eToro is an investing platform that allows investors to trade stocks, ETFs, cryptocurrency, commodities, and more. In the United States, only stocks and crypto assets are available.

As a a "social trading" platform, eToro makes it easy for investors to copy the trades of other top traders on the platform.

Whether you're looking to get involved with Bitcoin investing or you'd like to learn strategies from experienced traders, eToro could be a great way to diversify your investments and expand your knowledge. Learn more about eToro in our full review below!

See how eToro compares to the best cryptocurrency investing platforms here.

Promo: Right now, eToro is giving you a bonus of $10 if you trade $100 in eligible assets. This offer is available for US users only. Learn more here >>

Securities trading offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. The College Investor may be compensated if you access certain products or services offered by the MSB and/or the BD.

eToro Details | |

|---|---|

Product Name | eToro |

Min Invesment | $10 |

Trading Fees | Stocks and ETFs: 0% Crypto: 1.00% |

Account Type | Taxable |

Promotions | $10 Bonus |

Who Is eToro?

eToro (eToro USA Ltd.) is a cryptocurrency, social trading platform. Its co-founder & CEO is Yoni Assia. The company was founded in 2007 and is located in Hoboken, NJ. It has registered offices in Cyprus, Israel, and the United Kingdom.

eToro is a private company. It’s last funding round was a $250 million round in 2023.

What Do They Offer?

We’ll be reviewing eToro's US platform. Until recently, US customers were limited to trading cryptocurrencies on eToro, but the company recently announced that it had expanded its US offerings to include stocks and ETFs.

Before you can begin using eToro, you must verify your account. Verification requires uploading proof of identity (POI) and proof of address (POA). You can use the eToro mobile app to upload documents.

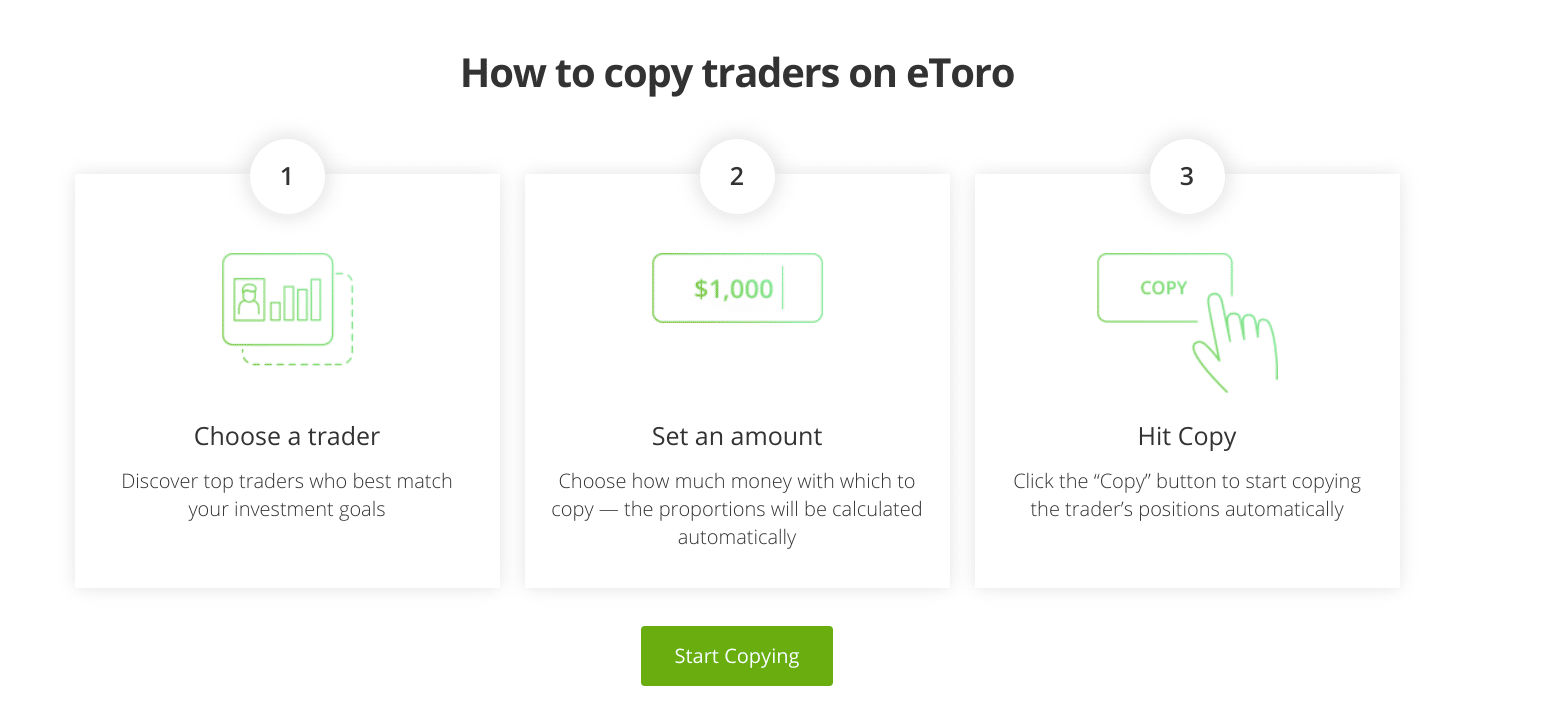

CopyTrader

A big attraction of eToro is its ability to copy trades in real-time. CopyTrader allows you to select a specific trader and copy all of their trades. This means the platform will automatically trade the same trades as your copied trader.

You can set the amount of funds to allocate to each CopyTrader. Additionally, you’ll be able to set stop losses so you can control drawdowns. Any positions that are open with the CopyTrader will be immediately opened for you.

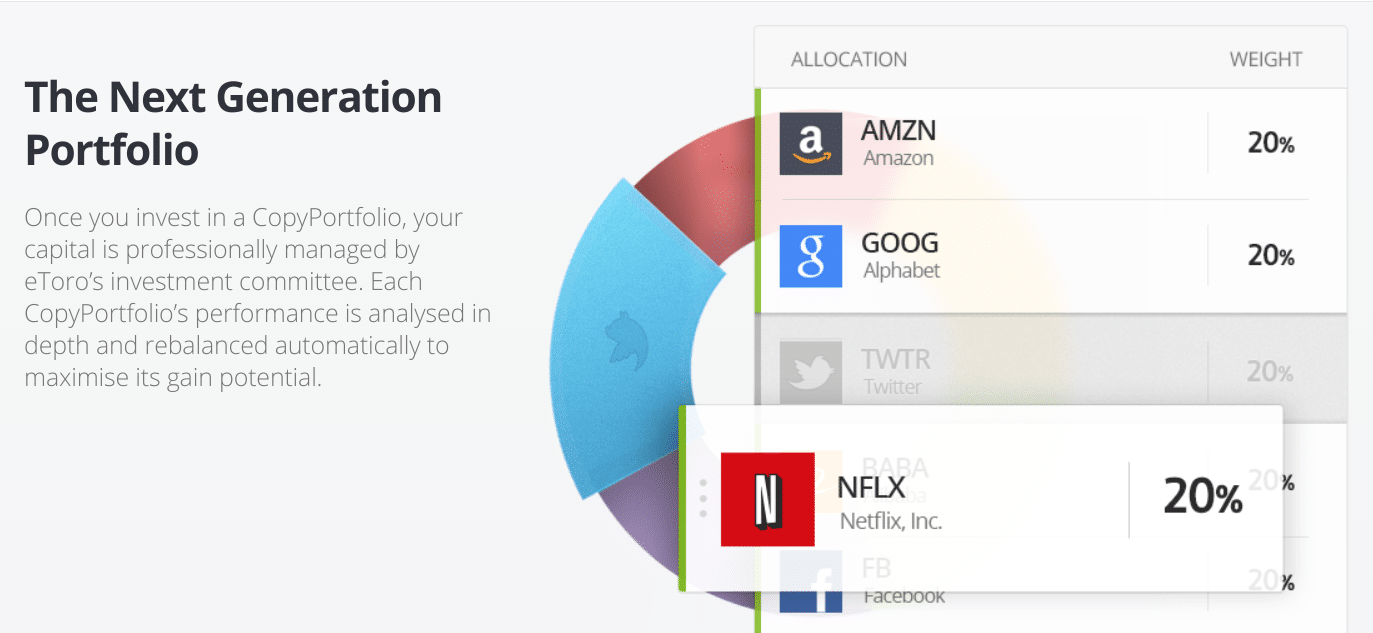

Investment Portfolios

Investment Portfolios works a lot like CopyTrader, except you get to copy an an entire portfolio of traders instead of just one at a time. eToro allows traders to invest in two different types of portfolios:

- Top Trader Portfolios: Copy the portfolios of the top performing and most sustainable traders

- Market Portfolios: Invest in portfolios that bundle together various investments.

These portfolios are managed through regular rebalancing. They can be an efficient way to diversify your cryptocurrency investments.

Risk Scores

When viewing a trader to copy on eToro, you can look at their performance. This includes monthly historical performance and drawdown information.

Another component of their performance is eToro’s risk score. Each traders is assigned a 1-10 risk score -- 1 being the least risky and 10 having the potential to blow up an account.

Supported Cryptos

eToro has been consistently adding to its asset list over time. It now supports just over 70 cryptocurrencies, including 17 of the most popular coins. You can see its full list of supported coins here.

You'll have the option to sell your assets for a few months, but this functionality will eventually go away as well. So the bottom line is if you're hoping to invest in or trade Cardano or TRON, you'll probably want to choose a different crypto exchange.

Fractional Share Investing In Stocks And ETFs

While eToro's EU customers have been able to trade stocks and ETFs for quite some time, this functionality wasn't available in the US until recently.

US customers now have access to commission-free investing of stocks and ETFs and can invest in fractions as little as $10. Get started here.

eToro securities trading offered by eToro USA Securities, Inc. (‘the BD”), member of FINRA and SIPC. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. The College Investor is an affiliate and may be compensated if you access certain products or services offered by the BD.

eToro Money Crypto Wallet

eToro's crypto wallet supports over 120 cryptocurrencies and allows users to change over 500 crypto pairs. Plus, it includes an "unlosable private key" feature that can help you recover lost funds.

In the United States, that's limited to 70+ cryptocurrencies.

Depositing And Withdrawing Money

eToro places a 7-day hold on deposits, which means funds can't be used for 7 days. There is a one day hold on withdrawals. After the hold, transfers can take another 3 days.

Oddly, wired-in funds can take up to 7 days to receive, making it far more cost-effective to simply transfer funds via ACH. Withdrawal minimums are $30 and your account must be in good standing (i.e., not in review) to complete any withdrawal.

Are There Any Fees?

Yes. While eToro does not charge flat trading commissions, they take a commission through a spread.

Right now, all cryptocurrencies have a 1.00% spread.. You can see spreads per cryptocurrency here.

Customers that need to convert to USD from another currency can expect additional fees than those listed for US customers. This is because eToro’s base currency is USD. Upon deposit, it converts any other currencies into USD. Conversion fees start at 50 Pips.

If you move your crypto from eToro's investment platform to your eToro crypto wallet, you'll be charged a crypto transfer fee of 0.50%. Non-USD withdrawals will incur a $5 fee and there is a minimum withdrawal of $30.

Related: These Are The Best Apps That Let You Invest For Free

eToro Bonus and Promotions

Right now, through December 31, 2024, eToro is offering a $10 bonus if you deposit and trade $100 worth of crypto-assets. This offer is only available to US users.

eToro USA LLC; Investments are subject to market risk, including the possible loss of principal.

How Does eToro Compare?

The social trading features that eToro offers are clearly what set it apart from other crypto exchanges. You'll be hard-pressed to find another company right now that can match its CopyTrading technology.

However, if getting access to the most supported cryptos or lowest fees is more important to you, you'll probably be better off choosing a different platform like Coinbase or Binance. Check out this quick table to see how eToro compares:

Header |  |  | |

|---|---|---|---|

Rating | |||

Trade Fee/Spread | 1.00% | Starting at 0.50% | Starting at 0.10% |

Supported Cryptos In The US | 70+ | 100+ | 50+ |

Copy Trading | |||

Cell |

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. The College Investor is an affiliate and may be compensated if you access certain products or services offered by the MSB.

How Do I Open An Account?

You can open an account at https://www.etoro.com. Once you've opened your account, you'll be required to verify your identity and proof of address before you can start making trades. eToro accepts the following types of identification:

- Valid (unexpired) US passport

- Valid (unexpired) Driver’s License

- Valid (unexpired) State ID

New account holders can use the eToro app to upload their identity and address verification documents directly to the platform.

Is My Money Safe?

Cash deposited with eToro is FDIC-insured up to $250,000, but there's no insurance for crypto deposits. Thankfully, eToro is a secure website and app that has never been successfully hacked as of writing. They also offer two-factor authentication for users who would like to add an extra layer of security to their accounts.

How Do I Contact eToro?

To get in touch with eToro support, you'll need to submit a support ticket here. Existing users can also access live chat support after logging in to their accounts. eToro doesn't publish a customer support number.

The majority of eToro's customer reviews online have been positive. The platform is currently rated 4.4/5 on Trustpilot out over 29,000 reviews.

Why Should You Trust Us?

We have been writing and researching cryptocurrency since 2016. We have been reviewing and testing all of the major cryptocurrency exchanges since 2017. Our team understands the crypto and NFT space, but also understands the intersection with TradFI (traditional finance). Our goal is to help bridge the gap between those in the cryptocurrency space, with those curious about it in the traditional finance space.

Furthermore, we have a compliance team that checks the accuracy of rates and service offerings regularly.

Is It Worth It?

If you're into cryptocurrency investing, eToro takes a unique approach in what you can do through interactions with others. The ability to follow a top-rated (on the eToro platform) trader and have the platform automatically trade the same trades is an interesting concept.

Just keep in mind that because a trader has done well in the past doesn’t mean they will continue doing so in the future. However, you can set limits on drawdowns and the amount of risk you’re willing to take. And using the CopyPortfolio feature is another way to diversify risk.

Plus, you can connect eToro with their own tracker Delta and manage all your accounts in one place.

If you are unsure about eToro, you can test drive it. Every user gets $100k in virtual currency, which you can put towards trying out CopyTrader. Just be sure to compare eToro's options and fees with other cryptocurrency exchanges like Coinbase, Binance, and Robinhood.

Check out our list of the Top 10 Most Popular Bitcoin And Crypto Investing Sites.

eToro FAQs

Here are a few common questions that we hear about eToro:

Does eToro support Shiba?

Yes, eToro added support for Shiba Inu in July 2021.

Can you invest in stocks on eToro?

Yes and you can invest in fractional shares of stocks and ETFs starting at $10.

Can you trade options on eToro?

No, the eToro platform doesn't currently support options trading.

Can you trade CFDs on eToro?

Yes, the company's CFD platform is regulated and offers up to 30x leverage. However, this is not available to US users.

eToro Features

Minimum Initial Deposit | $10 |

Investments | US investors are only able to trade cryptocurrency |

Trading Fees | Stocks: 0% Crypto: 1.00% |

Conversion Fees | Crypto-to-crypto conversion: 0.1% |

Crypto Transfer Fee | 0.50% |

Account Type | Taxable |

Coins Available To Trade | eToro has over 70 coins and tokens available in the United States, and many more worldwide |

Minimum Withdrawal | $30 |

Withdrawal Fee | $5 |

Hold On Deposits | 7 days |

Credit Card Deposits? | Yes |

Mobile Wallet Deposits? | Yes |

Demo Portfolios? | Yes |

Customer Service Options | Help center, support tickets, and live chat |

Customer Service Hours | 24 hour a day, Mon-Fri |

Mobile Apps | iOS and Android |

Web/Desktop Account Access | Yes |

Promotions | $10 Bonus |

Disclaimer

The College Investor is compensated if you access products or services offered by eToro USA LLC and/or eToro USA Securities Inc., as applicable. eToro USA LLC does not offer CFDs and makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication, which has been prepared by our partner utilizing publicly available non-entity-specific information about eToro.

eToro USA LLC; Investments are subject to market risk, including the possible loss of principal. This is not meant to be tax advice or financial advice of any kind. The above information we compiled from online tax forums. Please, consult a CPA or lawyer if you have questions about filing your tax return, forms to use, or what is/is not taxable. eToro is not a tax advisor.

Securities trading offered by eToro USA Securities, Inc. (“the BD”), member of FINRA and SIPC. Cryptocurrency offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. The College Investor may be compensated if you access certain products or services offered by the MSB and/or the BD.

eToro Review

-

Commissions And Fees

-

Ease Of Use

-

Customer Service

-

Investment Options

-

Tools And Resources

-

Specialty Services

Overall

Summary

eToro is a crypotocurrency investing platform that makes it easy to copy the trading strategies of top traders or portfolios of traders.

Pros

- Invest in crypto, stocks, and ETFs

- Copy other traders’ portfolios

- Buy, sell, or trade 7o+ tokens

Cons

- Trading fees may be higher than other platforms

- Other exchanges support more coins

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak