“That which matters most must never be at the mercy of that which matters least.” – Johann Wolfgang von Goethe

Novice investors frequently assume that they need to master every minute aspect of investing before earning a steady return: P/E ratios, capital gains taxes, load vs. no load mutual funds, technical analysis, on and on, ad infinitum. This is a profoundly mistaken belief, and one that freezes countless investors in their tracks instead of delivering the returns they deserve.

Today, I am going to try to liberate you from this flawed notion by discussing what I believe is the most important part of successful investing: nailing down the correct asset allocation.

Very simply, “asset allocation” refers to the overall mixture of stocks, bonds, and other asset classes in your portfolio, and how much of your total capital is invested in each one. Having the right balance—the correct asset allocation—is what keeps you diversified in the market, rather than heavily invested in one thing that could fall down and take your whole portfolio with it.

The Securities Exchange Commission (the government agency responsible for enforcing stock market laws) offers a helpful example to illustrate why this matters:

Have you ever noticed that street vendors often sell seemingly unrelated products – such as umbrellas and sunglasses? Initially, that may seem odd. After all, when would a person buy both items at the same time? Probably never – and that's the point. Street vendors know that when it's raining, it's easier to sell umbrellas but harder to sell sunglasses. And when it's sunny, the reverse is true. By selling both items- in other words, by diversifying the product line – the vendor can reduce the risk of losing money on any given day.

Let's dive into this in-depth.

The Two Key Drivers Of Your Asset Allocation

There are two key dimensions to asset allocation: your time horizon and your risk tolerance.

Time Horizon

In investing, “time horizon” refers to how many months, years, or decades you have to achieve your financial and investment goals. Your time horizon dictates how aggressive or conservative your asset allocation should be. For instance, an investor with a long time horizon (say, someone who is 25 years old and just opening a brokerage account for the first time) can be extremely aggressive, owning far more stocks than bonds.

Yet, as we just learned, that asset allocation would be grossly inappropriate for a 60 year old man expecting to retire in five years. Their time horizon demands a more conservative, “play it safe” asset allocation. And I’ll give you examples of each later on.

Risk Tolerance

The other key dimension of your asset allocation is your “risk tolerance.” This refers to your own personal ability to tolerate risk: the possibility of losing some or all of your investment capital in exchange for potentially earning a high return. This is a more “soft” dimension than time horizon, because it is, by nature, personal rather than formulaic. Just because abstract portfolio theory says a 25 year old should be aggressive in the market doesn’t mean you will feel comfortable doing that.

That’s why it’s important to constantly ask what your end goal is, and make every decision with it in mind. Is your end goal to earn the biggest return you possibly can? If so, you need to be comfortable accepting a great deal of risk, both early on and throughout much of your adult life.

On the other hand, if you are simply seeking to beat inflation and earn more than a savings account pays, you can adopt a more conservative asset allocation—and be relatively free of worry about huge losses.

As the SEC says, conservative investors prefer to keep “one bird in the hand”, while aggressive investors would rather roll the dice and potentially get “two birds in the bush.”

Why Asset Allocation Drives Investing Success

In investing, asset allocation (or the overall composition of your portfolio) is more important than any individual stock within it. That’s because while stocks run hot and cold, the correct asset allocation keeps you steered in the right direction for the long-term. Let’s say, for example, that technology stocks have a big year. Does this mean you should put 50% of your portfolio in tech from now on? NO!

Countless investors have lost money by assuming today’s hot sector would power their portfolios forever. But it never happens. Invariably, the following year (or even the following month) is dominated by health stocks, or manufacturing, or any number of other sectors. Conversely, investors who maintain an age-appropriate asset allocation tend to win over the long-term because poor individual stocks are outweighed by the correct overall mixture. In other words, the system is greater than the sum of its parts.

Want proof? In a 1991 study, Gary P. Brinson, Brian D. Singer, and Gilbert L Beebower determined that over 90% of long-term investment volatility came from decisions about one’s asset allocation – NOT timing the market or stock picking.

I want to explore what might seem to be a very counter-intuitive notion: how is one factor responsible for so much of your investment returns? After all, there are so many investment vehicles out there, endless different theories about when to buy or sell, seemingly infinite opportunities to do this or that with your portfolio.

Business schools teach semester-long courses on technical analysis, and some investors devote their entire lives to devising elaborate formulas that purport to time the market for high returns. Given all of this, how can simply owning the right mixture of assets virtually assure you of coming out ahead in the long run?

There is a simple reason for this: despite the way we are wired to think, tiny actions often cause massive results. As humans, we have an ingrained tendency to think linearly. We assume that what we put in is what we get out. If we work for two hours, we assume that should produce two hours of results. But this is frequently not the case at all. A relatively small amount of effort, applied to the right area, can produce enormously disproportionate results.

Examples:

- Creating a workout plan takes 1-2 weeks to research, but can add 30 pounds of lean muscle in just a few months.

- Planning a complex project takes 2-4 weeks, but can bring a 50% reduction in delays.

- Negotiating a single raise takes 1-2 hours, but can add $1 million or more in cumulative lifetime income.

Many of us would read a chart like this and fixate on the time, but that is entirely beside the point. These actions are not explosively productive because of how long they take, but because they are the things that drive disproportionate results.

Asset allocation is very similar. By taking the time to define how much of your money will be concentrated in stocks, and how much in bonds, and how much in commodities, you are laying a foundation for long-term success. Each month, as you put more and more money into your brokerage account, every dollar follows the logic set forth in your asset allocation, steering the ship of your portfolio towards your ultimate destination of wealth.

Another way to think about asset allocation is to compare it with a house. No matter how much you love French doors, or gold-tipped faucets, or breathtaking skylights, these things are not even 1% as important as the house’s blueprints: the instructions that helped the architect turn a bunch of raw materials into your dream home.

Asset Correlation And Why It Matters

Asset allocation works because it keeps you diversified and ensures you own assets that are not directly correlated with one another.

Technology stocks are subject to the same market trends, buying preferences, regulatory climates, and so forth as other technology stocks. Ditto for manufacturing, auto, or any other sector. It doesn’t matter if you own some stocks in Google, and some in Microsoft, and some in Facebook—that is not diverse enough. A portfolio made up of only those stocks is in serious jeopardy the next time a tech crash (like the one that happened in the late 1990’s and early 2000’s) rears its ugly head.

What can prompt a tech crash? Anything that threatens tech companies: harsh new privacy regulations, a rash of premature tech IPOs that fall flat at the same time, even the sudden downfall of an industry titan.

On the other hand, automotive stocks would generally be unaffected by these events, because auto is a separate industry with unique customers, laws, and trends. You become more diversified by owning stocks across many industries.

You become more diversified still by owning stocks from companies of different sizes: large cap, small & mid caps, international, etc.

Yet, you become the most diversified of all when you own entirely different asset classes, because they are even less correlated with one another. During a stock market crash, stocks plummet in value…but bonds increase, because investors start to seek safe returns again. The opposite is true during stock market booms: stock prices soar, while bond yields (generally) flatten.

If we could reliably forecast when booms and busts were going to happen, we could simply time our portfolios to own only the correct assets ahead of time and profit from what was about to take place. Many investors mistakenly believe they CAN do this.

They are wrong. All academic research shows that we have pathetically little skill at forecasting the overall market on a consistent, year in, year out basis with anything approaching reliable accuracy.

Therefore, the correct strategy is taking an “insurance policy” approach to investing, by owning several different types of assets that are not all highly correlated with one another. This way, even when some of your assets suffer, other assets prosper—helping to “even out” the damage inflicted by downturns, recessions, or just routine fluctuations.

The Importance Of Getting It Right Up Front

Before going into the nuts and bolts of asset allocation, I need to fully convey why it’s important to get this right now, before investing any money.

To continue the house analogy from part one: home builders focus almost obsessively on getting the blueprints right before buying a single nail or bucket of paint. Why? Because they have learned the time-honored saying “an ounce of prevention is worth a pound of cure” from hard experience. When you rush to get started on a large project without proper precautions, it becomes extremely messy, time-consuming (and, in some cases) impossible to reverse the mistakes that pile up.

Think back to the 2008 stock market crash that followed the real estate bust. How many stories were there about elderly people who lost their retirement savings in one fell swoop? The media used these stories to create doubts about the long-term viability of investing, essentially saying “see? this is what happens when you put your money in the stock market!” But in almost every case, the investors were failed by their asset allocation, not the market as a whole.

These elderly investors had aggressive asset allocations when they were young: which, as I explained earlier, usually means lots of their money invested in stocks. That’s great, and in fact, highly recommended for young investors, because they have time to take bigger risks and still come out ahead. But as these investors got older, they needed to shift more of their money into safer investments, to ensure it would be there when they needed it.

Had they done so, the 2008 crash would have merely hurt them a little. Instead, it completely wiped out a lifetime of retirement savings.

Still think asset allocation isn’t enormously and disproportionately important?

Three Asset Allocations Explained

Having laid that foundation, let’s get right into some example asset allocations and what they mean.

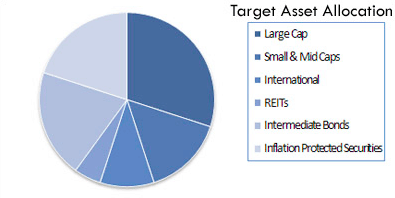

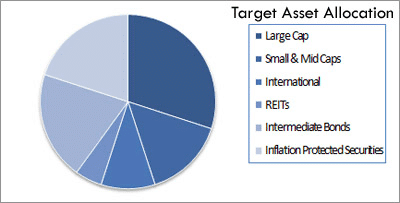

Here are some common examples from Allocation of Assets:

Within these broad asset classes, you might further specify the actual types of companies or funds you want to be invested in:

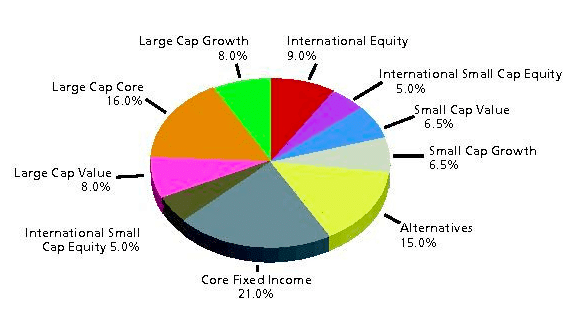

Depending on your sophistication and willingness to dive deep into investing, you could have an even more diverse allocation, such as this (from Wikipedia):

Again: this might seem like a luxury, something you can easily put off “until you have time” or “feel like dealing with it.” But recall how big of a mistake this can turn into. Of all the investors who lost their net worths in 2008, do you think any of them planned on it? Did a single one think about the risks, weigh out the pros and cons, and simply say “this doesn’t matter?”

Of course not. They all told themselves they would deal with it later—but when “later” came, it was already too late. You can’t afford not to get this right!

Also, if this is not clear to you by now, please realize that you do not simply pick one asset allocation and ride it out forever. Rather, you need to identify the correct asset allocation for your current situation, and then continuously re-calibrate it over the years to reflect your changing needs and circumstances.

In other words: if you are still investing the same percentage of your money into stocks, bonds, etc. five years before retirement as you were 30 years ago, you are in grave danger of losing everything. That’s why it is critical to gradually shift into a safer investment mix as you move through middle age and into retirement age.

As a hard-and-fast rule, you should own less stocks as you get older. By the time you are ready to retire, the vast majority of your money should be in bonds or other safe investment vehicles. There is a natural temptation not to do this, because (as we covered earlier in the book) bonds offer lower returns. Yet this is for a crucial reason: bonds are safer! When money is less likely to be lost, lower returns are the trade-off. Instead of resenting this or trying to tempt fate by getting higher returns, simply accept that this is a trade off you WANT to make at this stage of your life.

Failure to do so risks wiping out everything you spent decades working so hard to build.

Portfolio And Asset Allocation Rebalancing

The gradual re-organizing of your asset allocation as you age is called “rebalancing.” Unfortunately, despite its colossal importance, rebalancing does not happen by itself.

For instance, recall that this might be your target asset allocation in the beginning:

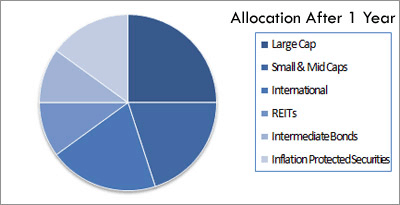

Ideally (if you determine that it is the correct one) you should keep this allocation for at least the next several years. Yet, because the market is constantly fluctuating, your asset allocation could wind up looking like this only 12 months later:

The problem is not anything you personally did. You set up your asset allocation to reflect your goals, time horizon, and risk tolerance exactly like you were supposed to. It simply happened naturally, as a result of the companies you invested in going up or down in value.

That’s why you need to rebalance, or bring your portfolio back into compliance with your chosen asset allocation. It’s not a particularly exciting task, and your portfolio will not cry out to you to be rebalanced. As such, it’s very easy to forget about, which is precisely what most investors do.

This is perhaps the most dangerous mistake untrained investors make. A portfolio that never gets rebalanced is like an ocean barge that veers off course. If the captain doesn’t straighten the ship out, it could wind up in Cuba instead of the Bahamas. Likewise, your portfolio could be exposed to exponentially more risk than you are comfortable taking on—all because you neglected to rebalance.

Rebalancing can be done manually, or semi-automatically through what are known as lifecycle funds. A lifecycle fund re-calibrates your holdings over time to stay aligned with your desired asset allocation. Just know that whether you use a lifecycle fund or go it alone, rebalancing is absolutely essential to keeping your portfolio invested in the right things, and that failing to do it places you in huge danger the longer it goes unaddressed.

It can also be done automatically for you via a robo-advisor. We will cover all three of these options in a minute.

Risk Versus Return In Real Life

I want to stress that although there are formulas and systems to get asset allocation right (and I highly recommend sticking to them when possible) there is an emotional component to all of this as well. And it can be exceedingly difficult to keep your emotions in check when faced with data that provokes strong reactions, fears, or impulses.

That said, successful investing is all about learning to do just that. For every data point that causes you to worry, there are others that (even if they don’t completely remove your worries) should cause you to consider another perspective.

As Wikipedia explains:

“In asset allocation planning, the decision on the amount of stocks versus bonds in one's portfolio is a very important decision. Simply buying stocks without regard of a possible bear market can result in panic selling later. One's true risk tolerance can be hard to gauge until having experienced a real bear market with money invested in the market. Finding the proper balance is key.”

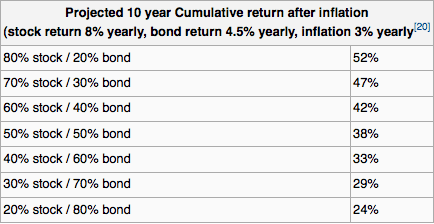

For instance, here is an example of after-inflation returns using different asset allocations from 2000-2002, a decidedly “bear market” period:

The table above seems to imply that a highly conservative portfolio is always desirable. Look at those positive returns! But when we take a long-term view (as younger investors generally should do), look at how those returns start going in the opposite direction:

Now do you see why time horizons and risk tolerance are so critical to your overall investment strategy?

If you simply dive in and start buying stocks without thinking about the bigger picture, you could be charting a course to major disappointment. Think about how many investors dumped tons of stock in the early 2000’s (not just tech stocks, which were the problem, but ALL stock) due to nothing more than fear and overreaction? Had they hung on to some of it, they would’ve been far richer come 2004 and 2005 than they in fact were.

On the other hand, some people are simply not emotionally capable of carrying huge losses through a 2-3 year bear market to realize the gains that come after. If that’s you, it is better to learn that sooner than later. Keep these issues in mind as you build out your investment portfolio.

Moreover, if you have not yet determined your correct asset allocation, stop everything and do it now. Wasting time on minutiae (like the merits of this stock vs. that stock or the fees a mutual fund charges) is pointlessly distracting until you nail down this foundational issue first.

Tools To Setup And Rebalance Your Asset Allocation

As I mentioned earlier, there are three approaches to take when it comes to setting up your asset allocation and rebalancing it:

- Do-It-Yourself approach

- The semi-automated approach with target-date funds

- The fully automated approach with robo-advisors

The DIY Approach

I'm personally practice the DIY approach, but it's not for everyone. Doing it yourself means that you are choosing your own asset allocation based on your own risk tolerance and time horizon. It then means you are selecting the funds that go with that asset allocation, and that you are rebalancing it yourself at least annually.

To choose your asset allocation, you can use a pre-existing one (such as the Boglehead's Lazy portfolios), or you can tailor one to meet your needs.

Once you select an asset allocation, you'll need to research ETFs and mutual funds that match your target allocation types.

Then, it becomes a matter of tracking your portfolio and allocations. I personally use Empower, which has a great (and free) asset allocation tracking tool. Empower is also great about tracking your investment portfolio in general. Try it for free here.

For rebalancing my portfolio, I use a Google docs spreadsheet to see what areas are overweighted and which are underweighted, and then sell and buy the dollar amounts appropriately. I do this twice a year - in the spring and fall.

Related: Best Portfolio Tracking Tools

The Semi-Automated Approach

If you're comfortable investing in ETFs, but don't want the headache of having to rebalance yourself every year, you can opt for the semi-automated approach. This is done by investing in target date or lifecycle mutual funds and ETFs based on your age.

What these funds do is automatically rebalance within themselves to create an allocation based on when you plan to retire.

For example, you can invest in the Vanguard Target Retirement 2050 Fund (VFIFX). This fund is designed for people who are currently 29-33 years old, who plan to retire around 2050. The portfolio itself is currently made up of almost 90% stocks, and 10% bonds. However, as you get closer to 2050, the fund will automatically change that to better reflect your risk tolerance and time horizon.

To highlight this, we can look at the Vanguard 2025 Fund (VTTVX). This fund is designed for people 54-58 who plan to retire around 2025. This fund currently has an allocation of roughly 65% stocks and 35% bonds. Much more conservative compared to the Vanguard 2050 Fund.

You can learn more about these Vanguard funds here.

The Fully Automated Approach

If you know you should be doing this, but just want to contribute money into an account and "set it and forget it", don't worry - there's still an option for you. You can setup a fully automated asset allocation with a robo-advisor, who will take care of all of this stuff for you.

Robo-advisors are pretty straightforward tools: they use automation to setup your portfolio based on your risk tolerance and goals. The system then continually updates your accounts automatically for you - you don't have to do anything.

All you do is deposit money into your account, and the robo-advisor takes it from there.

If you want to go the Robo-Advisor route, we recommend using one of the two below. For reference, WealthFront is free for the first $10,000 if you want to give them a try. See the two options below:

- Wealthfront: Wealthfront is a great robo-advisor for those with money to invest but don't want to deal with it. Wealthfront's service really shines with taxable accounts, and service is free for accounts under $5k. Click here to check out Wealthfront.

- Betterment: Betterment is a great robo-advisor for young investors. They make investing easy for beginners by focusing on simple asset allocation, goal setting features, and low-cost portfolio management. Click here to check out Betterment.

Final Thoughts

Hopefully you can see the importance of asset allocation to building wealth over time. I believe it's the single biggest driver in success when it comes to investing - not because it's going to help you earn outrageous returns, but because it's going to protect you from losing all of your money.

Remember, if you lose 50%, you have to earn 100% back just to break even.

What are your thoughts on the importance of asset allocation and rebalancing?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Richelle Hawley