The Flare Account offers a debit card with plenty of helpful features for easier money management. One of those features is access to a high-yield savings account that earns up to 6% APY.

Accessing a credit card can be challenging if you have bad credit or no credit. But if you aren’t willing to skip the convenience of a plastic card, then a debit card might be the solution.

Let’s explore how the Flare Account could fit into your finances.

Flare Account Details | |

|---|---|

Product Name | Flare Account |

Min Opening Deposit | None |

Monthly Fees | $9.95/mo |

APY for Optional Savings Account | Up to 6% |

ATM Access | 850 ACE Cash Express locations in the U.S. |

Account Type | Debit card |

Promotions | None |

What Is The Flare Account?

The Flare Account is made available through Pathward, which is formerly known as MetaBank. According to MetaBank, the reason behind the name change was to transform the business and culture. At the center of this change is a representation of “commitment to economic mobility.” The bank “provides game-changing financial products that bank the underbanked and serve the underserved.”

⚠︎ This Is A Banking Service Provider, Not A Bank.

Flare is a financial technology company, not a bank. While it uses partner banks to provide banking services, your FDIC-insurance protection may be limited. Read this article from the FDIC to understand the risks of using a non-bank company.

What Does It Offer?

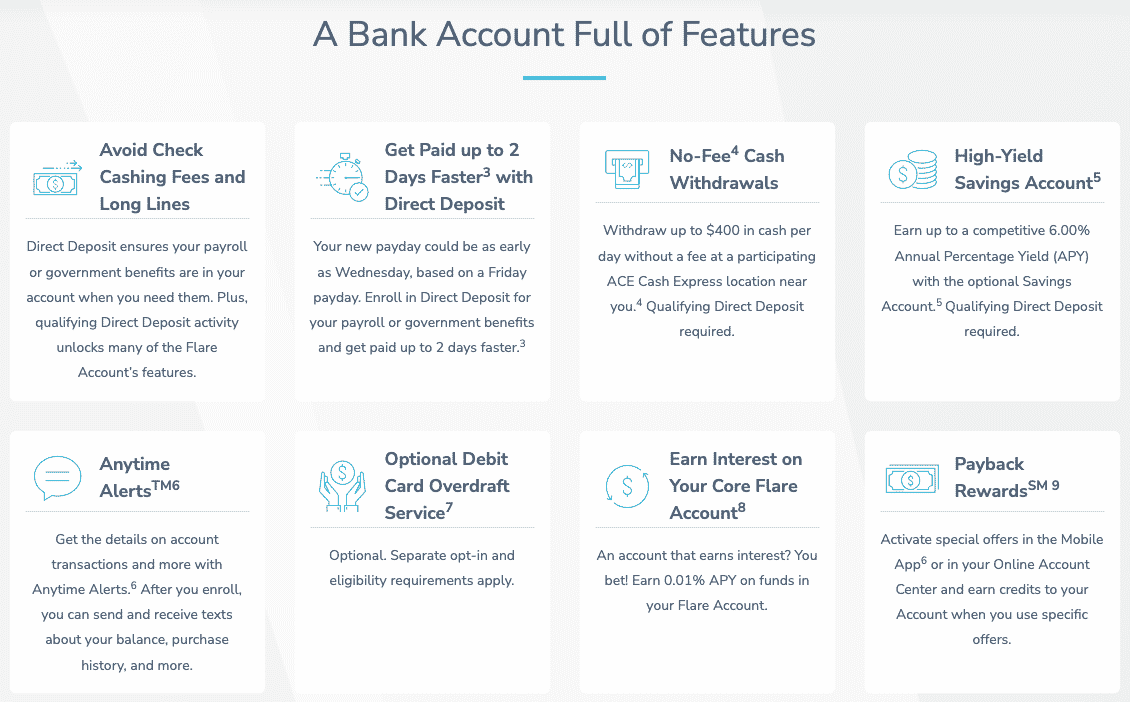

Here’s a look at what makes the Flare Account stand out.

Get Paid Faster

When you use the Flare Account, it’s possible to enroll in direct deposit. Depending on your employer, you can receive your paycheck up to two days early in your Flare Account.

Other ways to add money to your Flare Account include setting up a bank transfer for an existing bank account, adding money at the ACE store, or choosing a direct deposit for your tax refund.

Cash Withdrawals

You can use your Flare Account debit card to make purchases every day. But you can also withdraw cash at participating ACE Cash Express locations.

You’ll have the opportunity to withdraw up to $400 in cash per day without paying a fee. However, your account must receive a direct deposit of any kind in the preceding 35 days to avoid a fee.

Interest-Earning Opportunities

The Flare Account itself offers the chance to earn interest on your balance. You can earn 0.01% APY on the funds tucked into your Flare Account.

Not excited about 0.01%? You can unlock an optional high-yield savings account to earn much more.

The optional savings account offers 6% APY on your savings of up to $2,000. Beyond that amount, your savings will earn 0.50% APY. In order to secure that APY, however, you must establish a qualifying direct deposit of $500 per calendar month.

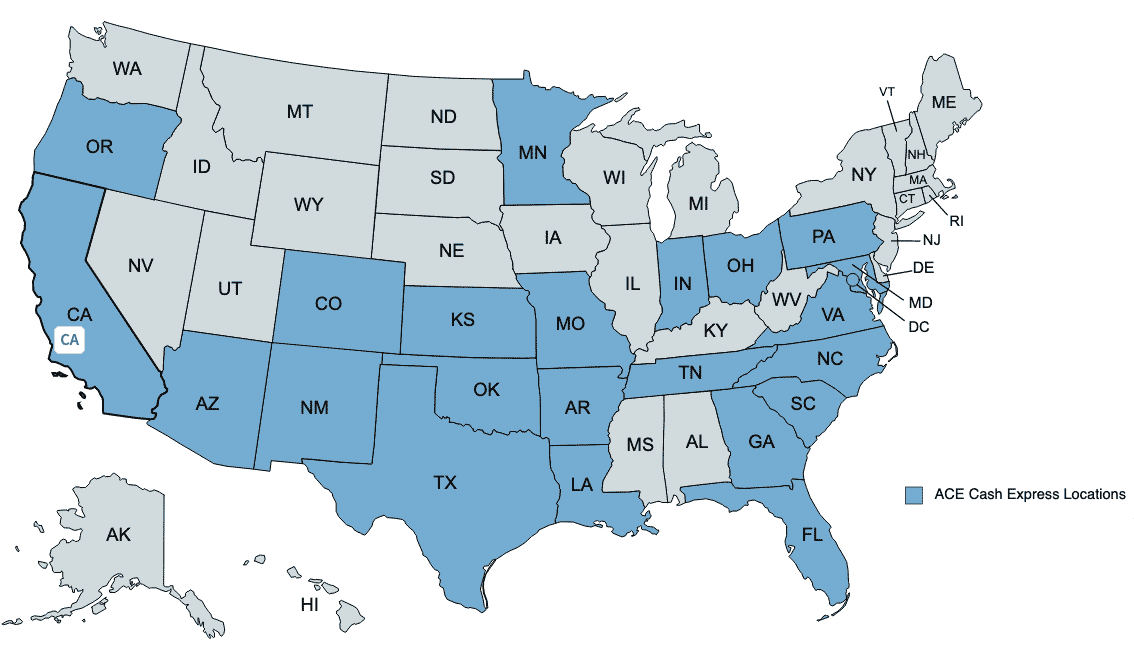

Limited Store Locations

Participating ACE Cash Express locations give you more account management options. For example, you can withdraw and deposit cash at these locations. But there are only around 850 locations available across the country, and not every state has one.

Currently, you’ll find ACE Cash Express locations in Arizona, Arkansas, California, Colorado, District of Columbia, Florida, Georgia, Indiana, Kansas, Louisiana, Maryland, Minnesota, Missouri, New Mexico, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, Tennessee, Texas, and Virginia.

Are There Any Fees?

The Flare Account comes with many fees to maintain and operate your account. A few of the fees include:

- Monthly: $9.95, but if the account receives at least $500 each month, your monthly fee is lowered to $5.

- ATM: $2.50 for domestic withdrawals and $4.95 for international withdrawals, plus, $1 for balance inquiries.

- In-person application fee: $3 to submit your application at a participating location. But it’s free to open an account online.

- Overdraft: $20 per transaction that overdraws your account by $10 or more.

- Foreign transaction: 3% for transactions outside of the U.S.

How Do I Contact The Flare Account?

You can get in touch with a Flare Account representative by submitting a question through their contact form or by calling 866-753-6355. Another way to connect is over Facebook @AceFlareAccount.

The Flare Account only earned 2.5 out of 5 stars on Trustpilot. But at the time of writing, there were only six reviewers, so it’s difficult to truly know what the majority of customers think of their experience.

How Does The Flare Account Compare?

The Flare Account is designed to give the underserved access to banking. But the high fees could be a hindrance to opening an account, especially since there are other institutions that don’t have as many fees.

If you are looking for a way to avoid banking fees, check out Chime.

Does the Flare Account feel a little lacking? If so, see what Chime has to offer. Here's a quick run-down that may entice you:

- They offer fee-free online banking.

- Monthly fees: $0

- ATM Access: 60,000+ free ATMs

Or a prepaid debit card, which you first need to load up with cash before you use it, could help you keep your spending in check. One great prepaid debit card is the Green Dot Card, which has a similar fee structure to the Flare Account. But keep in mind you won’t have the option to open a connected 6% high-yield savings account.

If the high-yield savings option interests you, see the best savings accounts and make your money earn more money.

The Best High-Yield Savings Accounts

In this article, we review the most competitive savings accounts.

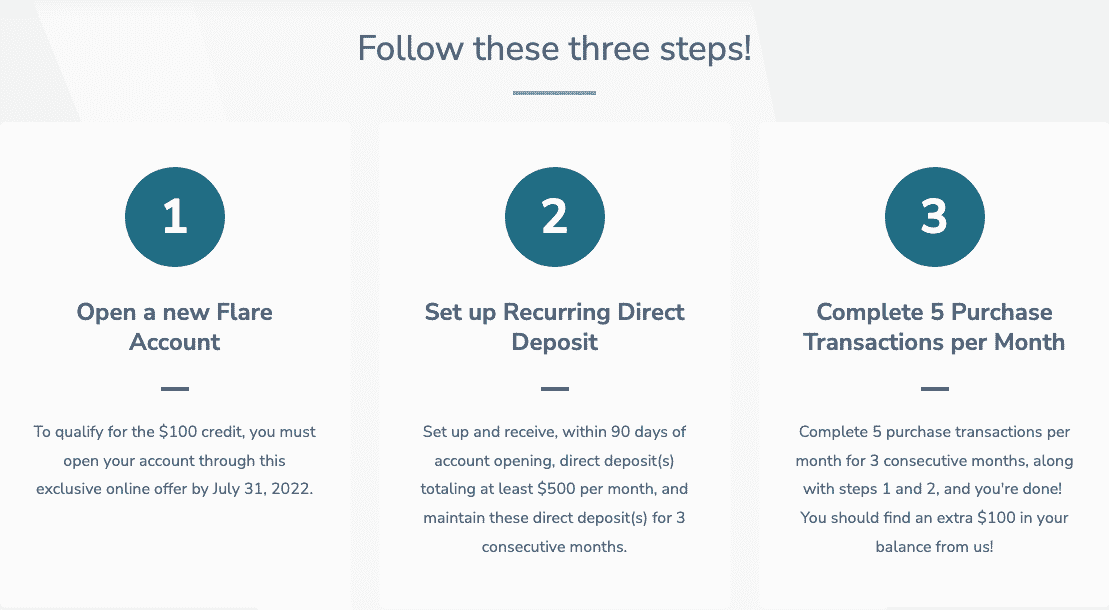

How Do I Open An Account?

Want to open the Flare Account?

It started by filling out an application. Here’s what information you’ll need to provide:

- Name

- Address

- Phone number

- Email address

- Social Security Number

- Date of birth

During the application process, you’ll have the chance to select a card design. A few of the options include an American flag and a Humane Society card.

Is It Safe And Secure?

The Flare Account is offered through Pathward, formerly known as MetaBank, which is an FDIC-insured bank, which means your funds are insured for up to $250,000. This level of protection may help you feel comfortable about opening the Flare Account.

Is It Worth It?

The Flare Account offers a simple way to spend money using a debit card. If you’re looking for a way to streamline your spending without credit cards, while having access to a high-yield savings account, then the Flare Account might be a great fit.

However, the relatively high fees might give you pause. The lack of any rewards for spending also means there are ways to get more bang for your buck out there. If a fee-free option is a top priority, then check out Chime.

Flare Account Features

Account Types |

|

Minimum Initial Load | None |

Savings APY | Up to 6% APY on first $2,000, after that 0.50% APY |

Monthly Fees | $9.95, but if the account receives at least $500 each month, your monthly fee is $5. |

Fees |

|

ATM Availability | 850 participating ACE Cash Express locations |

ATM Limits | Withdraw limit of $400 in cash per day |

Customer Service Number | 866-753-6355 |

Social Media Customer Service | Facebook @AceFlareAccount |

Mobile App Availability | |

Web/Desktop Account Access | Yes |

Direct Deposit | Yes |

FDIC Certificate | |

Promotions | None |

Flare Account Review

-

Fees

-

Ease of Use

-

ATM Access

-

Customer Service

-

Products and Services

Overall

Summary

The Flare Account offers a debit card and an option to open a high-yield savings account that earns up to 6% APY.

Pros

- Get paid up to 2 days faster

- Access an optional high yield savings account with 6% APY

- No minimum opening deposit

Cons

- Unavoidable monthly fee

- ATM fees

- Low Trust Pilot reviews

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak Reviewed by: Robert Farrington