As someone who spent her freshman year at the University of Alabama (UA), I know firsthand how costly simply attending two semesters of classes can be there. Add to that the experience of Greek life, and your social circle isn’t the only thing that suddenly expands.

Sorority hashtags and content exploded on social media, as universities eased Covid-19 restrictions and let students resume fall recruitment activities. This was especially true for UA, which is often used as the benchmark for recruitment across the country due to its size and funding.

Earlier this year, Max (formerly HBO Max) released a documentary that examines UA rush through a magnifying glass. Whether you’ve seen the documentary, enthusiastically followed the #BamaRush trend, or you’re simply curious about the price that’s paid for Greek life, this article is a good starting point for learning about the true costs of sorority recruitment.

I’ll break down the rush process, point out its main financial factors, and weigh the pros and cons of taking on Greek life.

Why Go Greek?

The purpose of Greek life on campus is noble enough: These organizations bring like-minded people together and allow them to explore new opportunities, give back to their community, and bond over shared commitments and responsibilities. Many find that the Greek system helps them build an identity on a large campus and, at the same time, form deep relationships with those who are in the same walk of life.

What Is Rushing?

Also referred to as “recruitment,” rushing is the journey that potential new members (or PNMs) embark on to meet with and be recruited by sororities in the hope that they’ll eventually be selected by one to join. During rush, PNMs meet with all participating sororities on campus to, essentially, be interviewed for how well they fit with the organization. The term “rushing” comes from the notion that sororities are rushing to show themselves as the best on campus and attract the best members.

Recruitment typically occurs in the fall and spring for many universities, with fall rush being the biggest recruitment period each year, mainly because it’s the start of the academic year. Some schools host recruitment a few weeks prior to classes starting, while others hold it shortly after classes have started. Either way, the typical rush cycle happens sometime between August and October each year.

Rounds Of Recruitment

During rush week, you’ll experience multiple themed rounds as you get to know each sorority and vice-versa. Rounds are often shorter at the start of the week and longer near the end, as sororities narrow their lists of PNMs and invite them in for a more intimate look at their sisterhood. Likewise, the number of houses a PNM visits lessens each day, as you also rank each sorority after interacting with them.

Here's what your week might look like:

- Day 1, Convocation: PNMs meet and learn about each sorority on campus. Note that sororities vote on their top candidates at the end of each round.

- Day 2, Philanthropy: PNMs learn about each chapter’s volunteer work and community involvement. This theme can sometimes extend for more than one night.

- Day 3, Sisterhood: PNMs get to know chapter members better through one-on-one conversations. These conversations are closely observed by other chapter members.

- Day 4, Preference Night: PNMs visit one to three of their favorite houses. This night is often the longest and most serious round, in which a chapter makes its final assessment of a PNM’s qualities, interest level, and compatibility.

- Day 5, Bid Day: This is the final day of recruitment. You’ll find out which sorority you matched with on Bid Day!

Qualities Of Interest During Recruitment

We all know sororities are assessing you based on what you bring to each visit. But what does that really mean? What’s most important to them? As you read through this list, keep in mind that it’s just as important that you assess how each chapter fits with your own interests.

Here are some sample questions you’ll want to be ready to answer:

- Where are you from?

- Why did you choose this school?

- Why are you interested in Greek life?

- What’s your major?

- What activities were you involved with during high school?

- What activities do you plan to get involved with on campus?

- What do you hope to get out of joining a sorority?

When you answer these questions, think about how your answers convey your personal qualities. Some of the top qualities sororities are interested in are:

- Commitment to school, revealed by your grades and college entrance exam scores

- Commitment to your community, which may be demonstrated by past volunteer experience

- Leadership ability, which may also be exhibited by past volunteer experience

- Positivity, evidenced by the tone of your conversation

- Interest in being involved, indicated by previous extracurriculars and future plans to stay engaged on campus.

The Cost of Rushing

@yourrichbff The cost of Bama rush! #college #student #school #university #studentloans #studentdebt #navient #major #bamarush #bama #bamarushtok #greeklife #bamarushweek ♬ original sound - Vivian | Your Rich BFF

Here’s a breakdown of each area you should be ready to spend money on in your first year of sorority life:

Clothing

If you’ve decided to go through recruitment, I hope you are ready to get “glammed to the gods.” Sorority OOTD (Outfit Of The Day) videos gained a lot of traction on #RushTok during the fall 2021 recruitment period, highlighting the lengths some PNMs go to in order to stand out.

The popular clothing brands worn by PNMs during recruitment come at a price. And trust me, you will feel pressured to be seen wearing the same brands as your peers. Favorite items include Altar’d State tops (about $35 to $80 or so); Kendra Scott jewelry ($40 to $200); Lily Pulitzer floral-print dresses ($100 to $300); and Steve Madden shoes ($50 to $350).

Remember those rush themes I mentioned? This is where they start to hit your bank account, because you are also expected to play the part and curate a themed outfit for each night of recruitment. The combined cost of rush clothing may come to about $450 for the week, assuming you borrow some items from friends and keep new purchases on the cheaper side.

Member Dues

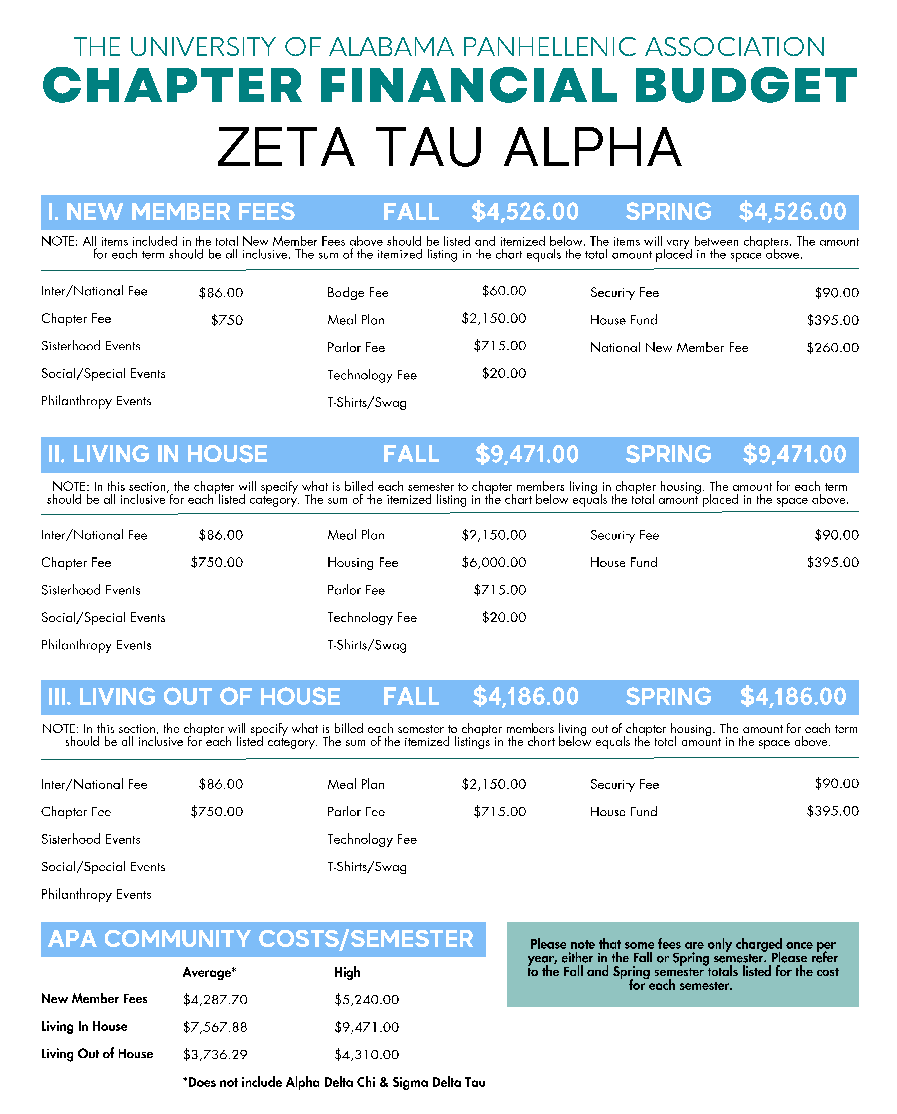

All members pay dues each semester, though these fees vary by the chapter you choose.

Expenses you should expect on an annual basis include chapter fees as well as room and board if you choose to live in the chapter house. One-time new member fees for pledging, initiation, and receiving your sorority pin increase first-year costs.

Average new member dues at UA for the 2023-2024 academic year are $4,165.59. Note that some chapters have scholarships or grants for members based on financial need or academic merit, though these are typically available for existing members only.

Want a breakdown of costs? See the financial budget below for one of the top-rated sororities at UA.

Housing

Regardless of whether you live in the chapter house or off campus, housing costs will add a substantial amount to your first-year expenses.

Note that living in a chapter house can potentially be more expensive than sharing a dorm or house with roommates elsewhere. However, living in-house also has the added benefit of being on or near campus, which creates ample social opportunities. And, perhaps most importantly, it gives you nearly all-day access to freshly prepared meals thanks to your chapter’s private chef.

Still, fees for living in-house during UA’s 2023-2024 academic year average $7,355.82 each semester. Compare that with the cost of living out-of-house, which averages $3,696.35 each semester. Should you choose not to live in-house, you are typically still required to pay for the chapter’s meal plan each term.

Miscellaneous

Don’t forget that there’s often a one-time, nonrefundable fee just to register for recruitment. At UA, that fee is $375, and it covers the cost of recruitment publications, use of campus facilities, transportation around campus, and a few recruitment T-shirts.

Adding up all the above expenses leads to an alarming result. All in all, you’re looking at an average new member cost of about $4,166 each semester, or $8,332 for your first year. After your first year, that total increases if you decide to live in the chapter house and decreases slightly if you choose to continue living outside it. Don’t forget, those averages are on top of the cost of attending your university.

To Rush, Or Not To Rush: That Is The Question

You’re looking at an average new member cost of about $4,166 each semester, or $8,332 for your first year.

Plenty of students gravitate toward the ample opportunities that Greek life offers. But it’s important to carefully consider what you want out of this potential chapter in your life and if its associated expenses are worth its benefits.

If your heart is set on rushing, I recommend at least creating a budget ahead of time to consciously plan your spending. After all, while Greek life may be a good investment in yourself, there’s no need to go into significant debt for it.

If your sorority dues exceed your school’s cost of attendance, you can’t use federal or institutional financial aid to cover the gap. So, if needed, research scholarships that might be available to you based on your academic profile. And reach out to see if the sorority offers its own internal scholarships or gradual payment plans. Also, consider other ways you may be able to save money elsewhere as a student, like splitting the costs of streaming services, cutting your cell phone bill, and buying items used instead of new.

Remember: Going through recruitment doesn’t promise you a bid at the end. So take time to really think about whether you’re ready to invest your money upfront in something you may end up walking away from.

Allison’s passion lies in decoding the ways of the world to help put others on a path to success. She likes to ask big questions, and it’s her goal to find answers to share with you. A self-acknowledged transplant to the Pacific Northwest, Allison likes to write about finance, policy, fitness, and anything else that sparks her curiosity.

Editor: Ashley Barnett Reviewed by: Robert Farrington