Tax filing season is here, and there are expected to be close to 100 million personal tax returns filed in America this year (remember - some returns could be for married couples, some for singles, some for head of households). And with tax returns comes tax prep. And we wanted to know how people are preparing their returns, and more importantly how much they're paying.

The IRS estimates that 70% of people filing a tax return could qualify for free file. However, last year, only 4.2 million people used it. That means, most Americans are paying to prepare their taxes.

So, how much are Americans paying to file their taxes? And what services are they using? Does it vary based on how much you make or filing status?

We commissioned a survey of 1,200 Americans across tax brackets and filing status to find out. Here's what we discovered.

Key Findings

- The majority of Americans surveyed PAID to file their taxes. In fact, 58% paid $50 or more to file their federal tax return.

- Only 25% of those surveyed reported filing their federal tax return for free. And 32% of those requiring a state tax return reported filing it for free.

- Filing status mattered more than tax bracket when it comes to how much Americans pay for taxes. Those who filed single were much more likely to file taxes for free versus those who were married filing jointly or other tax filing status.

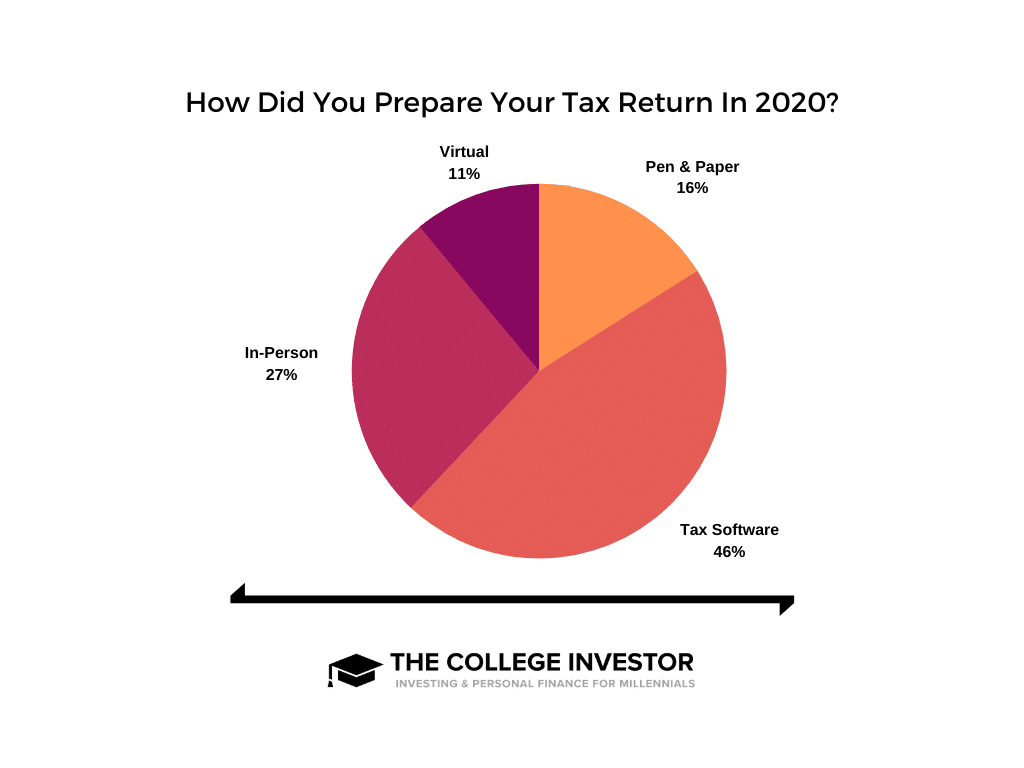

- 46% of Americans surveyed used tax software (like TurboTax) to file their taxes. A growing percentage (11%) used a full-service virtual tax service last year (such as Picnic Tax).

What Tax Preparation Looks Like In 2021

With those finding in mind, let's take a look at how people prepared their taxes. Then we can dive into the costs.

How Did Americans Prepare Their Taxes

Based on our survey, we found that 46% of Americans used tax software to file their taxes. 27% of Americans used a full-service in-person experience to file their taxes - typically a CPA or tax service.

Surprisingly, 16% of Americans still used pen and paper to file their return. And an up-and-coming trend of virtual tax preparation garnished 11% of respondents. We expect that number to grow this year.

What Tax Software Did Americans Use?

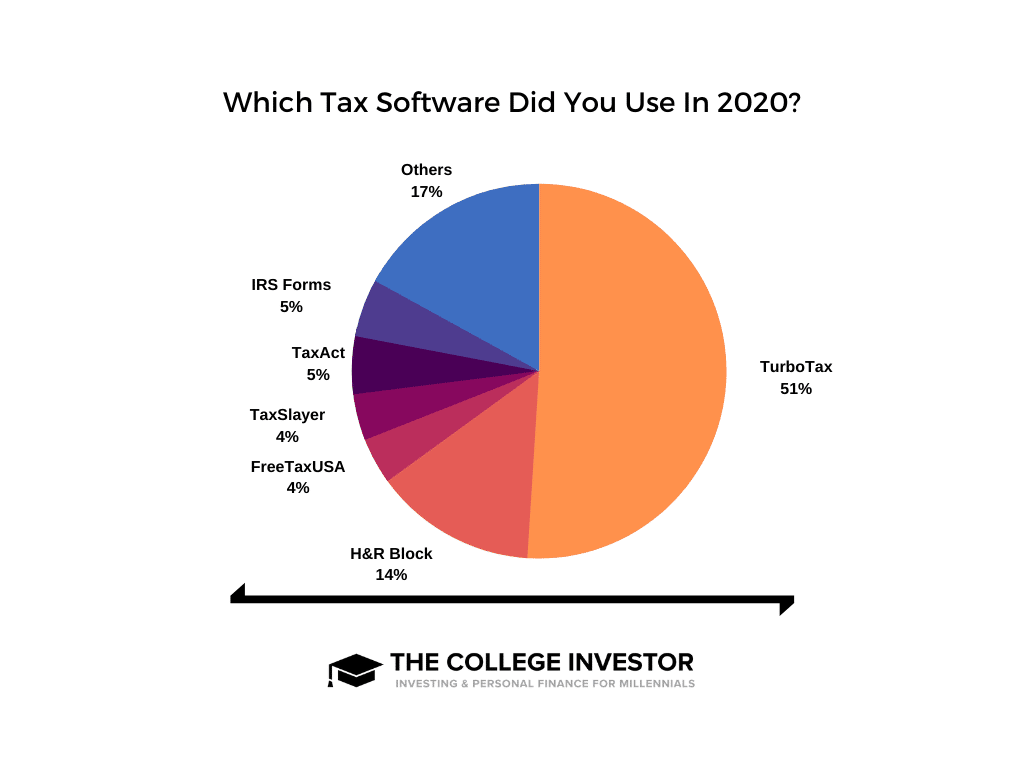

Given the popularity of tax software, we had to see which tax software Americans were using to file their tax returns. And by and large, TurboTax was the dominating winner - garnishing 51% of the total. H&R Block was second, but pretty far behind at just 14%.

Given there are over a dozen major and minor tax software companies in the market, there were quite a few in the 4-5% range, and many in the 1% or less range which we bucketed under "other".

It's also interesting to note that switching of tax software is not very common. In fact, 84% of those surveyed said they would be using the same tax software again. Only 4% said they would be for sure switching tax software this year.

What Matters When Selecting Tax Software?

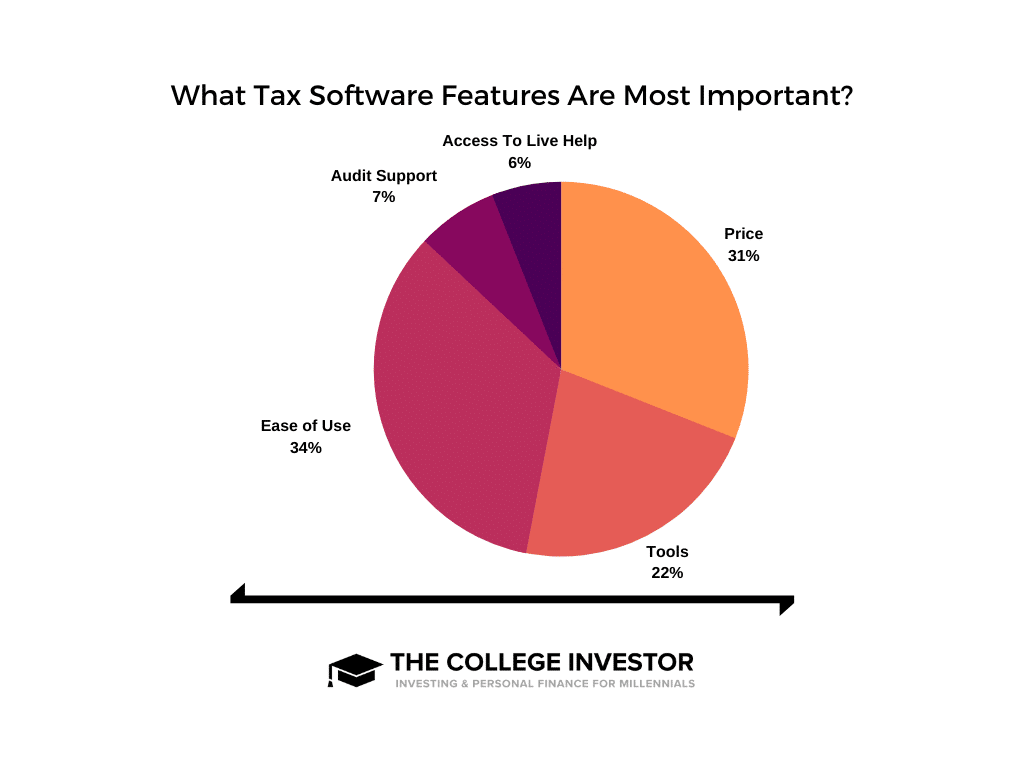

So, why did Americans choose the tax software they did? It's not just about price. In fact, the biggest factor in selecting tax software was ease of use - which might make sense as to why TurboTax is consistently the leader. TurboTax has the easiest to use tax software, with H&R Block a close second.

Price was the second factor, followed by the tools and features a company had to make filing easy.

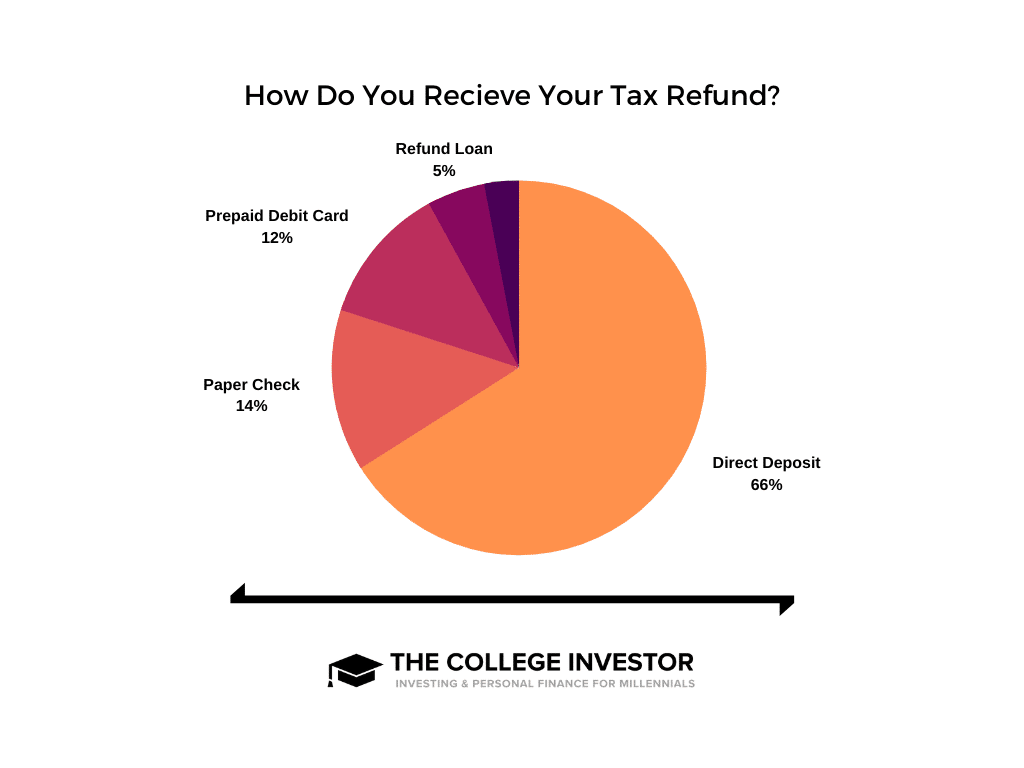

How Did Americans Receive Their Tax Refunds?

One of the more interesting aspects we looked at was how Americans receive their tax refunds. And while 66% of Americans opted for direct deposit, that means one-third chose another way to receive their money from Uncle Sam.

Of that one-third, 14% opted for a paper check and 12% opted for a prepaid debit card.

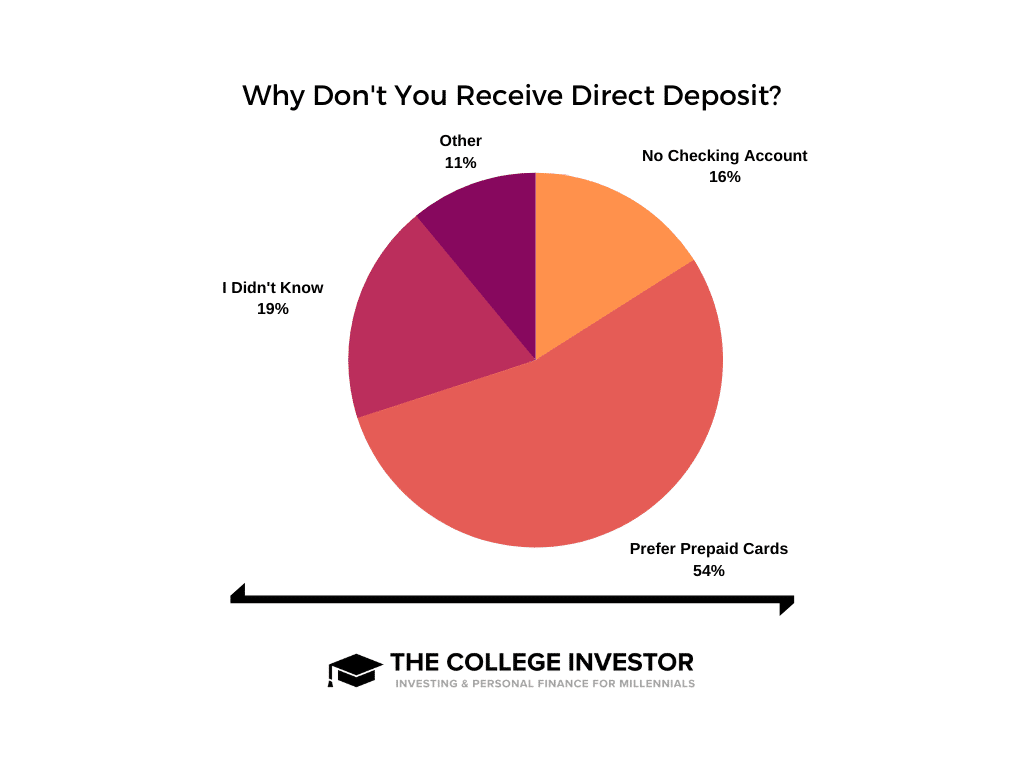

We asked that one-third why they didn't want to get a direct deposit, and there were some surprising answers.

54% of those surveyed simply preferred prepaid debit cards. Only 16% were unbanked and had no checking account.

But 19% said they didn't know because their tax preparer didn't tell them! That's a bit shocking.

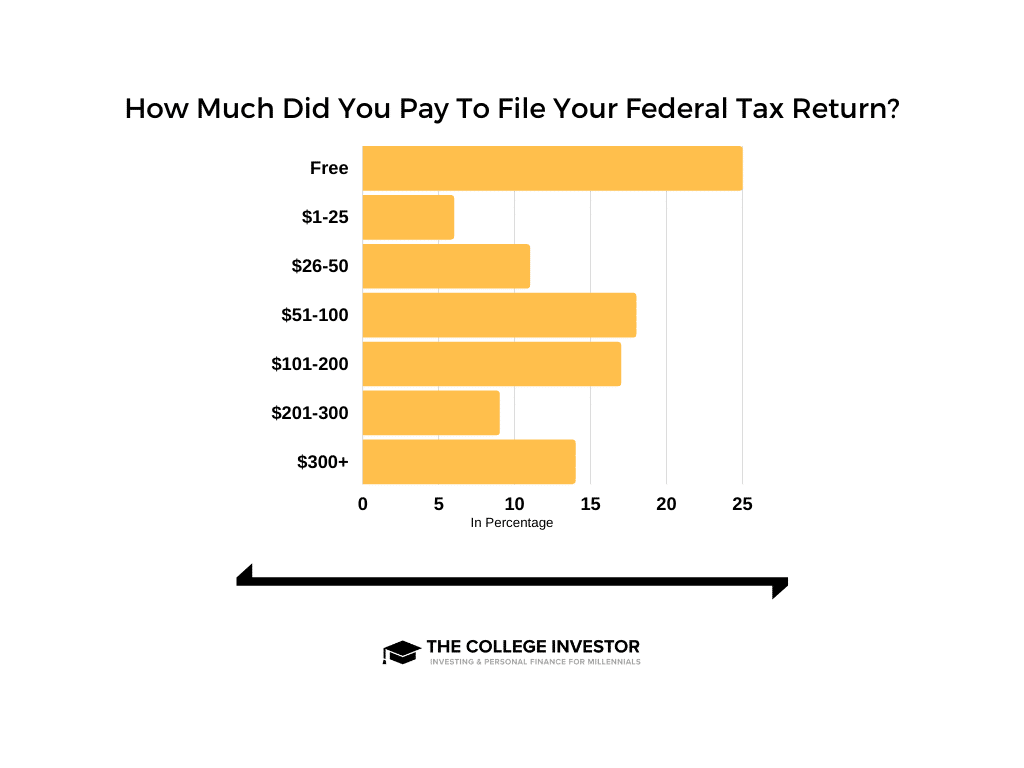

How Much Americans Paid To File Their Federal Tax Return

First, let's look at the overall picture of how much Americans paid to file their taxes. The hard part with taxes is that there is simply no "one-size-fits-all" approach. With different filing status, income streams, and more, the cost (and time) associated with tax prep can vary enormously. It's also one of the reasons why we can't just choose one best tax software; instead, we have a bunch of categories based on your needs.

With that in mind, here's how much Americans paid to file their taxes last year.

Overall Costs To File Taxes

Even though the IRS estimates 70% of people can file taxes for free, our survey found that only 25% of people filed their taxes for free.

In fact, 58% paid $50 or more to file their federal tax return.

Here's how it was broken down:

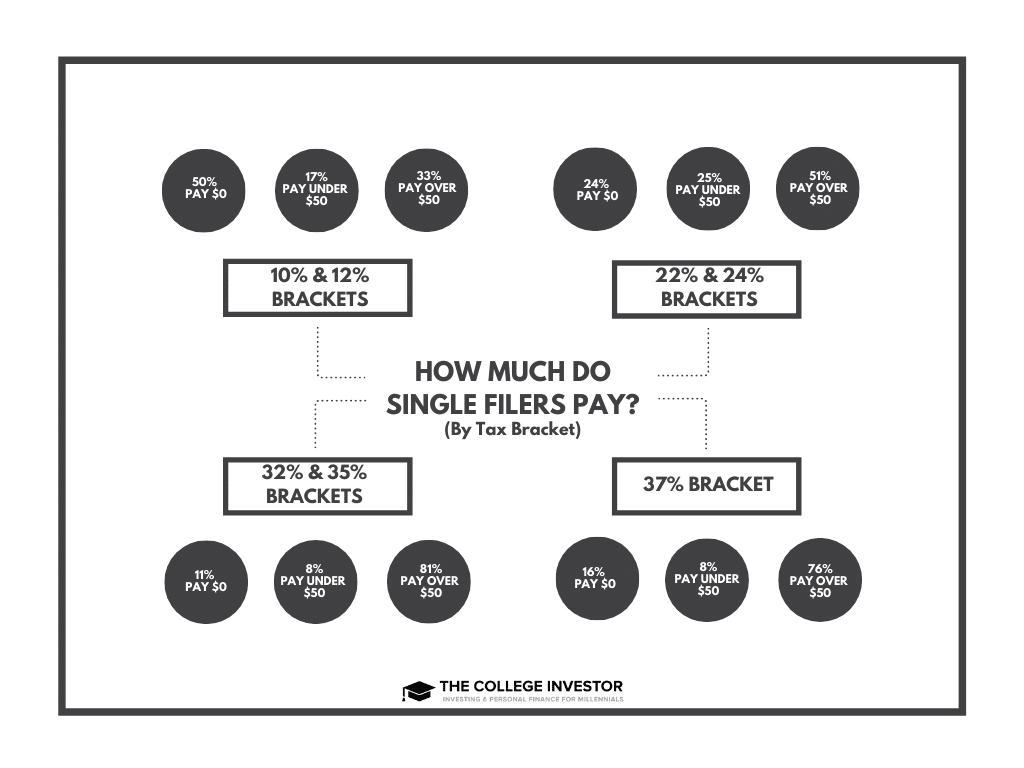

Do Tax Brackets And Filing Status Matter For Filing Costs?

We wanted to know how much a role tax brackets played in the cost to file taxes. Without looking at the numbers, you might assume that those in lower income brackets would pay less to file taxes, and those in higher tax brackets would pay more.

We also wanted to see how much of a role tax filing status played in the cost to file federal taxes. For example, would a single person pay less than a married couple filing jointly?

So, here is how much people paid at each bracket based on filing status:

As you can see, at lower brackets, more filers are filing their taxes for free. At the 10% and 12% tax brackets, 50% of single filers are paying $0 to file their federal tax return. By the time you get to the top tax bracket, you're down to 16% of people filing for free.

Remember, tax software like Credit Karma Tax allows free filing at all income levels - so it makes sense that some filers may still file for free at top tax brackets.

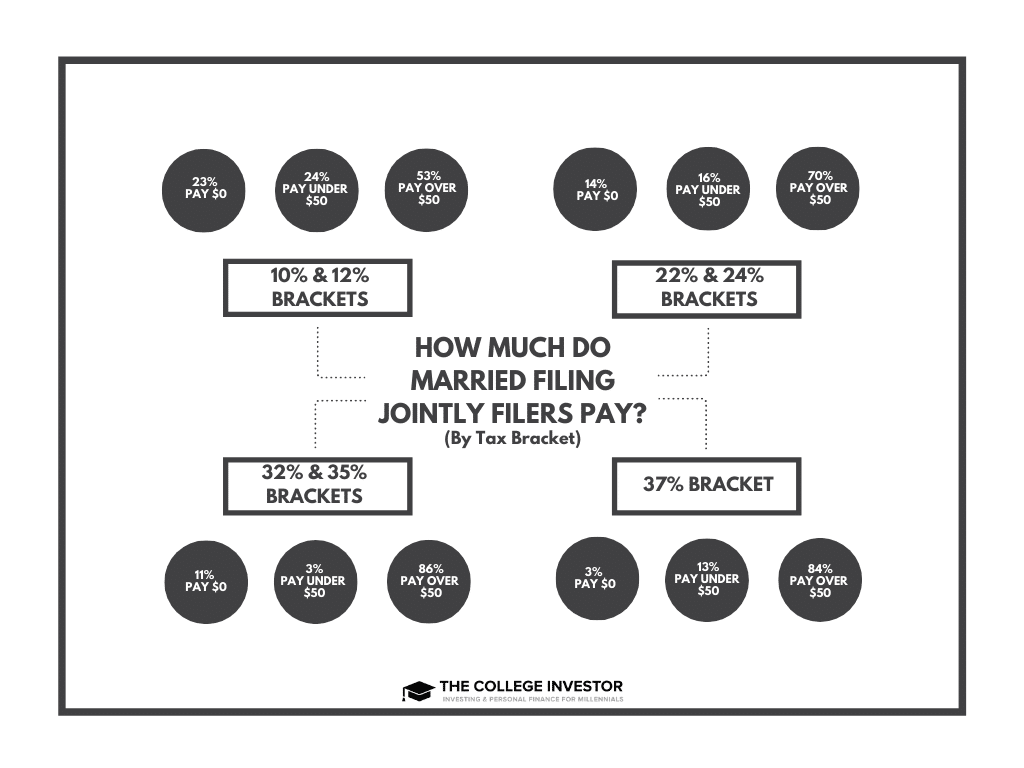

For taxpayers who file Married Filing Jointly, here's how it breaks down:

What's interesting here is that for couples in the lowest tax brackets, only 23% file their taxes for free. We think this has to do with the fact that many tax companies that advertise free tax software actually have a lot of "gotchas", such as making you move up to deluxe versions for certain tax credits or deductions.

We break down these "gotchas" in our list of the best free tax software. Married couples don't need to be paying more for their taxes, especially at lower income levels.

How Much Do Income Sources Matter?

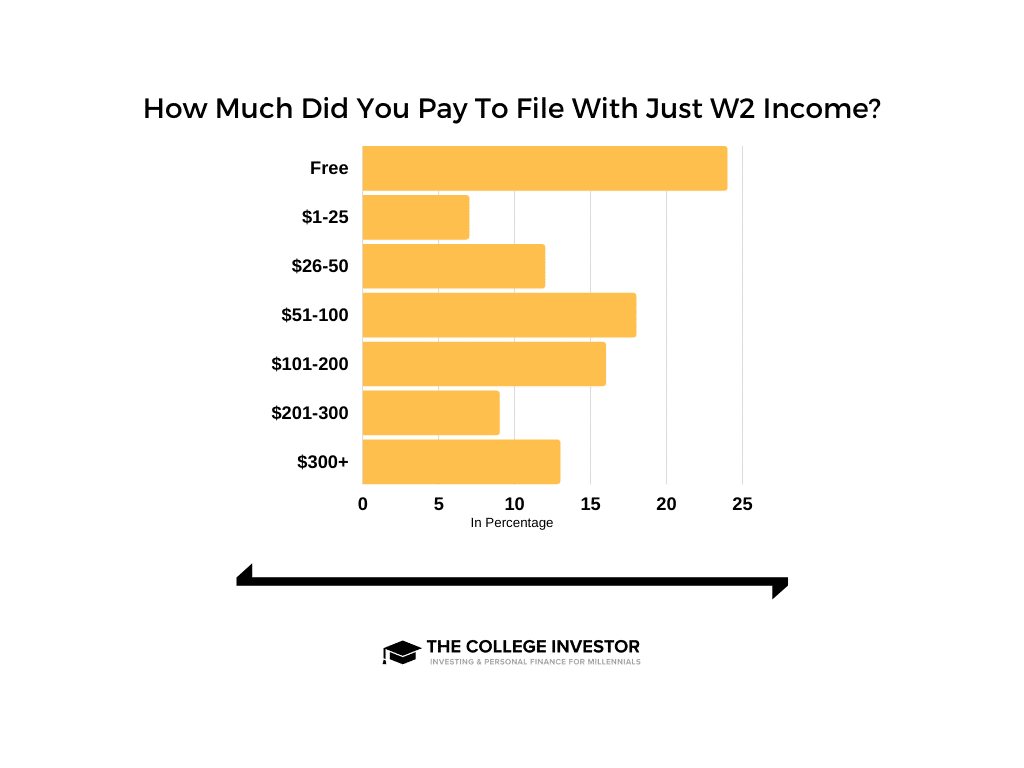

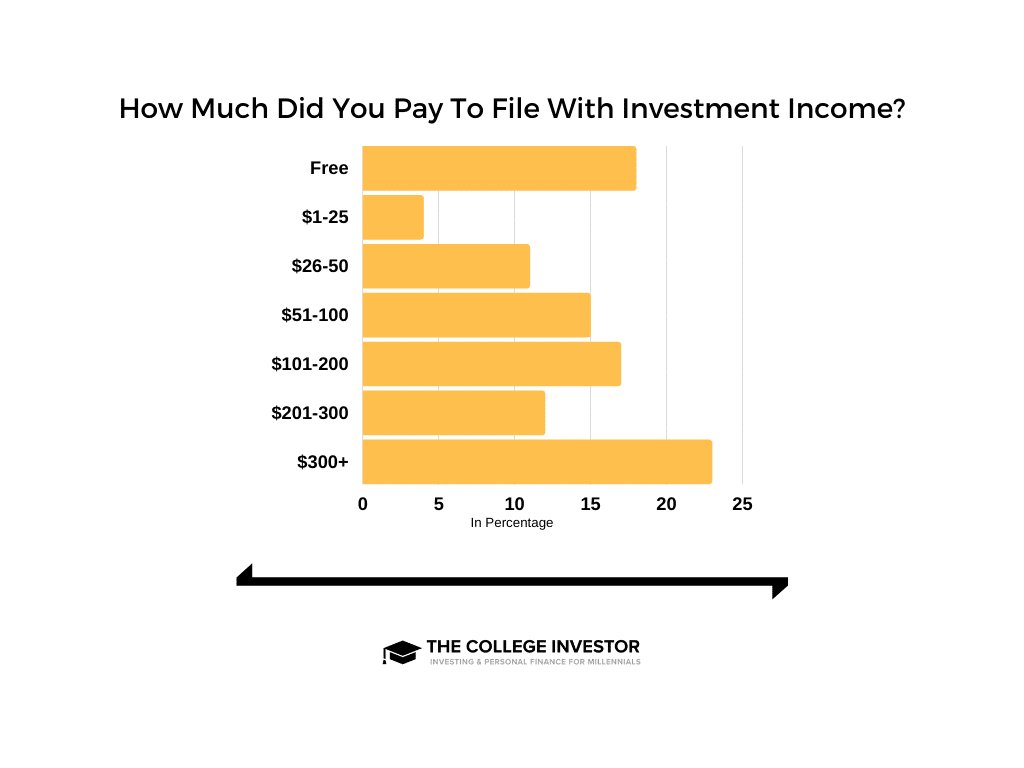

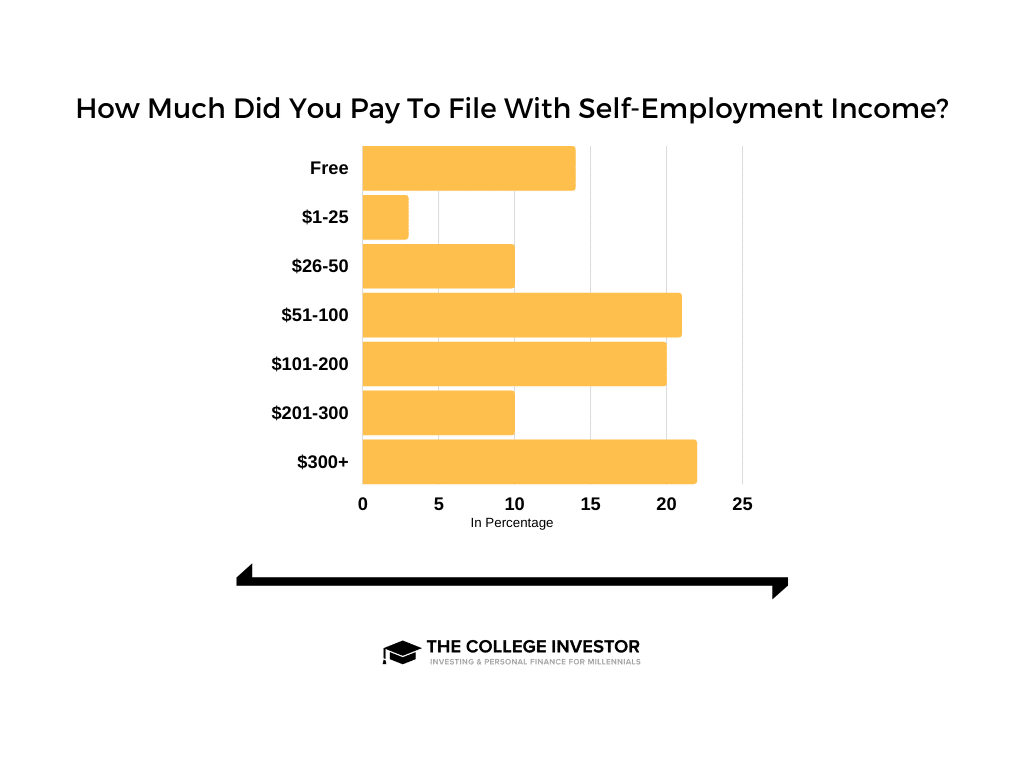

Finally, we wanted to examine how much income sources matter for tax filing costs. For example, does someone who only earns W2 wages pay less in taxes than someone who is self-employed.

The answer is yes, income sources matter a great deal in how much you pay. This is the primary way that tax software sets their pricing structure. As such, what income sources you have can dramatically change the price.

For example, 24% of those with only W2 income filed for free, with 18% paying between $51 and $100.

When you add investment income to your tax return, the cost Americans are paying to file goes up dramatically. With investment income, only 18% filed their tax return for free.

Incredibly, 23% of Americans with investment income paid over $300 to file their federal tax return.

And those with self-employment income paid the most in taxes. Sadly, self-employment income also refers to people who work in the gig economy, which can result into surprises for those who are filing taxes as a gig worker for the first time.

Only 14% of those with self-employment income filed for free.

Meanwhile, 22% of Americans who responded to our survey as self-employed paid over $300 to file their federal tax return. And 30% paid between $101 and $300 to file their federal return.

It's statistics like this that make tax software companies like TaxSlayer a compelling offer, where they offer all self-employment forms and assistance for low prices.

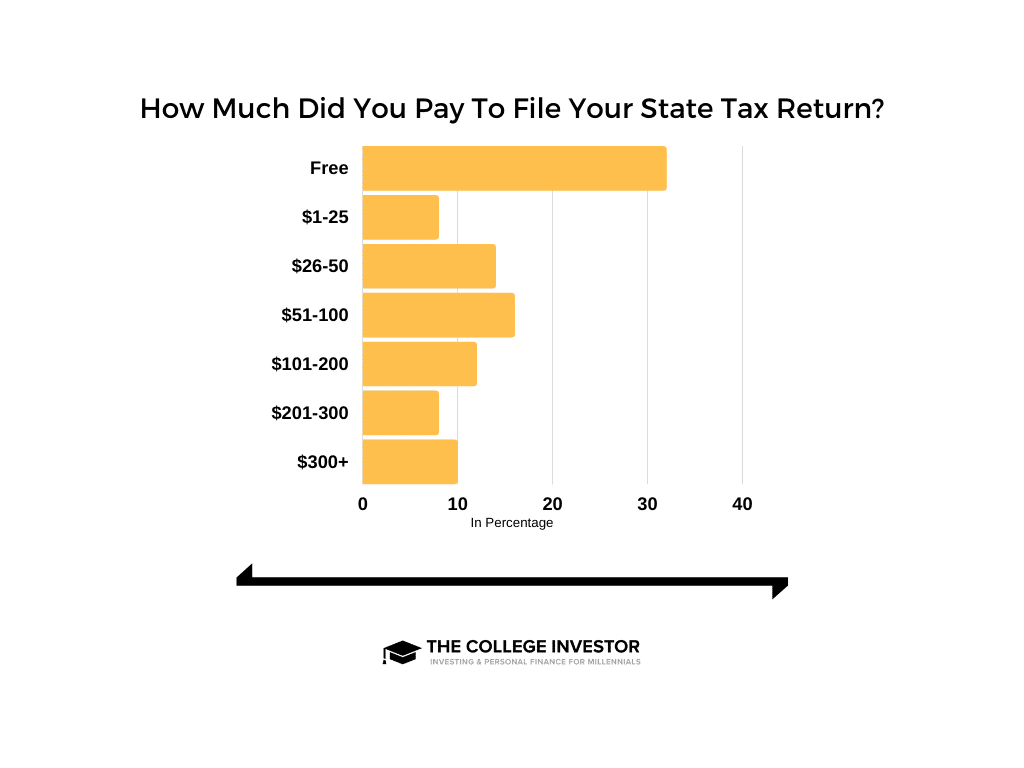

How Much Americans Paid To File Their State Tax Return

Finally, we wanted to see how much Americans paid to file their state tax return. 43 states require you to file a state tax return. And there are two states that may require you to file a tax return (hello Tennessee and New Hampshire, who only have taxes on investment income, but not earned income).

And while most of these states that do require you to file a tax return have free file programs, most tax payers still end up paying to file their taxes.

On the state level, 32% of tax filers filed their taxes for free. It's important to note, though, that this also includes taxpayers that "bundled' their federal and state returns - essentially making the state free.

83% of taxpayers on the state-level paid less than $100 to file their taxes in 2020. 51% paid between $1 and $99.

Here's how it was broken down:

Final Thoughts

I was shocked that only 25% of Americans reported filing taxes for free in our survey, especially given the expansion of robust free file tax software options.

I was also shocked by the gap in married filing jointly couples that aren't filing their taxes for free versus other cohorts. This tells me that they are definitely falling into "gotcha" traps setup by tax filing companies who force you to upgrade once you start the process.

There also appears to be an interesting gap in pricing, with not many people paying under $25 to file, when companies like FreeTaxUSA fall into that range. It seems to reflect the adoption of these services compared to the behemoth that is TurboTax.

I was also shocked by the results of how people choose to receive their refund. Given that some people don't have checking accounts and many prefer direct debit, I think there is a big opportunity to target these unbanked people with free checking accounts. I would expect to see more banking partnerships from tax software companies in the future.

Methodology

The College Investor commissioned Pollfish to conduct an online survey of 1,200 Americans. The survey was fielded February 4, 2021.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak