Credit-building apps are tools that allow you to improve your credit history and hopefully improve your credit score.

Before credit cards, auto loans, and mortgages were commonplace, your credit history was as good as your word. Most people only got loans from friends and family. And formal bank loans weren’t an important part of the average person’s financial life.

Today, solid credit history is the primary way that most people qualify for loans. Without a good credit score, you’ll struggle to find loans with reasonable interest rates.

If you’re one of the hundreds of millions of Americans with subprime credit or no credit, you may be tempted to turn to credit-building apps to boost your score. But before you download the first app you see, it's important to understand what the app is, and how it can help you. Below we rank the best credit-building apps and explain what they can do for you.

Promo: StellarFi. Automatically build your credit score with the bills you already pay, every day. Use StellarFi credit builder and get up to $25k of your bills reported monthly to all major credit bureaus. On average, StellarFi increases credit scores by 26 pts in 30 days*. Try StellarFi free for 30 days today >>

What Credit History Is And Why It Matters

Credit history is a record of a person’s use of credit. Credit includes debts like credit cards, student loans, car loans, and home mortgages. It can also include records of unpaid bills such as cell phone bills, medical bills, and unpaid judgments against you (for example, unpaid child support).

Good credit history shows that a person consistently pays their bills on time. Bad credit history shows debts being paid late or falling into delinquency. Frequently running up credit cards or applying for new debts also hurts your credit since it indicates that you may be on the brink of financial disaster.

When Is Credit History Used

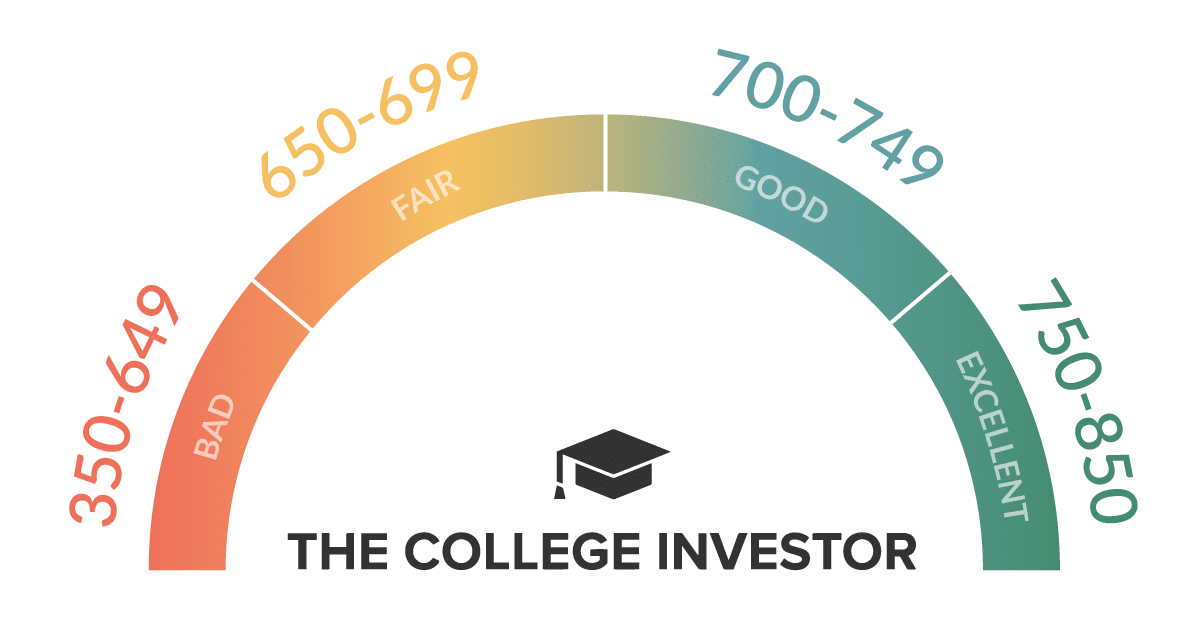

Lenders are the primary users of credit history. Lenders use an applicant’s credit history to decide whether to issue a new loan to a borrower and at what interest rate. A numeric representation of a lender’s willingness to issue credit is called a credit score. There are hundreds of ways to calculate a credit score, but most methods yield similar results.

To calculate a credit score, lenders need to access a person’s credit history. In the United States, three major credit reporting bureaus (Equifax, Experian, and TransUnion) record credit history for credit users in the United States. Banks pay these credit bureaus to access a person’s credit history when a person requests a loan.

In a few cases, non-lenders use credit history. For example, a landlord may pull your credit history to decide whether to rent an apartment to you. Utility companies may use your credit history to decide whether you need to put in a deposit. Sometimes (but rarely), employers will look at your credit history to decide whether you’re eligible for certain security clearances.

Good credit makes your life a little bit easier. With good credit, you can more easily qualify for a home mortgage. You may be able to access 0% APR credit cards for financial emergencies. Over time, you may qualify for travel rewards credit cards.

How To Build Positive Credit History

You can build excellent credit without jumping on the hamster wheel of consumption. But a great credit score can’t be built overnight. It takes discipline, knowledge, and time. Simply repaying credit cards on time and in full each month can allow you to build credit easily over a few years.

Building credit is important, but it’s probably the least important tool for building wealth. You can have an excellent credit score and a negative net worth. Credit scores focus on the use of debt. Credit scores don’t differentiate between “consumer” debt and “investment” debt. You may be underwater on your boat, your motorcycle, and your student loans, but still, have a great credit score.

In too many cases, people chasing a great credit score do so because they want to spend money they don’t have on things that will depreciate over time. This is a recipe for always running and never getting ahead.

Why Credit-Building Apps Should Be A Last Resort

People who are first learning about credit may feel confused about the ins and outs of credit scores vs. credit history. Because of that, I’m quick to recommend a credit tracking app like Credit Karma. It's free and provides helpful insights for people learning about credit.

Credit-building apps, however, are a different story. Most of these apps are positioned as quick ways to build credit. Several have high monthly fees, or they extend credit at double-digit interest rates. This kind of credit-building app can be a distraction. In some cases, they can enable or exacerbate bad spending habits.

Others offer low-cost options to build credit, but these apps are imperfect too. The reason they're successful is that they require users to practice good credit behavior over an extended period. Most people can get the same results without paying any money.

Despite these warnings, credit-building apps can make sense in certain situations. If you have terrible credit but have a stable income, a credit-building app can push you in the right direction. They can be a temporary tool to help you while you build financial stability.

Best Credit-Building Loan Apps

With credit-building loans, borrowers typically get no money upfront. Instead, they pay a small fee to save money at a particular bank. The bank tracks their monthly “payments” or deposits and reports them to the credit reporting bureaus. Over several months, borrowers build savings and boost their credit score (assuming they make on-time payments). These apps offer credit-building loans.

The apps below aren’t my favorite (I don’t like paying money to save money), but they're the best of the bunch. If you sign up for these loans, choose one that can be repaid over two years or less. Most of the time, two years is enough time to establish good savings habits and good credit.

CreditStrong

CreditStrong issues credit-building loans that can be repaid over up to five years. They offer three products: Revolv, Instal, and CD Max. Loan amounts range from $1,000 to $10,000. The smaller loans carry high effective interest rates but are still likely to boost your credit score significantly over time.

You don't need any credit score whatsoever to qualify for a CreditStrong loan. And while it will check your credit, it only uses a soft credit inquiry that won't negatively impact your score. You can also cancel your loan at any without having to pay fees.

Self

The credit-building loans from Self (previously known as Self Lender) offer various levels of savings. Each loan runs two years, but you can choose from five monthly payment options: $25, $35, $48, or $150.

People who use the loans will pay effective rates ranging from 12.44%-15.91%APR for the two-year loans. There's also a one-time administration fee of $9 that's charged on every loan.

Best "Debit As Credit" Credit-Builder Apps

The next genre of credit-building apps is “debit as credit” apps. These apps cover a range of apps that allow users to build credit by making payments. Some offer no-cost methods of building credit, while others don't. Our top two choices in this category are no-interest, no-fee apps.

The third app on our list issues a revolving line of credit to borrowers with strong income. Users can use this line of credit to help them make ends meet while awaiting their next paycheck. Once the borrower has money in their account, they can repay the line of credit. This app offers reasonable interest rates (compared to credit cards), but it may perpetuate a paycheck-to-paycheck lifestyle.

Grow Credit

Grow Credit offers a free way to grow credit for anyone who pays for subscriptions (Hulu, Netflix, etc.). You can pay for these services for free through Grow and it will report a $204 annual credit line to the credit bureaus. But note that number is divided by 12 to calculate a monthly spending limit of just $17 per month.

Related: Hulu vs. Netflix vs. Amazon Prime: What Is The Best Option For Streaming?

Still, that $17 monthly limit is enough to cover one Standard Netflix subscription ($13.99) or both a Netflix Basic ($8.99) and Hulu (with ads) subscription ($6.99). If you’re already paying for a subscription service anyway, you can pay for it with Grow and build credit history.

Grow also has paid memberships that allow users to build their credit even faster. These plans can increase your credit line that is reported to the credit bureaus up to $1,800 ($150 monthly spending limit). Paid memberships cost $1-$7.99 per month.

Kikoff

Kikoff issues a $500 line of credit to be used to buy consumer items in its store. The items cost as little as $10 and are repaid in five to ten months. Once you buy the item, you pay for it in installments. The loan itself is a 0% interest loan (though the price of the items is admittedly inflated).

I don’t love the idea of buying things you don’t need at excessive prices to build credit. But the cost is much less than other loans. Plus, a $5 per month credit building membership can be just the thing you need to boost your credit score.

A Quick Word On Credit Repair Apps

Credit repair apps are the O.G. of credit-building apps. Desperate people often turn to these apps in the hopes of a magical credit turnaround. These apps aren’t magic. Instead, they help people identify and dispute untrue negative information on their credit reports. When the credit company cannot substantiate the information in the report, the credit bureau removes it.

Incorrect information on a credit report is more common than you might think. A third of all people have incorrect information on their report according to Consumer Reports.

Incorrect information usually happens when the debt falls into delinquency. Lenders typically sell bad debt to credit collection companies. These companies do what they can to collect the debt and sell it if they can’t collect payment. This cycle can lead to the same delinquent debt appearing on your credit report multiple times.

You can dispute incorrect information on your own without the help of a credit repair company. Check out this guide from the Consumer Financial Protection Bureau (CFPB) to learn how.

Does A Credit-Building App Make Sense For You?

Credit-building apps can offer value to people who have struggled with credit in the past. These apps can help you build a strong credit history over time.

But none of the apps work instantly. You need to use them consistently for several months (and sometimes multiple years) to see a good credit score.

Of course, you can build credit for free. Most people don’t need an expensive app to help them look good for banks. But credit-building apps can certainly provide an assist along the way.

*Credit score increase based on StellarFi member data. Credit score increase not guaranteed. On-time payment history can have a positive impact on your credit score. Nonpayment may negatively impact your credit score.

Self

Self Visa® Credit Card issued by Lead Bank, First Century Bank, N.A., or SouthState Bank, N.A., each Member FDIC. See Self.inc for details.

The secured Self Visa® Credit Card requires an active Self Credit Builder Account and qualification based on other eligibility criteria including income & expense requirements. Criteria subject to change.

Credit Builder Account Pricing:

$25/mo, 24 mos, 15.92% APR; $35/mo, 24 mos, 15.69% APR; $48/mo, 24 mos, 15.51% APR; $150/mo, 24 mos, 15.82% APR. See self.inc/pricing

Credit Builder Accounts & Certificates of Deposit made/held by Lead Bank, Sunrise Banks, N.A., SouthState Bank, N.A., First Century Bank, N.A., each Member FDIC. Subject to credit approval.

"A loan with a $25-month payment, 24-month term at a 14.14% Annual Percentage Rate. Pricing is specific to this card, and to receive this pricing the purchaser must redeem the card at self.inc/build25."

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller