I am an extremely frustrated Wells Fargo customer. Maybe since I’ve always been a capitalist at heart, I never really was bothered too much by bank fees, because most of the time they seemed, on some level, to make sense. However, earlier this month, I came across a fee at Wells Fargo that really made no sense at all – a bank-to-bank transfer fee from my checking account. Not only did the fee not make sense, Wells Fargo has two levels of the same fee!

I am an extremely frustrated Wells Fargo customer. Maybe since I’ve always been a capitalist at heart, I never really was bothered too much by bank fees, because most of the time they seemed, on some level, to make sense. However, earlier this month, I came across a fee at Wells Fargo that really made no sense at all – a bank-to-bank transfer fee from my checking account. Not only did the fee not make sense, Wells Fargo has two levels of the same fee!

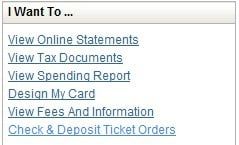

Now, you may ask why it doesn’t make sense? Well, because my account with Wells Fargo is their PMA Package, which, if you maintain certain limits on accounts, you get all sorts of free stuff. Apparently, bank-to-bank transfers are not one of them, but I get free checking, AND free checks. Yes, Wells Fargo will pay to give me free checks, which I could write to myself to transfer money, but they will charge if I do it online and save them money? Makes no sense (and maybe you see where this post is going!).

Now, you may ask why it doesn’t make sense? Well, because my account with Wells Fargo is their PMA Package, which, if you maintain certain limits on accounts, you get all sorts of free stuff. Apparently, bank-to-bank transfers are not one of them, but I get free checking, AND free checks. Yes, Wells Fargo will pay to give me free checks, which I could write to myself to transfer money, but they will charge if I do it online and save them money? Makes no sense (and maybe you see where this post is going!).

Customer Service Could Fix This…

Now, being an optimist, I thought a quick phone call to Wells Fargo could resolve the situation. I called the PMA Member hotline (yes, they do try to make you feel warm and fuzzy), and I told the representative my concern. The representative at PMA Checking said “that is online banking, I can’t help you, I don’t know and don’t have access to those systems”. Fair enough, so she transferred me to a representative at online banking. The representative at online banking was even less helpful – it was more of a long pause, some flipping through a manual (I could hear her doing this on the phone), and finally a “Ummm…I don’t really know, you need to speak to someone at PMA Checking…” and then she transferred me back.

So, speaking to the third person, back again at PMA Checking, I told them my concern again, and the gentleman again said he didn’t know, it was an online banking thing. I ask him, as the concierge for PMA Checking, if he could just do the transfer, and he informed me that bankers in his division aren’t allowed to do bank-to-bank transfers (very odd, because that is a pretty common banking request). He said, once again, that I needed to speak to online banking, but he recommended I speak to a supervisor over there, and he transferred me again.

Back at online banking, the fourth person I’ve spoken to at Wells Fargo, I finally spoke to someone who knew a little more. She told me the fee structure was correct, and that it couldn’t be waived. I asked for her supervisor, and she said the only people who could waive the fee were the “executives”. She put me on hold while she asked them, and then came back a few minutes later and told me “No”.

Since Wells Fargo is Dumb, I’m Going Leaving Them, and They Will Pay For It

I no longer want to be a Wells Fargo customer, and I’m going to get my money out of there – but I’m going to make it costly for Wells Fargo – not just from losing my business (I’m nothing to them), but I’m going to use my PMA “Perks” to rack up some fees.

First, to get my money, I need some checks! Checks are free to the customer with my PMA Package, so no worries! Lot’s of free designs to choose from, and free shipping too!

I wonder how much that cost Wells Fargo? I’m sure Wells Fargo gets a discount for orders, but my guess would be it cost them about $2 for the checks, plus another $1 to ship it to me. Total: $3.

Hey! That’s the same as the bank transfer fee Wells Fargo was trying to charge me!

Maybe Wells Fargo should just have free bank-to-bank transfers instead of offering free checks…it may save them more money!

How This Cost Wells Fargo More Than Any Fee – Step by Step

Step 1. Checks Arrive.

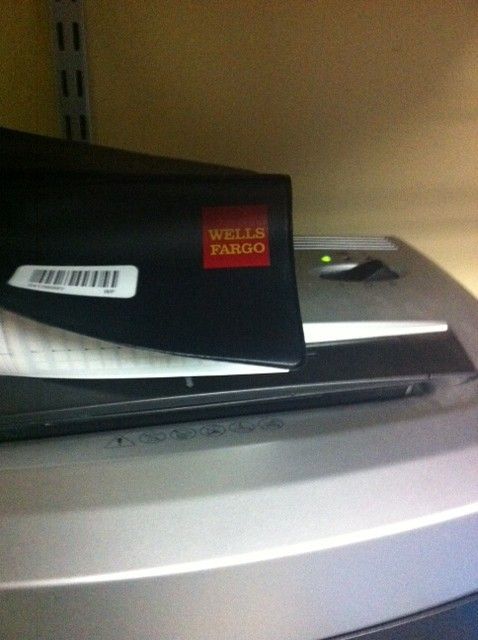

Step 2. Write myself a check and deposit it at home using my scanner at an awesome bank like USAA.

Step 3. Shit…this wasn’t supposed to happen…damn accidents.

Step 4. Order More Checks. Another few charges for Wells Fargo to incur.

Step 5. Checks arrive.

Step 6. Repeat until all my money is out of Wells Fargo!

This is why people hate banks – not because of fees in general, but because their fees make no sense, and their customer service is too ingrained in the company culture to understand that from a customer’s perspective. Wells Fargo’s executive team should have had the common sense to see this wasn’t a wise fee, and could have easily waived it. However, they chose not to.

Let’s see how this business model plays out:

- Earn $3 fee, customers upset

- Earn $3 fee, customer upset, customer leaves Wells Fargo, Wells Fargo loses business

- Earn $3 fee, upset blogger, posts on his site, other customers realize it

- Earn $3 fee, upset individual who will find ways to not pay fee, end up costing Wells Fargo more than $3 and individual still leaves Wells Fargo

- Don’t earn $3 fee, I stay as a customer, Wells Fargo uses my money to make loans, Wells Fargo makes money

- Don’t earn $3 fee, I don’t find ways to leave Wells Fargo, I don’t use my free check perk, Wells Fargo saves expenses

Wells Fargo, when you read this (I’m sure you will), you need to get each division of your company (online, PMA banking, whatever) on the same page, and make a fee structure that makes sense. I cost you more money than you would have ever recouped in fees from me, AND you lost me as a banking customer. Charging dumb fees doesn’t really seem like a good business model now, does it?

Readers, have you experienced anything like this? I would love it if you could help promote and get this story out there!

Robert Farrington is America’s Millennial Money Expert® and America’s Student Loan Debt Expert™, and the founder of The College Investor, a personal finance site dedicated to helping millennials escape student loan debt to start investing and building wealth for the future. You can learn more about him on the About Page or on his personal site RobertFarrington.com.

He regularly writes about investing, student loan debt, and general personal finance topics geared toward anyone wanting to earn more, get out of debt, and start building wealth for the future.

He has been quoted in major publications, including the New York Times, Wall Street Journal, Washington Post, ABC, NBC, Today, and more. He is also a regular contributor to Forbes.

Editor: Chris Muller