Self offers a full suite of credit building tools and services.

Building an excellent credit score allows you to borrow money, secure rental leases, and pay lower insurance premiums.

But many students have thin credit reports or poor credit due to past missteps. Or, even more common, students and young adults don't have credit simply because they've avoided it. And now, after graduation, they need to build their credit scores.

If this sounds like you, and you need to build or improve your credit, consider becoming a member at Self Financial. Self is a fintech platform that will allow you to a open Credit Builder Account (CBA).

A Credit Builder Account is a loan that you essentially make to yourself that allows you to build savings and your credit at the same time. But before you open a CBA with Self, these are the things you should know.

Self Financial Details | |

|---|---|

Product Name | Self Financial |

Plan Terms | 24 months |

Monthly Payments | $25, $35, $48, or $150 |

APR | 15.65% to 15.97% |

Promotions | None |

What Is Self Financial?

Self Financial is a credit-building platform that offers two mains products: the Credit Builder Account (CBA) and the Self Visa® Credit Card.

Self's Credit Builder Accounts are targeted at consumers who have bad credit or none at all. The company's secured credit card, meanwhile, can be obtained within three months of opening your CBA account with no hard credit check.

Self Financial was founded by James Garvey, is based in Austin, TX and has already worked with over 175,000 people.

Note: This video is several years old and may not accurately reflect current pricing and features.

What Does It Offer?

Think of a Credit Builder Account as a reverse loan. You pay the payments first, and you get the money afterward. Since the account is structured as a loan, you build credit as you make payments towards your account. All of your loan payments are reported to all three credit bureaus, which should report the loan on your credit report.

You could see it as a forced savings program. But it’s better to consider it a controlled environment for building credit. Since you get the money at the end instead of upfront, you maintain the incentive to make timely payments.

If you’ve got poor credit, a Credit Builder Account may be among your only credit options. Self only performs a soft inquiry on your credit score to confirm your identity. But your previous credit history, not matter how sparse or how negative, will not cause you to be denied an account.

Credit Builder Accounts

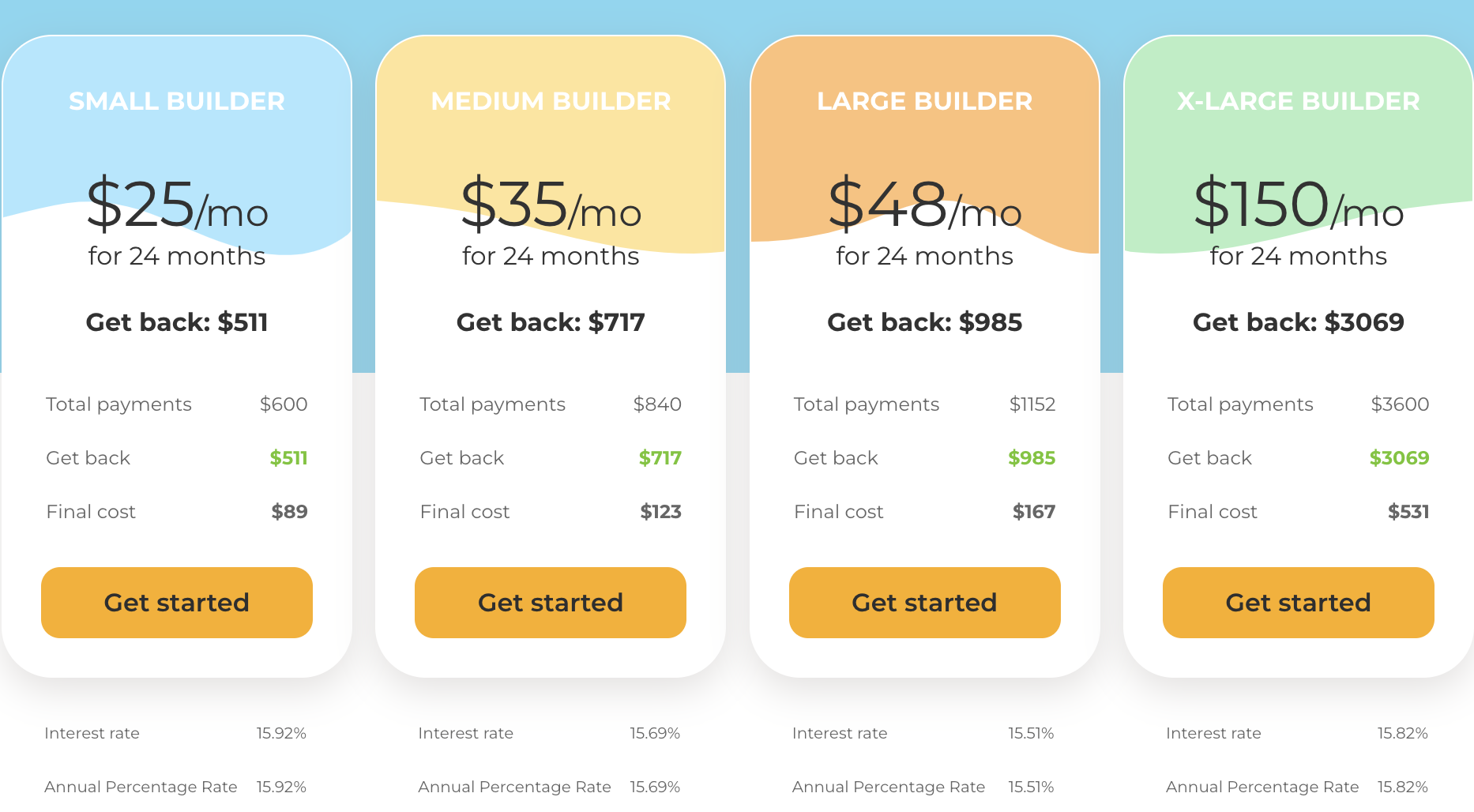

When you open a Credit Builder Account, the bank opens a Certificate of Deposit in your name. You can choose a CD for $520, $724, $530, or $1,663. For 24 months, you pay level payments of $25, $35, $48, or $150 to the bank.

Once you complete your payments, you get a mature CD. Remember, these are loans that come with interest rates. So you'll pay more over the course of your plan than the amounts listed above. For example, with the $520 plan (Self calls this plan the "Small Builder"), you'll actually pay $600 overall, including interest charges and the non-refundable administrative fee.

You can prepay the loan without penalty, but making a loan payment on time is the single best way to improve your credit in a hurry. The account is a double-edged sword. If you fail to make the payment, your credit report will show a late or delinquent payment.

Looking for a CD? Check out our table on the best CD rates.

Self Visa® Credit Card

Once you've made at least three on-time monthly payments with Self and have built-up at least $100 in savings, you can apply for the Self Visa® Credit Card and use a portion of your savings as your security deposit and credit limit.

The Self Visa® Credit Card comes with two major benefits. First, it doesn't require a credit check. As long as you meet the requirements above, you'll be approved. Second, adding a revolving credit line to your credit reports will improve your credit mix, which could have a positive impact on your credit score.

LevelCredit

Self acquired Rent Track in 2021 and combined it into their platform for a new tool called LevelCredit LevelCredit helps you build credit by reporting your rent, cell phone, and utility payments to the credit bureaus.

LevelCredit operates as its own subscription, and it costs $6.95 per month.

What Are The Fees?

A Self Credit Builder Account is not free. Even though you don’t get access to the funds up front, you will pay up to 15.97% APR on the loan. You also have to pay a $9 fee to open your account. In the "Features" section of this review, you'll find a detailed breakdown of all four of Self's Credit Builder Accounts, their APRs, and fees.

The Self Visa® Credit Card has its own variable interest rate, which is currently 23.99%. It also charges a $25 annual fee. That's a pretty hefty fee for a secured card that doesn't pay any rewards. If you're looking for lower-cost options, check out our favorite secured cards here.

How Does Self Financial Compare?

Self's plans can help anyone begin to build credit, even those who don't have any prior credit history. But when compared to some of its top competitors, such as Credit Strong and Grow Credit, there isn't a lot about Self's Credit Builder Accounts that stands out as terribly impressive.

Interest rates are on the higher end, the number of terms and loan amounts is limited, and there's no way for customers to get immediate cash access. However, Self is does allow you to use your built-up savings as security for its Self Visa credit card. Grow Credit does have a similar secured card setup.

Check out this quick chart for a closer look at how Self compares:

Header |  |  |  |

|---|---|---|---|

Rating | |||

Monthly Fee/APR | 14.14% to 15.58% | 3.02% to 15.73% | $0 to $7.99/mo |

Origination Fee | $9 | None | None |

Max Loan | $3,000 | $25,000 | $1,800 |

Upfront Cash | $0 | $0 | $0 |

Loan Terms | 24 months | Revolving credit, must be paid in full each month | None |

Secured Card | |||

Cell |

Can I Build My Credit For Free?

Of course you can! There are a lot of ways to build your credit for free. The trouble is, they all typically require you to take on some type of credit product, which is the Catch-22 people face. Here are some common ways to build credit for free:

- Become an authorized user on someone's credit card (maybe a parent)

- Get a cosigner for a loan if you can't qualify on your own (still requires a loan though)

- If you rent, see if your landlord will report your rent to the credit bureaus

- Apply for a secured credit card

The Discover It® Secured Credit Card and the Capital One Secured Mastercard are cards with no annual fee, and low security deposits. However, they charge interest if you do not pay your bill in full each month.

Compared to secured cards, Credit Builder Accounts offer a controlled environment, and it requires less cash upfront. If you feel confident with your credit, then a secured credit card may be the best option for you. But a Credit Builder Account can help you stay on top of your behavior while helping you build your credit.

Is My Money Safe?

Yes, Self Financial keeps your CBA funds inside an FDIC-insured CD at one of its partner banks ( (Sunrise Banks, Lead Bank or Atlantic Capital Bank). This means that the savings you build up with Self are insured by the federal government up to $250,000.

How Do I Contact Self Financial?

You can contact Self's customer support team by email or chat on the website and app. Or if you need to speak with someone over the phone, you can call 877-883-0999.

Self's customer service ratings are mixed. Its currently rated 2.9/5 on Trustpilot out of just 6 customer reviews. The company is accredited with the Better Business Bureau, though, and has a B rating.

Who Is This For Is It Worth It?

I recommend that everyone should build their credit as quickly and cheaply as possible. If you can trust yourself with a credit card, then that is probably your cheapest option.

But, not everyone feels comfortable with a credit card or they have a hard time being approved for a card (or don't have enough cash available to apply for a secured credit card). If you prefer the discipline of a savings secured loan, then opening a Credit Builder Account through Self is an excellent first step.

In personal finance, behavior and math both matter. You need to choose the option that is right for you.

If you’re interested in learning more about the Credit Builder Account, visit Self today.

Self Financial FAQs

Let's answer a few of the most common questions that people ask about Self Financial:

Is Self Financial a legit company?

Yes, Self Financial has been serving customers since 2014 and has been a BBB-accredited business since 2016.

What is Self Platinum Protection?

Self Platinum Protection includes $1 million of identity theft insurance, priority phone support, and a discount on your next Credit Builder Account. The cost of Self Platinum Protection is $5 per month.

Does Self have a referral program?

Yes, you can earn $10 for each friend or family member you refer to Self who opens a Credit Builder Account and makes their first payment.

Can you keep the Self Visa card open after closing your Credit Builder Account?

Yes, but the CBA funds that you used to secure your card will continue to be held.

Self Financial Features

Products |

|

Terms |

|

Monthly Payments |

|

Total Payments |

|

Amount You Get Back |

|

APR |

|

Administration Fee | $9 |

Early Termination Fee | Yes, less than $5 |

Prepayment Penalty | Unclear |

Self Visa® Credit Card Annual Fee | $25 |

Credit Check Required | Yes, for the Credit Builder Accounts Self uses soft credit inquiries, but only to confirm your identity Self does not perform an additional credit inquiry when you apply for the Self Visa® Credit Card. |

Availability | Available in all 50 states |

Minimum Income Requirement | None |

Reports to Credit Bureaus | Yes, Experian, Equifax, and TransUnion |

Customer Service Number | 877-883-0999 |

Other Support Options | Live Chat, Help Center FAQs |

Mobile App Availability | iOS and Android |

Web/Desktop Account Access | Yes |

Promotions | None |

Self Visa® Credit Card issued by Lead Bank, First Century Bank, N.A., or SouthState Bank, N.A., each Member FDIC. See Self.inc for details.

The secured Self Visa® Credit Card requires an active Self Credit Builder Account and qualification based on other eligibility criteria including income & expense requirements. Criteria subject to change.

For Credit Builder Account Pricing:

$25/mo, 24 mos, 15.92% APR; $35/mo, 24 mos, 15.69% APR; $48/mo, 24 mos, 15.51% APR; $150/mo, 24 mos, 15.82% APR. See self.inc/pricing

Credit Builder Accounts & Certificates of Deposit made/held by Lead Bank, Sunrise Banks, N.A., SouthState Bank, N.A., First Century Bank, N.A., each Member FDIC. Subject to credit approval.

"A loan with a $25-month payment, 24-month term at a 14.14% Annual Percentage Rate. Pricing is specific to this card, and to receive this pricing the purchaser must redeem the card at self.inc/build25."

Self Financial Review

-

Pricing And Fees

-

Ease of Use

-

Customer Service

-

Features

Overall

Summary

Not everyone feels comfortable with a credit card or they have a hard time being approved for one. If you prefer the discipline of a savings secured loan, then opening a Credit Builder Account (CBA) through Self is an excellent first step.

Pros

- Simultaneously work towards credit-building and savings goals

- Apply without hurting your credit score

- Get access to the Self Visa® Credit Card in as little as three months

Cons

- Interest rates may be higher than other forms of credit

- $25 annual fee on the Self Visa® Credit Card

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett