iTrustCapital is a crypto IRA provider that allows you to invest in alternative assets in your SDIRA.

Over the past decade, crypto has gone from an abstract digital concept to a more accepted form of alternative investment. In the last year or two, it’s become possible to invest in crypto inside of your retirement accounts.

If you’re in it for the long haul on crypto, a tax-advantaged IRA or Roth IRA could provide excellent tax shelters, as long as your bets pay off. But not every brokerage company allows you to trade crypto inside your retirement accounts.

That’s why niche players like iTrustCapital provide an important service. The company allows you to buy, sell and stake crypto assets inside your retirement accounts. Here’s how it works.

iTrustCapital Details | |

|---|---|

Product Name | iTrustCapital |

Min Investment | $1,000 |

Fees | Monthly account cost: $0 Cryptocurrency Trades: 1% Physical Gold: $50 over spot per ounce Physical Silver: $2.50 over spot per ounce |

Account Type | IRA Roth IRA SEP IRA |

Promotions | None |

What Is iTrustCapital?

Founded in 2018, iTrustCapital has a goal of helping 10 million people invest safely in blockchain assets. The company has already supported more than $6 billion in transactions. iTrustCapital allows investors to buy and sell crypto in real time inside their tax-advantaged retirement accounts.

With features including easy account creation, support for more than 25 crypto tokens, and articles that explain the ins and outs of crypto investing, iTrustCapital can be thought of as a strong consideration if you’re thinking about adding crypto into your retirement accounts.

What Does It Offer?

While iTrustCapital may expand in the future, it currently focuses on helping investors trade cryptocurrency inside of tax-advantaged IRAs.

Buy and Sell Crypto Within An IRA

An IRA is a tax-advantaged retirement account that allows you to claim a deduction for the money you contribute to the account. In 2023, the contribution limit for an IRA is $6,500. If you contribute to a Roth IRA, you won’t get a tax deduction now, but you will never pay taxes on income or gains inside the account.

Traditionally, it's been tough to enjoy the tax advantages of an IRA or a Roth IRA and invest in cryptocurrency. iTrustCapital allows you to open an IRA or a Roth IRA and buy and sell crypto assets inside the account. This can give you exposure to an alternative asset, and provide meaningful tax benefits.

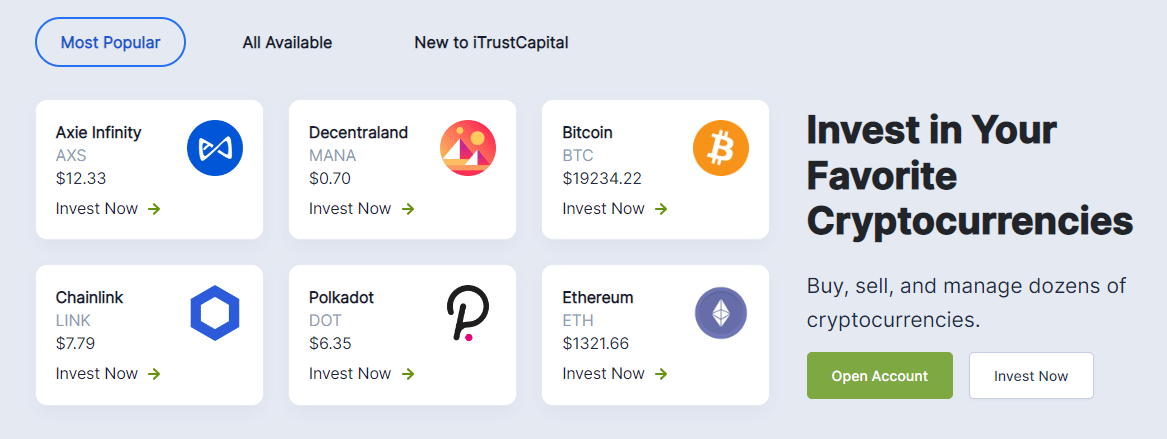

Right now, iTrustCapital supports live trading for 25 of the most popular crypto tokens.

Hold Precious Metals Within An IRA

In addition to giving you access to cryptocurrency investing, iTrustCapital allows you to buy and sell shares of precious metals. All precious metals bought through iTrustCapital are backed by gold or silver, but you won’t own any actual gold or silver. All ownership is recorded through a blockchain-enabled ledger.

Some Ability To Stake Crypto

Certain cryptocurrencies validate the blockchain through staking. Putting tokens into the blockchain allows it to show proof of validation. When you choose to stake your tokens, you may put your tokens at risk, but you will earn income for staking. You cannot trade your crypto tokens while they are being used for staking.

iTrustCapital allows you to stake certain Polkadot (DOT) tokens for a minimum of 90 days. iTrustCapital retains 20% of your earnings as a staking fee, but you get to keep the remaining 80% of the earnings.

High Trust Crypto Storage

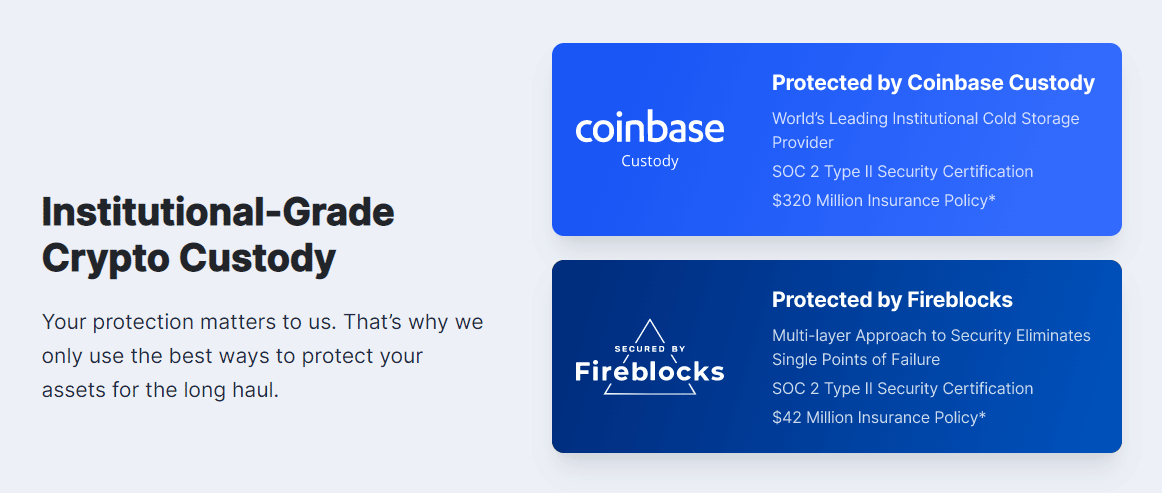

The company works hard to ensure investors feel comfortable using their iTrustCapital accounts. This means iTrustCapital implemented a multiplicity of best security practices.

All assets in the accounts are insured against corporate and cyber crimes. Additionally, crypto tokens are stored in cold storage, which makes it difficult for hackers to access. While you can’t store your tokens in your hardware wallet, a cold storage wallet is the next best option.

Are There Any Fees?

The fees that iTrustCapital charges are based on trading. It costs nothing to open an account and store assets at iTrustCapital. You start to rack up charges when you start to trade. These are the fees you can expect when trading with iTrustCapital:

- 1% Crypto Transaction Fee (when buying and selling)

- $50 over the spot price per ounce of gold

- $2.50 over the spot price per ounce of silver

How Do I Contact iTrustCapital?

iTrustCapital prides itself on transparency and accessibility. The company’s headquarters is based in Long Beach, CA. The address listed on their website is: 18575 Jamboree Rd Suite 600 Irvine, CA 92612.

You can also submit a help request through the company’s help website or call a support representative at 562-600-8437.

How Does iTrustCapital Compare?

iTrustCapital is one of only a few companies that allows you to buy and sell crypto inside your IRA. Of course, you can find much lower crypto trading fees on dedicated crypto sites like Binance or Coinbase. The trouble with crypto brokerages is that they don’t offer IRAs.

The Best Cryptocurrency Exchanges and Platforms

If you want to see what else is out there besides iTrustCapital, check out our view for top cryptocurrency platforms.

iTrustCapital specializes in investing in crypto inside your IRA. That comes with a higher trading fee, but the fee iTrustCapital charges is on par with other similar brokerages. For example, AltoIRA also charges a 1% trading fee, though it supports more than 130 tokens.

RocketDollar is a self-directed IRA and i401(k) company. It charges a setup and monthly maintenance fee along with trading fees.

Investors may find that iTrustCapital is a less expensive alternative. However, RocketDollar allows you to invest in a wider range of assets, not just crypto and precious metals like iTrustCapital.

Header | |||

|---|---|---|---|

Rating | |||

Setup Fee | $0 | $360 | $49 |

Annual Fee | $0 | $180 | Up to $499 |

Plan Types | IRA | IRA & 401(k) | IRA |

Checkbook? | |||

Cell |

How Do I Open An Account?

To create an account, visit the iTrustCapital homepage and select “Create Account” in the upper right corner. You’ll need to provide a username, an email address, a password, and a cell phone number. Once you complete that, it’ll ask you to verify your email address.

After that, you can log into your account and start an account application by hitting the button on the top right side of the screen. The application requests information such as your legal name, Social Security Number, current and former addresses, and other applicable details.

Once those details are complete, decide what type of IRA to set up (traditional, SEP IRA, or Roth IRA) and how to fund the account. Within a day or two, everything should be approved and you can start trading in your new retirement account.

Is It Safe And Secure?

Investing in crypto always carries a risk, and the risk profile associated with crypto investing may not be appropriate for your retirement investments. Your information could be stolen at any time, which is a risk of doing business anywhere online.

But iTrustCapital has several layers of security in place to keep your investment safe and secure. The assets are also insured against crime. While the assets could go down in value, you are unlikely to lose them to theft, hacking, or other major problems.

Assets at iTrustCapital are held in cold storage which means they are not accessible to hackers or other cyber criminals. The company also protects your personal information through encryption and multi-factor authentication.

Is It Worth It?

Overall, iTrustCapital has a unique product that makes crypto investing more accessible to everyday investors.

The big problem that I see with iTrustCapital is that it focuses exclusively on alternative assets. Most of the time, a retirement investment portfolio should be designed around classic growth and income assets like stocks and bonds.

Alternatives like crypto or precious metals will typically comprise a small portion of the portfolio. If you choose to invest retirement funds in crypto, iTrustCapital makes it easy.

But you need to manage your crypto holdings with your more traditional holdings. Don’t tip too far in the direction of crypto holdings simply because iTrustCapital makes crypto investing easy.

iTrustCapital Features

Account Type |

|

Minimum Investment | $1,000 |

Setup Fee | $0 |

Account Fee |

|

Investment Options |

|

Rollovers Allowed | Yes |

Transfer Fees | $0 |

Customer Service Number | 562-600-8437 |

Customer Service Help Desk | |

Mobile App Availability | |

Promotions | None |

iTrustCapital Review

-

Fees

-

Products and Services

-

Supported Currencies

-

Customer Service

-

Security

Overall

Summary

iTrustCapital allows you to buy, sell, and stake crypto assets inside your retirement accounts.

Pros

- Self-directed investing without monthly account fees

- Straightforward and competitive trading fees

- Support for more than 25 crypto tokens

Cons

- Does not allow you to invest in stocks or bonds

- Investors cannot get access to their physical precious metals

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington