If you’re investing for retirement, you need to figure out how to diversify your investments and maintain a balance of stocks, bonds, and alternative investments. Alternatives can be crowdfunded real estate, the crypto, or gold and silver bullion. However, it may also involve high minimum-investments, long lock-up periods, low liquidity, or high volatility. Tellus is looking to change that.

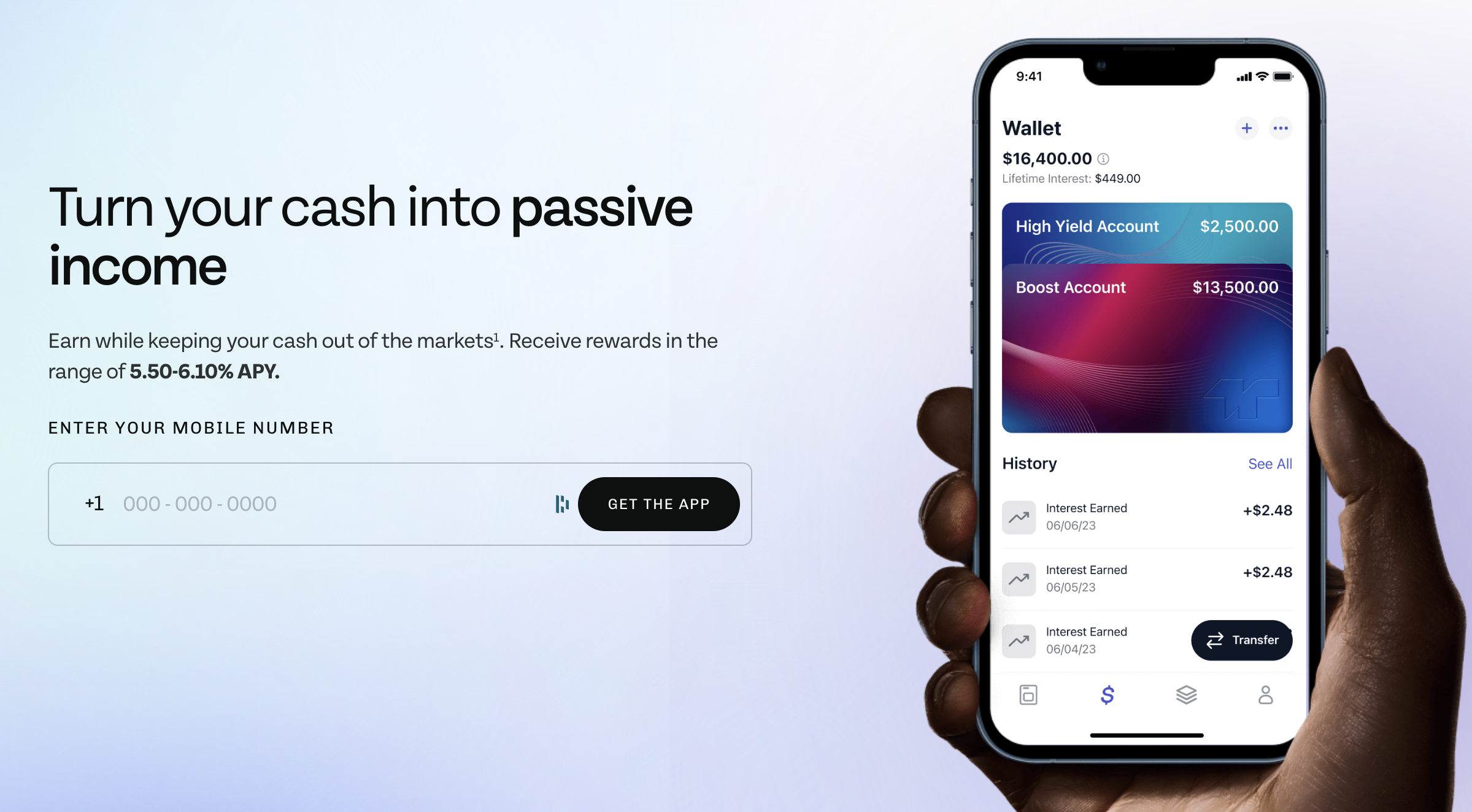

Tellus created an investment product that behaves like a high-yield savings account, with yields that are powered by short-term, real estate loans. You’ll earn a steady rate of return and you can pull money out of your account as quickly as you can transfer money from a bank account. The interest you earn on the account is paid out daily.

But unlike a bank account, the money you invest in Tellus is backed by real estate - specifically business-purpose residential loans. It is the interest from these loans that power Tellus’ business, and enable the company to provide high yields to savers starting at 5.50% annual percentage yield (APY). Although Tellus provides a low-volatility investment, there are also risks to consider. Find out the benefits and risks in connection with Tellus below.

Tellus Details | |

|---|---|

Product Name | Tellus Boost |

Min Investment | $125 |

Annual Fee | None |

APY | Starting at 5.50% |

Promotions | None |

What Is Tellus?

Tellus is a financial technology company seeking to modernize and democratize wealth-building for everyday users. The company operates is an investment firm, not a bank. The company is not FDIC-insured.

The company, which is based in Cupertino, California, focuses on developing tools and income-producing investment products in the real estate space. The company offers a wide range of non-FDIC savings and income products powered by residential real estate lending. In 2022, Tellus has launched two zero-fee products designed to give everyday people access to the wealth-creating power of real estate.

According to Tellus, the company is on a mission to “empower anyone of any net worth to responsibly build wealth through real estate.”

In addition to its high-yield savings products, Tellus provides fee-free property management software that allows landlords to communicate with their tenants, collect rent, and connect with their team. Apart from optional payment processing fees (charged to renters who choose to use credit or debit cards to pay their rent), this software is free to landlords and renters.

What Does It Offer?

For the sake of this review, we’re focusing on Tellus Boost Account - their savings and income product.

Earn 5.50%+ APY on Through Tellus Boost

Tellus aims to make passive income accessible to everyone. To start building wealth, you simply open a Boost account, deposit money, and start earning.

With Tellus, all the money you deposit is used to fund short-term, residential loans. Tellus earns a predictable return on these loans. And this, in part, is what allows Tellus to offer such impressive yields to its savers.

Right now, investors can earn a base rate of 5.50% APY per year on their deposits, with daily opportunities to earn even more.

Withdraw Anytime

Unlike many asset-backed investments, Tellus doesn’t require a lockup period. You can access deposited funds whenever you want, even if it’s the same day they hit the account.

Not FDIC Insured

Although Tellus looks like a regular bank savings account, it is a cash account from a financial technology, not a bank. You could lose money by investing through Tellus, and the returns are not guaranteed.

If an FDIC-insured bank goes out of business, its customers will get their money back. If Tellus goes out of business, its customers may get some money back, but it is not guaranteed.

Interest Paid Daily

Tellus pays out interest every single day. There are no complicated formulas based on starting and ending balance. If you have at least $125 in your account, then you’ll see a fresh interest payment in your account, every day.

The annualized yield on the Boost Account starts at 5.50% and can reach as high as 7.00% APY with free daily Boost rewards. You can activate rewards by simply logging into the app or correctly answering quiz questions.

Are There Any Fees?

Tellus does not charge any fees.

It’s free to join, and there are no monthly maintenance fees, subscription fees, balance fees, or usage fees, and it doesn’t charge any money to make transfers to or from the account.

If you prefer to wire funds rather than use ACH, Tellus also refunds wire transfer fees for deposits greater than $9,999, up to $15.

How Do I Contact Tellus?

When you download the Tellus app, you can access live chat support directly in the app. You can also email Tellus at support@tellusapp.com.

The company doesn’t advertise an address or phone number that you can use to reach them.

How Does Tellus Compare?

Doorvest is one of the first companies to make buying mortgage debt accessible to the everyday person. Groundfloor allows investors to buy specific real-estate-backed debts, and investors may see higher yields from it. However, Tellus offers more liquidity and doesn’t require any specific investment strategy.

If you’re looking for a simple real estate option, you may want to consider Concreit, which has a similar structure as Tellus. The main difference is that Concreit invests your money directly in real estate projects instead of in mortgages.

Investments that you buy through Fundrise and other crowdfunding platforms tend to have higher yields than those offered by Tellus, but these investments carry a higher risk of loss, and it can be hard to get your money out of these investments early.

No investment vehicle is perfect. As an investor, you have to weigh the pros and cons of each option to decide what fits your investment strategy.

Header |  |  | |

|---|---|---|---|

Rating | |||

AUM Fees | None | 1.00% | 1.00% |

Min Investment | $125 | $500 | $1 |

Open To Non-Accredited Investors? | |||

Cell |

How Do I Open An Account?

To create an account, download the Tellus app. Sign up by providing an email address, your legal name, and your phone number.

To deposit money into the account, provide your Social Security number and connect your bank account using Stripe, a third-party integrated service. Tellus needs your Social Security number (or another Tax ID) because all money earned through the platform is taxable.

Is It Safe And Secure?

The safety and security of Tellus can be broken into two categories. First, investors should understand the safety of Tellus’s underlying collateral. Tellus holds mortgages against single-family real estate in US markets that have a minimum loan-to-value on 20% (on origination).

According to Tellus, there is at least a 30% protective buffer around your deposits. This safety margin consists of approximately 20% real estate mortgages, and 10% cash held in reserve (as of November 2022).

The company receives a steady stream of income based on payments collected from these loans. Every dollar that Tellus lends is backed by at least $1.30 worth of property (according to their estimates of the value, which could change over time). The company has its largest concentration of loans in the Pacific Northwest.

If property values in the Pacific Northwest decline by 25%, your account at Tellus would still be safe. If property values in this area declined more than 35%, then Tellus would be underwater on its portfolio. Assuming borrowers also stopped paying on their loans, your investment in Tellus would decline in value and you'd likely early less interest since the cash flow wouldn't be coming in to pay it.

A massive drop in real estate values seems unlikely, but few people anticipated that the real estate market would decline in 2006 to 2008. If an event of a similar magnitude happened again, the investments could lose value.

For context, the average home value in the United States declined 13% in the Great Recession. However, as many know, each market is different, and while some areas were mildly impacted during the Great Recession, other areas saw 30-40% declines in home value.

Also, for user funds before they are invested are custodied by JP Morgan Chase, N.A., Member FDIC; Wells Fargo Bank, N.A., Member FDIC; and Sunwest Bank, Member FDIC.

The other side of safety and security to consider is digital security. Tellus uses bank-level encryption, requires multi-factor authentication, and works with digital leaders to manage money movement and transactions. You’ll have to provide personal information to Tellus, but the company has tons of precautions in place to mitigate risks of hacks or identity theft.

Is It Worth It?

Tellus offers a simple way to get exposure to real estate income in your portfolio. This can be a useful way to boost your investment yield while keeping your investment tactics simple. However, we believe that Tellus tends to understate the risk inherent in real estate cash flows and values. If the real estate market tanks, you could lose some or all of your money.

Investors who want exposure to real estate (rather than real estate debt) should consider direct real estate investing sites like Concreit or Fundrise instead.

You may also want to be mindful about the yields that Tellus advertises. A 5.50% is a good rate for a savings account, but remember that Tellus isn’t a savings account. It’s an investment and it carries risks.

Savings accounts with no risk are yielding over 5.25% at the time of the review, and rates are rising. You can find 12-month CDs that currently exceed what Tellus is paying out on its Vault product.

The bottom line is that the rate that Tellus offers may not be worth the potential risk, especially as rates rise on risk-free products like savings accounts and CDs.

Tellus Features

Account Types |

|

Minimum Investment | $125 |

Management Fees | None |

Investor Requirements | None |

APY | Starts at 5.50% |

Withdrawal Term | None, you can withdraw whenever you want |

Customer Service Email Address | support@tellusapp.com |

Company Address | 21580 Stevens Creek Blvd. Ste 210 Cupertino, CA 95014 |

Mobile App Availability | iOS and Google Play Store |

Web/Desktop Account Access | No |

Promotions | None |

Tellus Review: A Tool To Help You Reach Super High-Yield Savings

-

Pricing and Fees

-

Customer Service

-

Diversification and Risk Management

-

Ease of Use

-

Products and Services

Overall

Summary

Tellus is a savings tool backed by mortgages and pays out a decent yield.

Pros

- No investment lock-up periods

- Interest paid daily into your account

Cons

- Not FDIC Insured

- $125 Investment Minimum

- Currently pays out less than the rate of inflation

- Yields may decrease

- Tends to understate the risk associated with holding investments backed by debt

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Chris Muller