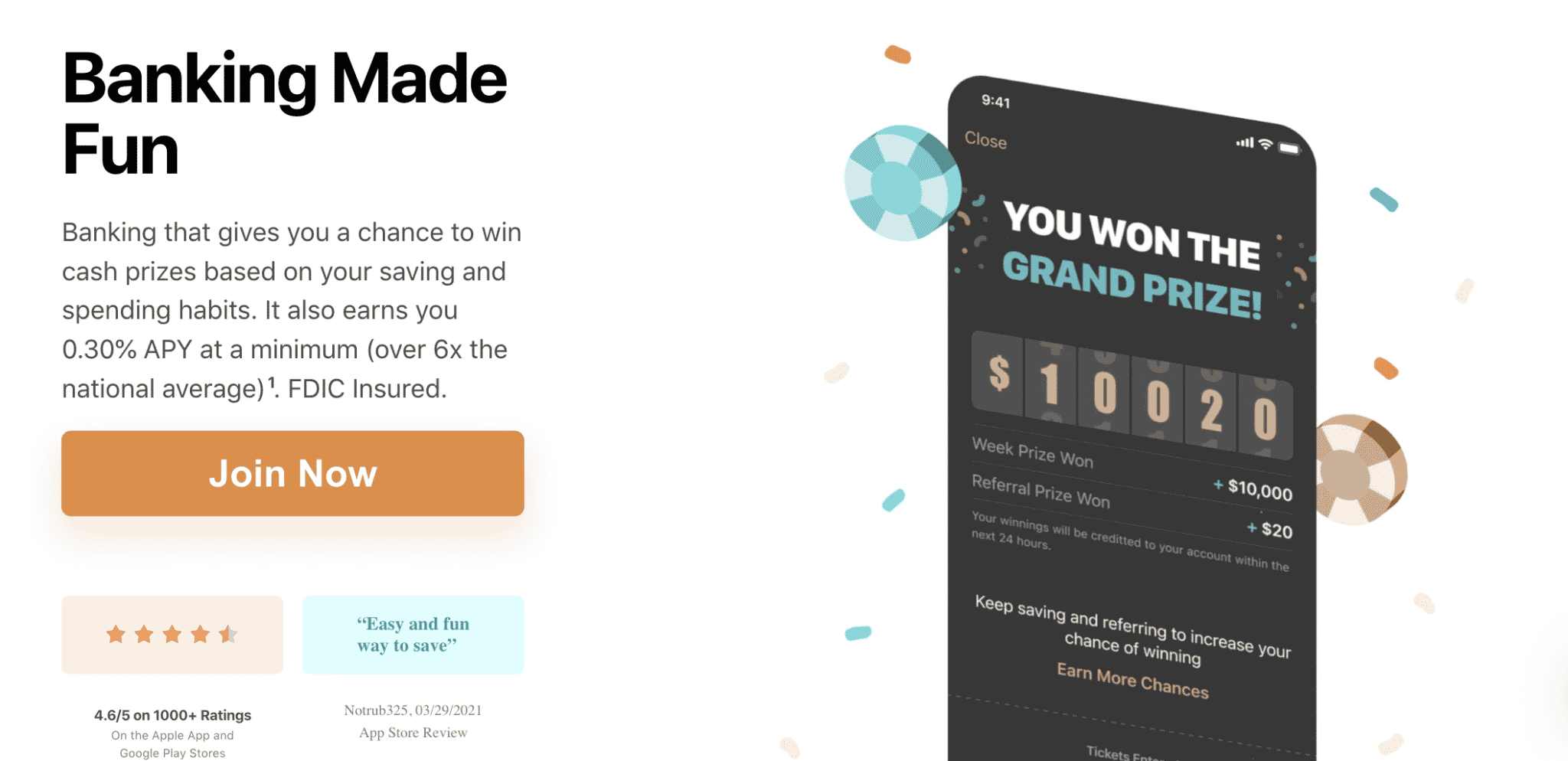

Finding the motivation to save more in a fun way can be difficult. PrizePool makes it exciting to grow your money and the APY isn't so bad. (The current average is around 0.30% APY.)

Beyond a higher APY, PrizePool offers the chance to win $10,000 in savings every single month, setting it apart from other FinTech savings tools.

If this savings account sounds interesting to you, read the rest of our PrizePool review to find out what else they offer.

PrizePool Details | |

|---|---|

Product Name | PrizePool |

Min Balance | None |

Monthly Fee | None |

APY | 0.30% |

Promotions | 6,000 weekly prizes and monthly chance to win $10,000 grand prize |

What Is PrizePool?

Frank Chien and Joe Woo co-founded PrizePool in 2019 to help make saving money more fun and exciting. According to the website, PrizePool’s mission is to “incentivize Americans to build a better financial foundation.”

With the potential to win real cash each month, the hope is that savers will be more motivated to save. The banking services for PrizePool are provided by Evolve Bank & Trust.What Does It Offer?

PrizePool is a relatively new platform. Here’s how it’s different.

Cash Prizes

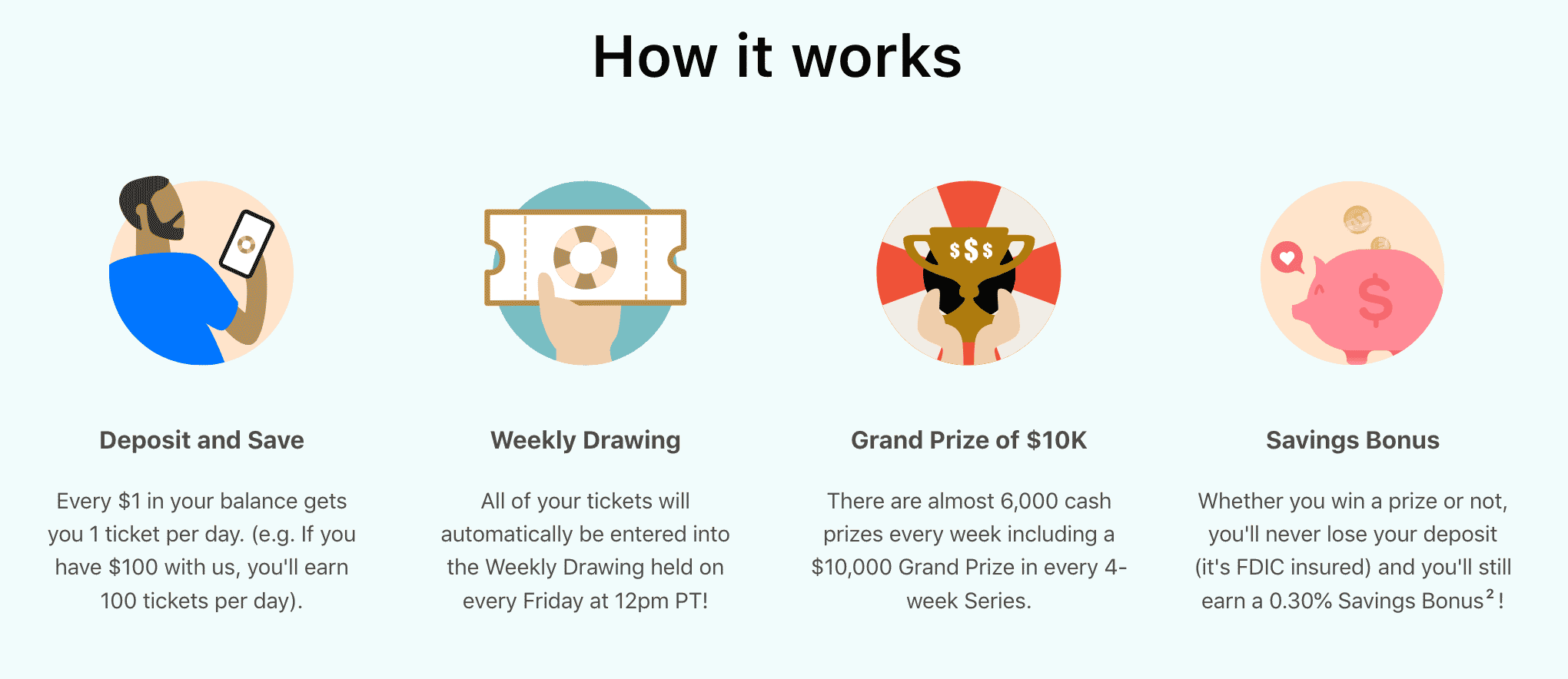

The main attraction of PrizePool is the potential cash winnings. Once you open an account, here’s how the drawing works.

Each dollar in your PrizePool account will earn 1 ticket per day. So, if you have $100 in your account, that would lead to 100 tickets per day or 700 tickets per week. Each of the tickets is automatically entered into the weekly cash drawing.

Each month, you have a chance to win 6,000 cash prizes. That includes the monthly grand prize of $10,000.

Competitive APY

Even if you don’t win a cash prize, your funds will still earn a 0.30% fixed APY. Each month, your savings account will see a boost from this competitive APY.

Although it’s possible to find higher APYs elsewhere, this is significantly higher than the current national average.

Note: These numbers are from June 2022. It’s likely the offered APY will change over time.

Without a, you can’t easily spend funds from this account. If you need regular access to spend directly from your savings account, then PrizePool probably isn’t a good fit. Generally speaking, however, a savings account shouldn’t function in the same way as a checking account. The whole point of saving is to put money away and not touch it until you need it.

No Minimum Balance Requirement

Saving money is a smart move. But it can take time to build up a savings account. Luckily, PrizePool doesn’t require any minimum balance. With that, you can build savings at your own pace.

Of course, you might be more motivated to save based on the way the drawings work. After all, more dollars leads to more chances of winning the grand prize. It’s a great way to encourage yourself to build savings quickly.

No Debit Card

Without a debit card, you can’t easily spend funds from this account. If you need regular access to spend directly from your savings account, then PrizePool probably isn’t a good fit. Generally speaking, however, a savings account shouldn’t function in the same way as a checking account. The whole point of saving is to put money away and not touch it until you need it.

Are There Any Fees?

It might be surprising, but PrizePool doesn’t have any fees. Zip, zero, none. You can open an account and participate in the drawing pool without paying a single fee, ever.

How Do I Contact PrizePool?

Need to get in touch with PrizePool? You can email support@getprizepool.com.

If you reach out, it’s likely you’ll have a good experience. The company has earned 4.6 out of 5 stars on Trustpilot. It’s also earned 4.4 out of 5 stars on the Google Play Store and 4.7 out of 5 stars on the Apple App Store.

How Does PrizePool Compare?

PrizePool isn’t the only savings account out there that encourages savings through a drawing system.

Another good option is Yotta. With Yotta, you can also tap into a lottery system reward opportunity. The big difference is that Yotta has a debit card. So, if you want an easy way to spend your savings, then Yotta might be a better fit.

Header |  |  | |

|---|---|---|---|

Rating | |||

Top APY | 0.30% | 4.65% | 0.20% |

Monthly Fees | $0 | $0 | $0 |

Min Deposit | $0 | $100 | $0 |

ATM Access | N/A | Fee Refunds (Up to $30/month) | 55,000 Fee-Free ATMs |

FDIC Insured | |||

Cell |

How Do I Open An Account?

Open your account on the PrizePool site. You’ll need to provide your name and email. Plus, add a password to create your account.

From there, you can download the app to manage your savings easily.

After your account is set up, you can start building savings. Remember, every dollar gets you a daily ticket into the prize drawings.

Is It Safe And Secure?

PrizePool is a safe savings opportunity. The company works with a partner bank, Evolve Bank & Trust to safeguard your funds. The account is FDIC-insured. With that, your funds are insured for up to $250,000.

Is It Worth It?

PrizePool offers a great way to build savings in a free account. The incentive of regular cash prizes can definitely help many savers up their game. After all, you’ll have the chance of winning $10,000. That’s motivation to tuck a little bit extra into savings each month.

If you struggle to build savings, then PrizePool is an opportunity worth trying. The platform could be just what you need to grow your savings. Plus, you might even get lucky and win thousands of dollars to accelerate your financial goals.

But even if you don’t win, PrizePool offers a respectable APY to help you grow your savings. When combined with the lack of fees, PrizePool could be the right tool to help you meet your savings goals.

Want to See the Best High-Yield Savings Accounts?

We've reviewed the top 10 savings accounts that will earn you the most.

Compare and find an account that works for you.

PrizePool Features

Account Types | Savings account |

Minimum Deposit | $0 |

Savings Rewards | 0.30% |

Monthly Prizes | Up to $10,000 |

Tickets Earned Per Dollar Saved | Each $1 in your account will earn 1 ticket, per day. |

Monthly Fees | $0 |

Branches | None (online-only) |

ATM Availability | N/A |

Customer Service Email | support@getprizepool.com |

Customer Service Hours | Monday-Friday, 8 AM-11 PM (EST) Saturday-Sunday 8 AM-9 PM (EST) |

Mobile App Availability | |

Web/Desktop Account Access | Yes |

Direct Deposit | Yes |

Bill Pay | No |

FDIC Certificate | 1299 (through Evolve Bank & Trust) |

Promotions | 6,000 weekly cash prizes and monthly chance to win $10,000 grand prize |

PrizePool Review: A Chance to Win $10K Every Single Month And Save Money

-

Rewards Rate

-

Fees & Charges

-

Customer Service

-

Ease of Use

-

Tools & Resources

-

Products & Services

Overall

Summary

PrizePool offers gives you the change chance to win $10,000 in savings every single month, but is it enough to make you want to save?

Pros

- No fees

- No minimum balance requirements

- Weekly cash prizes

- Fairly competitive APY

- FDIC insured

Cons

- Currently, no debit card offering

- Can find higher APYs elsewhere

Sarah Sharkey is a personal finance writer covering banking, insurance, credit cards, mortgages and student loans. She has written for numerous finance publications, including MagnifyMoney, Business Insider and ChooseFI. Her blog, Adventurous Adulting, helps young adults get a handle on their finances.

Editor: Claire Tak Reviewed by: Robert Farrington