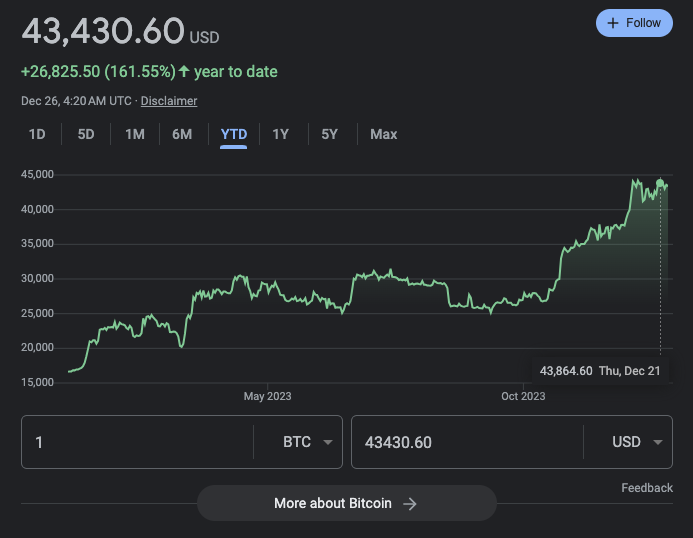

Since its inception in 2009, Bitcoin has rocketed in value from less than $1 per Bitcoin to a high of $69,000. And even when everyone thought bitcoin and crypto were dead, it rallied again in 2023.

With such astronomical gains and rising concerns over the fiat banking system, it’s no surprise that many investors still have their eyes on Bitcoin and other digital currencies in 2024.

Whether you want to support Bitcoin’s vision of decentralized finance, or simply are looking to diversify your portfolio with a powerful and promising asset, we’re here to help you in your investment journey.

Let’s talk about 3 ways you can invest in Bitcoin right now, and how it's easier than ever before.

What Is Bitcoin?

Bitcoin is a decentralized digital currency that was created in 2009 by an unknown individual or group of individuals under the pseudonym Satoshi Nakamoto. It is the first decentralized currency that operates without a central bank or single administrator, making it a peer-to-peer electronic currency system.

The history of Bitcoin began with the publication of a white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" in 2008 by Satoshi Nakamoto. The paper outlined the design and implementation of a decentralized digital currency that would operate on a blockchain, a distributed ledger technology that allows for secure and transparent transactions without the need for intermediaries.

The first Bitcoin transaction occurred on January 12, 2009, when Satoshi Nakamoto sent 10 bitcoins to Hal Finney, a computer programmer and one of the earliest adopters of Bitcoin. Over time, more people began to adopt Bitcoin as a means of payment and investment, leading to its growth in popularity and value.

In 2010, the first Bitcoin exchange, BitcoinMarket.com, was launched, enabling users to trade Bitcoin for fiat currencies like the US dollar. In the same year, the first Bitcoin ATM was also introduced in Vancouver, Canada, making it easier for people to buy and sell Bitcoin.

Since then, Bitcoin has undergone several significant events, such as the 2011 hack of the Mt. Gox exchange, which resulted in the loss of approximately 850,000 bitcoins. Despite this setback, Bitcoin continued to grow, with more merchants accepting it as a means of payment.

In 2013, the price of Bitcoin reached a high of $1,242, driven by increased interest from investors and the media. However, the price subsequently crashed, leading to a prolonged bear market that lasted until 2017.

In 2017, Bitcoin experienced another price surge, reaching a high of nearly $20,000 in December of that year. This was driven by increased demand from investors and speculators, as well as the launch of Bitcoin futures trading on the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE).

Bitcoin reached it all-time high (as of this writing) in 2021, hitting $68,789. However, it has since fallen off significantly. But even near the end of 2023, it's back over $43,000.

Since then, Bitcoin has continued to experience volatility in its price, but it has also gained wider acceptance as a means of payment and investment. Several major companies, such as Tesla and Square, have invested in Bitcoin, and more merchants are accepting it as a means of payment.

In fact, Michael Saylor, CEO of MicroStrategy, has said, "Bitcoin is a digital store of value, a hedge against inflation, and a payment system with low transaction fees."

Bitcoin has come a long way since its inception in 2009. It has gone from a digital currency with little value to a widely accepted means of payment and investment. Its history has been marked by significant events, both positive and negative, that have shaped its growth and adoption. However, despite its volatility, Bitcoin has shown resilience and has continued to attract interest from investors and the wider public.

Invest In Bitcoin Through Cryptocurrency Exchanges

Cryptocurrency exchanges are online platforms that allow users to buy and sell various cryptocurrencies, including Bitcoin. These exchanges provide a convenient way for investors to purchase and store Bitcoin, and offer a range of trading features and tools to help users manage their investments.

If you’re just getting started in your investment journey, or simply don’t have the time to delve into more intense investing methods, using an exchange may be best for you. It's an easy "on ramp" to start investing in crypto, as it works very similar to what you'll find at traditional brokerage firms like Fidelity.

Here are 4 quick steps you can take to invest in Bitcoin through an exchange:

1. Open an account at an exchange of your choosing

The first step is to open an exchange. Your options will vary by country, and while every exchange supports Bitcoin, if you want to invest in other cryptocurrencies in the future, make sure they are offered on your exchange.

You can see some of our top picks for best crypto exchanges here.

Note: Many exchanges require you to submit some form of ID to comply with anti-money laundering laws.

2. Deposit fiat currency

Next, you need to deposit your "fiat" currency. Fiat means money like dollar bills, Pounds, Euros, etc.

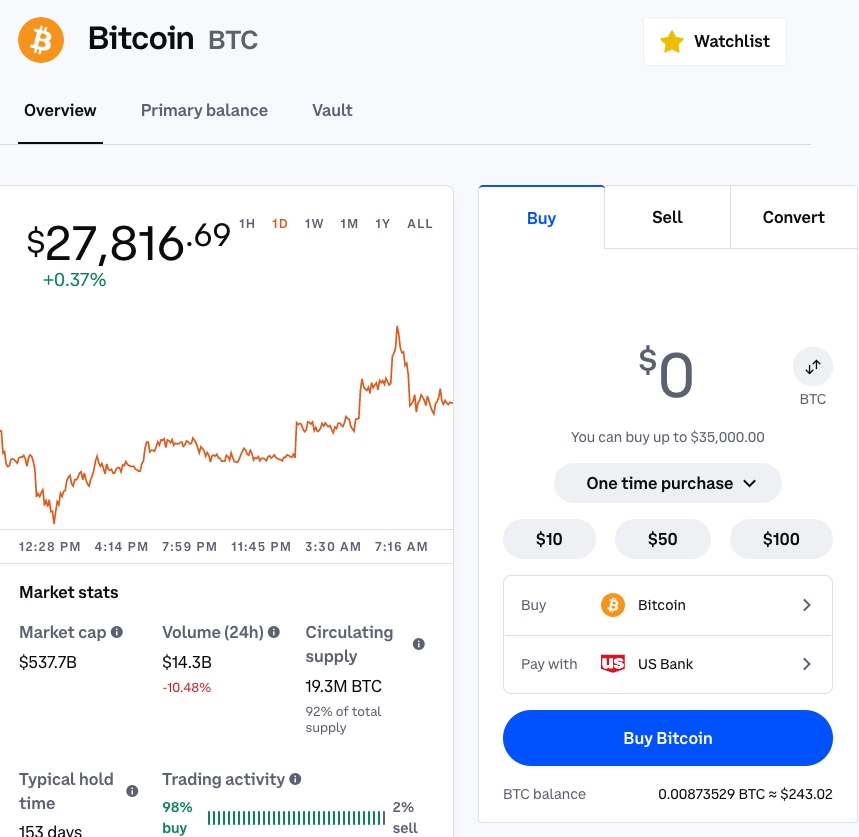

Most platforms let you start with as little as $10, letting you deposit through bank transfers, credit/debit cards, or electronic wallets such as PayPal.

3. Search for BTC

With your newly funded account, use your exchange’s search feature to find “BTC”, the ticker symbol for Bitcoin.

Most platforms also offer a variety of other cryptocurrencies to invest in, such as popular altcoins like Doge, Solana, Ethereum, and XRP.

Screenshot of how to buy Bitcoin on Coinbase

4. Invest

Using the exchange’s trading function, purchase your desired amount of Bitcoin. Consider strategies such as dollar-cost-averaging (DCA) – which means purchasing a set amount of Bitcoin at regular intervals, regardless of price.

Once your trade goes through, you’re now a proud Bitcoin holder. Congratulations!

Of course, exchanges aren’t the only way to invest.

Bitcoin Investment Funds

Bitcoin investment funds are a great way to gain exposure to cryptocurrency without having to purchase and store it yourself.

These funds are managed by professionals who invest in Bitcoin on behalf of their clients, with the goal of generating returns that outperform the overall market.

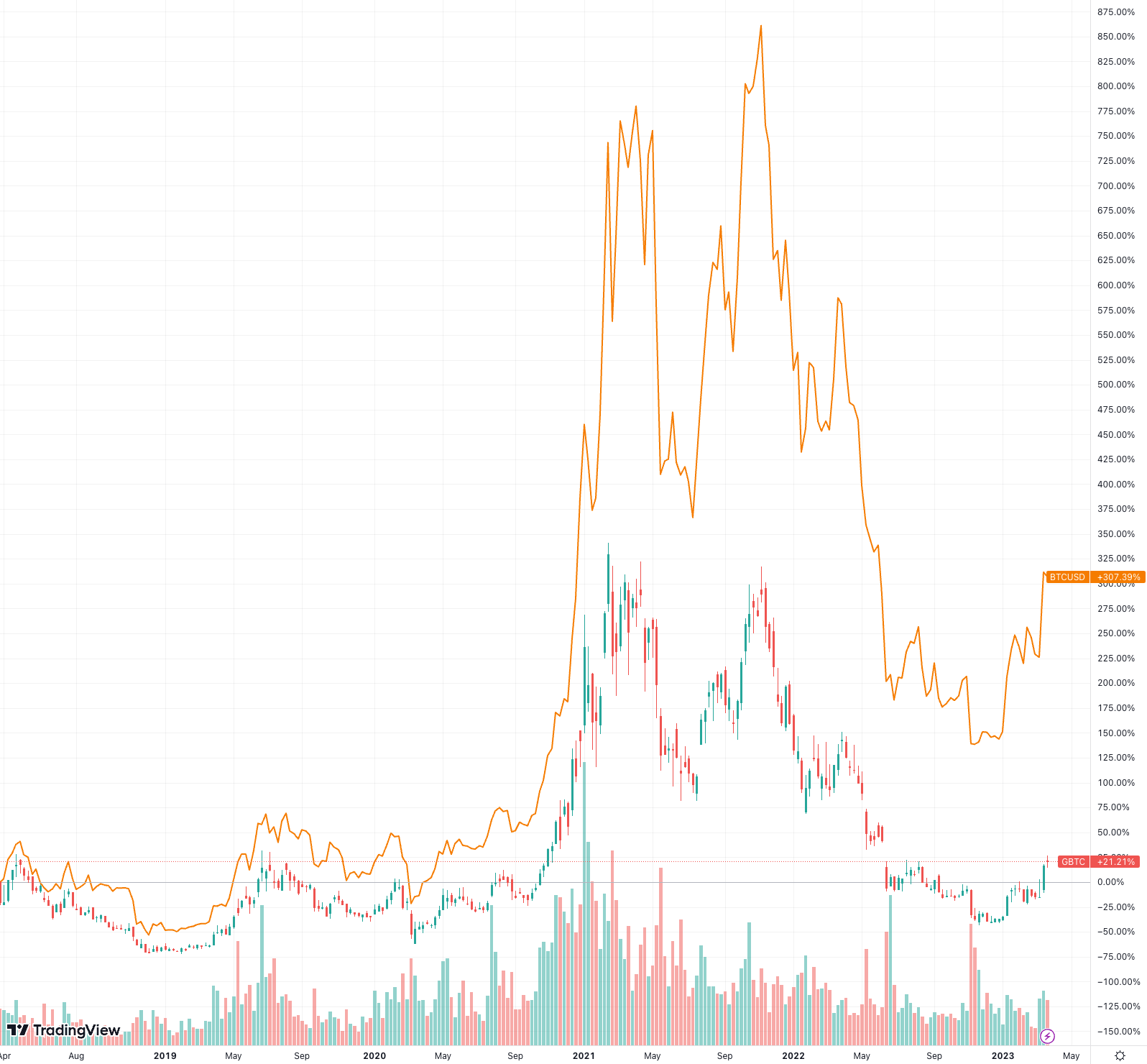

It's important to note that these funds invest via "contracts" or "futures", so they price may not actually reflect the exact price of Bitcoin. Also, the movement of the fund may not directly correlate as well. Here's a comparison of BTC vs. GBTC (a fund) over the last 5 years.

1. Exchange Traded Funds (ETFs)

Bitcoin ETFs are funds that are traded on exchanges like traditional stocks. These funds track the price of Bitcoin, providing investors with exposure to the cryptocurrency market. ETFs can be bought and sold easily, and their prices fluctuate throughout the trading day.

Bitcoin ETFs can be attractive to investors already familiar with stock market investing and prefer to have a diversified portfolio of stocks and cryptocurrencies. Additionally, Bitcoin ETFs may be suitable for investors who are looking for a way to invest in Bitcoin that is regulated by financial authorities, as ETFs are subject to regulatory oversight.

There are several ETFs on the marketplace:

- ProShares Bitcoin Strategy ETF (BITO)

- Valkyrie Bitcoin Strategy ETF (BTF)

- VanEck Bitcoin Strategy ETF (XBTF)

You can also short Bitcoin with ProShares Short Bitcoin ETF (BITI).

2. Bitcoin Trusts And Mutual Funds

These funds are managed by investment professionals who make decisions about which assets to invest in, and when to buy or sell them.

Trusts, such as Grayscale Bitcoin Trust, Osprey Bitcoin Trust, and others hold Bitcoin as their underlying asset. This allows investors to gain exposure to Bitcoin's potential returns without actually owning the cryptocurrency itself.

The trust's shares are traded on over-the-counter (OTC) markets, making them accessible to retail investors who may not have access to cryptocurrency exchanges.

Benefits Of Bitcoin Funds

- Diversification: Investing in a Bitcoin fund can diversify an investor's portfolio, as the fund may invest in other assets in addition to Bitcoin.

- Professional Management: Bitcoin funds are managed by experienced financial professionals with expertise in cryptocurrency markets.

- Accessibility: Investing in a Bitcoin fund is typically easier and more convenient than purchasing and storing Bitcoin yourself.

Risks Of Bitcoin Funds

- Volatility: Bitcoin is a highly volatile asset, and investing in a Bitcoin fund can expose investors to significant price fluctuations. Even with professional management, it’s important to remember that there is always the risk of losing funds.

- Fees: Bitcoin funds charge fees for management and administration, which can eat into returns.

Overall, investment funds might be a good choice if you value a hands-off strategy and the assurance that your money is in professional hands. Given the unique nature of investment funds, it’s always recommended to do as much research as possible before investing.

However, if you prefer to maintain ownership of your assets (or just want to invest long-term without worrying about fees) then you may want to consider a third option: Self-custody.

How To Use And Invest In Bitcoin Via Self-Custody

One major disadvantage to holding Bitcoin on an exchange or with an investment fund is that there is always the risk of dealing mismanagement by the custodian. And since exchanges often are not insured like banks, losses due to external factors may not always be recoverable. Just look at Celsius, BlockFi, and others.

That's why you may have heard the phrase "not your keys, not your crypto". Basically, if you don't own your crypto via self-custody, you don't truly own your crypto.

Crypto self-custody means you have complete control over your funds. Sending, receiving, and storing your Bitcoin and digital currencies are all done without any third-party involvement.

In a sense, you are your own bank.

Of course, it's important to note that self-custody requires a certain level of technical knowledge and responsibility, as there are risks involved in managing your own private keys. But if you’re looking for maximum control and security over your investments, here are 4 steps to get you started on the path of self-custody.

1. Get a wallet

There are lots of Bitcoin wallets to choose from, including desktop, mobile, and hardware wallets. Each has its own benefits and drawbacks in terms of security, accessibility, and ease of use. So you'll want to research and compare options to find one that best fits your needs.

We recommend that you get a hardware wallet for the most security. You can see some of our top picks of cryptocurrency wallets here.

2. Setup your Bitcoin wallet

Once you've chosen a wallet, you'll need to download and install it on your device or hardware. You'll also need to create a strong password and back up your wallet's seed phrase, a series of randomly-generated words used to recover your wallet in case of loss or damage.

It’s very important you store your seed phrase in a safe location. It’s estimated that some 3 million BTC have been lost, in many cases due to users being unable to access them.

NEVER SHARE YOUR SEED PHRASE

And ideally, never type your seed phrase into a computer, and never take a picture of it.

3. Purchase Bitcoin

The annoying part is you cannot simply buy Bitcoin using a self-custody wallet. If you're mining Bitcoin, or receiving it as payment, you can use this directly.

But, you still need an exchange if you're going to be using fiat currency. So, pick your favorite exchange above to make the initial purchase, and then you can transfer your Bitcoin.

Once you’ve set up your wallet, you’ll be given a unique Bitcoin address (a long series of letters and numbers) or a QR code that links to the wallet. Using this, you can transfer Bitcoin from an exchange to your self custody wallet.

4. Secure your Bitcoin

After you've purchased your Bitcoin, you'll want to ensure that it’s securely stored. Depending on your wallet, this may involve additional steps such as enabling two-factor authentication. For maximum security, we recommend a hardware wallet over software wallets.

Also, try to avoid text message (SMS) two-factor authentication. This can be hacked easily. Instead, use an app-based authenticator like Authy.

4 Different Bitcoin Investing Strategies

Now that you know how to buy it logistically, what type of Bitcoin investing strategies are there? Here are the four major ways to invest in bitcoin strategically.

1. Buy And Hold

The buy and hold strategy is the simplest and most popular strategy for investing in Bitcoin. The idea behind this strategy is to buy Bitcoin and hold it for the long term, with the expectation that its value will increase over time. This strategy is based on the assumption that Bitcoin will become more widely accepted as a means of payment and investment, leading to an increase in demand and value.

Pros | Header | Cons | Header |

|---|---|---|---|

The buy and hold strategy is simple and easy to implement. | The buy and hold strategy is not suitable for short-term investors or those looking for quick returns. | ||

It allows investors to benefit from long-term growth and appreciation in the value of Bitcoin. | Bitcoin's value can be volatile and subject to sudden fluctuations, which can lead to significant losses for investors. |

2. Dollar Cost Averaging

The dollar-cost averaging strategy involves investing a fixed amount of money in Bitcoin at regular intervals, regardless of its price. For example, an investor may choose to invest $100 in Bitcoin every month, regardless of whether its price has gone up or down. There are new tools like the Soon App that can help with this.

Pros | Header | Cons | Header |

|---|---|---|---|

The dollar-cost averaging strategy can help investors avoid the volatility and risk of trying to time the market. | The dollar-cost averaging strategy may not be suitable for investors looking for quick returns or those who believe that Bitcoin's price is likely to increase significantly in the short term. | ||

It can also help investors build a position in Bitcoin over time, without having to make a large upfront investment. | The strategy may also result in missed opportunities if Bitcoin's price suddenly spikes. |

3. Trading Strategy

The trading strategy involves buying and selling Bitcoin based on its price movements. Traders will often use technical analysis to identify patterns and trends in Bitcoin's price, in order to make informed decisions about when to buy or sell.

Pros | Header | Cons | Header |

|---|---|---|---|

The trading strategy can allow investors to take advantage of short-term price movements and generate quick returns. | Trading requires a significant amount of skill and knowledge, and can be very time-consuming. | ||

It can also help investors manage risk by setting stop-loss orders or other risk management tools. | It also involves a high level of risk, as Bitcoin's price can be unpredictable and subject to sudden fluctuations. |

4. Bitcoin Mining Strategy

The mining strategy involves using computing power to validate transactions on the Bitcoin network and earn rewards in the form of newly minted Bitcoin. This strategy requires a significant investment in hardware and electricity, and is typically only viable for large-scale operations.

Pros | Header | Cons | Header |

|---|---|---|---|

The mining strategy can provide investors with a steady stream of newly minted Bitcoin, which can be used for investment or other purposes. | The mining strategy requires a significant upfront investment in hardware and electricity, which can be expensive and time-consuming. | ||

It can also help investors support the Bitcoin network and its decentralized architecture. | The profitability of mining can be affected by factors such as Bitcoin's price, network difficulty, and the cost of electricity. |

Final Thoughts

Bitcoin can be a fantastic way to diversify your portfolio and potentially generate significant returns in 2023 and beyond.

With the variety of investment options we’ve discussed–self-custody, cryptocurrency exchanges, and investment funds–you’re sure to find a strategy that can meet your needs and risk tolerance.

As with any speculative asset, investors should always be sure to do proper research, and of course, never invest more than you can afford to lose. While Bitcoin could grow significantly, it could also go to $0.

But if you’re willing to educate yourself, explore your options, and make informed decisions, investing in Bitcoin in 2023 could be a chance to have a part in a rapidly growing market set to reshape the financial industry.

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Claire Tak Reviewed by: Chris Muller