Buying a house when you have student loan debt can feel daunting. It can feel out of reach for many student loan borrowers.

How will the student loans affect your experience? Do you have Federal student loans on an income-driven repayment plan? Do you know how your lender is going to handle your debt to income ratio?

We’ve got some answers to your questions and some recommendations. This could make buying a house with student loans less intimidating.

Plus, you may want to check out our Home Buying 101 Guide here >>

Know What's Going On With Your Student Loans

Sounds simple, but you’d be surprised how many people don’t know precisely how much they owe and to whom. They don’t know what their payment plan options are. You might be one of those people. Getting ready to buy a home is a perfect excuse to get your loan situation together. This might be a deciding factor in your ability to buy a property.

Save For A Down Payment

Depending on the loan type you get, you may need a down payment. Even if you're getting a 0% down home loan, you still need something for fees - and lenders typically want to see you'll still have an emergency fund even after you close escrow.

A few tips to save for a down payment with your student loans:

- Earn more money - go side hustle and make some extra cash

- Get on an income-driven repayment plan

- Only pay the minimum on your loans

- Leverage a windfall

- Save automatically out of your paycheck

Talk To A Mortgage Lender

We assume you’re here because you need a mortgage. If you can pay all cash for your new home, congratulations on your good fortune! Your home buying process is much more straightforward. But for most people buying a home, a mortgage is necessary, so you need a lender. This can be anyone from a local loan officer in town to an online mortgage company located anywhere in the world. It’s a good idea to vet several potential lenders and find the one that works well with you.

When should you talk to your lender? Right away. You can contact a lender before you even talk to a real estate agent. In fact, we recommend it. That way you can get an accurate picture of your price range and not waste time looking at — or getting attached to — homes you couldn’t possibly afford.

Your lender can let you know what steps you need to take to be able to successfully secure a mortgage with their company. They should at the very minimum talk to you about how high your credit score should be, viable down payment amounts, and your debt-to-income (DTI) ratio.

Your debt-to-income ratio is the percentage of your gross monthly income that goes to repaying debts. You cannot have debt payment take up more than 43% of your income for most lenders to provide you with a mortgage. Even if you are able to make your student loan payments each month, if your DTI ratio is deemed too high, you’re out of the running. Be honest with your lender about what you will be able to afford and ask questions to make sure you’re not getting into something you can’t handle.

The mortgage lender might even pre-qualify or pre-approve you, in which they take a look at your finances and let you know much they will likely lend to you. While these are not guarantees of successfully getting a mortgage for a specific house — or guarantees you can actually afford the amount they approve you for — a pre-qual or pre-approval is a handy tool to have when putting an offer on a house. Sellers will know you are a serious buyer who has already been screened a bit.

Your lender can also introduce you to federal or state programs that provide specialized mortgages with lower down payments, grants for down payments, or other ways you can save money. For example, FHA and VA loans require a smaller or no down payment.

We recommend shopping around for a mortgage lender using a service like LendingTree. It takes a few minutes and you can see offers from multiple lenders in seconds. Check out LendingTree here.

FHA Loan Requirements and Student Loan DTI Calculations

DTI is still critically important for FHA loan approval. Once student loans are factored in, DTI requirements become more strict. Using the above example, the student loan monthly payment is $350. Let’s say the total outstanding loan amount is $50,000.

In 2021, President Biden made it easier for student loan borrowers to get an FHA Loan - by easing the requirements of how to calculate DTI for borrowers on income-driven repayment plans.

On the third page of the June 17, 2021 Student Loans document produced by the U.S. Department of Housing and Urban Development, it states the following (Editor's Note: Formatting has been modified from original document):

“(4) Calculation of Monthly Obligation

For outstanding student loans, regardless of the payment status, the Mortgagee must use either:

- the payment amount reported on the credit report or the actual documented payment, when the amount is above zero; or

- 0.5 percent of the outstanding balance on the loan; when the monthly payment reported on the Borrower's credit report is zero.

0.50% of $50,000 is $250. In this case, $250 will be used instead of $350. That brings total debt along with the $1,500 mortgage payment to $2,800 and DTI to 51%. 3% more doesn’t seem like much but depending on the difference between the monthly student loan payment and the 1% calculation, it could be enough to push DTI above what lenders are willing to accept.

“This can push the debt-to-income ratio to a level where purchasing a home with an FHA loan is out of reach until that balance is reduced,” Justin Derisley, vice president of mortgage lending with the Troy, Michigan, office of Guaranteed Rate, told MortgageLoan.com.

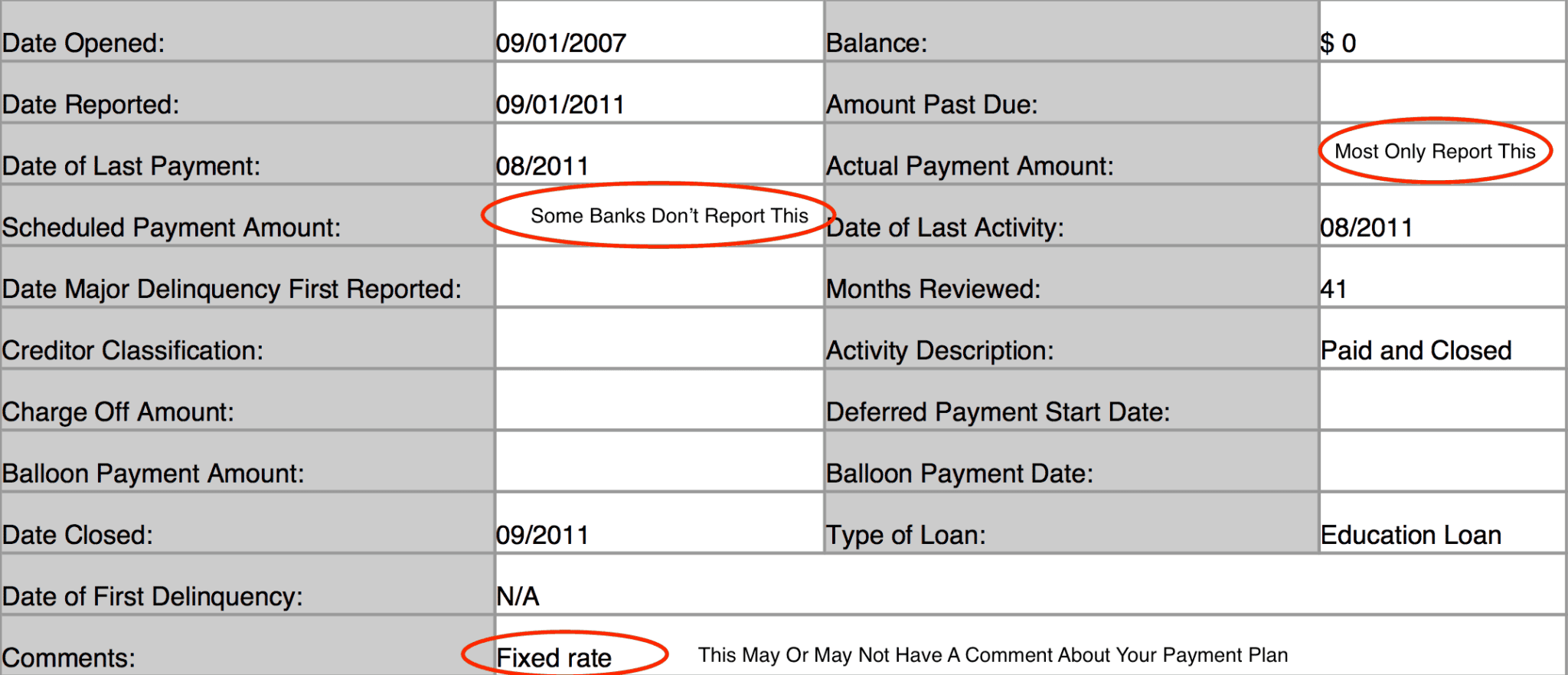

Here's what you're looking for on your credit report:

A few things:

- Many lenders only report the actual payment amount and if it was delinquent. As such, your “scheduled” payment amount may be blank

- I’ve also seen some banks put the Standard 10-year plan amount as the “scheduled” payment amount, and then the actual payment amount shows as less

- Some lenders put the payment plan in the comments, but most do not

Note: Just because this is the rule, each lender can have their own internal guidelines. Some lenders won't accept this. They will require a payment or use the 1% rule, or other variation.

Find Assistance Programs

As a student loan borrower or first time home buyer, you may be able to find assistance programs to help you buy your first home, or even help you with your student loans!

For example, Maryland has a really unique program called SmartBuyer, where they will put 15% of the purchase price of the home towards paying off any outstanding student loan balance. This can significantly improve your credit and debt-to-income ratio to be able to buy your first home!

Consider An Income-Driven Repayment Plan

Getting on an income-driven repayment plan for your federal student loans may help reduce your debt-to-income ratio. Emphasis on “may.” The reason is that lenders who follow Fannie Mae underwriting guidelines (i.e., most lenders) must use the payment amount that shows up on your credit report. The catch is that your IDR payment may not show up on your credit report. (See our post on credit reports, IBRs, and mortgages for a visual example.)

To understand better, say your monthly payment on the Standard repayment plan is $500 a month, but you can’t afford that so you enroll in an IDR that brings your payments down to $100 a month. If that $100 payment shows up on your credit report, the lender will use that to calculate your DTI ratio. You’re good to go! But if that $500 shows up on your credit report, they will use that — even if this number isn’t what you truly pay.

If no amount appears on your credit report, they must calculate the amount as 1% of your remaining loan balance. Or they can calculate a payment amount that, if paid over a 20 to 25 year period, would result in full repayment. This could be a lot higher than your IDR payment.

If your IDR payment is zero, however, the lender cannot use it to formulate your debt-to-income ratio and the other options will be utilized.

So, if you are on an IDR plan and it does show up on your credit report, that’s probably good for you. This may dramatically reduce the debt end of the debt-to-income equation, upping your chances of securing a mortgage. In fact, this may be the factor that makes or breaks your ability to buy a home.

Don't Change Your Repayment Plan

Your offer on a place got accepted? Thrilling, yes, but your journey in buying a home is far from over. Your lender still has to actually give you the loan. Even if you’re pre-approved, the lender must now go through their full underwriting process to verify you as a truly qualified borrower.

This process may unearth factors that were not previously apparent. With luck and your own truthful reporting, you will not run into any bad surprises. But sometimes people mess up their own chances, perhaps unknowingly. How? By making financial changes before their loan is secured.

A good lender and a good real estate agent will tell you repeatedly: no big purchases while in escrow. Don’t buy a new car or a new boat. Don’t finance that new set of furniture you’ve been eyeing for your new house. Don’t even buy a new TV.

As for your student loans, don’t change them up either. Keep paying as you were before on the same student loan repayment plan.

Don’t refinance if you have private loans. Don’t consolidate any of your loans, change up your payment plan on your federal loans, or remove any co-signers on any loan.

Why not? These might trigger your lender to recalculate your debt-to-income ratio and not fund your loan. Depending on where you are in the escrow process, you might be forced to cancel your contract and lose your deposit — a fate we’d all like to avoid.

You've Successfully Purchased Your Home - Now What?

You made it! Loan documents are signed, the contract is closed, and you have the keys to your new home. It’s a great feeling, but now you are embarking on a life as both a homeowner and a student loan debtor. So now what?

Whether you’re on an income-driven repayment plan, a Standard payment plan, or some other kind of repayment, if you are happy and stable with that plan, you can just keep paying your loan like normal.

If you are on an IDR payment and continue to need it, make sure you submit your yearly recertification of your income. If you don’t re-submit your income, you will revert to the Standard payment plan, which will drive up your monthly costs and may compromise your ability to pay your mortgage.

After six months of owning your home, Fannie Mae also provides guidelines for lenders to allow you to use your mortgage to pay student loans. The option is a student loan cash-out refinance. Similar to a regular cash-out refi, if your home has increased in value and you meet their requirements, you can refinance your mortgage for a larger loan. You can choose a new lender or the same one, if possible. The lender takes the difference between this new loan and your current loan, transforms it into cash, and directly applies it to your student loans.

You should only refinance your home if you are confident it’s a financially sound decision.

Closing Thoughts

Buying a home with student loans is not always easy. In fact, your ability to obtain a mortgage for a property could depend on your loans, resulting in some disappointment if your loans are not in good shape. But you have no chance to get that mortgage if you don’t assess your student loan picture and make sure you are taking all the necessary steps to be successful. Sometimes it won’t work, but having the knowledge to get there is the crucial first step of your journey to home ownership.

If you're not quite sure where to start or what to do, consider hiring a CFA to help you with your student loans. We recommend The Student Loan Planner to help you put together a solid financial plan for your student loan debt. Check out The Student Loan Planner here.

To reiterate, here are some things that might help with the home-buying process if you have student loans:

1. Enrolling in an IDR plan might jump start your home buying process by reducing your monthly expenses.

2. Look into federal or state programs that help home buyers save money.

3. Talk to your student loan lender or servicer. See if you can request that your servicer report your true IDR payment to the credit agencies. It never hurts to ask, and if you don’t, the answer will always be no.

4. Get a second or third opinion. Talk to more lenders to see if they will work with you. Each mortgage company does things a little differently. All of them have certain laws and regulations they have to follow, but they are flexible in other areas. Again, if you don’t ask, the answer will always be no.

If nothing works, delay your home goal a couple years as you get your student loans and other debt in order. This time might be used to bank away money for your down payment, seek a higher paying job, or reduce other kinds of debt that may be holding you back.

Are you looking to buy a home despite having student loan debt?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Colin Graves