Quicken Simplifi is an app-based budgeting and personal finance tool made by the team at Quicken.

For years, Quicken reigned as the number one personal finance software on the market.

But over time, more companies have released free personal finance budgeting and tracking software services. Companies like Tiller Money allow power users to create bespoke financial spreadsheets, and Empower (Personal Capital) and Monarch have made easy-to-use apps that track every part of your financial life.

While it’s a little late to the party, Quicken has recently released Simplifi, a mobile app for tracking personal finances.

Promo: Quicken Simplifi is 50% off through July 14, 2024! Check it out here >>

Simplifi by Quicken Details | |

|---|---|

Product Name | Simplifi |

Services | Spending Tracking and Budgeting |

Annual Cost | $47.88/yr ($3.99 per month) |

Promotions | 50% Off Though July 14, 2024 |

What Is the Simplifi App?

Simplifi is a personal finance app designed to help users manage their cash flow and get a big picture view of their finances.

The app is mobile-friendly and available as a desktop website.

What Makes Simplifi Special?

Since Simplifi is a basic financial tracking and budgeting app, it can be tough to stand out.

However, Simplifi has several nice features. For example, it has a great net worth tracker that allows you to see your net worth broken down by account or all together.

The app also has a simplified budget called a spending plan where users track income, fixed bills, and discretionary spending.

If you’re into detailed spending reports, splitting transactions, or ignoring certain transactions (such as work expenses that will be reimbursed later), the app works very smoothly. The visualizations of spending were especially good (on both the desktop and app versions).

Best Features in Simplifi

Simplifi has amazing features.

Share Your Finances With Your Partner Or Accountant

Simplifi makes it possible to share your Simplifi account with your partner or let your accountant manage your tax-related categories.

Simplifi allows you to give them their own log-in. They don’t need their own Simplifi subscription.

These benefits help you to achieve:

- Savings goals with your partner

- Manage your spending as a team and keep your budget on track

- Track your net worth together and build your dream retirement

- Easier tax prep by sharing it with your accountant

It’s super easy to get started. Go to Settings > Spaces and Sharing on the Simplifi web app and click Invite Member. That will send an email to the person you invite, so they can create their own log-in and password.

Spending Plan

The first is its spending plan. The spending plan essentially forecasts your income and fixed expenses for the month. The difference between the two is your “spending plan,” or the discretionary income you have to spend.

Some months, the extra income will go towards a vacation, and other months it will go towards snow tires for your vehicle and copays at the doctor. Instead of worrying about the details, you can focus on spending within your means.

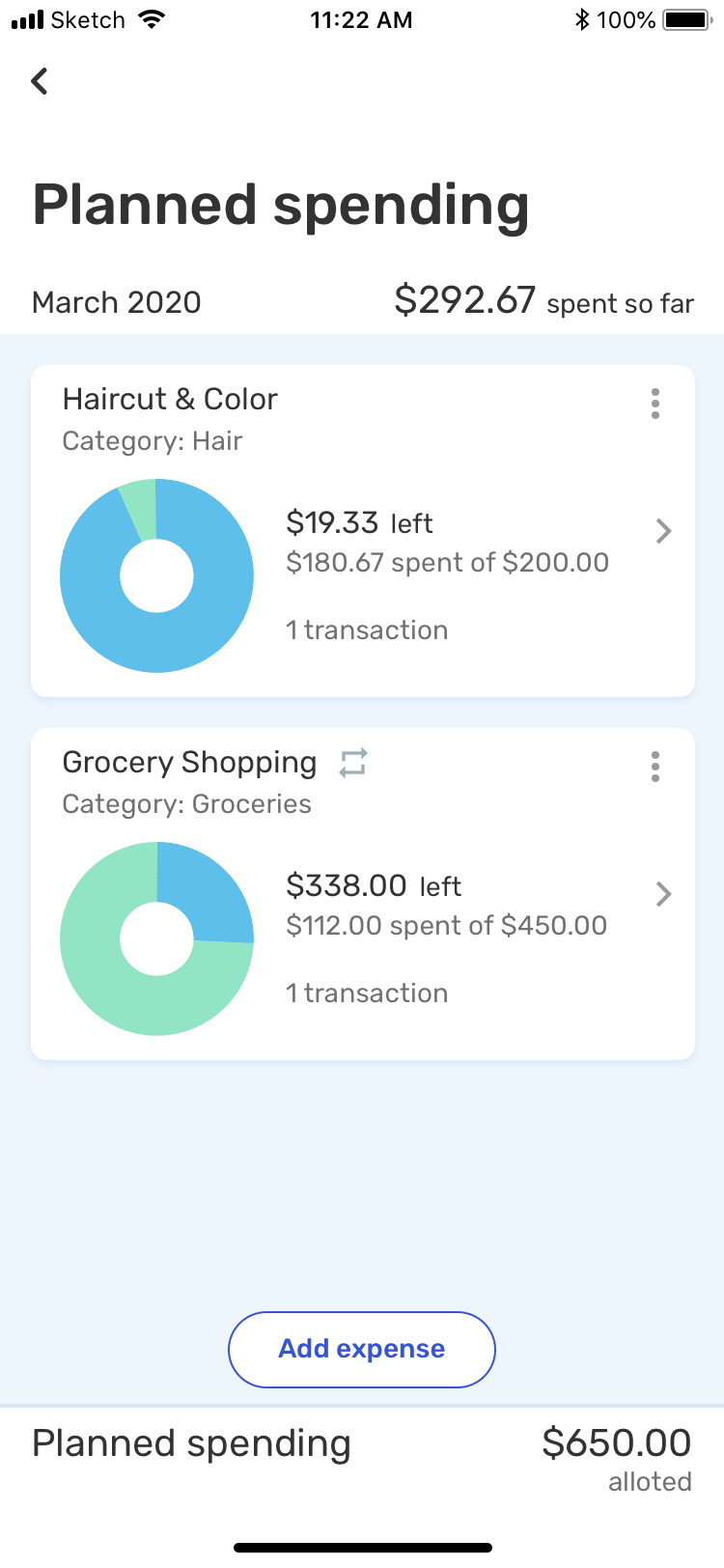

Check out this planned spending feature here:

Watchlists

The watchlists, which give users a way to keep tabs on specific spending targets, are also helpful. If you love going out to restaurants with friends, but you want to limit monthly spending to $150 on restaurants, you can set up a watchlist.

With the watchlist, you can easily see how much money you have left in your “budget.” That way, you can decide whether it’s a boozy-brunch kind of a day, or a split-a-Little-Caesars-pizza-four-ways kind of a day.

Enhanced Reporting

Simplifi reporting lets users filter reports by category, payee, tag, account, and more to offer fresh insight into spending behaviors.

For example, you can filter a spending report by category to see how much you’ve spent on groceries or filter by payee to see your spending on Amazon. Additionally, a monthly summary reports make it easy to compare your finances month over month.

Where Simplifi Doesn’t Shine

Although Simplifi gives a great overview of cash flow, it doesn’t do much to motivate users to save money or pay off debt. The design of the app, especially the “spending plan” feature, makes it too easy (in my mind) to ignore savings, investing, and eliminating debt.

That said, the spending plan feature can work well as long as users already have a lot of their finances automated. For example, if you save for retirement through work, and you automatically draft to a savings account for short- and mid-term goals (such as a vacation, new furniture, or a vehicle fund), the spending plan will work perfectly. There is no need to beat yourself up over natural fluctuations in spending.

How Much Does Simplifi Cost?

The first 30 days with Simplifi are free, but it costs $3.99 per month after your initial trial. The price is somewhat lower than most “high-end” personal finance apps (such as Tiller Money, You Need a Budget, or Monarch).

Even with a relatively low price, I’m not sure that Simplifi is worth the price. Apps such as Emma, Personal Capital, and Clarity Money offer similar functionality for free.

How Does Simplifi Compare?

Simplifi is not the only budgeting and money tracking app available. In does a lot of things well, but it's still lacking in several areas that might not make it the best choice for you.

For example, if you're looking for a specific budgeting method, YNAB might be a better choice for you. If you have a lot of investments, Empower (formerly Personal Capital) might make sense.

See this quick comparison below, or check out our full list of the best budgeting apps.

Header |  | ||

|---|---|---|---|

Rating | |||

Pricing | $47.88/yr | $11.99/mo or $84/yr | Free |

Net Worth Tracking | |||

Retirement Planning | |||

Cell |

Quicken Simplifi Promotions

Right now, Quicken Simplifi is having a sale! You can get 50% off for the first year!

This brings the price down to just $1.99 per month, or $23.94 for the first year.

Offer expires on July 14, 2024.

Should You Download Simplifi?

Right now, I can’t recommend Simplifi for most people. While it offers excellent functionality, I don’t think that the spending plan and watchlist features are compelling enough to make the app worth the monthly cost. While these features are somewhat unique, many apps offer similar functionality in my opinion - for free!

While they are continuing to develop the app, I think it's a wait and see how much it improves before paying.

That said, if you’re the type of person who wants to give yourself a 10,000-foot view of your finances, and only get alerts when something is wrong, Simplifi could be the app for you.

Simplifi Review

-

Product Cost

-

Ease of Use

-

Tools and Features

-

Customer Service

Overall

Summary

Simplifi is a new personal finance app from the makers of Quicken that focuses on spending tracking and budgeting.

Pros

- Comprehensive spending tracking and goal setting

- Ad-free money experience

- Highly customizable

Cons

- It is a paid app, versus many of the free options available

- Still lacks some of the investment features of more robust apps

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Clint Proctor Reviewed by: Colin Graves