As the digital landscape rapidly transforms banking, some local banks and credit unions have struggled to keep up with the times.

But not Magnifi Financial. This credit union, which was founded in 1939, has a digital-first approach to serving its customers throughout the United States.

Here’s what you need to know about Magnifi Financial.

Quick Summary

- Full-service credit union

- Solutions for consumers and small businesses

- Well-developed digital banking app

Magnifi Financial Details | |

|---|---|

Products | Checking, savings, CDs, money market, business banking, loans, and IRA savings |

Min Balance | $0 or more (depending on the account) |

Monthly Fee | $0 (depending on the account and as long as you maintain a minimum balance) |

Savings Reward | 0.05% to 1.9% |

Promotions | None |

What Is Magnifi Financial?

Magnifi Financial is a credit union that serves residents of Minnesota, Wisconsin, and North Dakota. It offers business banking for small businesses as well as consumer checking, savings, mortgages, car loans, and credit cards.

Originally called Central Minnesota Credit Union, the company has expanded through acquisitions and re-branded as Magnifi Financial in 2022.

Like other credit unions, Magnifi Financial exists to serve its members. It “returns” profits to its members in the form of enhanced services, lower loan rates, or higher yields on deposit accounts.

What Does It Offer?

As a full-service credit union, Magnifi offers dozens of accounts, loans, and services. Below we highlight some of the major banking categories.

Checking Accounts

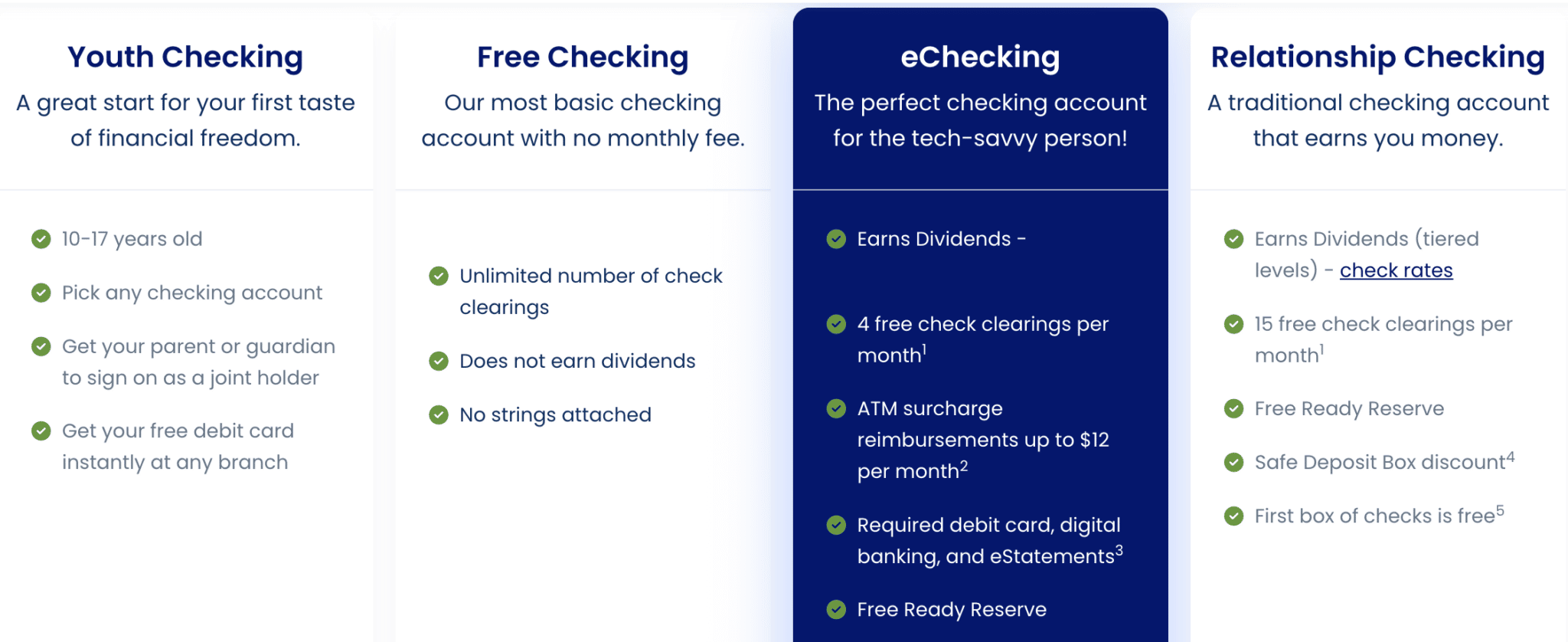

Magnifi has four different checking accounts including a youth checking account, a free checking account (with no monthly fees), e-Checking ($5 monthly fee unless you maintain a $1,000 balance), and relationship checking accounts.

While Magnifi has generous service options (such as the ability to block overdrafts from your account), the schedule of fees for checking accounts is nothing amazing.

Savings Accounts and CDs

Magnifi offers a range of savings products including high-yield savings accounts, CDs, and money market accounts. Yields on accounts typically vary by the amount in the account. In addition to savings products for adults, Magnifi has youth savings accounts and CDs.

The rates at Magnifi aren’t the most compelling in the market, but it has some unique savings programs that can help people jump-start their savings goals. For example, a My Goal savings account earns a higher yield than a standard savings account at Magnfi. The downside is that this account is only eligible for higher yields for one year before it converts to a standard savings account.

The company also offers the “WinCentive'' savings account that offers opportunities to win cash when you regularly deposit money into your account.

The myriad savings products help you automatically save more money. This is one of the keys to helping you build wealth without trying too hard.

Consumer Loans

Whether you need a mortgage, a reward credit card, a car loan, or a HELOC, Magnifi Financial has you covered. The 9.9% interest rate on Magnifi’s Platinum credit card is a competitive rate by credit card standards.

While avoiding high-interest debt is ideal, the Platinum credit card might be a good one to keep as an emergency card. Magnifi also has competitive rates on auto loans, RV loans, and personal loans.

Many of Magnifi Financial’s home loan products are designed for people living in rural areas who may qualify for agricultural or USDA loan products that aren’t available in urban environments. If you’re looking to build, buy or remodel in a rural area, Magnifi Financial may have a good loan option for you.

Business Banking

Magnifi offers a full suite of business banking services for small business owners ranging from side hustlers to farmers to entrepreneurs. It is especially focused on issuing credit to small business owners and farmers through SBA loans, business credit cards, and other forms of financing.

While Magnifi offers reasonable business and agricultural checking accounts, the fees on the accounts can be as high as $40 per month. We recommend checking out some alternative business bank accounts before committing to checking at Magnifi.

Wealth Management

Magnifi Financial offers a range of financial planning and wealth management services. The company’s brokers manage assets, provide tax and retirement planning, and sell insurance products (including life insurance and long-term care insurance).

Some of the financial advisors are Certified Financial Planners while others are brokers or licensed insurance agents. In general, when you’re looking for financial advice, we recommend seeking fee-only financial planners who can provide ongoing services for a reasonable fee.

Are There Any Fees?

Magnifi Financial charges interest and fees on its various loan products. The exact rates you’ll pay depend on your credit score and other factors. Magnifi also charges monthly fees for its eChecking account and most of its business checking accounts unless you meet certain banking criteria.

Meeting the stringent criteria can be difficult, so most members should count on paying monthly fees unless they keep high balances in their business and personal checking accounts.

How Do I Contact Magnifi Financial?

Headquartered in Melrose, Minnesota, you can receive personal customer service at any of Magnifi’s branch locations.

To contact Magnifi via phone, call 1-888-330-8482. You can also visit the contact website to complete an online contact form.How Does Magnifi Financial Compare?

Magnifi Financial is a full-service credit union and fees on its checking account products are higher than some of the best checking accounts. However, its loan rates are competitive.

If you’re willing to pick accounts a la carte, you can certainly find better checking, savings, credit cards, and loans. Since Magnifi discontinued its high-yield checking, you may want to check out Blue FCU, which offers an attractive option.

For high-yield checking, Juno offers a 5.00% APY on checking account balances up to $10,000.

If you are looking to open a CD, Magnifi offers average rates, with their highest being Boom! Certificate at 3.05%, which is a youth account designed for those under the age of 19.

For CDs with a competitive rate, look into American First Credit Union, which offers a CD with a 4.90% APY as well as a money market with a 5.24% APY

.

Header |  |  |  |

|---|---|---|---|

Rating | |||

APY | 5.15% | Up to 5.00% | 5.24% |

Interest-Earning Checking | |||

Monthly Fees | |||

ATM Access | 30,000+ Fee Free ATMs | 85,000+ Free ATMs | 30,000+ Fee Free ATMs |

Cell |

But if you want to do all your banking under one roof, Magnifi Financial could be an excellent credit union for you.

Thanks to the range of products, a well-designed app, and brick-and-mortar locations, Magnifi Financial is ideally suited to serve all of your financial needs in one place.

How Do I Open An Account?

Before you can open an account at Magnifi financial you need to become a credit union member. Membership is open to people in select counties in Minnesota, North Dakota, and Western Wisconsin. You can also donate $10 to the Magnifi Foundation (a charitable organization) to become member eligible.

To apply for membership, provide your name, email, phone number, social security number, address, employment information, and ID information. Magnifi verifies your information and then allows you to log in to the website and open new accounts.

Is It Safe And Secure?

Magnifi Financial has both online and brick-and-mortar locations. It adheres to banking standards regarding privacy, digital security, and asset protection. All deposits at Magnifi are protected through NCUA insurance.

Despite the company’s relatively small footprint, it appears to have invested in digital security to better serve members. Of course, even with these investments the credit union could be subject to hacking or other online attacks. It is important to exercise caution when engaging in any online banking transaction. For example, it is safer to use the credit union’s app rather than its mobile website.

Is It Worth It?

Magnifi Financial has decent checking and savings accounts and reasonable loan rates. It offers a wide range of services and has brick-and-mortar locations throughout the Twin Cities, central Minnesota, and a few cities in Western Wisconsin and North Dakota.

If you can qualify for free checking, Magnifi may be a decent place to start banking, especially if you value a physical location to visit.

At this time, none of Magnifi’s products are industry-leading products that would drive you to switch your banking relationship. If you're already a customer or you want to switch to Magnifi to bank locally, you may not want to use all of its products.

For example, it makes sense to shop around to find the best mortgage rates. And looking for a great rewards credit card may allow you to boost cashback rewards, earn significant travel bonuses, or take advantage of unique perks.Magnifi Financial Features

Minimum Deposit | $0 |

Minimum Balance | $0 or more (depending on the account) |

Cash Back Rewards | No |

APY On Savings | 0.05% to 1.9% |

Maintenance Fees on Checking Accounts | Various checking accounts are either free or require a monthly minimum balance in order to forgo fees. For example, e-Checking has a $5 monthly fee unless you maintain a $1,000 balance. |

Branches | Mostly located in Minnesota and North Dakota |

ATM Availability | 24,000 ATMs (part of the MoneyPass ATM network) |

Cash Deposits Allowed | Yes |

Customer Service Number | 1-888-330-8482 |

Customer Service Hours | Monday to Thursday: 8 a.m. to 6p.m. |

Mobile App Availability | |

Bill Pay | Yes |

Mobile Check Deposit | Yes |

Promotions | None |

Magnifi Financial Review: A Full-Service Credit Union

-

Interest Rates

-

Products and Services

-

Customer Service

-

Rates and Fees

Overall

Summary

Magnifi Financial is a credit union that offers business banking for small businesses as well as consumer checking, savings, mortgages, car loans, and credit cards.

Pros

- Digital and in-person banking

- Competitive yields on savings accounts

- Wide range of banking services

- Emphasis on youth savings and checking accounts

Cons

- Monthly fees on most business checking accounts

- Wealth management and insurance sales are lumped together

- Better rates are available at other credit unions and banks

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington