Welcome to another reader question! This question comes from John, who is trying to get a mortgage while being on an income based repayment (IBR) plan for his student loan debt. Here is John’s story and the question:

Welcome to another reader question! This question comes from John, who is trying to get a mortgage while being on an income based repayment (IBR) plan for his student loan debt. Here is John’s story and the question:

I have about $80,000 in student loan debt and am currently on the Income-Based Repayment Plan (IBR Plan).

The difficulty is that the plan only authorizes your payment for one year’s time – you must continually submit tax returns and your payment amount increases proportionally to your income. Well, recently when applying for a credit card with the local credit union that I am a member of, I had difficulty getting a decent credit limit because they kept looking at the amount I would owe each month under the standard repayment plan. The documents that my loan servicer provides describing my terms under IBR show my rate for the next 12 months, then shows a rate thereafter IF I do not resubmit income verification and thus default back into the standard plan (which would be around $940/month payment).

This same credit union (who also provides the best home loan rates, and I would like to use them in 2 years or so to buy a home) keeps viewing it as a “what if” I had to pay that full amount. I did educate them about how the reverification under IBR works, and even got a letter from my loan servicer describing that they only specify a particular payment amount for 1 year at a time, describing the reverification process and stating that that $940 amount was ONLY if I switched out of the IBR plan. Regardless, the credit union was still very reluctant (despite seemingly understanding how the plan works) to lend. As I said, I am interested more so for down the road, as we would like to purchase a home in the relative near future.

Do you have any advice on this situation? I’m sure there are others on the IBR plan interested in buying a home that have similar difficulties with the unfixed nature of the loan payments.

Thanks for the great question John! I’m sure that there are a lot of readers in the same situation as you are!

I should also note to readers (because someone will inevitably mention it), that both John and his wife have well-paying jobs, no other debt, and could afford both the higher amount of student loan payments (if they had to).

Why Getting A Mortgage While On IBR Is A Challenge

Getting a mortgage while on any type of income-based repayment plan will be a challenge – and pretty much impossible for some. The reason is, Fannie Mae and Freddie Mac, the two largest mortgage insurance companies (and they pretty much set the rules for “conforming” loans), have created the following rules for dealing with borrowers under income-driven repayment plans (IBR, PAYE, RePAYE, ICR).

If you read Fannie Mae’s guidelines, they state that a lender must use one of the following to calculate the debt payment for the student loan for the debt-to-income ratio:

- The payment amount listed on the credit report, not the amount due (even if it’s an income driven repayment plan like IBR)

- 0.5% of the outstanding balance (which is almost always higher than the IBR payments) – this was updated in 2020

- The actual Standard plan repayment amount reported on the credit report (this is the most common method lenders choose because it’s the easiest). Remember, your credit report will always show your standard 10-year amount for “Amount Due”, not the amount you actually pay

- A calculated payment that will fully amortize the loan over the repayment period (this means that you have to calculate a payment with no forgiveness after 20/25 years). This could be equal to your IBR payment or higher.

This rule is what makes getting a mortgage a challenge.

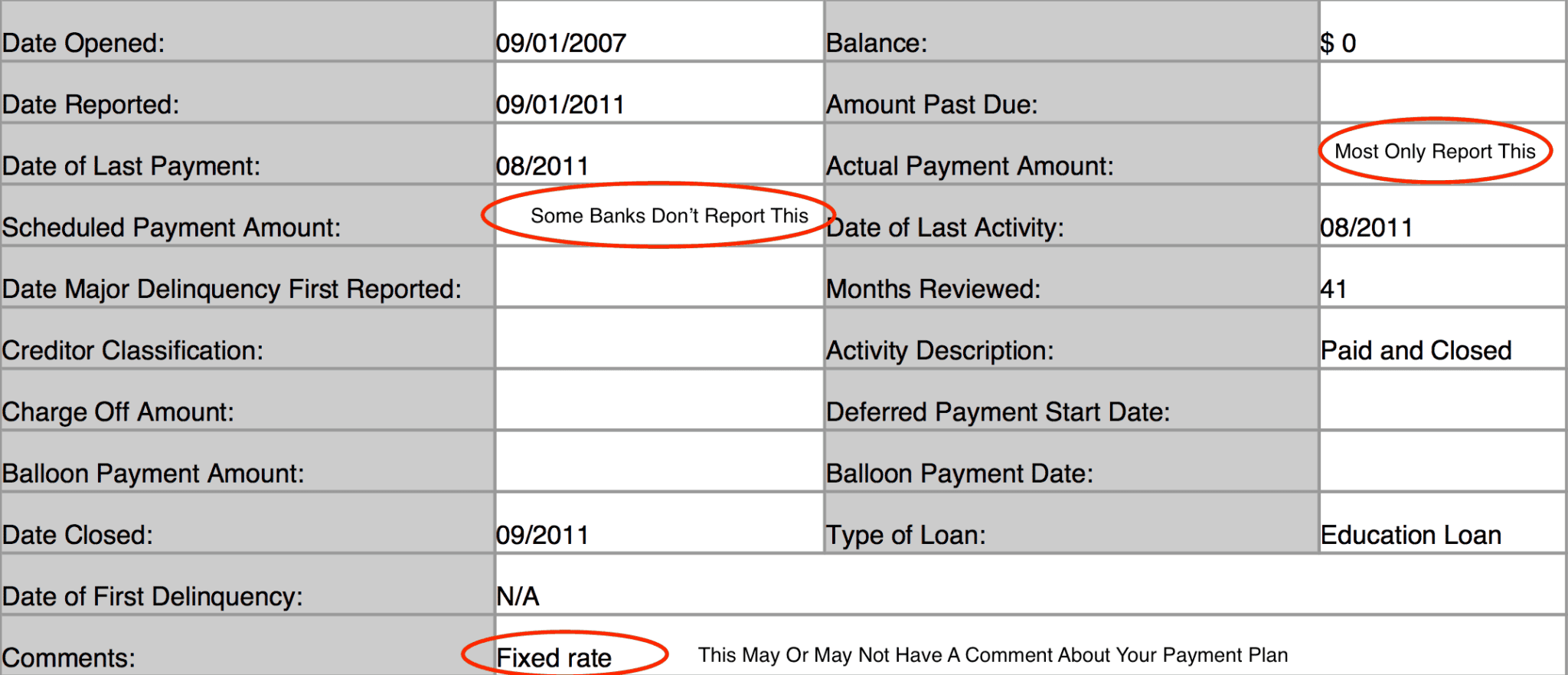

If you don’t know what your credit report says, you need to head over to AnnualCreditReport.com and find out. Here’s a picture from my credit report so you can see what to look for:

A few things:

- Many lenders only report the actual payment amount and if it was delinquent. As such, your “scheduled” payment amount may be blank

- I’ve also seen some banks put the Standard 10-year plan amount as the “scheduled” payment amount, and then the actual payment amount shows as less

- Some lenders put the payment plan in the comments, but most do not

My Thoughts Applying For A Mortgage While On Income Based Repayment (IBR)

This is a tricky situation, but at least John has time on his side because he isn’t looking to get a mortgage for a few years. Here’s his options (and they aren’t great).

Knowing What Your Student Loan Payment Would Be

The first thing to do is to know exactly what number your lender is going to use for your student loan payment. That means doing a little homework and knowing the number for each of the three scenarios above.

Do you know what your credit report says?

Do you know what your payment would be at 0.5% of the loan balance?

Do you know what your student loan payment is on the standard repayment plan?

And most important (because this is the one scenario that could help you), do you know if your loan payment under IBR will fully amortize the loan? This last one sounds complicated, but it really is asking – are you going to get loan forgiveness or not? If you’re going to end up fulling repaying the loan before your 20 or 25 year timeline is up, your loan is said to be fully amortized. That means your IBR payment would count for a lender. But you will likely have to educate them on this.

** Also important to note – there is a difference between the law and a bank or lender’s policies. Some lenders will have policies to use one formula, and there won’t be much you can do to change that. Other lenders may be more flexible.

The big takeaway here is know what your Debt-To-Income ratio (DTI) would be.

Finding A Better Mortgage Option

If you’re struggling with your lender, or your lender isn’t able to answer these questions, it’s probably time to find another lender. We recommend LendingTree to compare your loan options. In about 5-10 minutes, you’ll get quotes from multiple lenders, and you can have conversations with the about your debt-to-income ratio situation.

The earlier you share this with your lender in the process, the smoother you can go. Some lenders will write you off right away, but others may be more willing to work with you through the process.

We like LendingTree because you have multiple lenders working at once, versus just one bank or credit union you might have otherwise. Give it a shot here: LendingTree.

A second option is Credible Mortgage. Less spammy, better experience.

Make Sure You Know the Full Picture

Finally, it is important that you know the full picture of your credit report. Maybe the student loans weren’t the only thing the credit union was concerned about. For example, while you told me you were debt free, if you use your credit card each month and pay it in full, your credit card company may still report the balance on the closing date as your “Balance”. So, even if you pay no interest, the credit union may assume you’re carrying a balance. The trick is to pay off your credit cards and only use debit cards for 6 months prior to applying for a mortgage. This will boost your score right before the application, which will help.

You should also make sure that your credit report is correct. You can use AnnualCreditReport.com once a year to get a free copy of your credit report. Then just verify to make sure all the information is correct. If you’re curious about your credit score, you can pay to view them. I partner with Credit Karma to allow readers to check their credit scores.

What other tips do you have for John to get a mortgage under IBR?

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Clint Proctor Reviewed by: Chris Muller