Most people depositing money into a savings account are simply looking for a safe place to keep their money. The more ambitious of us will shop around for the highest interest rate possible, which isn’t that high with current rates well under 1%.

But what if you are looking to back a cause with your deposited money? That can be a tall order to fill.

If your cause happens to be supporting a green climate, Atmos Financial could have the perfect savings account for you. They support clean energy initiates by loaning customer deposits. But that doesn't mean customers are taking unnecessary risks. Atmos deposits are FDIC insured. In this article, we'll see how Atmos links green energy to banking.

Atmos Financial Details | |

|---|---|

Product Name | Atmos Financial |

Min Deposit | $0 |

APY | Up to 2.40% (1.20% Base Rate + 1.20% Donation Bonus) |

Cash Back | Up to 5% |

Monthly Fee | $0 |

Account Type | Savings |

Promotions | None |

Who Is Atmos Financial?

Atmos Financial is a fintech that loans its deposits to green initiatives. It was founded in January 2020 by co-founders Ravi Mikkelsen & Peter Hellwig. Atmos isn’t a bank. It offers banking services through Synapse's bank partners, members FDIC.

“Banks lend out money, and it’s these loans that create the society in which we live,” Mikkelsen told Climate Impact Capital. “By choosing where we bank, we get to choose what type of world we live in.

What Do They Offer?

Atmos Financial offers a savings account that pay up to 2.40% APY and a checking account that pays up up to 5% cash back on your spending at sustainable brands. Here's a closer look at what the company offers and how it supports clean energy initiatives.

High-Yield Savings

Atmos "climate-positive" high-yield savings account offers interest rates of up 2.40%. The base rate is 1.20%. But you'll earn an additional 1.20% if you sign up for automatic recurring monthly donations to one of the many nonprofits that Atmos supports.

Cash-Back Checking

Atmos recently launched a cash-back checking account as well. It offers up to 5% cash back on your purchases. Here's how much you'll earn depending on your spending category:

- Clean Energy & Electric Mobility: 2%

- Sustainable Clothing & Apparel: 2%

- Sustainable Grocery, Restaurants & Cafes: 2%

- Climate-Wise Farms, Ranches & CSAs: 5%

The checking account also offers fee-free cash withdrawals at over 55,000 Allpoint ATMs nationwide. And there's no monthly fees or minimum balance requirements.

Clean Energy Initiatives

Atmos Financial loans are distributed through partner banks. Those loans go to green initiatives in the following areas:

Atmos also avoids lending money to companies that are in any of the following business segments:

Climate Impact Measurements

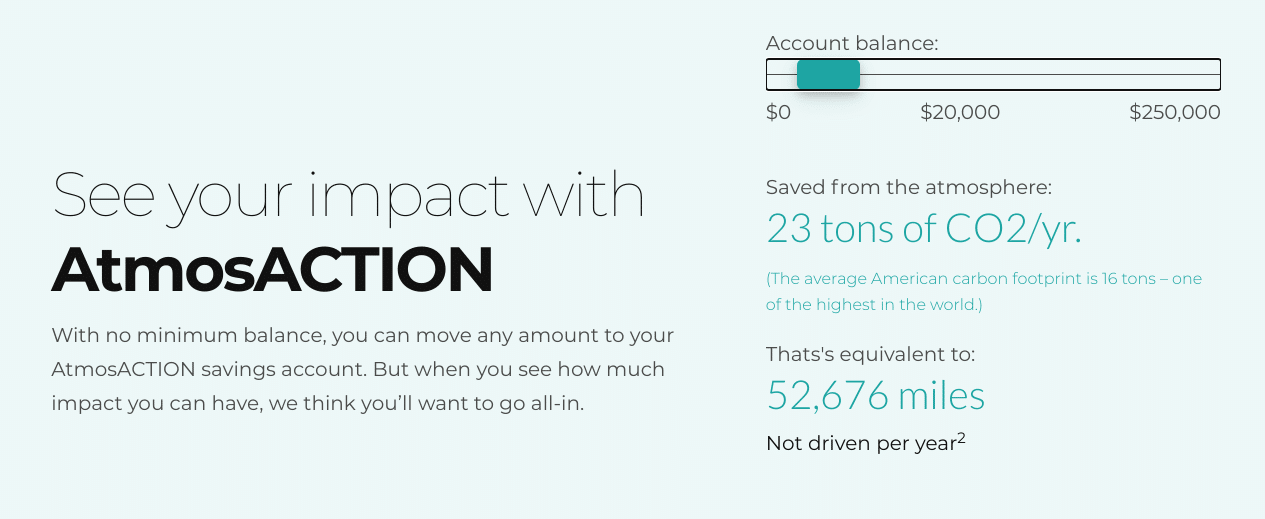

To get an idea of how your deposits positively impact the climate, Atmos measures impact in tons of CO2 removed per year. Below is a scale showing how much CO2 that Atmos says you can remove in a year based on your deposits:

Deposited Amount | Tons Of CO2 Removed | Equivalent Number Of Miles Not Driven Per Year |

|---|---|---|

$1,000 | 1 | 2,634 |

$2,500 | 3 | 6,585 |

$5,000 | 6 | 13,169 |

$10,000 | 12 | 26,338 |

$20,000 | 23 | 52,676 |

For comparison, the average American contributes 16 tons of CO2 into the atmosphere every year. That’s one of the highest CO2 contributions per person in the world.

Are There Any Fees?

Atmos Financial doesn't charge a monthly service fee and there are no minimum balance requirements. Its base interest is competitive with other leading online banks and if you're able to earn the additional 0.40% bonus, you'll be earning an overall rate that's really hard to beat.

The cash back option is also nice, but unless you shop at a lot of sustainable brands, you may not find as much as value in that feature. For most people, the high-yield savings account is probably what's really going to stand out. Here's a quick look at how the Atmos savings account compares to other top high-yield savings accounts available today.

Header |  |  |  |

|---|---|---|---|

Rating | |||

APY | Up to 2.40% | Up to 4.25% | Up to 5.05% |

Monthly Fees | $0 | $0 | $0 |

Min Deposit | $0 | $0 | $100 |

FDIC Insured | |||

Cell |

How Do I Open An Account?

You can visit the Atmos Financial website to get started. The sign up process is simply and should only take about four minutes to complete.

Still have a few more questions about how the company's process works that you'd like to have answered before opening your account? No problem. Simply book a 15-minute video conference meeting with a member of the Atmos team.

Is My Money Safe?

Yes, deposited funds are FDIC insured up to $250,000 through Atmos' partner banks.

Is It Worth It?

An APY of 0.40% to 0.80% is not bad at all in today's interest rate environment. That alone could be enough to entice people to deposit their funds with Atmos. But if you also want to support the climate, Atmos Financial is the bank (or fintech in this case) for you.

There's no real drawback to using Atmos. Your money remains liquid and you get all of the benefits of a modern-day savings account. However, if maximizing APY is your top priority, know that other top banks may offer a slightly higher base rate. Compare high-yield savings accounts here >>>

Atmos Financial Features

Account Types | Savings |

Minimum Deposit | $0 |

APY |

|

Maintenance Fees | $0 |

Clean Energy Initiatives |

|

Branches | None (online-only bank) |

ATM Availability | 55,000+ fee-free ATMs that are part of the Allpoint ATM network |

Customer Service Number | 1-866-246-7194 |

Customer Service Email | hello@joinatmos.com |

Booking Link For Video Meeting | https://calendly.com/connect-with-atmos/meet-with-atmos?month=2021-04 |

Mobile App Availability | iOS and Android |

FDIC Insurance | Yes, through Synapse bank partners |

Promotions | None |

Atmos Financial Review

-

Interest Rates

-

Fees and Charges

-

Customer Service

-

Ease of Use

-

Tools and Resources

-

Products and Services

Overall

Summary

Atmos Financial offers high-yield, FDIC-insured savings accounts to its customers and uses their deposits to fund clean energy projects.

Pros

- Top-yielding savings account

- No monthly fees or account minimums

- Funds clean energy initiatives

Cons

- Best APY requires recurring donations

- ATM transactions may not be supported

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor