to justify this cost through the amount you’ll save by using the software.

The following is from their website, “On average, new budgeters save $600 by month two and more than $6,000 the first year! Pretty solid return on investment.”

Read out full YNAB review here.

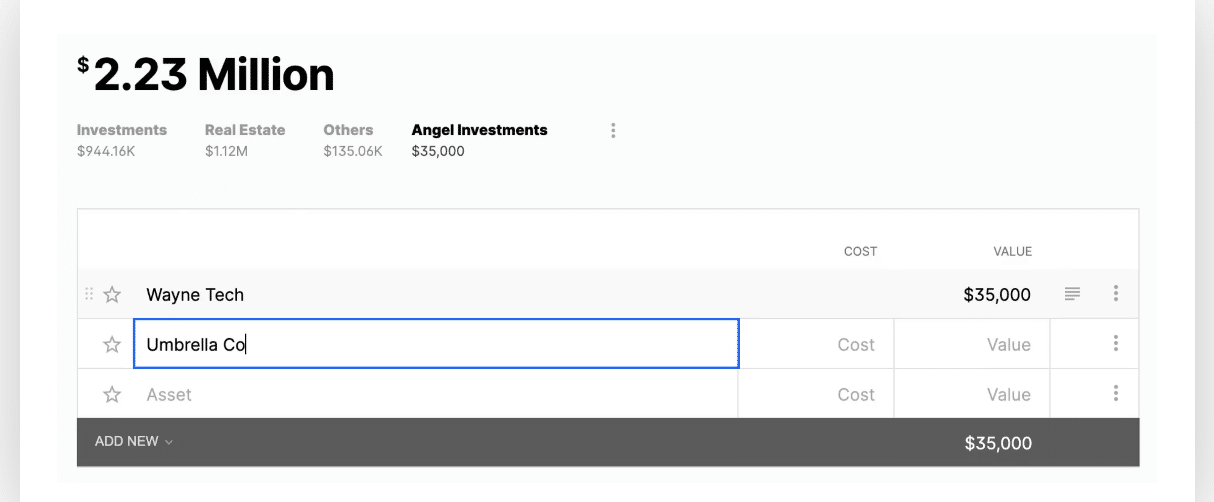

4. Kubera

Kubera is a net worth tracking software program that links to all of your banks, investments, and cryptocurrency assets. It's extremely customizable, and you can easily add rows and sections for assets and organization to meet your own needs.

Kubera also includes organization for your insurance policies, documents, and has a heartbeat check feature that will send this key information to a spouse or trusted person.

Kubera really shines if you have significant cryptocurrency assets. It's the only platform that will link up and track your crypto and DeFi assets along with your traditional bank accounts and investment accounts. Plus, unlike other aggregators, Kubera uses multiple back-end services so you'll always be connected.

Kubera is a paid product, costing $15 per month, or $150 per year.

Read our full Kubera review here.

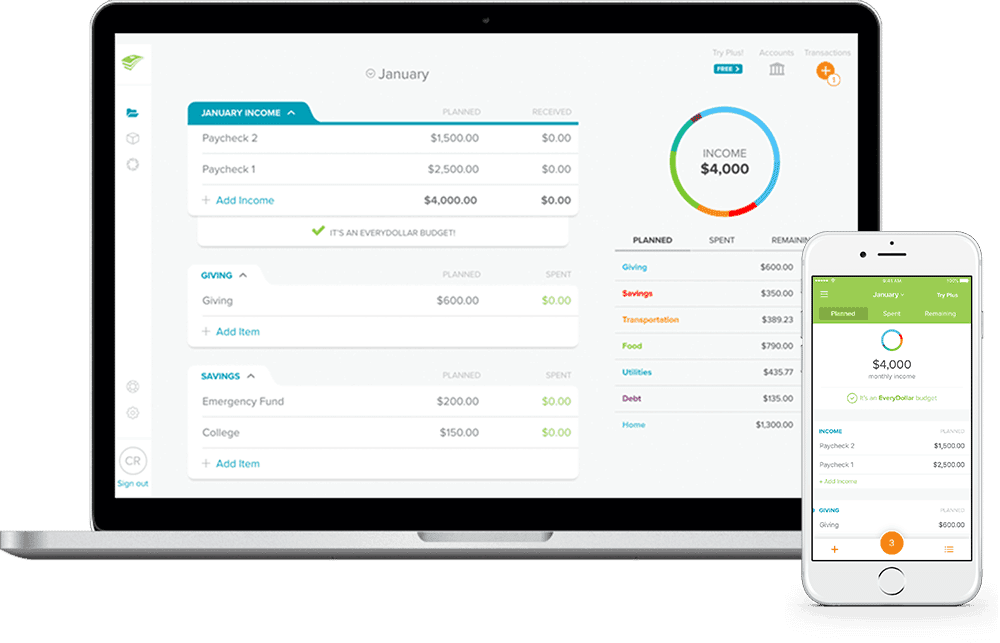

5. EveryDollar

EveryDollar is the budgeting app created by Dave Ramsey’s company. Similar to YNAB, EveryDollar follows the zero-sum budgeting concept, which is the same as “give every dollar a job”.

EveryDollar has free and paid versions. The paid version has a 15-day trial and cost $99/yr. Without the paid version, you can’t sync your accounts, which means you’ll have to manually enter in every transaction. The paid version pulls them in automatically.

If you are familiar with Dave Ramsey’s Baby Steps system, EveryDollar follows them. You’ll be able to automatically see which step you are on.

EveryDollar focuses on budgeting. That’s all it does. If you follow the Baby Steps and want a way to track them through a budgeting app, EveryDollar is for you.

EveryDollar is available online and on mobile.

Read out full EveryDollar review here.

6. NewRetirement

NewRetirement is a retirement planning service with some great free tools for beginners. You can set up a basic retirement plan or for a small monthly fee upgrade to more robust calculators.

NewRetirement also allows you to run simulations and play with variables like how long you expect to live, the effects of runaway inflation, unforeseen medical expenses and other black swans.

You can also link your current bank and investment accounts to get instant updates on your readiness for retirement. Updating your plan when circumstances change is easy.

NewRetirement’s tool is different from other retirement calculators or budgeting apps in several ways. The NewRetirement Planner tool can help you compare traditional IRAs to Roth and the cost of conversion as well as the pros and cons of making annuities part of your retirement income.

Read our full NewRetirement review here.

7. Tiller Money

Tiller Money is the Quicken alternative if you're a spreadsheet junkie. Tiller takes personal finance, budgeting, and investment tracking, and helps you put it into a spreadsheet, and keep it updated.

Tiller allows for full customization within Excel or Google Sheets, but also has a variety of starter-spreadsheets that you can use to get started right away.

What's amazing is that Tiller has figured out how to make your spreadsheets dynamically update, and they connect to your bank and brokerage and import the latest data. That's amazing.

Read our full Tiller Money review.

8. PocketSmith

PocketSmith is a budgeting and personal finance tracker that focuses on forecasting to hopefully help you change your behavior with spending and saving money.

PocketSmith has robust budgeting categorization, which can help improve the forecast and your money habits. However, if you don't upgrade to the paid version, you have to manually enter all of your transactions (the paid version will connect to your accounts and download the transactions).

PocketSmith has plans from free to $19.95 per month.

Read our full PocketSmith review here.

9. Moneydance

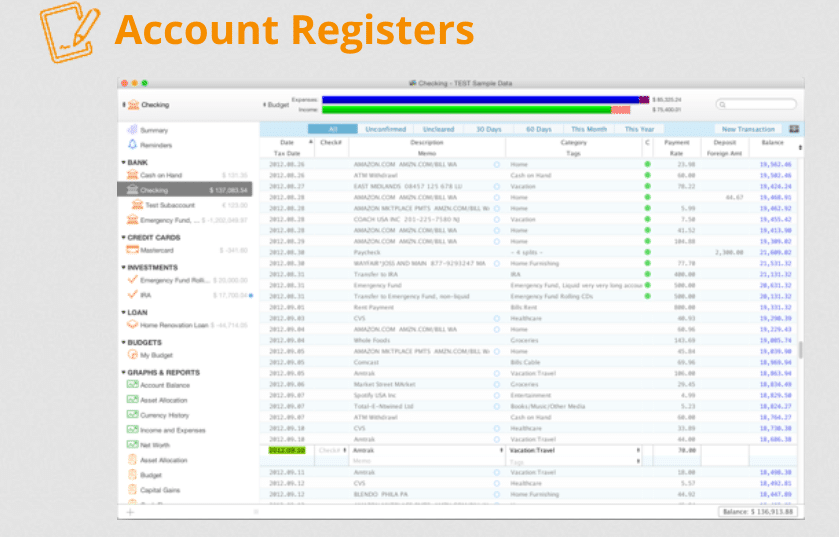

Moneydance is one of the strongest alternatives to Quicken on this list - it just feels like old school Quicken with a few modern takes. This is also probably the best alternative for Mac users on this list.

Moneydance isn't cloud software - you actually download it to your computer. And unlike most products and services on this list, you don't pay a subscription - just a one time fee. I know that was a real hot button issue for many Quicken users, and Moneydance is trying to avoid it.

With Moneydance, you get budgeting, net worth tracking, portfolio tracking, and more. It also allows you to import your Quicken data so that you can get up and running quickly.

Read out full Moneydance review here.

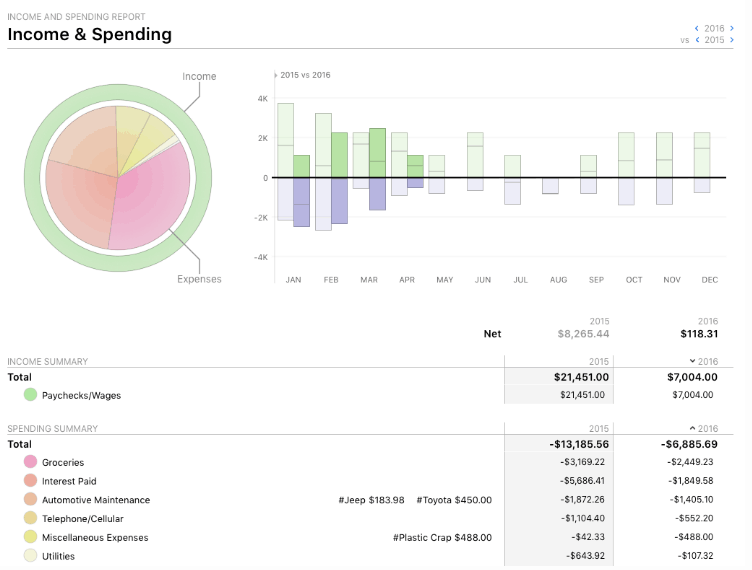

10. Banktivity

Banktivity is another old-school program on this list that's very similar to Quicken, but it's available just for Mac. It has a familiar feel for Quicken users because of the way it setups up dashboards and reporting (which they call workspaces).

They also have a solid register function, and investment tracking. Reporting is the most robust feature of Banktivity, with the ability to create and save custom reporting.

Given the price point and how other software handles portfolios, their portfolio reporting and tracking could be better.

Read our full Banktivity review here.

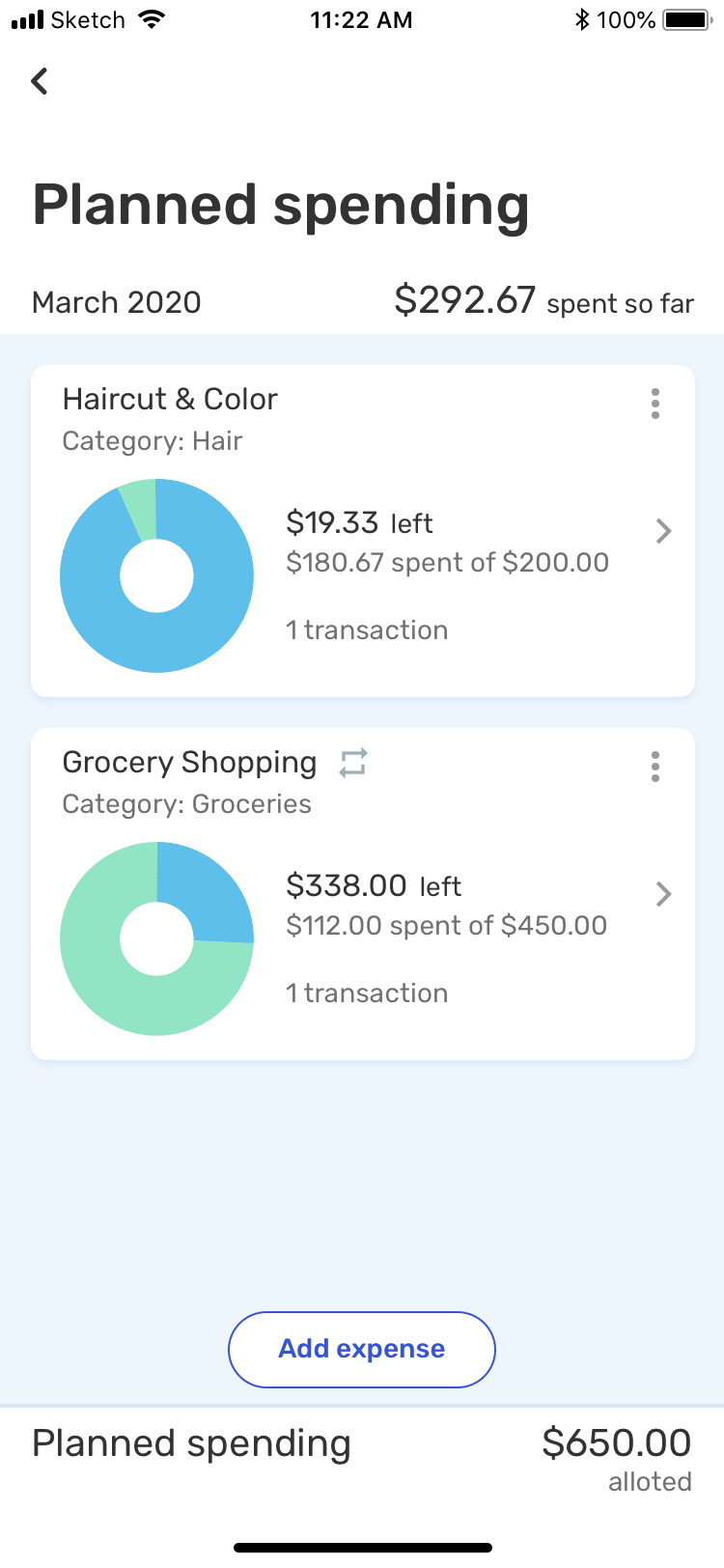

11. Simplifi

Last, but not least, is Simplifi by Quicken. Yes... a new personal finance app from Quicken. However, it is an alternative (this is NOT Quicken), so you should know about it and see if it makes sense for you/

First off, Simplifi is app-based, focused on budgeting and spending tracking, and has a nice user interface. The best features of Simplifi include its spending tracking and watch list for certain spending categories.

Second, they are always improving this product. Being it's a new release from Quicken, they are spending significant time to push updates almost monthly too it. However, at this point, it still lacks the investment reporting that old school Quicken users would expect.

Read our full Simplifi review here.

Common Questions

Here are some common questions to think about when shopping for Quicken alternatives.

What is the best Quicken alternative?

It really depends on what you want to do with your money and your style of budgeting and tracking your finances. If you're looking for a net worth tracker, we recommend Kubera. If you want a strict budgeting software, YNAB. If you're looking for something all-around, then Empower.

What is the best free budgeting app?

Empower is our pick for the best free budgeting app.

What is the best paid Quicken alternative?

Kubera and YNAB are our picks for the best paid Quicken alternative, depending on your needs.

Can you migrate your Quicken data over to an alternative?

There are options that allow you to migrate your Quicken data over. Moneydance is one option on this list that allows Quicken import.

Conclusion

Quicken has been around for a while and use to be one of the only financial management app worth using.

With the rise of so many fintechs offering great alternatives, Quicken is no longer king of the hill.

For those who are focused on budgeting, Mint, YNAB and EveryDollar are great apps. Of those, Mint is free and EveryDollar offers a free option. Although, you’ll likely want to pay for the upgrade to avoid manually entering in all of your transactions.

While Empower isn’t as strong on the budgeting side, it makes up for it in investment analysis. Linking your accounts doesn’t cost anything and you’ll have all of Empower’s investment tools at your disposal.

If you're not a big budgeter, value privacy, and have crypto, then Kubera may be the best choice for you.

Whatever your personal finance situation, I hope you find a Quicken alternative that works for you.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett