Empower is a mobile app that has a comprehensive set of personal finance features and is perfect for people who want only one app to manage their finances.

The big focus of Empower is providing an instant cash advance, but they also offer a ton of great money management features.

It lives up to its name when it says that it empowers people to take control of their money. Here’s what you need to know about Empower.

Note: Empower (this app) is NOT the same as Empower (formerly Personal Capital) the budgeting app. Since Personal Capital rebranded, there has been a lot of confusion!

Empower is a financial technology company, not a bank. Banking services provided by nbkc bank, Member FDIC.

Empower Details | |

|---|---|

Product Name | Empower |

Min Deposit | $0 |

Monthly Fee | $8/mo |

APY | 0.01% APY* |

Promotions | None |

What Is Empower?

Empower is a personal finance app that helps you take control of your money. Once you connect a checking account, you’ll be able to get a complete and accurate snapshot of your financial life and effortlessly cut unnecessary expenses, save for a rainy day and uncover additional savings.

Note: Don't confuse Empower Finance (this app) with Empower (formerly Personal Capital). Personal Capital rebranded in 2023 and also picked the name Empower.

What Does It Offer?

Some of Empower's key features include:

- Access Cash Advance of up to $250^

- Get paid up to 2 days faster*

- Get cashback rewards of up to 10%**

- Track your spending

- Save with Empower AutoSave

Here's a closer look at how some of these features work.

Empower Cash Advance

Unlike typical loans, you don't have to submit to a credit check to get a Cash Advance with Empower. Instead, Empower uses your bank account history and activity, recurring direct deposit, and average monthly direct deposit to determine if you’re eligible to receive a Cash Advance.

Cash Advance amounts can go as high as $250. Empower doesn't charge any fees or interest on its Cash Advances. Instead, you'll simply pay it back automatically when you receive your next paycheck.

See how Empower compares to other cash advance apps.

AutoSave

Within the app, you can set up AutoSave to help you reach weekly goals, such as paying down debt faster or building your emergency fund.

The app will analyze your income and spending and will automatically set money aside for you when it recognizes that you'll have extra funds available.

You only earn interest in your AutoSave Account if you also have an Empower Card. And even then, the rate is only 0.01% APY. If earning interest is a main priority for you, you'll want to check out one our favorite high yield savings accounts instead.

Empower Card

The Empower Card connects with the app. The card comes in two colors: black or peach.

You can control your Empower debit card anywhere and anytime within the app plus get 24/7 notifications to track your spending. There’s also no account minimums, no overdraft fees, no insufficient funds fees and unlimited withdrawals.

Plus, you can rack up cashback of up to 10% on places and things you spend money on already, get paid up to 2 days faster, and access free instant delivery of Empower Cash Advance. The Empower Card also works with Apple Pay, Google Pay and Samsung Pay.

It should be noted that, depending on your spending habit, the Empower Card's limits could pose a problem. Currently, you can only withdraw up to $500 per day and spend up to $2,000 per day. Also, your daily transfer limit will be $2,500 for the first 30 days and $5,000 thereafter.

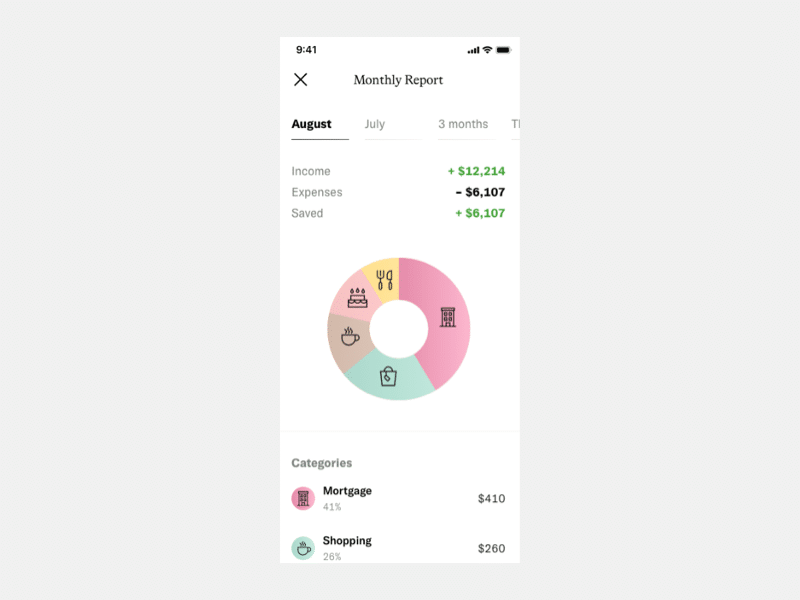

Expense Tracking

Once you’ve connected your data, you can categorize expenses, track your spending, and more. Empower will automatically set a budget for each category. However, it isn’t designed to be a proactive budgeting tool. For that, You Need a Budget, EveryDollar, or Mvelopes make more sense. Even Mint.com would be a better tool.

You can find our list of best budgeting apps here.

How Much Does Empower Cost?

Empower is free for the first 14 days. After 14 days, Empower charges $8 per month for continued access to its full suite of money management tools.

Customers can withdraw cash for free from over 37,000 in-network MoneyPass® ATMs. Empower doesn't charge overdraft fees and it will even refund you for overdraft fees that are charged by your third-party bank in the following circumstances:

- Any overdraft fees caused by Cash Advance repayment attempts

- The first overdraft fee caused by your Empower subscription fee

- The first overdraft fee caused by an AutoSave debit

The company doe does charge a foreign transaction fee of 1%.

How Does Empower Compare?

Empower is impressive in its design and how much it empowers users to take action within the app. And its design is on par or better than any other app that we've reviewed.

If you look at each feature that Empower offers (such as transferring money, paying down debt, tracking spending, etc.) you can find an app that does it better. For example, Empower (Personal Capial) or Monarch Money offer better financial tracking.

However, as an all-in-one financial app, Empower is more of a contender. Its one downside is that it doesn't offer any investment option, unlike some of its competitors such as Dave. Here's a closer look at how Empower compares:

Header |  | ||

|---|---|---|---|

Rating | |||

Cost | $8/mo | $1/mo | $3/mo to $5/mo |

Overdraft Fee Reimbursements | Yes, unlimited for overdrafts caused by Cash Advance repayment debits. Otherwise, only the first fee is refunded. | Yes | None |

Debit Card Rewards | |||

Investing | |||

Cell |

How Do I Open An Account?

You can get started with opening an Empower account by visiting its website. Once there, you can enter your mobile phone number to receive a text message with a link to the mobile app. During signup, Empower will ask you to provide a valid ID to verify your identity and a current proof of address.

Is It Safe And Secure?

Yes, Empower's banking services are provided by NBKC, which is a member FDIC bank. So money that is transferred into your Empower account is insured by the FDIC up to $250,000.

Empower also uses 56-bit SSL end-to-end encryption on its website and app. And customers can use multi-factor authentication tools to further lock down their accounts.

How Do I Contact Empower?

Empower offers live chat, phone support at (888) 943-8967, and email support at help@empower.me. Customer service hours are 9 AM - 6 PM (PT), Monday through Friday.

It should be noted that Empower has a "D" rating on the Better Business Bureau (BBB) due to a failure to respond to complaints. However, its app store ratings are high. It's rated 4.8/5 on the Apple Store from over 33,000 ratings and 4.6/5 on the GOogle Play Store from over 23,000 votes.

Why Should You Trust Us?

We have been following the growing space of cash advance apps since they first emerged about 5 years ago. Since then, we've reviewed and tested many of the cash advance apps in the marketplace - as well as followed the news and controversies that have surrounded several of these products.

Along with cash advance apps, we've also reviewed and compared many of the alternatives, including personal loans and tax advance loans. We've also been comparing and reviewing banks since 2018, and track the best banks for savings and money market accounts daily from a list of over 50 major banks and credit unions.

Furthermore, our compliance team regularly reviews the companies in this comparison to ensure that all rates and terms are accurate.

Who Is This For And Is It Worth It?

If you’re not tracking your finances, you should download Empower and start using it today. It’s a great app — designed for ease, information and action.

I’m impressed by the app, but not so impressed that I recommend switching from an app that’s working for you. If you have your finances under control, then you don’t need to check out Empower. But for everyone else, Empower could be the start of controlling your money for the first time.

Check out Empower here.

^ Eligibility requirements apply.

* Timing may vary by employer.

** Deals will vary and must be selected in the app.

Empower FAQs

Let's answer a few of the most common questions that people ask about Empower:

Are Empower and Empower Retirement the same companies?

No, the two businesses are completely unrelated.

Can I log into my Empower account on my computer?

Not right now. The Empower platform is currently mobile-only.

Can I add an authorized user to my Empower card?

Not yet. While this feature is one that the company says is "one their radar," Empower doesn't currently support joint accounts of any kind.

Does the Empower card earn cash back on every transaction?

No, customers only earn cash back at retailers that have an available in-app perk that has been activated and only one in-app perk can be activated at a time.

Empower Features

Cash Advance Limits | Up to $250 |

Cashback Rewards | Up to 10% |

Early Direct Deposit | Up to 2 days early |

Monthly Fees | $8 (after a 14-day trial) |

Overdraft Fee | $0 |

Foreign Transaction Fee | 1% |

Branches | None |

Mobile Check Deposits | No |

Cash Deposits | No |

Checkbook Support | No |

Transfer Limits |

|

Card Spending Limits | $2,000 per day |

ATM Availability | 37,000+ fee-free ATMs that are part of the MoneyPass® network |

ATM Withdrawal Limits | $500 per day |

Customer Service Number | (888) 943-8967 |

Customer Service Email | help@empower.me |

Customer Service Hours | 8 AM-11 PM (EST) |

Mobile App Availability | Mon-Fri, 9 AM - 6 PM (PT) |

Bill Pay | Unclear |

FDIC Certificate | |

Promotions | None |

Empower Review

-

Cost

-

Commission and Fees

-

Ease Of Use

-

Customer Service

-

Features and Options

Overall

Summary

Empower is a financial budgeting app with built-in savings, cash advance features, early paycheck, and more.

Pros

- Cash advance and early payroll

- Robust categories and budgeting

- Easy to link external accounts

- Earn up to 10% cashback on spending

Cons

- Monthly fee is expensive

- Missing critical banking features such as cash and mobile check deposits

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Ashley Barnett