Yotta is a prize-linked savings account and debit card.

The most recent data from the U.S. Census Bureau shows that Americans spend over $71 billion per year on lotto tickets for an average expenditure per adult of $285.

And what are the odds of winning? Well, Mega Millions says that the odds of winning its jackpot are just over 1 in 300 million. Meanwhile, your odds of getting struck by lightning this year are "just" 1 in 500,000 according to the CDC.

So, yes, lottery players are much more likely to get struck by lightning this year than to earn a big payday on the $285 they spent on tickets. Instead of throwing that money away, they could have put it into a high-yield savings account. The problem is that saving isn’t nearly as exciting as winning the jackpot.

Yotta may have an answer for those who love the thrill of playing the lottery but are also eager to stop flushing money down the toilet. What if just choosing to save could enter you into a sweepstakes that offers serious cash rewards? That's exactly what Yotta offers. Here's how it works.

Yotta Savings Details | |

|---|---|

Product Name | Yotta Savings |

Min Balance | $5 |

Base Rewards Rate | 0.20% |

Weekly Cash Prizes | $0.01 to $10 million |

Promotions | 100 bonus tickets for each friends you refer |

Who Is Yotta?

Yotta is a fintech that offers an alternative interest rate structure on savings. Yotta was founded in October of 2019 by Adam Moelis and Ben Doyle. It's based in New York City. The company has raised $16.6 million through a Series A round.

Yotta's business model was inspired by the UK's Premium Bonds program. In 1956, the UK government started selling bonds that didn't pay any interest. Instead, bondholders were entered into a lottery-like system to win cash prizes. While Yotta follows the Premium Bonds model, it uses a slightly different setup since Yotta does pay a small amount of interest on deposits.

But, returning to Premium Bonds for a moment, did the potential to win prizes encourage people to save? Actually, yes it did! Over 23 million people so far have participated in savings through the program. To learn more about the success of Premium Bonds, you can check out this Freakonomics podcast episode which highlights the program.

What Do They Offer?

Yotta is not a bank, but a FinTech or neoBank that leverages an underlying bank with their technology on top. In Yotta's case, banking services are provided through Evolve Bank.

Instead of earning cash interest, savers earn a small amount of interest plus cash-based prizes through Yotta's lottery ticket system. Yotta account holders do everything through the Yotta mobile app, which is available for Android and iOS.

Earning Tickets

Every $25 deposited up to $10,000 earns one recurring ticket each week. And every $150 above $10,000 earns you a ticket. So someone with a $10,000 balance would earn 400 tickets per week.

If you set up direct deposit, you’ll also get paid up to 2 days early and get 5% bonus tickets on your paychecks.

Every night at 9PM ET, a number is drawn. At the end of the week, the more numbers you have matched on your tickets, the more you win. It is similar to the powerball, but with Yotta, customers don't lose any money. Picking numbers is done by a third-party insurance company.

Savings Rewards

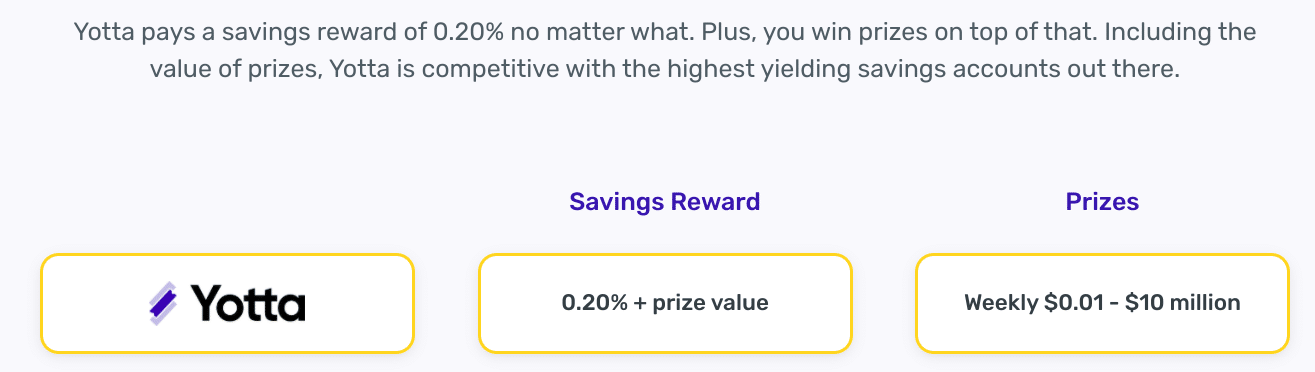

Multiple outlets have tried to calculate what the "average" person could expect to earn with Yotta in rewards. Some claim it has an "effective savings rate" of 1.5% - 2%.

That doesn’t mean you’ll automatically earn 1.5% - 2% interest on your deposits however. Yotta's base savings reward is 0.20%. Effective rate calculations factor in both the base rewards + prize winnings from lottery tickets.

Yotta's weekly prizes range from $0.10 to $10 million. And that includes partial ticket matches, which do pay out small amounts of money.

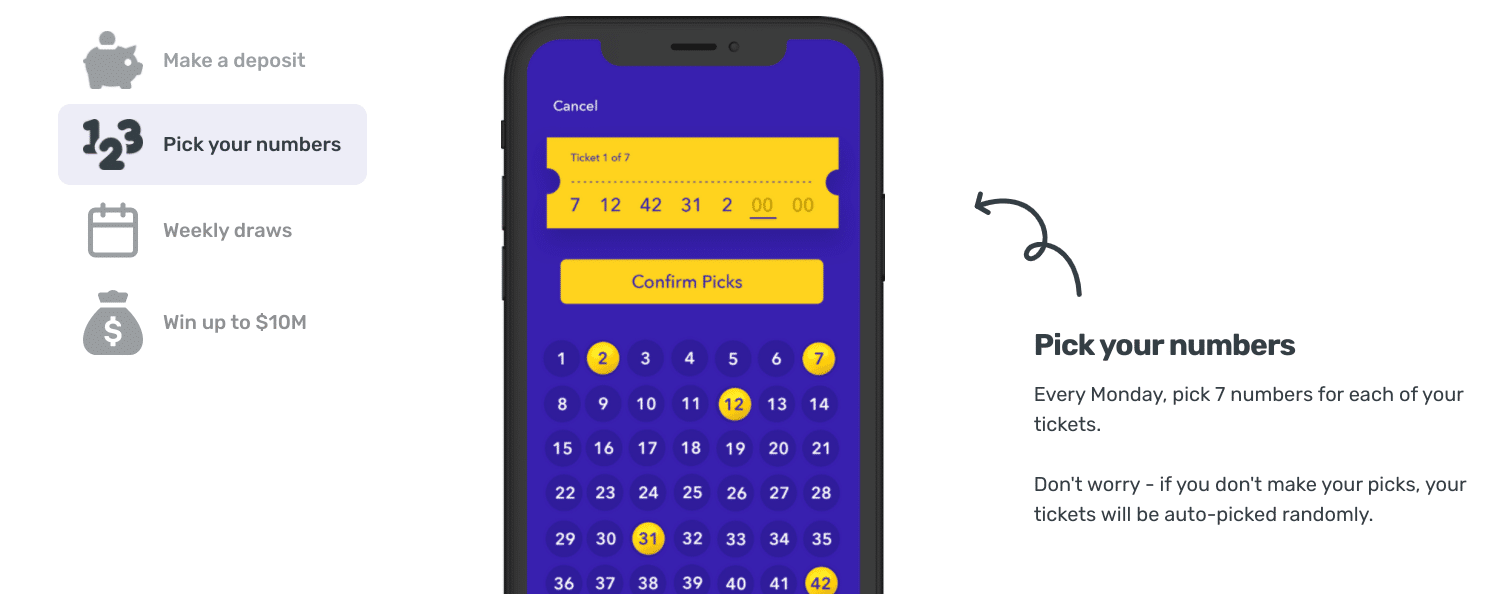

Picking Ticket Numbers

Each lottery ticket must be filled in. If you have a lot of tickets, it can take a while to fill them out. As we already mentioned, depositing $10,000 would produce 400 weekly tickets.

Who has the time to fill out numbers on 400 tickets? Thankfully, Yotta has a simple solution to quickly fill out a lot of tickets. Just select auto fill and all of your tickets will be filled in with random numbers.

Partial Matches

It isn’t necessary to match every number on a lottery ticket to win a prize. Partial matches will still earn money and go toward increasing your effective savings rate (i.e., anything above 0.20%). Below are a few examples of the prizes that it offers for partial matches:

Matching Yotta Ball | Matching Numbers | Prize | Odds |

|---|---|---|---|

Yes | 0 of 6 | $0.10/ticket | 1:110 |

Yes | 1 of 6 | $0.15/ ticket | 1:181 |

Yes | 2 of 6 | $0.75/ticket | 1:867 |

Yes | 3 of 6 | $10/ticket | 1:9,913 |

No | 3 of 6 | $0.15/ticket | 1:160 |

No | 4 of 6 | $7/ticket | 1:4,406 |

No | 5 of 6 | $3,000 | 1:346,955 |

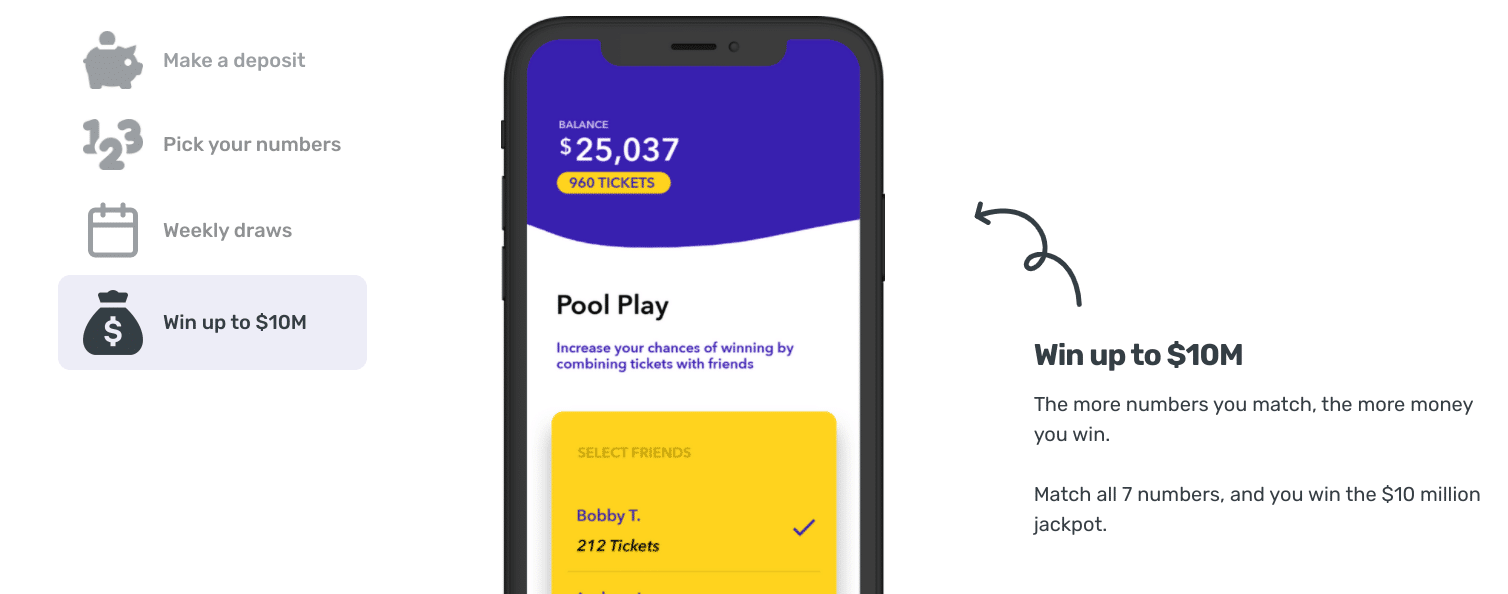

Pool Play

Pool Play allows you to pool tickets together from different people and increase your odds of winning. This is similar to an office lottery pool where employees pool together their tickets in case someone has the winning ticket. They then distribute the winnings to everyone in the pool.

Debit Card

Yotta has a Mastercard debit card. And, you guessed it, you’ll earn tickets for using it. For every $10 spent, you’ll earn one ticket towards the next week’s drawing.

You’ll also have up to a 1 in 100 chance to win the item you just bought for free. If you can spend $2,000 in the first four months of opening an account, you’ll also earn 1,000 bonus tickets.

Cardholders will also be automatically upgraded to a premium metal card once they've made 10 referrals. Customers can use the Yotta Debit Card today in the mobile app.

Withdrawal Limits

You’re limited to six withdrawals during a statement period. This limit is standard across banks. Additionally, the following dollar limits apply:

- $10,000 per day

- $40,000 per month

- $100,000 per year

Referral Program

Yotta customers can use their referral code to earn an extra 100 bonus tickets. The person you are referring will also earn 100 bonus tickets.

Are There Any Fees?

Yotta does not charge a monthly service fee. There are also no minimum deposit or overdraft fees but there is a minimum balance requirement of $5 at the end of each month.

Yotta also has a network of ATMs that you can see within the app that allow for free withdrawals.

Header |  | ||

|---|---|---|---|

Rating | |||

Interest Rate | 0.20% | 4.65% | Up to 0.61% |

Monthly Fees | $0 | $0 | $0 |

Min Deposit | $0 | $100 | $250 |

ATM Access | 55,000 Fee-Free ATMs | Fee Refunds (Up to $30/month) | Fee Refunds (Unlimited) |

FDIC Insured | |||

Cell |

How Do I Open An Account?

You can visit the Yotta website to open an account. You'll need your date of birth, phone number, street address, and social security number. The information requested by Yotta is similar to what you'll find on most banking applications.

Is My Money Safe?

Yes — deposited funds have “pass-through” FDIC insurance up to $250,000. Pass-through FDIC insurance is not technically the same as direct FDIC insurance that depositors get at most large banks. For practical purposes, though, they are basically the same.

As long as Yotta continues to meet the pass-through requirements, depositors will be protected. Yotta uses Plaid to link your bank account to the app which is an industry-standard service.

Why Should You Trust Us?

The College Investor has been actively tracking the best savings account rates since 2018, with a daily updated list that monitors roughly 50 banks and credit unions that have a history of great rates. But we also are always scouting out other banks that may compete on this list.

Unlike other well-known companies who create "best savings account rate lists", we strive to put out rates in order highest to lowest so that you can know you're actually getting the best rate. And if you don't make the cut, too bad. You can find the full list of our bank review here.

Who Is This For And Is It Worth It?

Yes, the base rewards rate at Yotta is already nearly 3x higher than the national average interest rate on savings accounts. Plus, those who can deposit several thousand dollars will earn quite a few lottery tickets which could lead to a much higher effective rewards rate.

But perhaps the biggest potential benefit of Yotta is that it could simply make the act of savings fun. And if the potential to earn prizes would motivate you to increase your savings rate, that's a huge win in and of itself.

There really isn't any major drawback to using Yotta. There are no account minimums or fees. But if if participating in weekly drawings doesn't sound like your thing, you may be better off looking for a traditional savings account that offers a higher base interest rate. See our favorite high-yield savings accounts >>>

Account Types | Savings |

Minimum Deposit | $0 |

Base Rewards Rate | 0.20% |

Weekly Prizes | $0.01 to $10 million |

Tickets Earned Per Dollar Saved | Up to $10,000: One weekly ticket per $25 Above $10,000: One weekly ticket per $150 |

Tickets Earned Per Dollar Spent (Using the Yotta Debit Card) | 1 ticket per $10 |

Maintenance Fees | None |

Overdraft Fees | None |

Withdrawal Frequency Limit | 6 times per month |

Withdrawal Amount Limit |

|

Branches | None (online-only) |

ATM Availability | 55,000 Fee-Free ATMs |

Customer Service Number | (844) 945-3449 |

Customer Service Email | support@withyotta.com |

Mobile App Availability | iOS and Android |

FDIC Certificate | 1299 (through Evolve Bank & Trust) |

Promotions | 100 bonus tickets for each friend you refer |

Yotta Review

-

Rewards Rate

-

Fees and Charges

-

Customer Service

-

Ease of Use

-

Tools and Resources

-

Products and Services

Overall

Summary

Yotta is a mobile app that pays monthly savings rewards to its customers and also gives them the chance to win weekly prizes.

Pros

- No monthly fees or account minimums

- Free weekly lottery to win prizes

- Always pays a 0.20% base rewards rate

Cons

- The base rate isn’t the highest available

- Doesn’t offer desktop account access (coming soon)

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak