Have you ever wondered about some of these tax docs you have to deal with? One of our readers asked about the difference between a W2 and W4.

When it comes to filing taxes, all the forms you need can certainly sound like an alphabet soup.

W4.

W2.

1040.

Eventually they all begin to sound like the same thing.

But they are not.

In this post, we will look at the differences between a W2 document and a W4 document.

What's The Difference Between A W2 and W4?

Let's break it down!

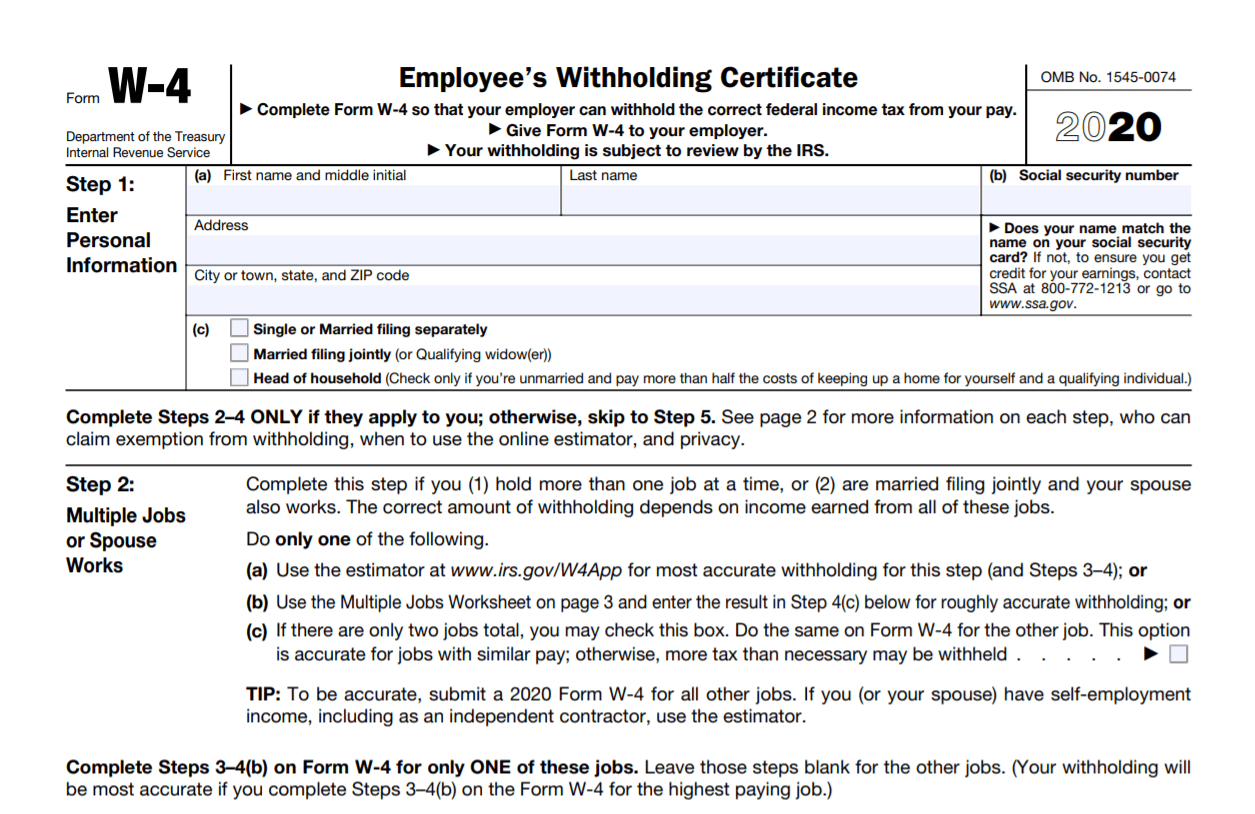

But basically, a W4 is a form you submit to your employer that sets up how much is withheld from your paycheck. A W2 is issued by your employer in January and reports what you earned to both the IRS and you (so you can file your taxes).

W4

If you are an employee of a company, a W4 is the legal certificate which allows your employer to know the amount of federal income tax to withhold from your paycheck based on:

Depending which side of the spectrum you fall on any of the above factors, a score is given and that total score is entered on your W4 form and ultimately will determine how much tax will be withheld from each paycheck you receive from your employer.

The secret to paying your fair amount of taxes and making sure you get the breaks you deserve lies largely on what you put on your W4.

The W4 starts off with lines A through H.

If nobody can claim you as a dependent, you will put the number 1 on the box at the end of Line A.

If you are a college student currently being supported by your parents, it is important to verify with your parents that they will not be claiming you as a dependent during tax season as conflicting information could cause you (and your parents) some trouble with the IRS. If they won’t be claiming you as a dependent on their taxes you are free to enter 1 on Line A.

Lines B and C have to do with your marital status and whether or not your spouse works. This is usually easy to determine.

Line E is another crucial line on the W4.

This is where you will state whether you will file taxes as the “Head of Household”.

You will enter a 1 here if you are unmarried or if your income accounted for more than 50% of the costs of keeping up a home for yourself and/or your qualifying dependents. This is something you don’t want to get wrong either. If you but currently separated, it is important to discuss with your spouse who the Head of Household will be as there can only be one Head of Household (or you may opt to file as “married filing separately.

Make sure to seek the help of a certified tax professional here so you can stay legal.) If you have children, same goes for who will claim the children as dependents on Line A.

Line F is for daycare expenses of at least $2000 while you were at your job and if you plan to claim credit for it on your taxes. If you made less than $70,000 (single parents) or less than $100,000 for married couples, you will qualify for a tax credit called dependent care expenses credit for up to 2 children. If this scenario defines you, you will enter a 1 on this line.

Line G is for parents who have children within a particular income bracket. If you make less than $70,000 as a single parent, or $100,000 for married parents, you will write down 2 on this line for each eligible child. If you make between $70,000 and 84,000 (single parents) and between $100,000 and $119,000 for married parents, you will enter 1 on this line for each.

You can get back up to $2000 for up to 4 children you list as dependents on your tax returns. This is not chump change at all.

Finally on Line H, you add up all the numbers from the previous lines and enter the total. This number will determine your tax level.

Filling out the W4 form correctly, will ensure the right amount of taxes are taken out so take time to fill it out correctly so you don’t face any avoidable questions from the IRS later on.

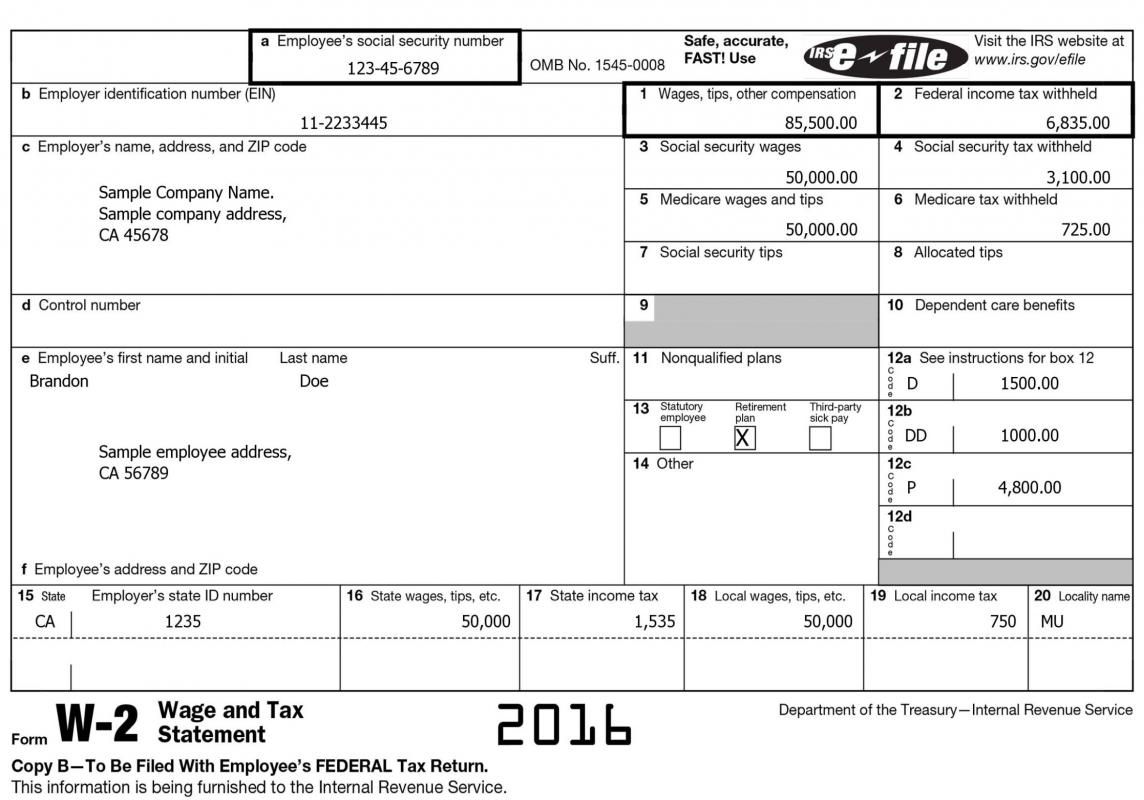

W2

A W2 document on the other hand is a form which reports the wages an employee earned and taxes and deductions withheld in the course of the year. This is filed by an employer for the employee even if the employee is related to them.

The employer is required to send one copy to the employee and one copy to the IRS. The employer must have the W2 available to the employee latest by January 31st of the next year for tax filing purposes.

Box 1 on your W2 shows your gross income. So if Mr. John made a gross income of $21,000 during the year it will go in Box 1.

Box 2 will show how much of your gross income was taxed, so if Mr. John was taxed $2300 during the year it will show here. This amount directly reflects the information you entered on your W4 form.

Everything else on your W2 is fairly straightforward and gives you information on deductions taken out for Social Security and Medicare as well as what came out as state and local income tax.

Wrapping It Up

So that, in a nutshell, is the difference between a W4 and W2.

One document allows you to essentially dictate how much you should be taxed whereas the other one gives you a report of how much money you made and how much you were taxed during the course of a given year.

You fill out a W4 form when you start a new job you can contact your HR office to update it at any time of the year should your circumstance change) and you will receive a W2 at the beginning of the year so you can file your taxes and not get in trouble with Uncle Sam.

Your thoughts and questions are welcome below.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller