With hundreds of thousands of college freshmen starting college across the country, I wanted to share some of the best tips, tricks, and insights I've found and compiled so that none of you turn into a delusional college student.

Starting life alone for the first time can be a challenge on multiple fronts - educational, financial, social, and more. With safety nets gone, college freshman have to figure it out alone. Here is a great guide to help them find the information they need to be successful.

This guide isn't all-inclusive (although we tried to be). If you have a great tip or trick for college students, please share it in the comments below!

To navigate the list, here are the main areas of tips for college freshmen:

Financial Aid

Getting financial aid isn't just something that you do before you start your freshman year. You typically have to re-apply for financial aid each school year, and sometimes each semester. Keep these links handy so that you can easily track down the resources you need.

- FinAid - FinAid is an amazing resource for everything related to financial aid, from scholarships to student loans.

- FAFSA - You need to submit your FAFSA (Free Application For Student Aid) every year you attend school. Not filling it out one year can make it harder to get financial aid the following year. This form is also mandatory to get Federal Student Loans.

- CSS/Financial Aid Profile - This application from The College Board allows you to apply for non-Federal financial aid.

- Top 10 Financial Aid Tips - This resource from Scholarship.com is the best resource I've found for getting financial aid for school. They have many of the traditional tips, but also some out-of-the-box tips as well.

- Know Your Expected Family Contribution - US News and World Reports looks at how you can know your Expected Family Contribution, which determines how much financial aid you may be able to qualify for. If you're looking into financial aid, this is a great tool.

- What Can You Do If Your Parents Refuse To Pay for College - FinAid has an excellent article on what you can do if your parents refuse to help you pay for college, and what your options might be.

- The Best Order Of Operations To Pay For College - If you don't know the right way to pay for college, check out this guide to figuring out the best student loans and other options to pay for college.

- Best Scholarship Search Websites - Remember that you can still apply for, and win, scholarships even after your freshmen year. So make sure you keep an eye on college scholarships.

- Does Soaring Tuition Matter - This is a great look at the rising cost of education, and the potential return on your investment. A must read for anyone who cares about the cost of education.

- What To Do If You Can't Afford Your Tuition Payment - If you run into a situation where you can't pay your tuition payment, College Express has some tips that can help you stay in school while you sort out the finances.

- Ask Your Financial Aid Question - Check out our financial aid award homepage and ask a question about financial aid options!

Student Loan Tips For College Freshmen

The fact of life is that most college Freshmen will either have student loans or will need to get them before they graduate. Here are some essential resources for college students when it comes to dealing with student loans.

- The Definitive Guide To Student Loan Debt - This free resource has everything you need to get into student loans the smart way, and ways to get out quickly when you're out of school.

- StudentAid.Gov - This is the Department of Education resource for getting student loans and keeping track of them once you have them. Bookmark this for the future.

- My Aid and the NSLDS - If you don't know who owns your loans or where you send payment, this is the website for you. It is maintained by the US Department of Education, and keeps track of all your student loan data.

- The Best Student Loans To Pay For College - If you don't know the right way to borrow to pay for college, check out this guide to figuring out the best student loans to pay for college.

- Understanding Student Loan Repayment Plans - Don't know how much you're going to pay when you graduate? Here are the main repayment plans for student loans and what each will cost you.

- Ways To Get Student Loan Forgiveness - Depending on what you do after graduation, there are some cool programs that can get your student loans forgiven.

- Mastering Student Loan Deferment - While you're in school, your student loans are deferred (meaning you don't have to pay, but the interest still builds). Here's everything you need to know about student loan deferment.

- The Best Way to Avoid Student Loans All Together - The bottom line is that it can be done, and here's the best way to do it!

- Learn How to Consolidate Your Student Loans - Only the Federal Government offers consolidation student loans, and this is where you can learn more about it.

- Credit Karma - Before you get student loans, you need to know your credit score, and there is no better service that offers a free credit score check and resources to help you improve it.

- Credible - Credible compares all of the major student loan lenders to help you find the best rates and fees for your student loans. Don't just apply to a single lender, compare a bunch of them.

Personal Finance

College may be the first time that you may have to deal with personal finance issues on your own. You'll have to budget, you'll encounter sales people chucking credit card offers your way, and you'll have to navigate the financial world on your own. Here are some simple tips for college Freshmen when it comes to handling personal finance topics.

- The Best Automatic Savings Apps - If you want to easily save money while you're on the move, check out these automatic savings apps to make saving money easy.

- The Best Online Banks For College Students - Having a bank that works for you while you're traveling to school and home is important. You need mobile banking, easy access to your accounts, and more. Check out these options.

- Best Car Insurance Options For College Students - College students have unique needs when it comes to car insurance. Specifically, they don't drive much and may not even own a car. Check out these great options.

- The Best Credit Cards For College Students - Here's our guide to the best credit cards for college students. Spend wisely!

- 40 Money Tips for College Students - Jim over at Wallet Hacks has a great list of money tips for college students, but the biggest tip is the first tip. Check it out!

- 50 Ways To Save Money In College - You can save money in college, it's possible! Here's 50 ideas to make it happen!

- 85 Super Easy and Practical Ways to Save Money - We all want to make saving money easy, and Jeff Rose from Good Financial Cents has some amazingly simple tips that college students can use right now.

- 10 Tricks to Get Cheaper Textbooks - Textbook costs are what really get you in college, especially since you typically only use that $100+ book for a single class. Here is a great resource from Free From Broke on how to get cheaper textbooks.

- 5 Personal Finance Habits That Will Make You Rich - Get these five things right and you won't have to worry much about your finances.

- 60+ Discounts For Students - College students are on a budget, so here are over 60 deals and discounts that college students can take advantage of.

- The Best Discounts for College Students - Many stores offer special programs for students, and college students are poised to take advantage of these programs. If you want savings, check out this list from the Christian Science Monitor and find the best discounts on stuff you're going to buy anyway.

- Stores Offering Discounts for College Students - Another great list from Brad's Deals of stores that offer discounts to college students. This list also highlights places that give discounts by showing student IDs.

- Best Student News, Music, And Streaming Discounts - Check out this updated list of news service and streaming service discounts.

- Textbook Rental Comparison Tool - Renting your college textbooks is the best way to go when it comes to saving money. Check out this tool and see where you can find the best rates for textbook rentals.

Investing

The key to wealth is saving and investing. And to gain even more wealth, you should start as early as possible. Here are some simple tips and resources for college students to start investing, even with just a little bit of money.

- The College Student's Guide to Investing - If you're a college student, now's the time to get started investing.

- These Colleges Offer Their Students Hedge Funds to Run - Some colleges and universities offer their students hedge funds that they can run as a learning tool. If that interests you, check out this list.

- How to Start an Investing Club - If you're college doesn't have an investing club you can join, you should start one yourself. It's pretty easy to do, and just takes a little time and effort.

- The Best Investment Advice I've Received - We all need some advice when it comes to investing and handling our money, and here's a really good tip.

- How and Why to Start Investing in College - We share with you the top tips and tricks so that you can get started investing in college, even on a limited college budget.

- Investing Tips for College Students (Video) - Ramsey Solutions has a great video about how college students should jump start their future by starting to invest early.

- The Dos and Don'ts of Investing for College Students - The Examiner has a great resource on the do's and don't that college students should follow when they start to consider investing.

- Colleges For Hedge Fund Managers - Learn where some of the world's best hedge fund managers went to school and the lessons they learned from their alma maters.

- The Best Brokerage Account - Looking to find the best online broker for investing? We compare all of the top brokerage firms in our Brokerage Comparison Tool.

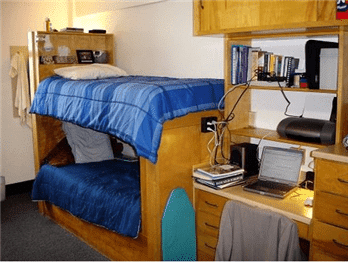

Dorm Life

Dorm life is a completely new experience for college freshmen. It's a huge change from living at home, and it opens up a ton of new experiences. Here are some simple guides to making the most of dorm life for your first time away from home for a long period of time.

- Dorm Room Checklist - Every store and shop has a different dorm room checklist, but I like this dorm room college packing checklist to make sure you bring everything you need to college.

- How To Spot An Avoid Roommate Scams - I think college was the first time in my life I was ever swindled, and it happens to a lot of people. Make sure that you read this list on avoiding Craigslist scams, since most college student rely on Craigslist to buy and sell their stuff.

- How to Live Alone Without Going Broke - College life and living alone can be expensive, so you have to know some tips and tricks on living alone before you go away to school.

- Why Costco is Great for College Students - You need a deal in college, and Costco is the place for college students to stock up their dorm and do it on a budget.

- How To Make Friends In College - Making friends in college is one of the biggest keys to emotional success in college.

- Rules to Know For Splitting Rent with Roommates - Chances are, you're going to have roommates in college, and even after college. Here are some great rules to live by from the BankRate team.

- 6 Survival Tips for Living in a Suite - Many Freshman will have to live in a suite dorm, meaning more than just a single roommate. Here are six amazing tips from Campus Explorer to help you adjust.

- Meal Planning 101 - Figuring out how to leverage the best meal plan vs. going out with friends is tough. Work Week 101 shares some great tips on how to maximize the college meal plan.

- How to Choose the Right Meal Plan - Saving For College shares some secrets to picking the right meal plan for your tastes and diet. Since many colleges give multiple meal plan choices, here is a great tool to help you choose the right meal plan.

- Five Tips for Getting to Know Your College Roommate - Your first few weeks of college are made or broken by your relationship with your roommate. Here are some great tips from Teen Vogue on how to get to know your roommate so you can enjoy your college dorm experience.

- The Basics of College Roommates - The College Board has a great video interview that shares the basics of getting to know your roommate and how to set rules to be successful.

- The Most Common College Scams And How To Avoid Them - College is usually the first time a student has been away from home. Here's some thoughts on how to avoid becoming a victim.

- Tips, Tricks, and Advice for Studying Abroad - Go Overseas has some amazing tips and tricks for studying abroad that you should bookmark for the future when the time comes to make the trek across the pond.

- Amazon Student Is A Must Have For College Students - Did you know that Amazon Prime makes a college student version that's 50% cheaper! Learn more here.

College and Careers

The whole point of college is to set yourself up for a successful future career. As such, you need to take certain steps while you're at college to get on the right track. Here are some essential career resources for college students to get an internship and eventually get a real job upon graduation.

- Building a Skill Set That Employers Want - Coming from experience in my own day job, I can't tell you enough how unprepared many new college graduates are. Here is a great lesson on how to understand what employers are looking for.

- Don't Do These Three Things When Signing Up For College Classes - Too many people take classes based on their major and career path, but that can be a mistake. Make sure you check out these three tips on signing up for college classes.

- The Ups and Downs of Seasonal Jobs - If you're only going to work part time (such as over breaks or during the summer), here are some essential tips you should know from Money Ning.

- 8 Simple Steps to Networking Like a Boss - Beyond the classes you take, the single most important thing you can do in college is network with your peers, professors, and alumni.

- The Two Key Traits Employers Are Looking For In Today's College Graduates - A survey I did revealed that employers want graduates who can communicate effectively and problem solve in the workplace.

- The Ultimate College Internship Guide - Everything you need to know about getting a college internship and making the most of it in one place.

- A Few Thoughts on Unpaid Internships - Earnest shares some great thoughts on whether or not you should consider getting an unpaid internship - remember, the bottom line is that it's about the experience.

- 14 Insanely Easy Ways to Look Busy At Work - Look, we all have times at our jobs that suck, but we need to keep the boss off our backs...here are some fun tips from PT Money about how to do it.

- How and Why to Get an On-Campus Job - Sometimes, getting a job on campus is one of the best choices for working in school. US News shows how you can get a job on campus and how it can be a great experience.

- Online Jobs For College Students are a Smart Move - If you're thinking about getting a summer job, hopefully this article will seal the deal and highlight why you should be getting a summer job.

- Figuring Out Your Major - The toughest college decision of all is figuring out your major and deciding what path you want to take. Just remember, it's not a final choice, and you can always change later.

- A College Grad's Guide to the Job Search - Your first job search after graduation can be the toughest, but these simple steps can help you make it a little easier.

- Your College Major Doesn't Matter - A simple reminder that your major probably doesn't matter, but rather what you make of yourself during college.

- How To Calculate Your GPA - 4.0? 5.0? Graduating with Honors? Here's what to know.

- Understanding Satisfactory Academic Progress In College - There's not always a lot of guidance for your college career. Here's what to know about moving in the right direction.

- 100+ Ways To Make Money In College - Don't have time for a full time job during school? Here are 100 ways that you can make a small side income while in college.

Love Life

College is also a time for you to experience your love life in a way that you've probably never done it before. As the first two articles below share - you must date in college or else... Here are some fun quick tips for making the most of your college love life.

- How to Get Girls if You Live at Home With Mom and Dad - It happens. Some people choose to live at home and go to college, while others move home to save money. Either way, you need to learn how to get girls (or boys) if you live at home. From our friend Sam at Financial Samurai.

- How to Actually Date in College - This article from The Art of Charm has some amazing tips on how you can make dating in college much more romantic and less "hook-up".

- How To Avoid Dating A Loser- Enough said, but plain, simple advice.

- Dating a Roommate: Yes or No - The bottom line is that close quarters can make things happen, but should you really consider dating your roommate in college?

- 20 Resolutions to Improve Your Love Life - You may be young and having fun on campus, but a lot of these tips from SheKnows to improve your love life can make things so much better.

- Confessions and Tips for Being Discreet - Yes, it does happen... and yes, you're going to have to avoid your roommates Here are some tips for being discreet in your dorm room.

- Dorm Room Sexy Time is Possible - Here are some key tips from Men's Health on making sure you're communicating appropriately with your roommates.

- Explore Your Dorm Room - Being in a dorm room opens up a wide variety of possibilities, and these tips from Her Campus can be a lot of fun!

Dealing With Parents

Once you head off to college, the dynamics with your parents change forever. You're now an adult, and they now have less and less control over your life. It can be a hard and awkward transition, and these tips can help you navigate the path towards a real adult relationship with your parents.

- 8 Ways to Prepare For Leaving Your Parents - The first time away from home for a long time can be tough, and here is a great article from the Huffington Post about things you can do to prepare.

- College Students Tell Their Parents How to Communicate With Them - Here is a great article from Psychology Today on how you can communicate with your parents if you're a college student.

- Being an Adult Means That Your Parents Aren't The Boss Anymore - It can be hard to say no to your parents, but now that you're an adult and moving away, you need to know what that means in the changing dynamic.

- 10 Tips For Dealing With Parents - US News has put together a fun article about how you can deal with your parents while you're in college and how you can build a relationship with them.

- Boundaries for Older Children at Home - Here's a great article about setting up appropriate boundaries for parents and college students when they're at home from the team at Empowering Parents.

- 5 Ways to Cope When a Sibling Goes Off To College - It's important to remember the changes that impact younger siblings when an older sibling leaves and goes to college. Here are some great tips from LoveBox.

- Taking a Break From College - What To Say... - Credible has some great advice for college students who are considering taking a break from college and what they should say to their parents if they decide to leave school.

- How To Adjust To College Life - Drexel has a great guide to adjusting to college life, especially on how to have tougher conversations with your parents if things aren't going as planned.

Prepping for the Future

Finally, even though you're a college freshmen, it never hurts to start looking towards the future. Here are some simple steps you can take when you start college to make the most of your future - even if it just inspires you and gives you motivation to succeed.

- Start Building a Life List - You're young and still excited about life. Now's the time to jot down everything that you want to do, and start thinking about ways to achieve it. Check out J Money's life list for a great starting point.

- How Much Do The Top Income Earners Make - I think most people go to college to make more money. So, how successful do you really need to be to consider yourself a top income earner?

- 5 Things Your Millionaire Neighbor Isn't Telling You - If you're a college freshman, you're familiar with Princesses, Real Housewives of XYZ, and tons of other "reality" shows. The trouble with those shows? They don't really highlight how your millionaire neighbor made it.

- Should a College Student or Recent Grad Buy a House - This is a thought that crosses the mind of most college students when they're paying rent, but there is a lot to take into consideration.

- Don't Just Go to Graduate School to Postpone Life - Many students think that they will go to grad school, but it isn't always the best option - especially for recent grads.

- The Post-College Financial Plan - The financial plan changes as you venture into the future, so it's a good idea to set yourself up for success as early as possible.

- The Best Commencement Speeches of All Time - Time Magazine has a great list of the best commencement speeches of all time, and they are a must listen/watch for all college students prepping for the future.

- Secrets of the Most Successful College Students - As you're looking at your future, here are some lessons learned from the most successful college students.

- 15 Famous People Who Never Graduated College - The truth is that college isn't for everyone, and there are plenty of successful and famous people out there who never went or never completed college.

Bonus: Check out our list of the best college blogs to follow if you want more amazing content to make your college experience that much better!

What are some other essential resources and tips for college freshmen heading to college this fall?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor