MoneyLion is a finance app that offers a suite of financial products and services all in one place.

By combining multiple financial products, they claim they can save you money - and their offerings are compelling.

Their core offering is RoarMoney℠ which give you access to early direct deposits, debit card rewards, price protection and more. See how they compare to other free checking account options.

In addition to its mobile banking services, MoneyLion also offers no-interest cash advances, ETF and crypto investing, and credit-builder loans. Check out the full details in our MoneyLion review below.

MoneyLion Details | |

|---|---|

Product Name | MoneyLion |

Min Account Balance | $0 |

Monthly Fees | RoarMoney and Invest: $1 Credit Builder Plus: $19.99 |

ATM Access | 55,000+ in-network ATMs |

Promotions | None |

Who Is MoneyLion?

MoneyLion was founded in 2013. They provide financial products such as a checking account, debit card, loans, and investing.

They claim to have saved people over $250 million in bank fees. MoneyLion also says that its customers have earned over $14 million in rewards.

MoneyLion’s checking accounts and debit cards are issued by MetaBank®, N.A., Member FDIC. The company is based in Sandy, UT with offices in New York City, San Francisco, and Kuala Lumpur.

What Do They Offer?

MoneyLion believes consumers should have access to all their necessary financial products in one place with minimal fees. With that in mind, it offers a wide array of products. We take a closer look at each of them below.

RoarMoney℠ Mobile Banking

MoneyLion's RoarMoney accounts offer early access to your direct deposit paycheck (up to two days early) and access to fee-free withdrawals at over 55,000 ATMs.

RoarMoney account holders can earn cash back on their debit card transactions in two ways. The first option is Shake ‘N’ Bank. This features allows you to earn cash back up to the full amount of your purchase each time you spend $10 or more just by shaking your phone. You'll also find more traditional cash back offers from top retailers inside the MoneyLion app.

Price Protection is also included with the The MoneyLion Debit Mastercard®. If you find a lower price within 90 days of making an eligible purchase, you can get a refund. You can receive up to $1,000 per year in Price Protections reimbursements.

Instacash℠ Advances

Instacash cash advances have a 0% APR and don't even charge convenience fees if you choose standard delivery times. You don't have to be a RoarMoney account holder to take advantage of this service either. You simply need to link a checking account.

To start, your limit will be $25. But if recurring deposits are detected in your linked checking account, your limit can increase up to $250. And if you switch your direct deposits into a RoarMoney account or you become a Credit Builder Plus member, your maximum credit limit will be $300. Your specific limit will be based on 30% of your recurring direct deposit amount for the pay cycle.

As mentioned above, Instacash advances are interest-free and fee-free for standard delivery. However, you can pay a one-time convenience fee for instant delivery. If the money is deposited into a RoarMoney account, the instant delivery fee is $3.99. For all other bank accounts, the fee is $4.99.

Investment Accounts

MoneyLion offers diversified portfolios of ETFs that members can automatically invest in. There are five different asset allocation options to choose from:

- Conservative portfolio

- Moderately conservative portfolio

- Moderate portfolio

- Moderately aggressive portfolio

- Aggressive portfolio

The company also offers thematic portfolios such as "technology innovation" or "social responsibility." You can set up recurring investments and/or use round ups to invest automatically.

MoneyLion charges a flat monthly fee of $1 for its investment accounts rather than charging a percentage of assets under management. This similar to other apps like Acorns and Stash. No commissions are charged on trades.

Credit-Builder Loans

MoneyLion’s offers loans with amounts of $500 to $1,000 and interest rates of 5.99% to 29.99% APR. These small loans are credit-builder loans which means that the money you pay will be available to you as a savings nest egg at the end of your payment term (minus fees and interest). Loan terms are 12 months and do not have any origination fees.

In addition to the interest charges, you'll need to pay a Credit Builder Plus membership fee of $19.99 per month. Note that if you also have a RoarMoney or investment account, the $1 monthly fees for these accounts are waived once you become a Credit Builder Plus member.

The membership fee is deducted from your checking account on each payday. This is done to ensure money is withdrawn only when it's most likely to be available in your checking account, helping to avoid potential overdrafts. If you're paid bi-monthly rather than monthly, the fee is split into two payments of $9.99.

See how this compares to the other best cash advance apps currently available.

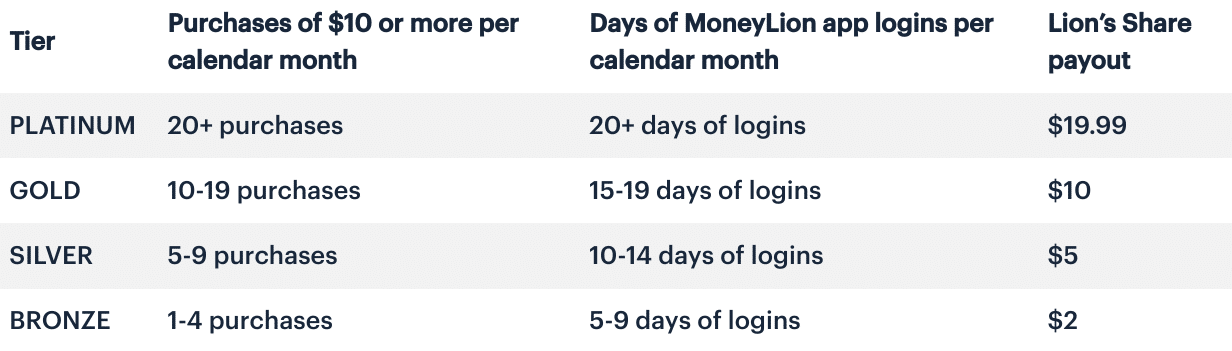

Through the Lion's Share Loyalty Program, you can reduce your monthly Plus fee (up to the full $19.99) just by logging into the app and making debit card purchases. The table below shows the requirements for each of the rewards tiers.

Note that you must meet both requirements to qualify for a specific tier. Let's say that you make 20+ purchases but only log in to the app 10-14 times during a particular month. In this case, you'd fall within the Silver range ($5 of rewards) even though your number of purchases made falls within the Platinum tier.

MoneyLion Crypto

MoneyLion recently added crypto support to its list of offerings. However, right now MoneyLion Crypto only supports Bitcoin and Ethereum transactions. You can also set your debit card round ups to invest in either of these cryptocurrencies.

MoneyLion uses Zero Hash to route its crypto trades. Zero Hash will charge a spread on each transaction, however there's no defined spread schedule. You'll want to check the exchange rate on your order confirmation page before placing a trade to make sure that the fees are reasonable.

Are There Any Fees?

Yes — RoarMoney and investment accounts have $1/mo fees. These fees are waived for Credit Builder Plus members, but Plus membership comes with its own $19.99/month fee (although this fee can be fully reimbursed through earning loyalty rewards).

There is a $2.50 fee for out-of-network ATM withdrawals plus the financial institution’s fee. Cash deposit fees will vary by retailer but can be as high as $4.95. However, there's no foreign transaction fee for using your debit card abroad.

How Does MoneyLion Compare?

MoneyLion isn't the only company that uses a subscription-based pricing model and offers a variety of financial products. Acorns and Stash fit this description as well. However, neither of those companies offer credit-builder loans or crypto investments. Here's a quick look at how MoneyLion compares:

Header |  | ||

|---|---|---|---|

Rating | |||

Monthly Fees | $1 or $19.99 | $3 or $5 | $1 to $9 |

Banking | |||

Managed ETF Portfolios | |||

Crypto Trading | |||

Credit-Builder Loans | |||

Cell |

How Do I Open An Account?

You can visit here to open an account. You'll need to verify your identity. To do this, you'll be asked to provide a few pieces of personal information, including your birthday, home address, and Social Security number.

You must be a U.S. resident and at least 18 years of age to be eligible to open a RoarMoney account. Once your account has been created, you'll be able to link an external bank account to make your initial deposit.

Is My Money Safe?

MoneyLion uses encryption on its website and app. They also monitor their site and database 24/7 for any threats. The MoneyLion app also provides real-time transaction alerts and the ability to lock a stolen card.

MoneyLion has strict privacy and information security practices. You can be sure your data is handled carefully and is secure. Your MoneyLion checking and debit card are FDIC-insured. Any investments are not insured and can result in a loss.

How Do I Contact MoneyLion?

MoneyLion doesn't have any local branches. However it offers 24/7 customer service by phone, email, or live chat. To get in touch by phone, you can call 888-704-6970.

Based on its glowing reviews online, it would appear that MoneyLion offers superior customer support. On Trustpilot, the company currently has an "Excellent" rating of 4.7/5 out of over 21,000 customer reviews.

Who Is This For And Is It Worth It?

MoneyLion offers a lot of perks such as interest-fee cash advances and widespread use of fee-free ATMs. You also have access to early direct deposits, cash back rewards, and investing. All of this makes MoneyLion a solid all-in-one financial app worth considering.

However, none of MoneyLion's core accounts (RoarMoney, Investing, or Credit Builder Plus) are fee-free. Also its Auto Invest and MoneyLion Crypto accounts both have limited asset support. So if you're willing to put up with the hassle of having to open up separate banking, brokerage, and crypto accounts, you can probably save money on fees plus access more features.

Finally, if you periodically find yourself in need of small loans to hold you over for a few months, the Plus membership may be what you need. Keep in mind that these loans are expensive and should be paid back as soon as possible.

MoneyLion FAQs

Here are a few of the most common questions that people ask about MoneyLion:

Does MoneyLion offer credit monitoring?

Yes, credit monitoring is included with Credit Builder Plus membership which costs $19.99 per month.

Can you cancel a Credit Plus membership early?

It doesn't appear so. MoneyLion says that the only way to cancel a Credit Plus membership without paying fees is to repay your Credit Builder Plus loan in full.

What is MoneyLion Overtime?

Overtime is a soon-to-launch MoneyLion feature that will allow users to borrow $50 – $600 in zero-fee installment loans that are paid back over four payments.

Is MoneyLion running any promotions?

Not right now, but we'll update this review if MoneyLion adds a signup cash bonus or other promotional offer in the future.

MoneyLion Features

Account Types |

|

Minimum Deposit | $0 |

Monthly Fees |

|

Supported Stock Market Assets |

|

Supported Crypto Assets |

|

Instacash Advance Amount | Up to $300 |

Instacash Advance APR | 0% |

Instacash Advance Delivery Fee |

|

Credit Builder Plus Loan Amounts | $500 to $1,000 |

Credit Builder Plus Loan Terms | 12 months |

Credit Builder Plus Loan APR | 5.99% to 29.99% |

Spread On Crypto Trades | Unclear |

Branches | None (online-only bank) |

ATM Availability | 55,000+ in-network ATMs |

Out-of-Network ATM Fee | $2.50 |

Cash Deposit Fee | Up to $4.95 |

Customer Service Number | 888-704-6970 |

Customer Service Hours | 24/7 availability |

Mobile App Availability | iOS and Android |

Bill Pay | Yes |

FDIC Certificate | 30776 (through Meta Bank, N.A.) |

Promotions | None |

MoneyLion Review

-

Pricing and Fees

-

Products and Services

-

Ease of Use

-

Investing Options

-

Customer Service

Overall

Summary

MoneyLion offers banking, no-interest cash advances, investing, and credit-builder loans. Check out the full details in our MoneyLion review below.

Pros

- All-in-one financial app

- Cash advances with 0% APR

- Access to 55,000+ fee-free ATMs

- Automatic investing with round ups

Cons

- $1/mo fee for banking and investing

- $19.99/mo for Credit Builder Plus

- Rates on credit-builder loans can be high

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Claire Tak