Many people struggle to get or maintain high credit scores. Financial products that are not credit-card based, such as Extra, are designed to help consumers build credit. However, Extra debit can be costly.

Here’s what you need to know about Extra, the credit-building debit card¹.

Extra Details | |

|---|---|

Product Name | Extra Card |

Interest Rate | 0% |

Monthly Fee | $20/mo to $25/mo |

Rewards Points | Up To 1% |

Reports Credit | Experian and Equifax |

What Is Extra?

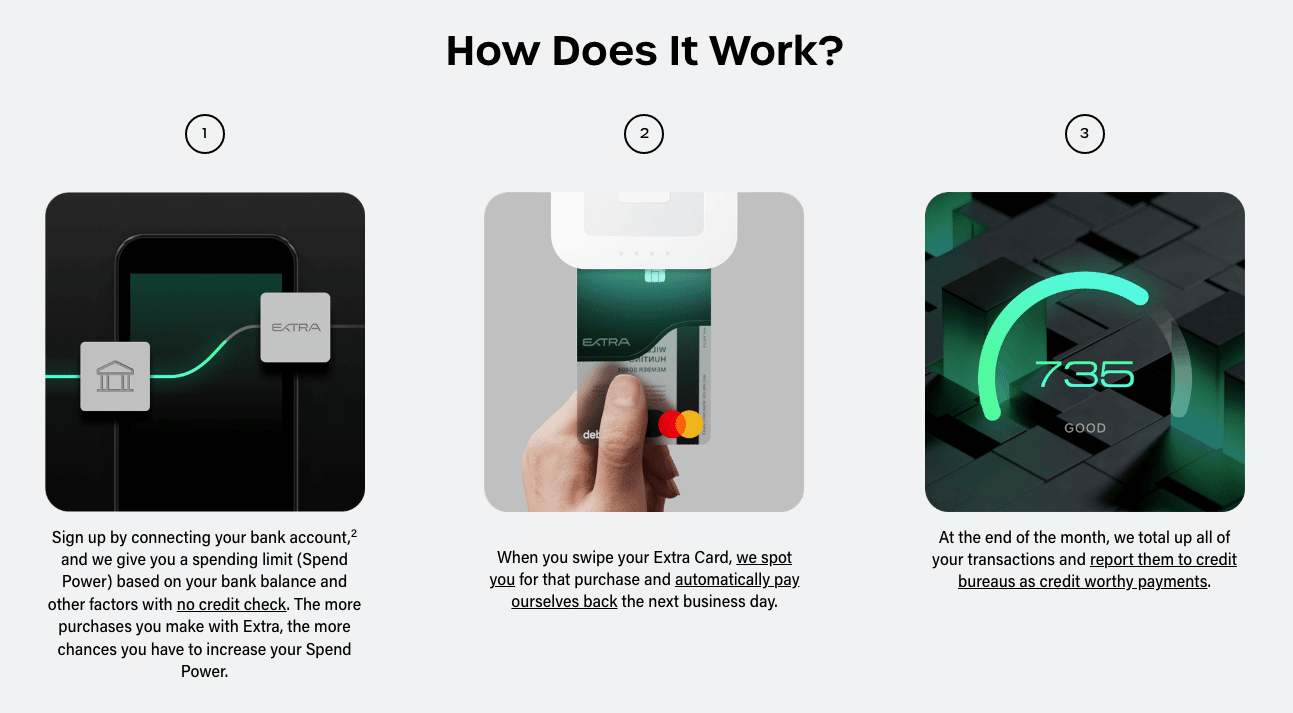

Extra is a debit card that reports payments to credit reporting bureaus Experian and Equifax. When you swipe your Extra debit card, the company spots you the money. The next business day, Extra pays itself back from your bank account. At the end of the month, Extra reports your payment history to the credit bureaus.

By reporting payment history, Extra helps you build credit. With better credit, you may be able to take out lower-cost loans and qualify for the best rewards credit cards.

What Does It Offer?

Extra’s main product is the Extra Debit Card. These are some of the card features.

Spending Builds Credit

Extra reports your transactions on the debit card at the end of the month as creditworthy payments to Experian and Equifax. Currently, it does not report your activity to TransUnion, which is the third major credit bureau.

When Extra starts to report payment history to Experian and Equifax, you start to build a credit history. However, you might run into issues because you won’t have the same credit history at TransUnion. Lenders may not view you as a favorable credit risk if you have vastly different credit history at different credit bureaus.

Spend Power based on your Bank Account Balance

Your “Spend Power” on your Extra debit card is based on your bank account balance and other factors. It starts out small for new members and generally increases as you establish a positive payment history. If you have a large bank account balance, you may have a higher spending limit each day. However, people with smaller account balances will have lower limits.

The Spend Power limit may seem a bit restrictive, but Extra tracks your bank balance and uses Spend Power to help you avoid spending money you don’t actually have (the #1 contributing factor leading to debt).

Spend Today, Pay Tomorrow

When you spend on your Extra debit card today, Extra spots you for your purchase and the exact amount you spent will be deducted from your bank account the next business day. Extra helps customers keep track of their purchases.

Available in the U.S.

You don’t have to be a U.S. Citizen to use Extra. You must be 18 years old, have a U.S.-based bank account, a U.S. address, and a SSN or ITIN number.

Extra can be a great tool for people who don’t have a strong foothold in the U.S.-based financial system to start building credit.

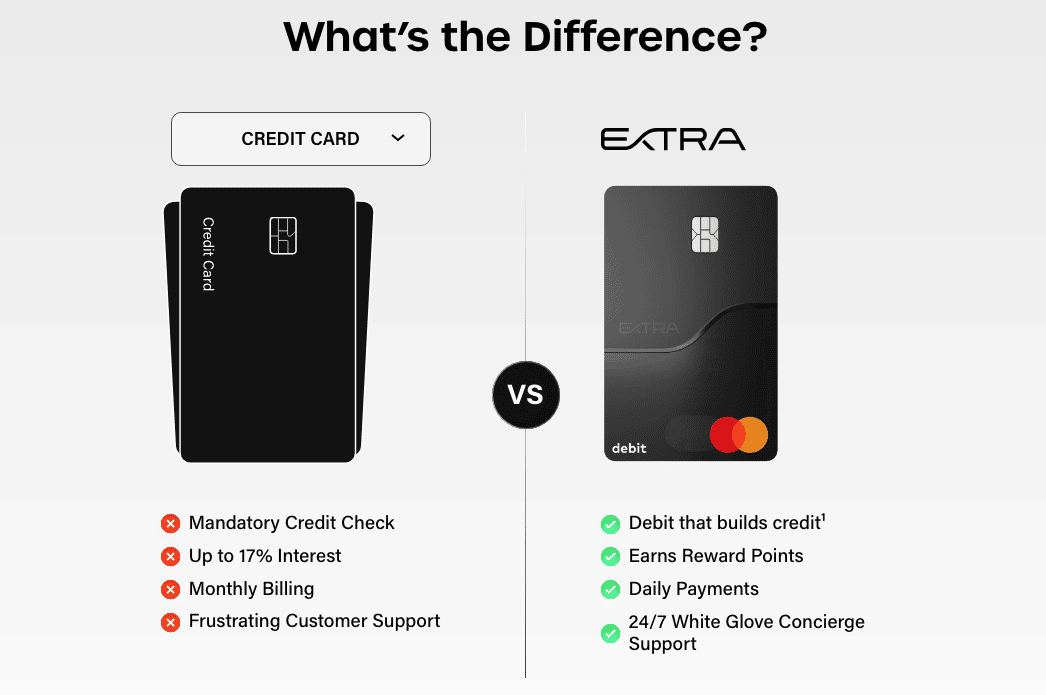

Flat Monthly or Annual Fee

Extra lets you choose between monthly or annual payment plans. The monthly options range from $20 to $25 per month, and the annual plans are available for $149 or $199 per year, delivering some long term savings. You’ll pay $20 per month to use Extra’s “debit as credit” service called Credit Building. Users also have access to a spending tracker app, similar to Empower and other Budgeting Apps.

If you upgrade to the Rewards + Credit building level, you’ll pay $25 per month or $199 per year, and, this option comes with up to 1% rewards points on all purchases made on your debit card.

Option to Earn Rewards Points

If you sign up for Extra’s Rewards + Credit Building option, you’ll earn up to 1% in reward points on all debit purchases. Anyone who spends more than $425 on the debit card per month will come out ahead with this option (compared to the $149 per year option).

Of course, once you qualify for rewards credit cards, the up to 1% reward points offered by Extra seems less enticing.

Are There Any Fees?

Extra has a monthly or annual subscription cost starting at $20 per month, and when you compare that to a free credit card, the upfront cost of Extra may seem high.

However, Extra’s argument is that their unique flat fee subscription model helps keep people out of debt because they don’t charge any interest, ever. (Almost all “free” credit products do)

And when you compare the average outstanding balance of an Extra member to the national average, they might be onto something with this approach and potentially saving people tons in the long run.

How Do I Contact Extra?

Extra calls its customer support team a white glove concierge, and the company is very accessible.

You can call the concierge team at 844-932-3955 or email hey@extra.app. For an online chat option visit http://extra.app/help and select the chat icon. After a few minutes, you’ll be chatting with an online agent.

Customers who want to write to the San Francisco based company can send a letter to: 150 Sutter Street, P.O. Box 372, San Francisco, CA 94104.

How Does Extra Compare?

Extra is a "debit card that builds credit.” While this may sound very similar to a secured credit card, Extra does not require a deposit or charge interest, and they report having a much greater impact on a users credit report because there is no deposit (secured cards are potentially weighed differently by the bureaus).

The company has thousands of reviews on the Apple App Store and seems like it's really helping people to build credit.

Other credit building products such as credit-building loans from Self are less expensive than Extra in terms of fees, but the downside is that not everyone may have the discipline to set aside money to pay it down each month - and their interest can become very expensive very quickly.

The benefit of Extra is that it pays itself back the next business day, which lessen hassle and worry while ensuring the credit-building aspect.

Extra has one major drawback compared to its competitors. Extra only reports credit history to Experian and Equifax. Self Financial and most secured credit cards will report payments to all three of the major credit bureaus.

Check out the comparison table below to see other options, besides Extra and Self.

Header |  |  | |

|---|---|---|---|

Rating | |||

Monthly Membership Fee or APR | $20 to $25/mo for membership fee | 15.65% to 15.97% | Credit Builder: $1/mo Borrow & Grow: 6:95% to 29.99% |

Credit Reporting | Yes | Yes | Yes |

Max Spend or Borrowing Power | Spend power can be up to 80% of your connected bank balance | $1,663 | Credit Builder: $500 Borrow & Grow: $7,000 |

Cell |

How Do I Open An Account?

Extra is available to most adults in the United States. To open an account you need to meet the following criteria:

- 18 years of age or older

- You must have an SSN or ITIN number

- A U.S. address where you can receive your Extra Card

- A U.S.-based bank account

Then you can start an online application or apply through the Extra app.

Is It Safe And Secure?

Extra uses several third-party sources to ensure that your money and your data is safe.

It uses Dwolla (a well-known financial data company) to process payments. For the financial tracker it uses Plaid, another third-party integration company that is considered a leader in the financial technology space and has a strong record of keeping information safe.

Extra also has several services in place that allow you to lock and replace stolen or lost debit cards. This helps keep you from owing money that you didn’t spend. The company does not share your data except with the credit bureaus and as noted in its privacy policy, as agreed.

Overall, Extra’s formula for handling money and data makes a lot of sense. The company strives to take the appropriate security measures to protect against unauthorized access. Of course, a data breach or an attack from a hacker could lead to stolen information.

Is It Worth It?

In most cases, you can build credit without paying interest or fees by simply making full payments on a credit card, paying your utilities on time, and repaying loans like a car loan or mortgage in full. For example, I signed up for a simple student credit card in college, made payments if full monthly, and have a 780 credit score today without paying any fees or interest.

If the fees are not appealing to you, you can build credit by using a secured credit card and paying the bills on time or sign on as someone’s authorized user on their credit card to help build credit. However, these methods require time.

It can take many months of slowly building a positive credit history to be able to take out a mortgage or an auto loan at a reasonable rate. Even getting approved for rewards credit cards can take several years of on-time payments on a credit card.

While Extra isn’t necessarily a must-have, weigh the pros and cons and decide if you believe it’s useful. If you have struggled with credit card debt in the past, may want to rebuild credit without touching credit cards. Extra is a perfect tool for the credit card-averse. Folks in this camp may gladly pay $149 per year to avoid taking out a credit card. Extra tracks your bank balance to help you avoid overspending, so you can build credit and stay on track with your other financial goals.

The downside for people considering Extra is that it doesn’t report to all three credit bureaus. To really build credit, you need credit history at Experian, Equifax and TransUnion.

The Best Secured Cards

Want more options to build your credit? In this article we compare the best secured cards to help you build credit.

Extra Features

Products |

|

Monthly Fees |

|

APR | None |

Rewards Points | Up To 1% on all debit purchases |

Credit Check | None |

Reporting to Credit Bureaus | Experian and Equifax (not TransUnion) |

Branches | None (online-only) |

Ability to Connect Your Bank | Yes, 10,000+ banks can be used with Extra's debit card |

Company Address | 360 E 2nd St, Suite 809, Los Angeles, CA 90012 |

Customer Service Number | 844-932-3955 |

Customer Service Hours | 24/7 |

Mobile App Availability | |

Web/Desktop Account Access | Yes |

Promotions | None |

Disclaimers

¹ The Extra Debit Card is issued by Evolve Bank & Trust or Patriot Bank N.A. (Member FDIC), pursuant to a license by Mastercard International. Loans provided by Lead Bank. Extra is responsible for credit reporting and reports on time and late payments, which may impact a credit bureau’s determination of your credit score. Rewards points only available with rewards plan. Membership fees apply.

Extra Review: Debit That Builds Credit

-

Pricing and Fees

-

Ease of Use

-

Customer Service

-

Features

Overall

Summary

Financial products that are not credit-card based, such as Extra, are designed to help consumers build credit.

Pros

- Build your credit with your spending

- Earn up to 1% rewards points on debit purchases

- Easy to get in touch with customer service

Cons

- High annual fee

- Only reports to two out of three credit bureaus

Hannah is a wife, mom, and described personal finance geek. She excels with spreadsheets (and puns)! She regularly explores in-depth financial topics and enjoys looking at the latest tools and trends with money.

Editor: Claire Tak Reviewed by: Robert Farrington