Quotacy is an online marketplace that lets you answer a few very simple questions, without providing your contact information, and quickly get quotes for life insurance and disability insurance from multiple companies.

Life insurance is one of those things a lot of people don’t think about until it’s much too late. If you’re traditionally employed, you might get basic life insurance for free as a standard benefit, but it’s rarely more than $10,000 or $20,000 — maybe enough to pay for a funeral and settling an estate, which isn’t nothing, but won’t do what many people need life insurance to do.

If you were to die in mid-career without adequate life insurance, it could leave your partner, children, pets, or other people you support in a really tough place. Houses might have to be sold and new jobs might have to be found to try to cover the loss of your income. That’s what life insurance is intended for.

Because unlike health insurance, the vast, vast majority of life insurance customers will not die young — life insurance is also surprisingly affordable. If you’re traditionally employed but want supplemental insurance to whatever your benefits package offers, or if you’re a freelancer and need comprehensive insurance, an online marketplace like Quotacy is a great way to compare some of your options.

You can compare Quotacy to Policygenius, an online insurance brokerage which offers a wider variety of insurance products and less customer service.

You can also compare what you find on Quotacy to Haven Life and Ethos, which we’ve also reviewed. Both of those companies offer life insurance directly rather than aggregating quotes, but because they’re fully online they might end up offering even lower prices. (This is an important decision, so take the time to compare everything — both costs and benefits!)

Getting a Term Life Insurance Quote At Quotacy

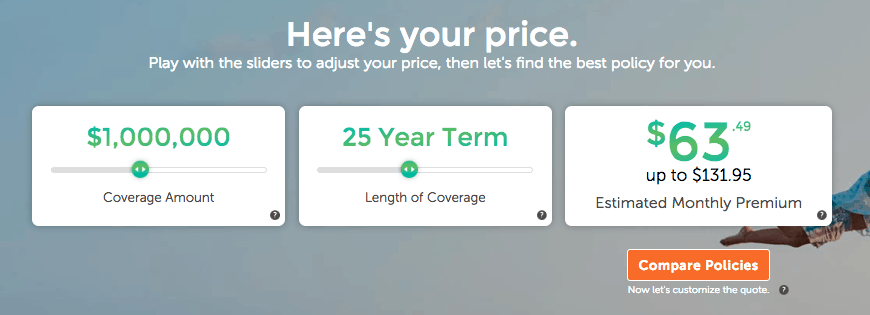

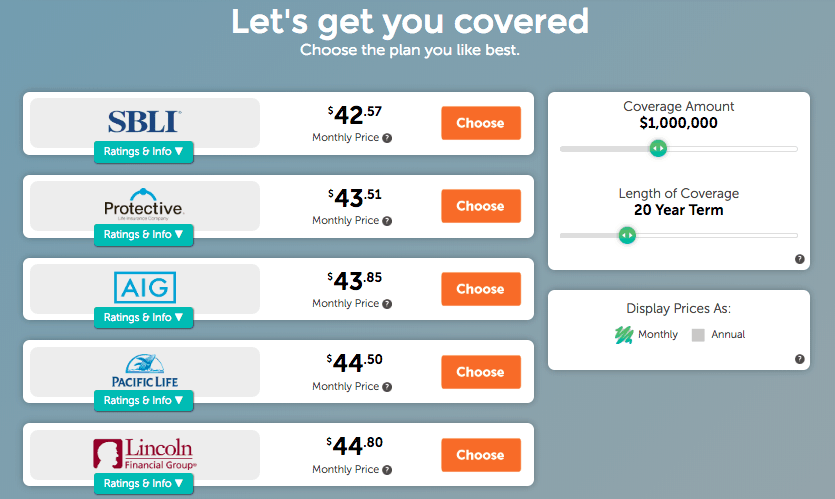

As a general rule, if you’re a major contributor to your family’s income, you’ll want enough life insurance to replace about 10 years of your salary. In other words, a person making $100,000 a year should insure themselves for $1 million. You might also want to consider enough life insurance to pay off a mortgage or student loans, if relevant. (If you die young, your loans might be forgiven, but enough life insurance to cover your partner’s loans might be a good idea.)

What Quotacy does is to get initial quotes for term life insurance from a variety of carriers and then they allow you to complete your initial application through their app.

Term life insurance is generally the best choice for adults who are concerned about replacing their income for their families during their working years — you can read more about why here. It lets you pick what “term” (span of years) you want to be covered for. So if you expect to work another 20 years, you get life insurance just for that term or period of time, and your family will only get a payout if you die within that period.

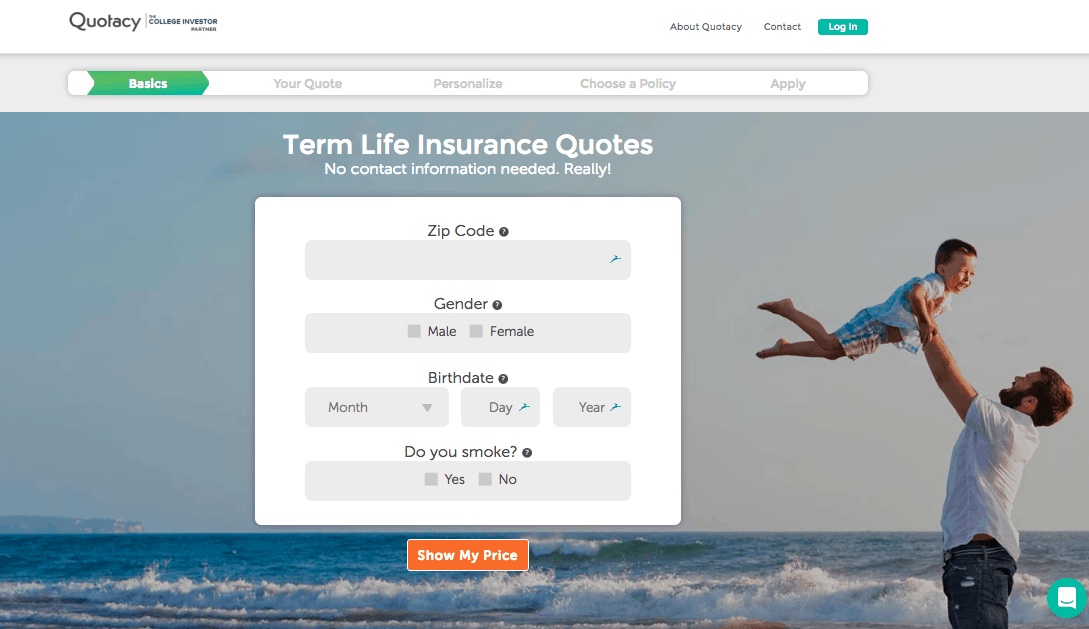

When you go to Quotacy, you begin by answering four very basic questions about: age, gender, location, and smoking status. (If that’s one of the four basics . . . if you smoke, you might want to quit, by any means necessary!)

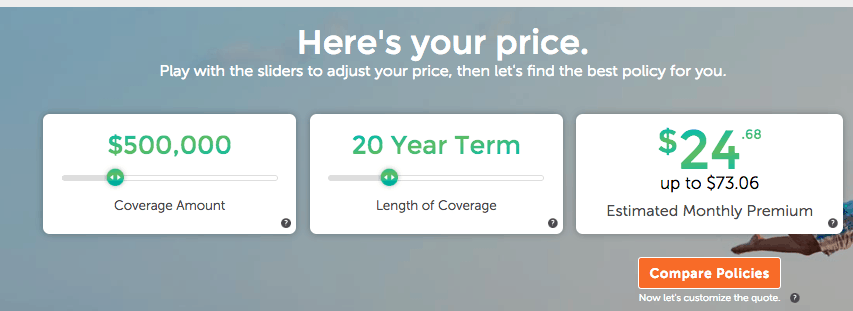

This takes about 10 seconds, so then you move to a second screen which gives you a range of initial quotes. You can play around with sliders here to see how your quotes might change if you want more years covered, a bigger or smaller payout, etc.

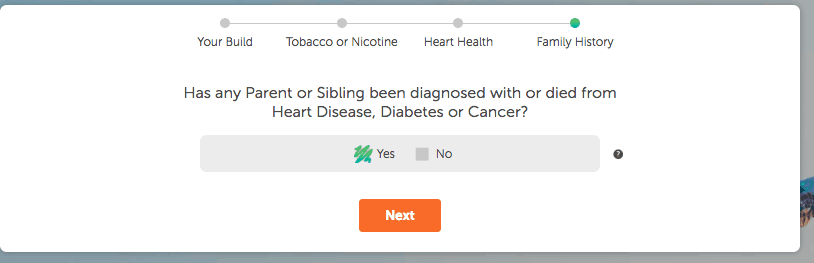

Following this, you spend about 60 seconds answering questions about your height and weight, whether you’ve used tobacco or had cholesterol issues, and whether an immediate family member has had heart disease, diabetes, or cancer.

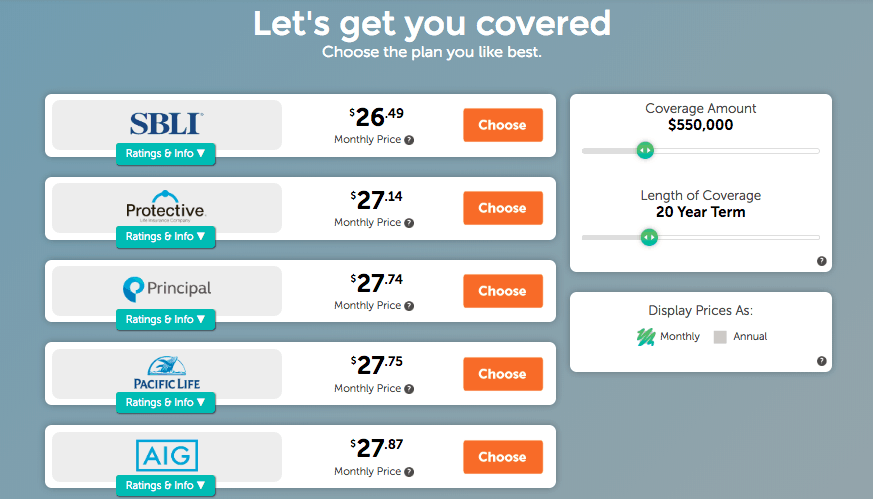

Then you get a list of preliminary quotes from a variety of insurance companies:

At this point, you can play with the sliders again to see how your quotes change as you request more or less coverage:

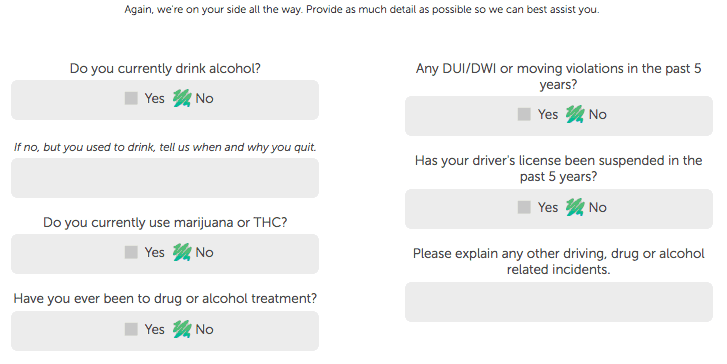

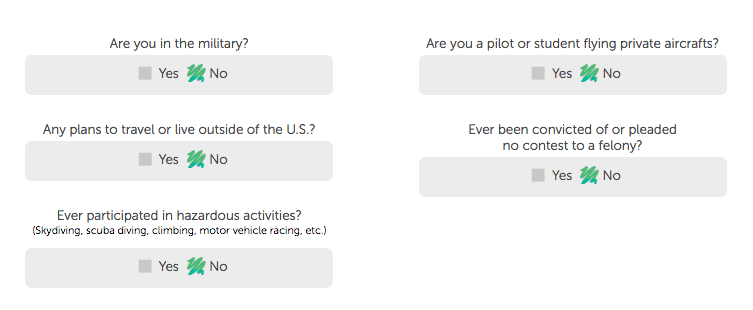

When you’re ready, you can choose a company and do the preliminary application in about five minutes. This asks more detailed questions about your health history and about other risks (like whether or not you drink or use drugs, and whether or not you fly private planes).

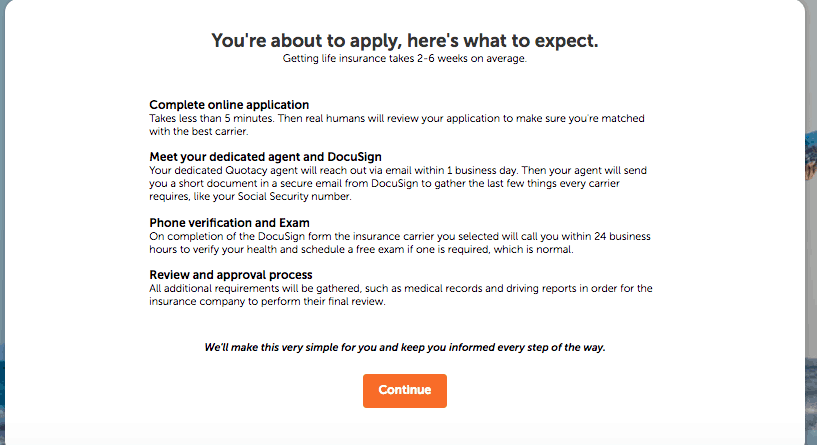

At this point, your application flies off into the ether, or anyway, to Quotacy’s central office. An agent will get in touch with you to get you to sign off on the initial application.

Then you’ll start dealing with the insurance company directly for a phone screen, and you might have to take a medical exam or provide more information like driving records. However, the Quotacy agent will facilitate all of this contact with the insurance company. (They’ll also work with a financial advisor or estate planner if you have one.)

After any of this extra information is provided, you’ll get a final offer from the insurance company. If the final offer is different from the initial quote, you can go back and start a new Quotacy process with another company, or ask your Quotacy agent if you can contest the insurance agency’s offer.

Contact Options and Help

Quotacy is pretty full-service. You can call them, text them, or email them, even if you’re not a customer. The team works on salary, not commission, which means they shouldn’t be pressuring you into buying something that’s not right for your needs.

If they need to contact you, they ask for your preference (call/text/email) and try to accommodate that, unless it’s not possible for technical reasons (can’t attach a document to a phone call!).

If you’re not in great health, Quotacy has an interesting option; they have an in-house underwriter who will look at your health history and help you find an insurance company that might be best for your specific issues. If you have a chronic condition or some other risk factor, some companies might be more willing to work with you at a reasonable price than others, and the in-house underwriter can help with that.

It’s worth mentioning that a number of people who reviewed them on Trustpilot mentioned having previously been denied life insurance because of a chronic condition. Quotacy’s agents, by working with many companies, may really be able to help guide people with issues towards a company that will work with them.

Quotacy seems pretty dedicated to being in touch as much as you want. Unlike some companies that bury their contact info, you can hardly spend time on the Quotacy website without seeing a phone number or email form that offers to put you in touch with a real person quickly.

Other Products Quotacy Offers

Quotacy also offers other products besides their main product of term life insurance.

They do provide quotes for whole life insurance, which we don’t recommend.

Maybe of more interest, they offer quotes for disability insurance. Like term life insurance, this could be incredibly useful if you become disabled and are unable to make the salary you otherwise would. It could also provide for your care, depending on what type of disability you develop.

You can’t get an instant quote for disability insurance. Instead, you answer brief questions about your age, health, occupation/job duties, and salary, and Quotacy employees research options and get back to you in a couple of days.

“Final expense” insurance is a form of whole life targeted at elderly people. It’s cheaper than typical whole life policies because it just aims to provide a small benefit of around $15,000 that covers end-of-life expenses like medical bills and a funeral.

A free account with something called “LegacyShield” is basically an online version of the filing cabinet in your parents’ basement that may or may not have the information on their insurance policies, wills, finances, etc., etc.

Who Is Behind Quotacy and Are They a Trustworthy Company?

Quotacy is a subsidiary of Hallett Financial Group (two of the founders are Halletts), and they’ve been around since 1990, though presumably their website was a lot less slick back then! They’ve really transitioned well to the Internet age. They work with most of the big health insurance companies, as you’ll see if you call up a preliminary quote from them.

They’re not a huge company; you can see photos and capsule bios of all the people you might deal with, including application assistants and insurance agents, on their site.

They have great reviews on Trustpilot which seem in general to especially focus on their customer service. Maybe they’re so nice because they’re based in Minneapolis? Anyway, if you want to deal with real people, they seem like a good option for that.

The best thing about Quotacy, in my opinion, is that their employees work on salary, not commission. I really dislike commission-based models for anything because they give such a big motive to sell the most expensive thing, not the best thing for the customer.

I also like that Quotacy promises not to sell your contact info. When I was buying car insurance a few years ago, I had to give my contact info to a site like this and spent weeks inundated with messages!

Final Word

To be honest, I didn’t start this review with great expectations. I’d never heard of Quotacy and after my car-insurance experience a few years ago I was suspicious about putting my info into another online insurance system.

But the time I spent exploring Quotacy while I wrote this review made me pretty enthusiastic. They don’t give you a hard sell, but rather present you with a lot of options and offer significant customer service focused on answering the questions real people have. As a freelancer, I want to buy life and disability insurance for myself pretty soon and this site has shot to the top of my list of places to search.

Quotacy Review

-

Pricing

-

Ease of Use

-

Products and Services

-

Customer Service

Overall

Summary

Quotacy is an online life insurance comparison platform where you can get multiple quotes very quickly.

Pros

- Quick and easy to get multiple life insurance quotes

- Good customer service with a team who’s not on commission

- Customizable policies

Cons

- Only term life insurance options are available online

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller